VPanteon/iStock by means of Getty Images

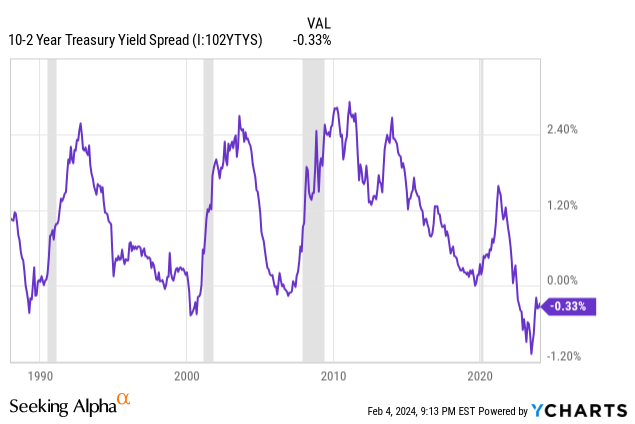

The bond market requires a chiropractic practitioner for a long period of time. It has actually been “misaligned” versus its typical upward-sloping nature because July of 2022. And according to a sign that is carefully tracked on Wall Street, that implies we need to have an economic downturn start by this coming July.

However work is strong, inflation is moderating, and the stock exchange is at all-time highs. Those are the boiler plate “bull” arguments. The “bears” counter with the unsustainable charge card financial obligation levels reached by United States customers, and the unsustainable deficit spending sustained by the United States Congress. Oh, and it’s an election year.

Honestly, none of that matters to me, and most likely should not to numerous financiers. We can not manage what the marketplace does, however we can manage how we position for it. And back on October 1 of in 2015, I composed an short article that accentuated a possibly unusual chance to take a few of the lowest-risk bonds or bond ETFs consisting of United States Treasury 2 Year Note ETF ( NASDAQ: UTWO) and not just make a good earnings return, however perhaps even some capital gains too. That part of the bond market is kept in mind for stability and more just recently, some relatively high yields compared to the previous 15 years. However not rate gratitude.

That 1-2 punch: Yield plus rate gratitude, from an unusual source

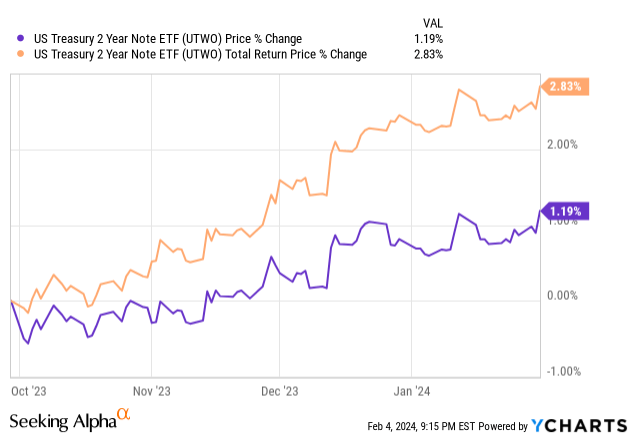

As it ended up, UTWO and other short-to-intermediate-term United States Treasury note ETFs did certainly provide on that possible “1-2 punch” of yield and gratitude. Now, the capital gain part was modest, however that has to do with all it might be unless rates crashed back towards absolutely no.

And while that might still take place, I am reporting that 4 months after that UTWO strong buy call, it is simply a good hold to me now, in the conventional sense. That is I like the earnings, however the capital gains kicker to that yield is not rather as juicy-looking versus in the past. That has more to do with the bond market’s indecision as anything else.

Above is the existing circumstance as it refers to the 10-2 spread. It stands at 33 basis points, which is simply a stone’s toss from re-inverting the yield curve. That may indicate that 2-year rates and UTWO surged lower in yield and greater in rate, however I’m not depending on that. I wish to stay “in the video game” for that situation, however a lot of other things are contending for my attention and my possessions, consisting of the YARP stocks I have actually been blogging about and a capacity (focus on “possible”) year 2000-like rip greater in a little number of Nasdaq 100 stocks.

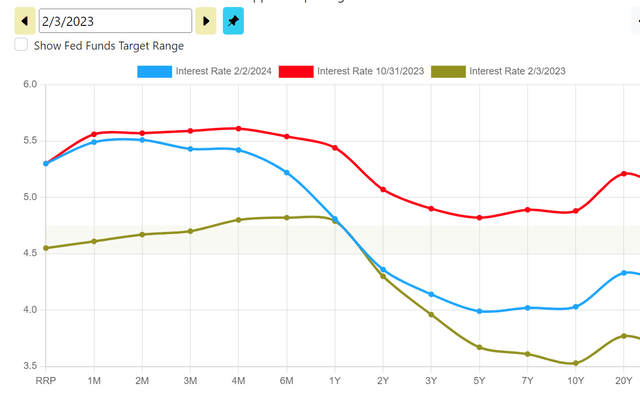

Below is a chart of the United States Treasury yield curve at 3 current moments. Blue is since last Friday, red is 4 months back and green is 12 months back. What’s taken place? For 2-year rates, essentially absolutely nothing over the 12 months, however in the previous 4 months they have actually stopped by more than 60 basis points. That drove the UTWO overall return I was trying to find.

On The Other Hand, the extremely brief end of the curve (T-bills) are still yielding a heap, however the vital 10-year part is at 4.0% versus 4.3% for the 2-year note. What occurs next? I do not understand, however in time I ‘d anticipate the 2-year yield to slide, not plunge lower. I simply see excessive of a yank of war in the bond market today, and the Fed is simply complicated everybody with their rhetoric.

The 10-year programs tips of kicking up simply a bit, therefore (simply a guesstimate), I might see something like a 3.9% 2-year and a 4.0% 10-year, and bang! there’s our turnaround of the inversion. And the news headings will be shrieking “economic downturn.” This is why I’m pleased I simply let rate guide and do not earn a living forecasting rates and economic downturns!

UTWO: Owns 2-year United States Treasury notes, got the job done, however the “minute” might be over

UTWO provided throughout the short duration I intended to capitalize. That 2.83% return over 4 months has to do with an 8.5% annualized yield. Okay for 2-year United States Treasuries! However the essential part is that purple line, which reveals that UTWO acquired 1.2% throughout the 4-month duration. That might not seem like much, however that resembles the S&P 500 getting 30% in 4 months. That is, it occurs however hardly ever.

So, the UTWO window of chance, while still open, is something I’m less passionate about. I continue to keep a 2-year United States Treasury position, though mainly through real bonds. I still hold a modest UTWO position, however as kept in mind above, it is more a hold than a strong buy now. It deserved the shot, and the outcomes definitely produced some alpha over T-bills alone, however it is time to include other, more fascinating reward/risk tradeoffs in my portfolio.