{“page”:0,” year”:2024,” monthnum”:1,” day”:19,” name”:” examining-cash-flow-in-small-cap-u-s-equities”,” mistake”:””,” m”:””,” p”:0,” post_parent”:””,” subpost”:””,” subpost_id”:””,” accessory”:””,” attachment_id”:0,” pagename”:””,” page_id”:0,” 2nd”:””,” minute”:””,” hour”:””,” w”:0,” category_name”:””,” tag”:””,” feline”:””,” tag_id”:””,” author”:””,” author_name”:””,” feed”:””,” tb”:””,” paged”:0,” meta_key”:””,” meta_value”:””,” sneak peek”:””,” s”:””,” sentence”:””,” title”:””,” fields”:””,” menu_order”:””,” embed”:””,” classification __ in”: [],” classification __ not_in”: [],” classification __ and”: [],” post __ in”: [],” post __ not_in”: [],” post_name __ in”: [],” tag __ in”: [],” tag __ not_in”: [],” tag __ and”: [],” tag_slug __ in”: [],” tag_slug __ and”: [],” post_parent __ in”: [],” post_parent __ not_in”: [],” author __ in”: [],” author __ not_in”: [],” search_columns”: [],” ignore_sticky_posts”: incorrect,” suppress_filters”: incorrect,” cache_results”: real,” update_post_term_cache”: real,” update_menu_item_cache”: incorrect,” lazy_load_term_meta”: real,” update_post_meta_cache”: real,” post_type”:””,” posts_per_page”:” 5″,” nopaging”: incorrect,” comments_per_page”:” 50″,” no_found_rows”: incorrect,” order”:” DESC”}

