We are presently awaiting the UK federal government to release its semiconductor technique. As context for such a method, my previous 2 blogposts have actually summed up the worldwide state of the market:

Part 1: the UK’s location in the semiconductor world

Part 2: the past and future of the worldwide semiconductor market

Here I consider what a practical and beneficial UK semiconductor technique may consist of.

To sum up the worldwide context, the vital countries in sophisticated semiconductor production are Taiwan, Korea and the U.S.A. for making the chips themselves. In addition, Japan and the Netherlands are essential for vital aspects of the supply chain, especially the devices required to make chips. China has actually been dedicating considerable resource to establish its own semiconductor market– as an outcome, it is strong in all however the most sophisticated innovations for chip manufacture, however is susceptible to being cut off from vital aspects of the supply chain.

The innovation of chip manufacture is approaching maturity; the extremely fast rates of boost in calculating power we saw in the 1980s and 1990s, connected with a mix of Moore’s law and Dennard scaling, have actually considerably slowed. At the innovation frontier we are seeing decreasing returns from the ever bigger financial investments in capital and R&D that are required to preserve advances. More enhancements in computer system efficiency are most likely to put more premium on custom-made styles for chips optimised for particular applications.

The UK’s position in semiconductor production is minimal in a worldwide point of view, and not a relative strength in the context of the general UK economy. There is really a somewhat more powerful position in the larger supply chain than in chip manufacture itself, however the most considerable strength is not in manufacture, however style, with ARM having a worldwide considerable position and beginners like Graphcore revealing guarantee.

The history of the worldwide semiconductor market is a history of significant federal government interventions paired with large economic sector R&D costs, the latter driven by significantly increasing sales. The UK basically pulled out of the race in the 1980’s, because when Korea and Taiwan have actually developed worldwide leading positions, and China has actually ended up being a quick broadening brand-new entrant to the market.

The harder geopolitical environment has actually caused a return of commercial technique on a big scale, led by the U.S.A.’s CHIPS Act, which appropriates more than $50 billion over 5 years to restore its worldwide management, consisting of $39 billion on direct aids for production.

How should the UK react? What I’m speaking about here is the core company of producing semiconductor gadgets and the surrounding supply chain, instead of details and interaction innovation more commonly. Initially, however, let’s be clear about what the objectives of a UK semiconductor technique might be.

What is a semiconductor technique for?

A nationwide technique for semiconductors might have several objectives. The UK Science and Innovation Structure determines semiconductors as one of 5 vital innovations, evaluated versus requirements including their fundamental character, market capacity, along with their value for other nationwide concerns, consisting of nationwide security.

It may be valuable to identify 2 a little various objectives for the semiconductor technique. The very first is the concern of security, in the broadest sense, triggered by the supply issues that emerged in the pandemic, and increased by the growing realisation of the value and vulnerability of Taiwan in the worldwide semiconductor market. Here the concerns to ask are, what markets are at danger from more disturbances? What are the nationwide security concerns that would emerge from disturbances in supply?

The federal government’s most current refresh of its incorporated foreign and defence technique guarantees to ” make sure the UK has a clear path to guaranteed gain access to for each [critical technology], a strong voice in affecting their advancement and usage worldwide, a handled method to provide chain dangers, and a strategy to safeguard our benefit as we develop it.” It reasserts as a design presented in the previous Integrated Evaluation the ” own, team up, gain access to” structure.

This structure is a welcome acknowledgment of the the truth that the UK is a medium size nation which can’t do whatever, and in order to have access to the innovation it requires, it should in many cases team up with friendly countries, and in others gain access to innovation through open worldwide markets. However it deserves asking exactly what is indicated by ” own” This is specified in the Integrated Evaluation therefore: ” Own: where the UK has management and ownership of brand-new advancements, from discovery to massive manufacture and commercialisation.”

In what sense does the country ever own an innovation? There are still a couple of cases where completely state owned organisations keep both a useful and legal monopoly on a specific innovation– nuclear weapons stay the most apparent example. However innovations are mostly managed by economic sector business with a complex, and typically worldwide ownership structure. We may believe that the innovations of semiconductor incorporated circuit style that ARM established are British, due to the fact that the business is based in Cambridge. However it’s owned by a Japanese financial investment bank, who have a good deal of latitude in what they make with it.

