SeanShot

Intro

In this post, I wish to act of things. Most importantly, I’ll discuss what to make from S&P Global ( NYSE: SPGI) as a dividend development stock, as it features an excellent company design, constant development, and strong dividend development, which offsets a few of the drawback associated to its low yield of simply 1%.

2nd, while diving into the business’s numbers and remarks, we’ll discover a lot about the state of the international economy and the health of the credit markets.

After all, while S&P Global is diversifying, it’s still the king of score firms.

So, let’s get to it!

3 As, One D

S&P Global isn’t simply the world’s biggest score company. With a market cap of $120 billion, it is among the world’s biggest monetary service business. Duration.

Regrettably, this big business has a really little yield, that makes it inappropriate for income-oriented financiers.

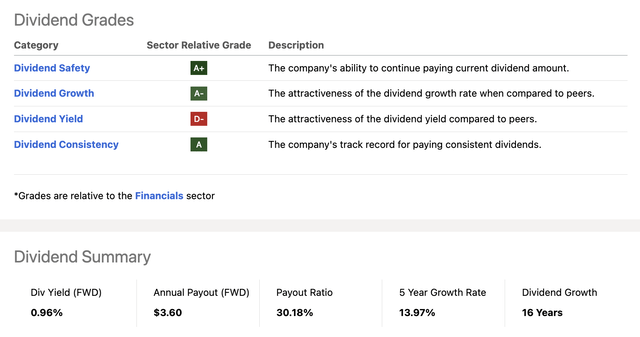

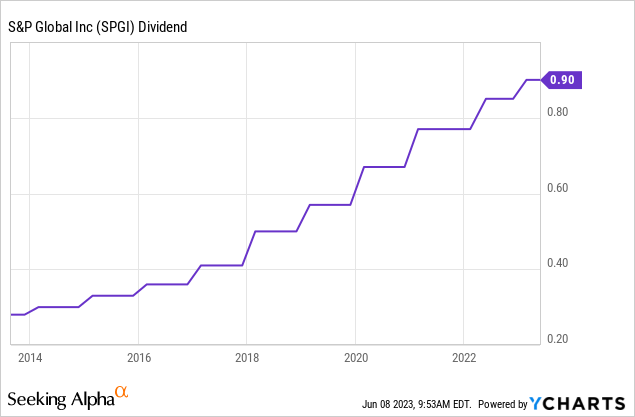

Luckily, this does not make it a bad dividend development stock, as the focus is on development. Taking a look at the dividend scorecard listed below, we see that the business ratings really high up on dividend security, dividend development, and dividend consistency.

The business has actually treked its dividend for 16 successive years, that includes the Great Financial Crisis, a payment ratio of simply 30%, and a typical yearly dividend development rate of 14.0% over the previous 5 years.

- On May 25, 2022, the board authorized a 10.4% dividend walking.

- On January 25, 2023, the business revealed a 5.9% dividend walking.

- The stock presently yields 1.0%.