[{“display”:”Craig Lazzara”,”title”:”Managing Director, Index Investment Strategy”,”image”:”/wp-content/authors/craig_lazzara-353.jpg”,”url”:”https://www.indexologyblog.com/author/craig_lazzara/”},{“display”:”Tim Edwards”,”title”:”Managing Director, Index Investment Strategy”,”image”:”/wp-content/authors/timothy_edwards-368.jpg”,”url”:”https://www.indexologyblog.com/author/timothy_edwards/”},{“display”:”Hamish Preston”,”title”:”Head of U.S. Equities”,”image”:”/wp-content/authors/hamish_preston-512.jpg”,”url”:”https://www.indexologyblog.com/author/hamish_preston/”},{“display”:”Anu Ganti”,”title”:”Senior Director, Index Investment Strategy”,”image”:”/wp-content/authors/anu_ganti-505.jpg”,”url”:”https://www.indexologyblog.com/author/anu_ganti/”},{“display”:”Fiona Boal”,”title”:”Managing Director, Global Head of Equities”,”image”:”/wp-content/authors/fiona_boal-317.jpg”,”url”:”https://www.indexologyblog.com/author/fiona_boal/”},{“display”:”Phillip Brzenk”,”title”:”Managing Director, Global Head of Multi-Asset Indices”,”image”:”/wp-content/authors/phillip_brzenk-325.jpg”,”url”:”https://www.indexologyblog.com/author/phillip_brzenk/”},{“display”:”Howard Silverblatt”,”title”:”Senior Index Analyst, Product Management”,”image”:”/wp-content/authors/howard_silverblatt-197.jpg”,”url”:”https://www.indexologyblog.com/author/howard_silverblatt/”},{“display”:”Michael Orzano”,”title”:”Senior Director, Global Equity Indices”,”image”:”/wp-content/authors/Mike.Orzano-231.jpg”,”url”:”https://www.indexologyblog.com/author/mike-orzano/”},{“display”:”John Welling”,”title”:”Director, Global Equity Indices”,”image”:”/wp-content/authors/john_welling-246.jpg”,”url”:”https://www.indexologyblog.com/author/john_welling/”},{“display”:”Wenli Bill Hao”,”title”:”Senior Lead, Factors and Dividends Indices, Product Management and Development”,”image”:”/wp-content/authors/bill_hao-351.jpg”,”url”:”https://www.indexologyblog.com/author/bill_hao/”},{“display”:”Maria Sanchez”,”title”:”Director, Sustainability Index Product Management, U.S. Equity Indices”,”image”:”/wp-content/authors/maria_sanchez-527.jpg”,”url”:”https://www.indexologyblog.com/author/maria_sanchez/”},{“display”:”Silvia Kitchener”,”title”:”Director, Global Equity Indices, Latin America”,”image”:”/wp-content/authors/silvia_kitchener-522.jpg”,”url”:”https://www.indexologyblog.com/author/silvia_kitchener/”},{“display”:”Shaun Wurzbach”,”title”:”Managing Director, Head of Commercial Group (North America)”,”image”:”/wp-content/authors/shaun_wurzbach-200.jpg”,”url”:”https://www.indexologyblog.com/author/shaun_wurzbach/”},{“display”:”Akash Jain”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/akash_jain-348.jpg”,”url”:”https://www.indexologyblog.com/author/akash_jain/”},{“display”:”Ved Malla”,”title”:”Associate Director, Client Coverage”,”image”:”/wp-content/authors/ved_malla-347.jpg”,”url”:”https://www.indexologyblog.com/author/ved_malla/”},{“display”:”Rupert Watts”,”title”:”Head of Factors and Dividends”,”image”:”/wp-content/authors/rupert_watts-366.jpg”,”url”:”https://www.indexologyblog.com/author/rupert_watts/”},{“display”:”Jason Giordano”,”title”:”Director, Fixed Income, Product Management”,”image”:”/wp-content/authors/jason_giordano-378.jpg”,”url”:”https://www.indexologyblog.com/author/jason_giordano/”},{“display”:”Brian Luke”,”title”:”Senior Director, Head of Commodities, Real & Digital Assets”,”image”:”/wp-content/authors/brian.luke-509.jpg”,”url”:”https://www.indexologyblog.com/author/brian-luke/”},{“display”:”Sherifa Issifu”,”title”:”Senior Analyst, U.S. Equity Indices”,”image”:”/wp-content/authors/sherifa_issifu-518.jpg”,”url”:”https://www.indexologyblog.com/author/sherifa_issifu/”},{“display”:”Qing Li”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/qing_li-190.jpg”,”url”:”https://www.indexologyblog.com/author/qing_li/”},{“display”:”Glenn Doody”,”title”:”Vice President, Product Management, Technology Innovation and Specialty Products”,”image”:”/wp-content/authors/glenn_doody-517.jpg”,”url”:”https://www.indexologyblog.com/author/glenn_doody/”},{“display”:”Sean Freer”,”title”:”Director, Global Equity Indices”,”image”:”/wp-content/authors/sean_freer-490.jpg”,”url”:”https://www.indexologyblog.com/author/sean_freer/”},{“display”:”Liyu Zeng”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/liyu_zeng-252.png”,”url”:”https://www.indexologyblog.com/author/liyu_zeng/”},{“display”:”Priscilla