Possibly it is more valuable to discuss control than ownership. The UK state maintains a particular quantity of control of innovations owned by business with a significant UK existence– it has actually been able in result to obstruct the purchase of the Newport Wafer Fab by the Chinese owned business Nexperia. However this brand-new assertiveness is an extremely current phenomenon; till extremely just recently UK federal governments have actually been completely unwinded about the acquisition of innovation business by abroad business. Undoubtedly, in 2016 ARM’s acquisition by Softbank was invited by the then PM, Theresa May, as remaining in the UK’s nationwide interest, and a vote of self-confidence in post-Brexit Britain. The federal government has actually taken brand-new powers to obstruct acquisitions of business through the National Security and Financial Investment Act 2021, however this can just be done on premises of nationwide security.

The 2nd objective of a semiconductor technique is as part of an effort to conquer the UK’s relentless stagnancy of financial efficiency, to ” create innovation-led financial development”, in the words of a current Federal government action to a BEIS Select Committee report. As I have actually blogged about at length, the UK’s efficiency issue is major and relentless, so there’s definitely a requirement to recognize and support high worth sectors with the capacity for development. There is a local measurement here, acknowledged in the federal government’s goal for the technique to produce ” high paying tasks throughout the UK” So it would be completely suitable for a method to support the existing cluster in the Southwest around Bristol and into South Wales, along with to produce brand-new clusters where there are strengths in associated market sectors