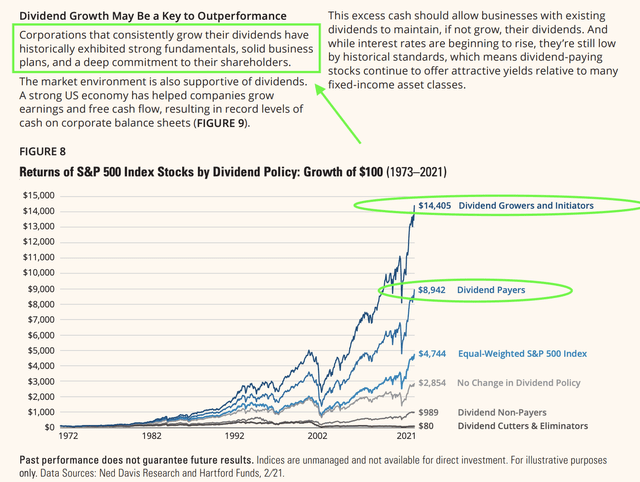

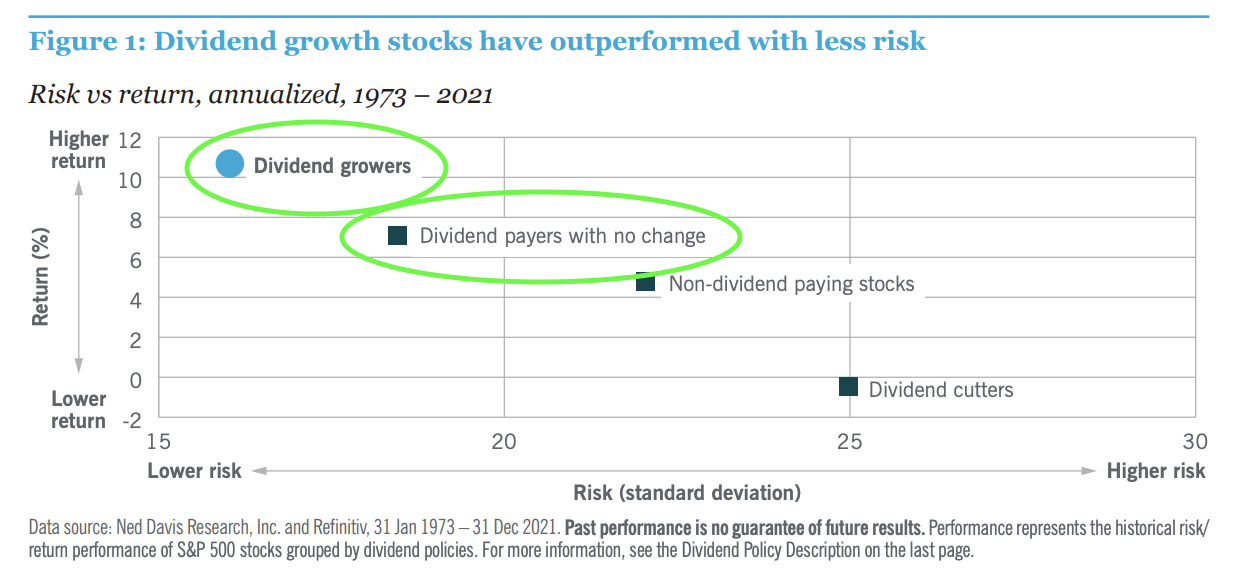

Once Again, while its yield is frustrating, the stock is surpassing the marketplace by a broad margin, which is backed by years of research study. For instance, Hartford Funds discovered that dividend development stocks surpass the marketplace with suppressed volatility.

Nuveen showed the relationship in between threat and volatility even much better.

Dividend growers not just have greater returns, however likewise regularly lower dangers, which is based upon the capability of dividend growers to create worth and enable financiers to take advantage of regularly increasing earnings. This is something lower-quality business can not take on – a minimum of not on a long-lasting basis.

Nuveen

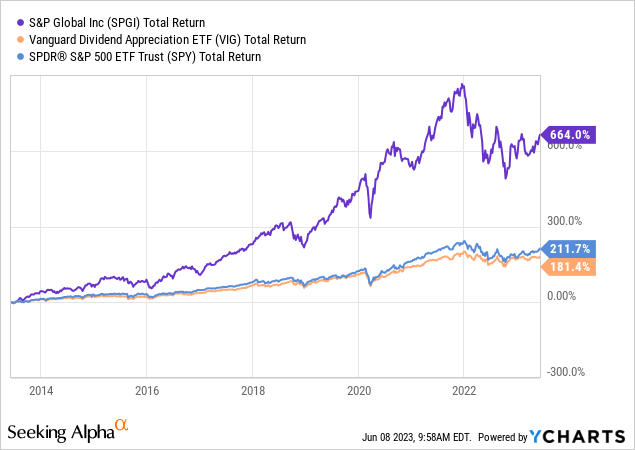

Over the previous 10 years, SPGI shares have actually returned 664%, which beats the marketplace and the Lead Dividend Gratitude ETF ( VIG) by a mile.

Moreover, as the numbers listed below program, SPGI regularly surpassed its peers with beneficial volatility.