Luk”,”title”:”Managing Director, Global Research & Design, APAC”,”image”:”/wp-content/authors/priscilla_luk-228.jpg”,”url”:”https://www.indexologyblog.com/author/priscilla_luk/”},{“display”:”George Valantasis”,”title”:”Associate Director, Factors and Dividends”,”image”:”/wp-content/authors/george-valantasis-453.jpg”,”url”:”https://www.indexologyblog.com/author/george-valantasis/”},{“display”:”Barbara Velado”,”title”:”Senior Analyst, Research & Design, Sustainability Indices”,”image”:”/wp-content/authors/barbara_velado-413.jpg”,”url”:”https://www.indexologyblog.com/author/barbara_velado/”},{“display”:”Cristopher Anguiano”,”title”:”Senior Analyst, U.S. Equity Indices”,”image”:”/wp-content/authors/cristopher_anguiano-506.jpg”,”url”:”https://www.indexologyblog.com/author/cristopher_anguiano/”},{“display”:”Benedek Vu00f6ru00f6s”,”title”:”Director, Index Investment Strategy”,”image”:”/wp-content/authors/benedek_voros-440.jpg”,”url”:”https://www.indexologyblog.com/author/benedek_voros/”},{“display”:”Jason Ye”,”title”:”Director, Factors and Thematics Indices”,”image”:”/wp-content/authors/Jason%20Ye-448.jpg”,”url”:”https://www.indexologyblog.com/author/jason-ye/”},{“display”:”Michael Mell”,”title”:”Global Head of Custom Indices”,”image”:”/wp-content/authors/michael_mell-362.jpg”,”url”:”https://www.indexologyblog.com/author/michael_mell/”},{“display”:”Andrew Innes”,”title”:”Head of Global Research & Design”,”image”:”/wp-content/authors/andrew_innes-189.jpg”,”url”:”https://www.indexologyblog.com/author/andrew_innes/”},{“display”:”Joseph Nelesen”,”title”:”Senior Director, Index Investment Strategy”,”image”:”/wp-content/authors/joseph_nelesen-452.jpg”,”url”:”https://www.indexologyblog.com/author/joseph_nelesen/”},{“display”:”Maya Beyhan”,”title”:”Senior Director, ESG Specialist, Index Investment Strategy”,”image”:”/wp-content/authors/maya.beyhan-480.jpg”,”url”:”https://www.indexologyblog.com/author/maya-beyhan/”},{“display”:”Izzy Wang”,”title”:”Senior Analyst, Factors and Dividends”,”image”:”/wp-content/authors/izzy.wang-326.jpg”,”url”:”https://www.indexologyblog.com/author/izzy-wang/”},{“display”:”Rachel Du”,”title”:”Senior Analyst, Global Research & Design”,”image”:”/wp-content/authors/rachel_du-365.jpg”,”url”:”https://www.indexologyblog.com/author/rachel_du/”},{“display”:”Fei Wang”,”title”:”Senior Analyst, U.S. Equity Indices”,”image”:”/wp-content/authors/fei_wang-443.jpg”,”url”:”https://www.indexologyblog.com/author/fei_wang/”},{“display”:”Eduardo Olazabal”,”title”:”Senior Analyst, Global Equity Indices”,”image”:”/wp-content/authors/eduardo_olazabal-451.jpg”,”url”:”https://www.indexologyblog.com/author/eduardo_olazabal/”},{“display”:”Jaspreet Duhra”,”title”:”Managing Director, Global Head of Sustainability Indices”,”image”:”/wp-content/authors/jaspreet_duhra-504.jpg”,”url”:”https://www.indexologyblog.com/author/jaspreet_duhra/”},{“display”:”Daniel Perrone”,”title”:”Former Director and Head of Operations, ESG Indices”,”image”:”/wp-content/authors/daniel_perrone-387.jpg”,”url”:”https://www.indexologyblog.com/author/daniel_perrone/”},{“display”:”Ari Rajendra”,”title”:”Senior Director, Head of Thematic Indices”,”image”:”/wp-content/authors/Ari.Rajendra-524.jpg”,”url”:”https://www.indexologyblog.com/author/ari-rajendra/”},{“display”:”Louis Bellucci”,”title”:”Senior Director, Index Governance”,”image”:”/wp-content/authors/louis_bellucci-377.jpg”,”url”:”https://www.indexologyblog.com/author/louis_bellucci/”},{“display”:”Srineel Jalagani”,”title”:”Senior Director, Thematic Indices”,”image”:”/wp-content/authors/srineel_jalagani-446.jpg”,”url”:”https://www.indexologyblog.com/author/srineel_jalagani/”},{“display”:”Elizabeth Bebb”,”title”:”Director, Factor & Dividend Indices”,”image”:”/wp-content/authors/elizabeth_bebb-511.jpg”,”url”:”https://www.indexologyblog.com/author/elizabeth_bebb/”},{“display”:”Narottama Bowden”,”title”:”Director, Sustainability Indices Product Management”,”image”:”/wp-content/authors/narottama_bowden-331.jpg”,”url”:”https://www.indexologyblog.com/author/narottama_bowden/”},{“display”:”Raghu Ramachandran”,”title”:”Head of Insurance Asset Channel”,”image”:”/wp-content/authors/raghu_ramachandram-288.jpg”,”url”:”https://www.indexologyblog.com/author/raghu_ramachandram/”}]