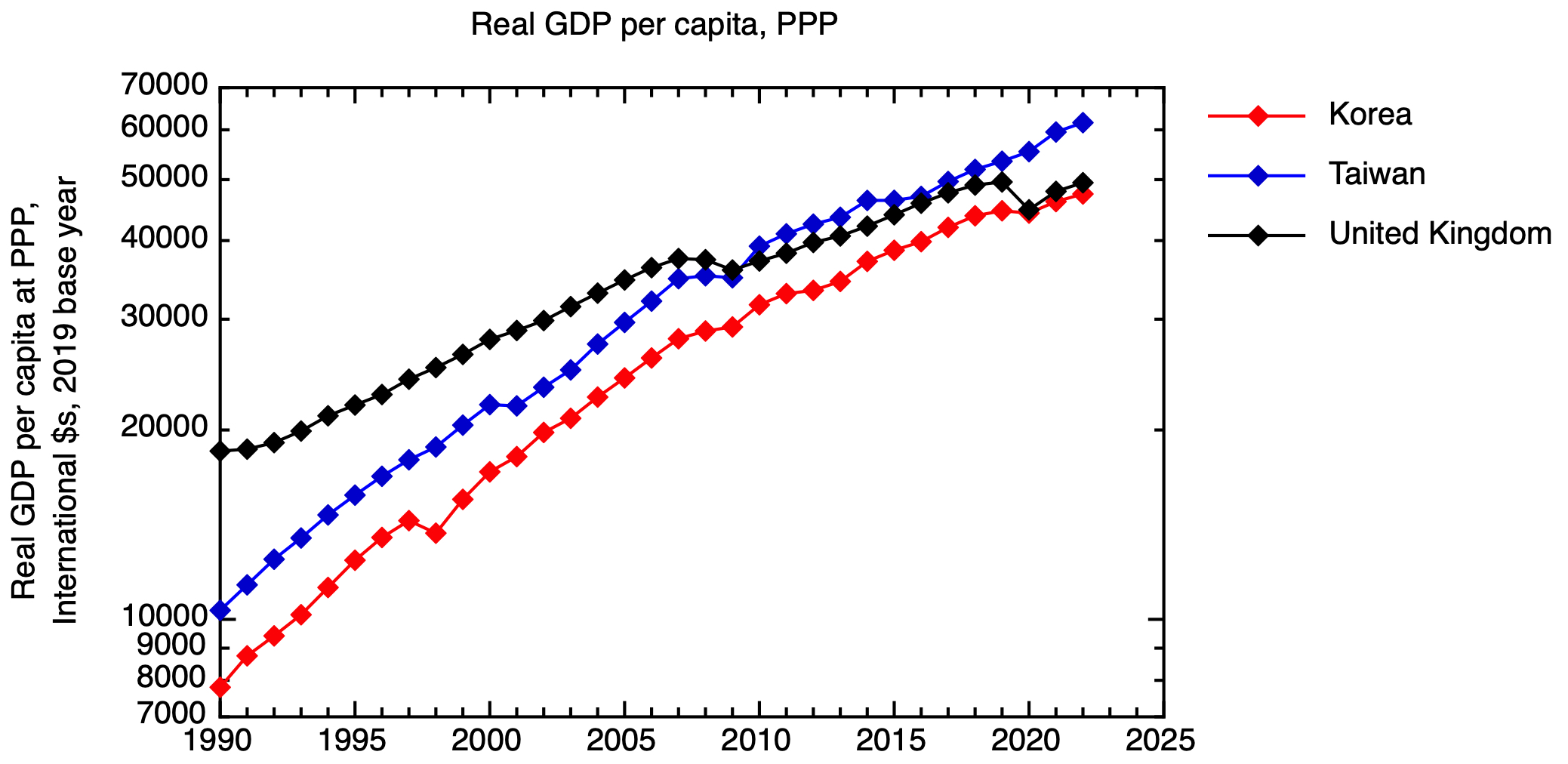

The economies of Taiwan and Korea have actually been changed by their extremely reliable implementation of an active commercial technique to benefit from a market at a time of fast technological development and broadening markets. There are 2 concerns for the UK now. Has the UK state (and the larger financial agreement in the nation) conquer its ideological hostility to active commercial technique on the East Asian design to step in at the essential scale? And, would such an intervention be prompt, provided where semiconductors remain in the innovation cycle? Or, to put it more provocatively, has the UK left it far too late to catch a substantial share of an innovation that is approaching maturity?

What, reasonably, can the UK do about semiconductors?

What interventions are possible for the UK federal government in designing a semiconductor technique that resolves these 2 objectives– of increasing the UK’s financial and military security by minimizing its vulnerability to shocks in the worldwide semiconductor supply chain, and of enhancing the UK’s financial efficiency by driving innovation-led financial development? There is a menu of choices, and what the federal government picks will depend upon its cravings for investing cash, its determination to take properties onto its balance sheet, and just how much it is prepared to intervene in the market.

Could the UK develop the production of leading edge silicon chips? This appears implausible. This is the most advanced production procedure on the planet, tremendously capital extensive and making use of a big quantity of proprietary and indirect understanding. The only method it might occur is if among the 3 business presently at or near the innovation frontier– Samsung, Intel or TSMC– might be attracted to develop a factory in the UK. What would remain in it for them? The UK does not have a huge market, it has a labour market that is high expense, yet doing not have in the essential abilities, so its only opportunity would be to advance big direct aids.

In any case, the attention of these business is somewhere else. TSMC is constructing a brand-new plant in Arizona, at an expense of $40 billion, while Samsung’s brand-new plant in Texas is costing $25 billion, with the United States federal government utilizing a few of the CHIPS act cash to subsidise these financial investments. In spite of Intel’s well-reported problems, it is preparing considerable financial investment in Europe, supported by incentives from EU and its member states under the EU Chips act. Intel has actually devoted EUR12 billion to broadening its operations in Ireland and EUR17 billion for a brand-new fab in the existing semiconductor cluster in Saxony, Germany.

From the perspective of security of supply, it’s not simply chips from the leading edge that are essential; for lots of applications, in cars, defence and commercial equipment, tradition chips produced by procedures that are no longer at the leading edge suffice. In concept developing production centers for such tradition chips would be less difficult than trying to develop production at the leading edge. Nevertheless, here, the economics of developing brand-new production centers is extremely hard. The expense of producing chips is controlled by the requirement to amortise the large capital expense of establishing a fab, however a brand-new plant would remain in competitors with long-established plants whose capital expense is currently totally diminished. These tradition chips are a commodity item.

So in practise, our security of supply can just be guaranteed by dependence on friendly nations. It would have been valuable if the UK had actually had the ability to take part in the advancement of a European technique to protect semiconductor supply chains, as Hermann Hauser has actually argued for However what does the UK need to contribute, in the development of more resistant supply chains more localised in networks of dependably friendly nations?