Nevertheless, over the previous 3 years, SPGI shares have actually begun to underperform, which is why I used a neutral score in in 2015’s post.

It’s likewise why I’m reviewing the stock. After all, bad efficiencies of business with otherwise excellent performance history might imply we’re purchasing terrific worth.

In Spite Of Headwinds, S&P Global Is Making Development

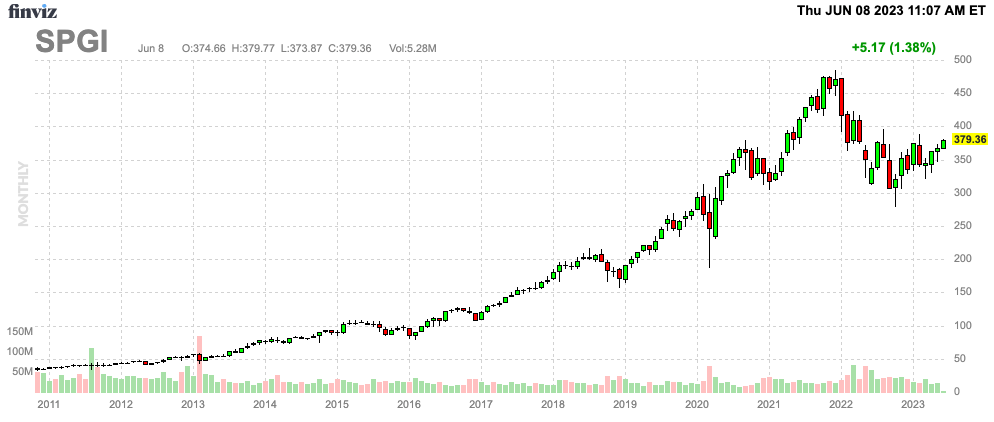

S&P Global shares are presently approximately 20% listed below their all-time high. This seeks an outstanding 34% rally off its 2022 lows.

FINVIZ

The business’s greatest issue is a really hard credit market, which injures the need for its scores.

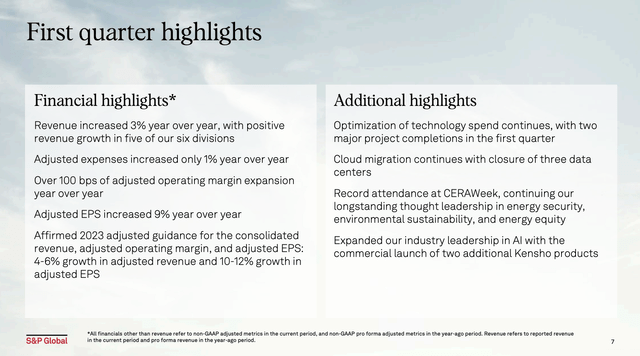

Nevertheless, in the very first quarter of 2023, the business saw a 9% boost in adjusted revenues per share compared to the previous year. This development was driven by a mix of 3% income development, running margin growth of 100 basis points, and an 8% decrease in the totally watered down share count.

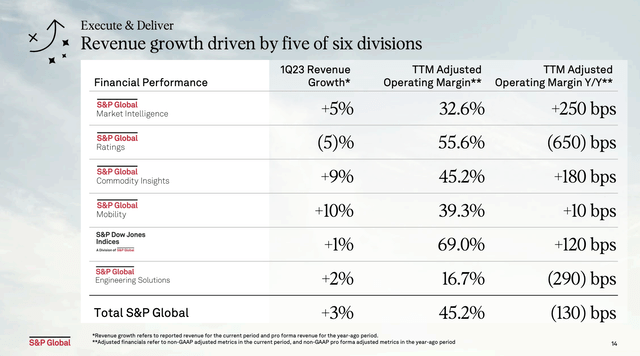

In the Market Intelligence section, which represented 34% of 2022 income, income increased by 5% with strong development in information and advisory options and credit and threat options.

Nevertheless, there was a lower issuance environment compared to the previous year, though it enhanced sequentially from the 4th quarter. Expenditure development stayed flat year-over-year, leading to a 16% boost in operating earnings and a 300 basis points increase in running margin to 32%.