Analyzing Capital in Small-Cap U.S. Equities

How does evaluating the S&P 600 for the leading 100 business based upon totally free capital yield impact efficiency? S&P DJI’s Michael Mell takes a customized take a look at the Pacer United States Little Cap Money Cows Index with Sean O’Hara, President of Pacer ETFs and Cameron Dawson, Chief Financial Investment Officer at NewEdge Wealth.

The posts on this blog site are viewpoints, not recommendations. Please read our Disclaimers

The Relative Worth of Insights

Lots of financiers utilize the start of the year to make forecasts for the approaching year and to consider methods to reveal views on these styles. This endeavor is not ensured to include worth: anticipating the future is extremely hard and success needs properly anticipating both the chauffeurs of future efficiency and the approaching effect of various market sectors. The many possible situations imply that is it simple to be wrong-footed

Nevertheless, the fundamental obstacle of forecasting suggests that financiers might want to focus their attention on market sectors where there is higher benefit for proper insight. Dispersion supplies a preliminary evaluation of the possible benefit for such insight. The higher the dispersion, the higher the possible benefits for properly selecting the best-performing constituents because market.

Display 1 reveals typical month-to-month dispersion figures for different sectors over the 15-year duration ending December 2023. The dispersion figures are determined for various levels of granularity, consisting of stocks, sectors, nations, U.S. designs and U.S. size sectors. S&P SmallCap 600 ®(* )stock dispersion was the greatest, usually, more than 3 times greater than the typical dispersion amongst S&P 500 ®(* )sectors. Lower levels of dispersion were observed in between U.S. size or design sectors, or in between nations or sectors in the S&P Established Ex.-U.S. BMI So does this mean that financiers would be well served to focus their attention on research study into small-cap U.S. equities rather of other locations? Not always: the relative worth of insight likewise depends upon the possible size of the positions that financiers might have the ability to take in various sectors. A financier’s capability to take active positions is associated with the typical market capitalization of constituents. For instance, there is more capability to take an active position in a trillion-dollar constituent compared to a smaller sized constituent. Display 2 plots the typical dispersion figures from Display 1 versus the index-weighted typical constituent size of the various sectors over the very same 15-year duration (note the log scale on the y axis).

Plainly, there has actually been a compromise in between dispersion and the typical constituent size. Greater dispersion sectors, which provide higher anticipated benefit for proper insight, might need smaller sized positions compared to lower dispersion sectors with bigger constituents.

Capacity-Adjusted Dispersion

supplies a method to represent capability when thinking about the possible worth of insight. It is determined by increasing the possible benefit to fix choices (dispersion) and possible size of active positions (typical constituent size). Display 3 reveals the typical ratio of capacity-adjusted dispersion procedures for various sectors compared to that of S&P 500 stocks, based upon month-to-month information over the 15-year duration ending December 2023.

Presuming that a financier’s forecasts are likewise important throughout each sector, Display 3 recommends that picking amongst the S&P Composite 1500

®(* )size sectors– the S&P 500, S&P MidCap 400 ®, and S&P SmallCap 600– might provide more than 9 times the possible chance compared to selecting S&P 500 stocks. Likewise, picking in between the S&P 500 Development and S&P 500 Worth or picking amongst S&P 500 sectors might have offered comparable chances as selecting nation parts of the S&P Emerging BMI or S&P Established Ex-U.S. BMI Such is the distinction in typical constituent size that insights into S&P SmallCap 600 stocks would need to be 50 times better than insights into S&P 500 stocks to supply the very same capacity-adjusted chance. As an outcome, revealing views through a U.S. size, design and sector lens might provide comparable chances as utilizing a nation lens. The relative capability of these sectors suggests they might provide higher chances than numerous other sectors.