The UK’s essential property is its position in chip style, with ARM as the anchor company. However, as a company based upon copyright instead of the huge capital expense of fabs and factories, ARM is possibly footloose, and as we have actually seen, it isn’t British by ownership. Rather it is owned and managed by a Japanese corporation, which requires to offer it to raise cash, and will look for to attain the greatest return from such a sale. After the proposed sale to Nvidia was obstructed, the most likely result now is a floatation on the United States stock exchange, where the normal appraisals of tech business are greater than they remain in the UK.

The UK state might look for to preserve control over ARM by the gadget of a ” Golden Share”, as it presently makes with Rolls-Royce and BAE Systems. I’m not exactly sure what the system for this would be– I would think of that the only guaranteed method of doing this would be for the UK federal government to purchase ARM outright from Softbank in a predetermined sale, and after that consequently drift it itself with the golden share in location. I do not expect this would be low-cost– the concurred rate for the warded off Nvidia take control of was $66 billion. The UK federal government would then try to recover as much of the purchase rate as possible through a subsequent floatation, however the existence of the golden share would probably decrease the marketplace worth of the staying shares. Still, the UK federal government did invest ⤠46 billion nationalising a bank.

What other levers does the UK need to combine its position in chip style? Smart usage of federal government acquiring power is typically pointed out as a component of an effective commercial policy, and here there is a chance. The federal government made the welcome statement in the Spring Budget plan that it would devote ⤠900 m to develop an exascale computer system to produce a sovereign ability in expert system. The procurement procedure for this center must be developed to drive development in the style, by UK business, of specialised processing systems for AI with lower energy usage.

A strong public R&D base is an essential– however not enough– condition for a reliable commercial technique in any R&D extensive market. As a matter of policy, the UK diminished its public sector research study effort in mainstream silicon microelectronics, in action to the UK’s general weak position in the market. The Engineering and Physical Research Study Council reveals on its site that: ” In 2011, EPSRC chose not to support research study targeted at miniaturisation of CMOS gadgets through gate-length decrease, as big non-UK commercial financial investment in this field indicated such research study would have been not likely to have actually had considerable nationwide effect.” I do not believe this was– or is– an unreasonable policy provided the truths of the UK’s worldwide position. The UK preserves scholastic research study strength in locations such III-V semiconductors for optoelectronics, 2-d products such as graphene, and natural semiconductors, to provide a couple of examples.

Offered the elegance of cutting-edge microelectronic production innovation, for R&D to be pertinent and translatable into industrial items it is very important that open gain access to centers are readily available to enable the prototyping of research study gadgets, and with pilot scale devices to show manufacturability and assist in scale-up. The UK does not have research study centres on the scale of Belgium’s IMEC, or Taiwan’s ITRI, and the concern is whether, provided the shallowness of the UK’s market base, there would be a client base for such a center. There are a variety of university centers concentrated on supporting scholastic scientists in numerous specialisms– at Glasgow, Manchester, Sheffield and Cambridge, to provide some examples. 2 centres are connected with the Catapult Network– The National Printable Electronic Devices Centre in Sedgefield, and the Substance Semiconductor Catapult in South Wales.

This existing facilities is definitely inadequate to support an aspiration to broaden the UK’s semiconductor sector. However a choice to improve this research study facilities will require a cautious and practical examination of what specific niches the UK might reasonably wish to develop some existence in, constructing on locations of existing UK strength, and comprehending the scale of financial investment somewhere else on the planet.

To sum up, the UK should identify that, in semiconductors, it is presently in a reasonably weak position. For security of supply, the focus should be on remaining near similar nations like our European neighbours. For the UK to establish its own semiconductor market even more, the focus should be on finding and establishing specific specific niches where the UK’s does have some current strength to develop on, and there is the possibility of quickly growing markets. And the UK must care for its one authentic location of strength, in chip style.

4 lessons for commercial technique

What should the UK do about semiconductors? Another appealing, however unhelpful, response is ” I would not begin with here” The UK’s existing position shows previous options, so to conclude, possibly it deserves drawing some more basic lessons about commercial technique from the history of semiconductors in the UK, and worldwide.