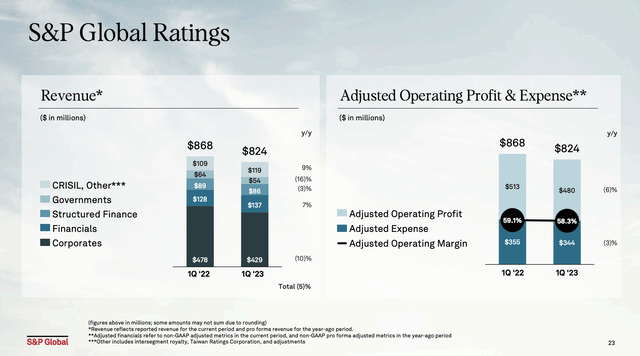

In the business’s Ranking section, income reduced by 5%. Nevertheless, there was an enhancement in the issuance environment compared to the previous quarter. Changed costs reduced by 3%, leading to a 6% reduction in operating earnings and an 80 basis points reduce in running margin to 58.3%.

The other sectors revealed development, improved by more need for advisory and transactional services.

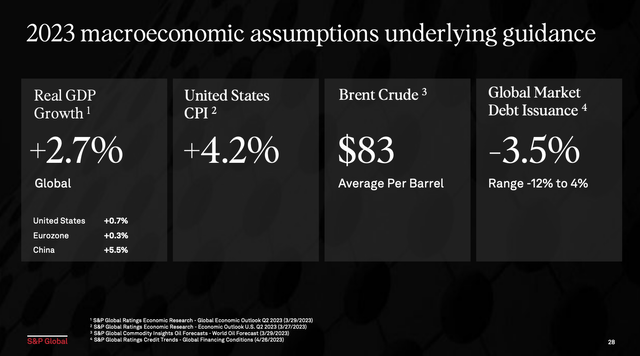

What’s intriguing is that the business’s economic experts anticipate international GDP development of 2.7% in 2023, with expectations of a moderate economic downturn in the middle of the year and a modest healing towards completion, which is basically the soft landing story most readers might recognize with.

Inflation is anticipated to stay above reserve bank targets, and energy rates are prepared for to remain above historic averages, which is something that I concur with.

While business conditions agree with for lots of services, the issuance environment stays unstable.

For this reason, the business keeps its assistance varies for income and changed operating margin however acknowledges increased unpredictability in the markets and the banking sector.

According to the business, there’s a raised threat real numbers might come closer to the low end of these varieties.

Once again, provided the larger photo, I concur with these numbers and think that SPGI is doing a fantastic task of plainly interacting chances and dangers.

Moreover, while S&P Global anticipates a moderate economic downturn behind at first prepared for, they predict volatility in equities, credit, and products markets.

The business likewise stressed the extension of nonreligious patterns, like the shift from active to passive property management and energy shift.

Although the occasions surrounding local banks include unpredictability, S&P Global does not anticipate a product effect on their monetary assistance for 2023 or their medium-term targets.

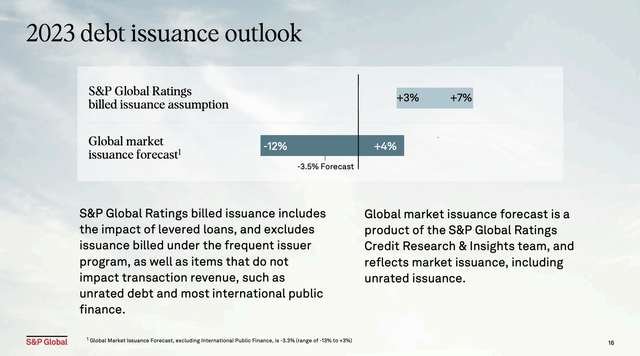

For this reason, the business tasks construct issuance to be up roughly 3% to 7% for the complete year.

In addition to that, S&P Global released numerous brand-new items, leveraging synergies in between groups to improve their client worth proposal.

For instance, the business presented brand-new rate evaluations for black mass and R-PET to enhance openness in the rates of battery basic materials and recycled plastics.