The posts on this blog site are viewpoints, not recommendations. Please read our

Disclaimers

Classifications Equities, Aspects

The posts on this blog site are viewpoints, not recommendations. Please read our

Disclaimers

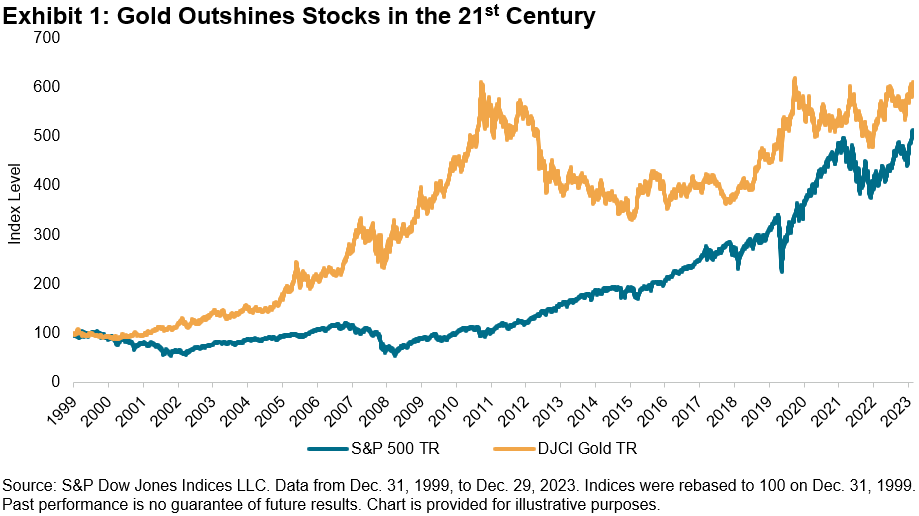

Twenty-First Century Fox: DJCI Gold Tops Stocks and Bonds This Century

Brian Luke Senior Director, Head of Commodities, Real & & Digital Assets

S&P Dow Jones Indices

-

2023,

products, -

Dow Jones Product Index Gold,

gold, S&P GSCI, S&P GSCI Energy, S&P GSCI Gold, S&P GSCI Grains, S&P GSCI Animals, S&P GSCI Gas, S&P GSCI Silver, S&P GSCI Unleaded Gas The equity markets roared to the goal, quickly passing products and bonds with a 26.3% return for the S&P 500 ®(* )in 2023. Much of that rally might be credited to decreasing customer rate indices and beneficial Federal Reserve assistance, with increased self-confidence in a soft landing. Decreasing inflation can best be observed at the cooking area table, where the

S&P GSCI Grains saw 15% decreases on the year and the S&P GSCI Animals stayed flat. In spite of another strong year of equity efficiency, the Dow Jones Product Index (DJCI) Gold preserved its leading perch for this century after reaching an all-time high in December. Gold attained a 12.8% return, outmatching both bonds and broad products, with the S&P GSCI

tape-recording a -4.3% yearly return. Returning to the start of the century, the DJCI Gold produced a 7.8% yearly return, compared to a 7% return for the S&P 500 throughout that time. Changing for volatility, gold has actually shown much better risk-adjusted returns than stocks, with a Sharpe ratio of 0.48 versus 0.45 for equities. Reserve banks appear to have actually taken notification in the outperformance of gold. After trading flat for much of the year, the S&P GSCI Gold and S&P GSCI Silver

staged a 4th quarter rally, increasing 11.4% and 7.2%, respectively. Worldwide reserve banks supported gold need, including over 800 metric loads to their portfolios with information through October. Gold has actually traditionally offered financiers an option to fiat currency. Going into the reserve bank purchase information, nations consisting of Russia and China have actually led the boost in reserve bank holdings. Foreign reserve banks appear to significantly value gold’s hedge versus inflation, financial obligation default and dollarization. Product Market Wrap-up Energy weighed down product efficiency in 2023, with the S&P GSCI Gas falling 62.6%. The decrease shows a go back to the longer-term rate levels observed throughout the previous years, in addition to robust production in addition to minimized export need of melted gas. The more comprehensive petroleum complex was combined, as lower oil didn’t equate to falling gas costs. The

S&P GSCI Energy

dropped 5.2% for the year, while the S&P GSCI Unleaded Gas increased 5.0%. The posts on this blog site are viewpoints, not recommendations. Please read our Disclaimers Tags

