Last month, the TeleGeography group signed up with ratings of ICT facilities experts in National Harbor, Maryland for International Telecom Week

Among the lots of subjects talked about was rate disintegration in Latin America. The primary pattern most likely comes as not a surprise: rates keep falling. However there is subtlety to how rate disintegration is happening in various markets.

Let’s check out the context in more information.

The Fight of Competitive Wavelength Prices

Connection to Latin America has actually traditionally been a lot more pricey than in more recognized areas, such as the trans-Atlantic. And while capability services in Latin America still tend to come at a premium, that distinction has actually diminished.

According to our Wavelengths Network Prices Database, in Q1 2023, the weighted typical 100 Gbps rate on Miami-Sao Paulo ($ 18,000) was simply 3 times more pricey than London-New York. That’s below 6.6 times more pricey in 2018.

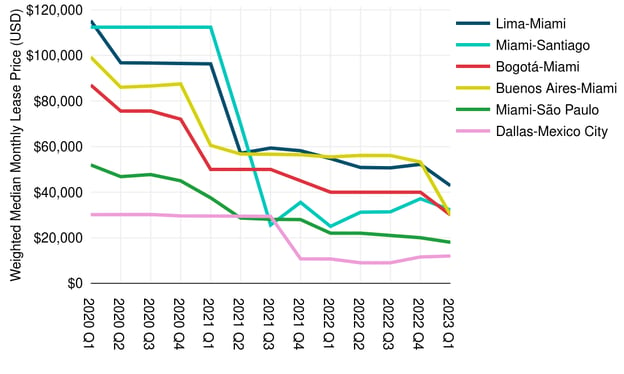

In the figure listed below, you can see how rates for 100 Gbps wavelengths on a number of other popular paths in Latin America have actually fallen in current years. Considering that 2020, the typical rate for 100 Gbps on these essential paths has actually fallen 30%, intensified each year.

Source: © 2023 TeleGeography

Source: © 2023 TeleGeography

There are a number of aspects adding to the quick speed of disintegration.

One element pointed out at ITW was market interruption. Some particular examples that we heard mentioned consist of the production of Cirion Technologies from Lumen’s previous Latin America properties, the production of V.Tal in the wake of Oi’s insolvency procedure, and basic personal equity financial investment in the area. This increased competitors may assist describe rates patterns in afflicted markets.

Cents on the Dollar for IP Transit

Another wholesale item with rates dropping in Latin America is IP transit. And in some markets, the decrease has actually been sharp.

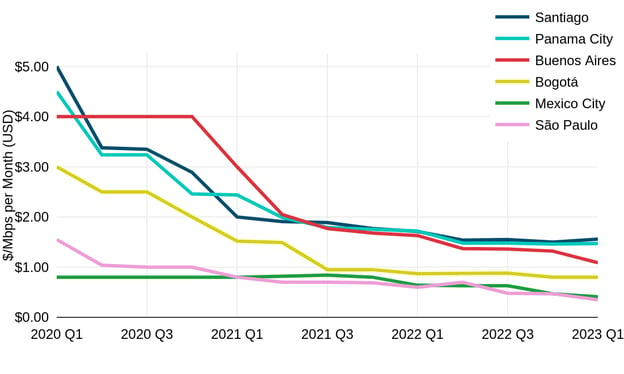

Utilizing information from our IP Transit Network Prices Database, the figure listed below programs simply how rapidly IP transit rates have actually fallen in essential Latin American cities.

Source: © 2023 TeleGeography

Source: © 2023 TeleGeography

While IP transit rate disintegration is definitely notable throughout several markets, rates in Brazil were a hot subject at ITW. That’s since the Q1 2023 weighted typical rate for a 10 GigE port in São Paulo was $0.35– a drop of 39%, intensified each year, because 2020.

In the submarine cable-friendly Rio de Janeiro and Fortaleza, rates is reported even lower, with weighted typical expenses of $0.31 and $0.27, respectively.

Although the Brazilian market has traditionally had considerably more competitive IP transit rates than other Latin American markets, over the previous year, disintegration has actually brought its IP transit rates in line with significant centers in the United States. ITW guests we talked to characteristic this to cable television launches, more competitors in the market, and the increase of caches in Brazil.

The Look For the Next Hot Market

In previous months, Colombia captured our eye as a progressively attractive location to buy telecoms facilities. That’s still the case, however network operators have actually turned their heads to other markets too.

One such location is Peru, where the just recently released South Pacific Cable Television System/Mistral even more links a location acquiring attention from providers and financiers alike. With systems like South America-1 and South American Crossing approaching retirement, the capacity for an infusion of extra bandwidth looms on the horizon. This might lead rates in Peru– generally a bit greater than in surrounding nations like Colombia and Chile– to fall at a sped up speed.

Additional north, we continue to find out about Quer̩taro, Mexico as a thriving market for financial investmentРboth for information centers and the fiber required to link them. In truth, information center development has actually increased a lot that there are issues over whether the energy supply suffices to sustain more growth.

Throughout Latin America, the scenario stays comparable: vibrant markets with rates that keep falling.

Throughout Latin America, the scenario stays comparable: vibrant markets with rates that keep falling. ITW 2023 was a practical possibility to sign in with contacts throughout the area and examine where the rest of 2023 may be headed for a growing area.