S&P Global likewise stayed concentrated on disciplined M&A and finished the acquisitions of TruSight and ChartIQ within market intelligence and market scan within movement.

Assessment

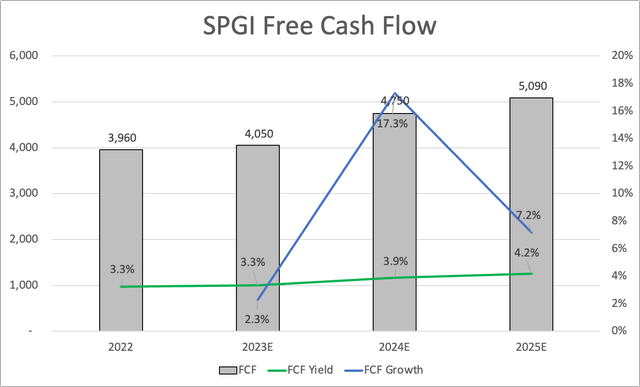

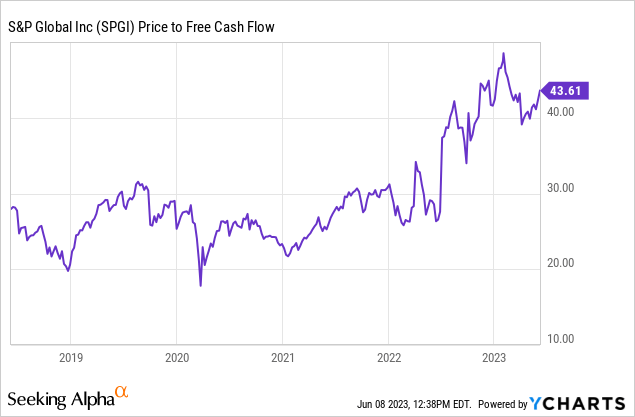

The business’s remarks and outlook are shown in expert price quotes. While 2023 is anticipated to be a sluggish year, 2024 is anticipated to see a considerable increase in totally free capital, followed by another 7% rise to $5.1 billion in 2025E totally free capital.

Thanks to a healthy balance sheet with a 1.6 x net utilize ratio, the business has an A- credit score from its peer Moody’s Corporation ( MCO).

For this reason, the business is most likely to keep strong buybacks and dividend development, improving its bottom line and investor payment.

Additionally, the anticipated rise in totally free capital recommends that the business is trading near to 25x 2024E totally free capital, which would imply that the business is relatively valued.

The existing agreement rate target is $410. That’s 8% above the existing stock rate.

I concur with that, as I’m not going to bank on greater rates. While the business has actually included higher-for-longer rates of interest in its outlook, I think that financial development might be weaker than anticipated.

For this reason, I likewise do not anticipate a fast return in providing need, as we saw in 2020 and 2021.

That stated, if SPGI drops listed below $330 once again, I’m most likely to purchase it.

Keep In Mind that I know that waiting on much better entries features dangers. For instance, SPGI might continue its uptrend if financial development begins to rebound, which would enable the Fed to create a soft landing.

Nevertheless, provided the business’s appraisal, I want to take that threat. For this reason, I put the SPGI ticker on my watch list. If it drops, I’m purchasing, as S&P Global integrates sustainable long-lasting dividend development with a wide-moat company that is poised to surpass the marketplace on a long-lasting basis.

Takeaway

S&P Global provides an appealing financial investment chance as a dividend development stock regardless of its low yield. With a strong company design, constant development, and an outstanding dividend performance history, the business makes up for its modest 1% yield.

The business has actually regularly increased its dividend for 16 years, even throughout the Great Financial Crisis.

Although the stock’s yield is frustrating, it has actually regularly surpassed the marketplace, showing the capacity of dividend development stocks with lower volatility.

Additionally, current underperformance might provide a chance to purchase into a business with a strong performance history at an appealing worth. In spite of difficulties in the credit market, SPGI is making development, driven by development in numerous sectors and expectations of a moderate economic downturn.

While financial unpredictabilities stay, SPGI’s long-lasting possible makes it an engaging stock to enjoy and think about for financial investment if the stock rate provides another correction chance.