2023, products, Dow Jones Product Index Gold,

As the leading dividend index company, S&P DJI is continuously searching for brand-new methods and approaches to bring unique concepts to the marketplace. Our just recently released

S&P 500

®(* )High Dividend Development Index

is a prime example of this ingenious thinking, as it includes a positive evaluation into its approach. This index tracks business in the

S&P 500 that have not just used constant or growing dividends in the past however likewise have the greatest projection dividend yield development. In doing so, constituents are picked based upon what dividend they are anticipated to pay rather of being evaluated entirely on what they have actually paid in the past. In this blog site, we will provide the index approach, present the S&P Global Dividend Forecasting Dataset and evaluate the index’s risk/performance profile. Approach Summary To be qualified for choice, constituents should have preserved or grown their historical dividends for 5 successive years and should likewise be predicted to do so over the next 12 months. From this swimming pool of qualified stocks, the leading 100 constituents with the greatest projection dividend development ratings are picked. Ball game is calculated as the 12-month projection yield minus the 12-month historic yield. Lastly, the index constituents are weighted by projection dividend yield with restraints put on private stocks and GICS

®

sectors.

1

To decrease turnover, the index utilizes a 20% buffer.

Dividend Forecasting Information The Dividend Projection Dataset is sourced from S&P Global Market Intelligence, which is another department within S&P Global. This group has more than 40 specialists carrying out basic analysis with the objective of providing exact projections of the size and timing of dividend payments. They serve over 150 consumers throughout the world, consisting of the majority of the top-tier international banks. 2 Efficiency Evaluation The efficiency data that follow are determined beginning in 2010, when the information for the dividend forecasting dataset started. Thus, the back-tested information includes projections that were saved as and when they were made, without any look-ahead predisposition.

While this duration has actually been a strong efficiency duration for the S&P 500, the S&P 500 High Dividend Development Index has more than kept up. Because 2010, it has actually had actually an annualized return of 11.94% while providing a considerably greater yield.

Disadvantage Defense and Benefit Involvement The historic capture ratios versus the S&P 500 reveal that the S&P 500 High Dividend Development Index has actually displayed reasonably protective qualities (94.5% drawback capture). Additionally, usually, the index has actually traditionally taken part in 96% of the marketplace return in up-market durations.

3

This is greater than the majority of dividend techniques and is most likely an outcome of its reasonably lower worth tilt and greater development tilt.

Historic Yield and Dividend Development Analysis

This ingenious approach provides a distinct mix of dividend development and high yield. Because 2010, the index has actually had a typical yield of over 3%, easily exceeding its standard and other techniques within the dividend development classification.

Remarkably, for a dividend technique providing a high yield, the index likewise has actually a high annualized dividend development rate. From 2010 to 2022, the S&P 500 High Dividend Development Index grew its dividend at a yearly rate of 13.8% (see Display 3). This exceeds the long-lasting U.S. inflation rate, even with the current spike in inflation over the last couple of years. Aspect Direct Exposure Display 4 reveals the element direct exposure distinction in between the S&P 500 High Dividend Development Index and

S&P 500 High Dividend Index

in regards to Axioma Danger Design Aspect Z-scores. The S&P 500 High Dividend Development Index showed less worth tilt and had lower dividend yield than the S&P 500 High Dividend Index.

Sector Direct Exposure

From a sector point of view, the S&P 500 High Dividend Development Index had lower sector weights in Energies (-11.5%) and Property (-5.8%), while having greater sector weights in Industrials (9.6%) and Infotech (6.3%) than the S&P 500 High Dividend Index (see Display 5).

In a market filled with passive dividend options, the S&P 500 High Dividend Development Index stands apart by using a positive technique while traditionally providing high dividend development and high yield. This index’s historic lower worth tilt and greater development tilt might assist to prevent compromising possible upside when looking for high yield. 1 For more info about the index style, please see the

S&P 500 High Dividend Development Index Approach

2

For more details, please see this link 3

The marketplace is specified as the month-to-month efficiency of S&P 500 standards from April 16, 2010, to Oct. 31, 2023. The posts on this blog site are viewpoints, not recommendations. Please read our Disclaimers