1. Fundamental research study is insufficient

The historian David Edgerton has actually observed that it is a long-running routine of the UK state to utilize research study policy as a replacement for commercial technique. Fundamental research study is fairly low-cost, compared to the costly and lengthy procedure of establishing and executing brand-new items and procedures. In the 1980’s, it ended up being standard knowledge that federal governments must not get associated with used research study and advancement, which must be delegated personal market, and, as I just recently gone over at length, this has exceptionally shaped the UK’s research study and advancement landscape However quality in fundamental research study has actually not produced a competitive semiconductor market.

The last considerable act of federal government assistance for the semiconductor market in the UK was the Alvey program of the 1980s. The program was not without some technical successes, however it plainly stopped working in its tactical objective of keeping the UK semiconductor market worldwide competitive. As the main examination of the program concluded in 1991 [1]: ” Assistance for pre-competitive R&D is an essential however inadequate ways for improving the competitive efficiency of the IT market. The program was not moneyed or geared up to handle the various stages of the development procedure efficient in being resolved by federal government innovation policies. If improved competitiveness is the objective, either the financing or scope of action must be commensurate, or expectations must be decreased appropriately”.

However the ideal R&D organizations can be beneficial; the experience of both Japan and the U.S.A. reveals the worth of market consortia– however this just works if there is currently a strong, R&D extensive market base. The development of TSMC reveals that it is possible to produce a worldwide giant from scratch, and this stresses the function of translational research study centres, like Taiwan’s ITRI and Belgium’s IMEC. However to be reliable in developing brand-new companies, such centres require to have a concentrate on procedure enhancement and production, along with discovery science.

2. Big is gorgeous in deep tech.

The contemporary semiconductor market is the embodiment of ” Deep Tech”: difficult development, typically in the product or biological domains, requiring long term R&D efforts and big capital expense. For all the love of garage-based start-ups, in a service that requires up-front capital expense in the $10’s of billions and yearly research study budget plans on the scale of medium size country states, one requires major, big scale organisations to be successful.

The ownership and control of these organisations does matter. From a nationwide perspective, it is very important to have big companies anchored to the area, whether by ownership or by considerable capital expense that would be difficult to reverse, so making sure the permanence of such companies is the genuine company of federal government. Naturally, huge companies typically begin as quick growing little ones, and the UK must make more effort to hold on to business as they scale up.

3. Getting the timing right in the innovation cycle

Technological development is unequal– at any provided time, one market might be going through extremely remarkable technological modification, while other sectors are fairly stagnant. There might be a minute when the state of innovation guarantees a duration of fast advancement, and there is a matching market with the capacity for quick development. Companies that have the capability to invest and make use of such ” windows of chance”, to utilize David Sainsbury’s expression, will have the ability to create and catch a high and increasing level of included worth.

The timing of interventions to support such companies is vital, and unquestionably difficult, however history reveals us that countries that have the ability to use considerable levels of tactical assistance at the ideal phase can see a product effect on their financial efficiency. The current fast financial development of Korea and Taiwan is a case in point. These nations have actually exceeded catch-up financial development, to equivalent or exceed the UK, showing their reaching the technological frontier in high worth sectors such as semiconductors. Naturally, in these nations, there has actually been a much closer entanglement in between the state and companies than UK policy makers are comfy with.

Genuine GDP per capita at acquiring power parity for Taiwan, Korea and the UK. Based upon information from the IMF. GDP at PPP in global dollars was considered the base year of 2019, and a time series built utilizing IMF genuine GDP development information, & & then revealed per capita.

4. If you do not select sectors, sectors will select you

In the UK, so-called ” vertical” commercial technique, where specific options are made to support particular sectors, have actually long run out favour. Choosing in between sectors is hard, and being viewed to have actually made the incorrect options harms the track record of people and organizations. However even in the lack of a clearly articulated vertical commercial technique, policy options will have the result of favouring one sector over another.

In the 1990s and 2000s, UK selected oil and gas and monetary services over semiconductors, or undoubtedly advanced producing more typically. Our existing financial circumstance shows, in part, that option.

[1] Examination of the Alvey Program for Advanced Infotech. Ken Guy, Luke Georghiou, et al. HMSO for DTI and SERC (1991 )