Summary.

The worldwide battery metals market is a quickly growing billion-dollar market. This market represents the raw products utilized in the production of batteries such as lithium, nickel, cobalt, manganese and graphite. With the increasing appeal of electrical cars, energy storage systems, customer electronic devices and electrical options to daily applications, the need for these metals has actually seen unmatched development.

The worldwide battery metals market price is anticipated to reach $ 20 5 billion in 2027 with a CAGR of 8.2 percent. A fast rise in the renewable resource market has numerous wanting to the battery mineral and metal expedition and advancement business to provide the need, which reveals robust forecasts throughout worldwide markets.

Battery Mineral Resources (TSXV: BMR, OTCQB: BTRMF) is a battery minerals business supplying investors direct exposure to the worldwide mega-trend of electrification while being concentrated on development through cash-flow, expedition and acquisitions in beneficial mining jurisdictions.

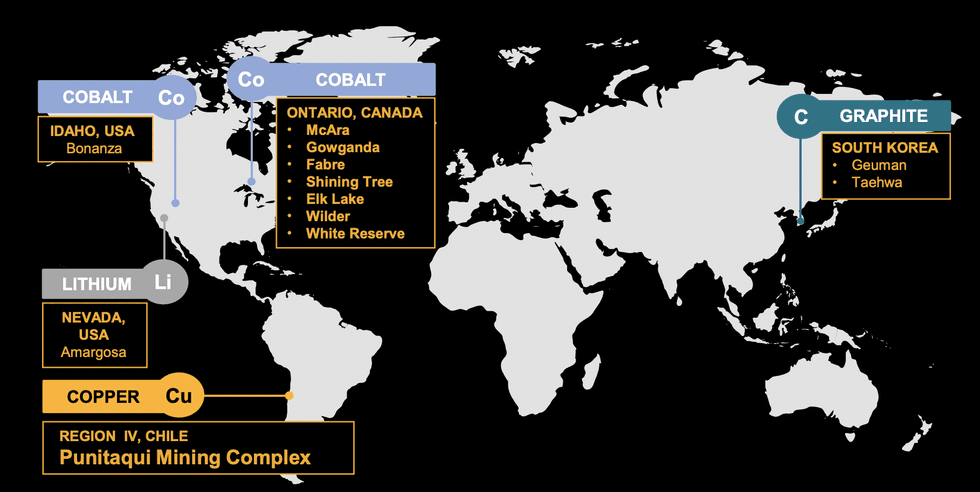

The business’s objective is the discovery, acquisition and advancement of battery metals (particularly, copper, cobalt, lithium and graphite) in The United States and Canada, South America and South Korea. It intends to end up being a leading inexpensive manufacturer of top quality, morally sourced battery metals from state-of-the-art, low-impact mines in steady jurisdictions that are close to significant customer markets.

BMR is headquartered in Vancouver, British Columbia, with a portfolio of jobs covering Canada, the United States, Chile and South Korea.

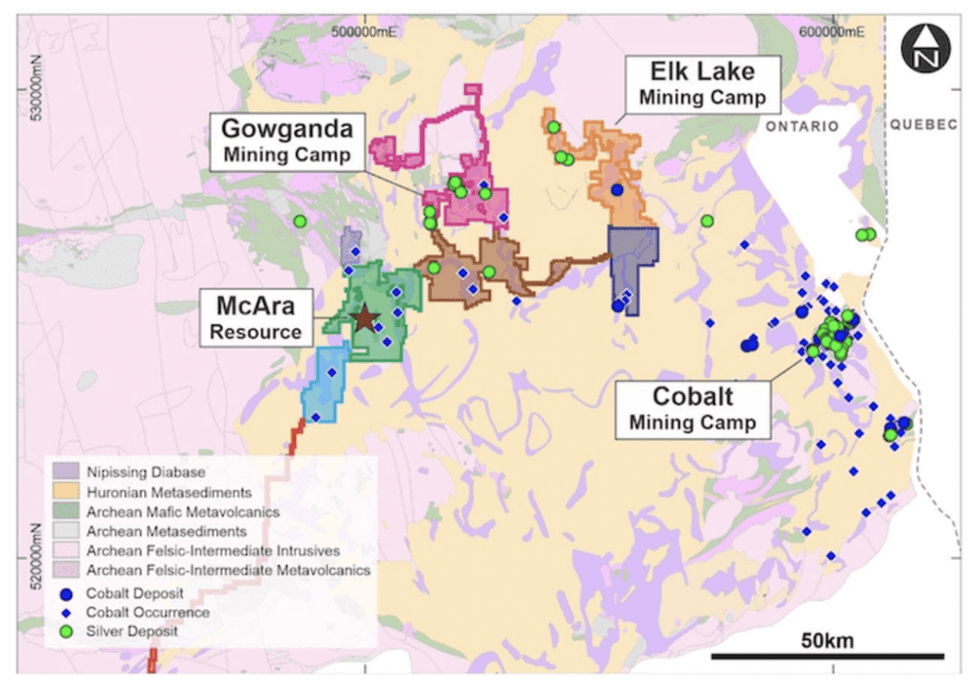

BMR stands as the biggest claim holder throughout all minerals in the Ontario Cobalt Belt, which is among the most highly endowed mining areas worldwide. It presently has a robust property portfolio, including its McAra, Gowganda, Iron Mask, Island 27 jobs in Ontario and extra jobs in the works throughout the province and Quebec. As a first-mover in the district, the business has actually led efforts in acknowledging the capacity of several brand-new, at-surface and state-of-the-art main cobalt discoveries in this area.

In March 2021, BMR obtained the near-term capital Punitaqui Mine Complex in Chile, which includes a central procedure plant fed by 4 satellite copper deposits– San Andres, Cinabrio, Dalmacia and Los Mantos. The past-producing mining operation leverages simple roadway access to regional population centers and provides impressive expedition chances throughout its timeless IOCG and manto-style copper-gold-silver veins.

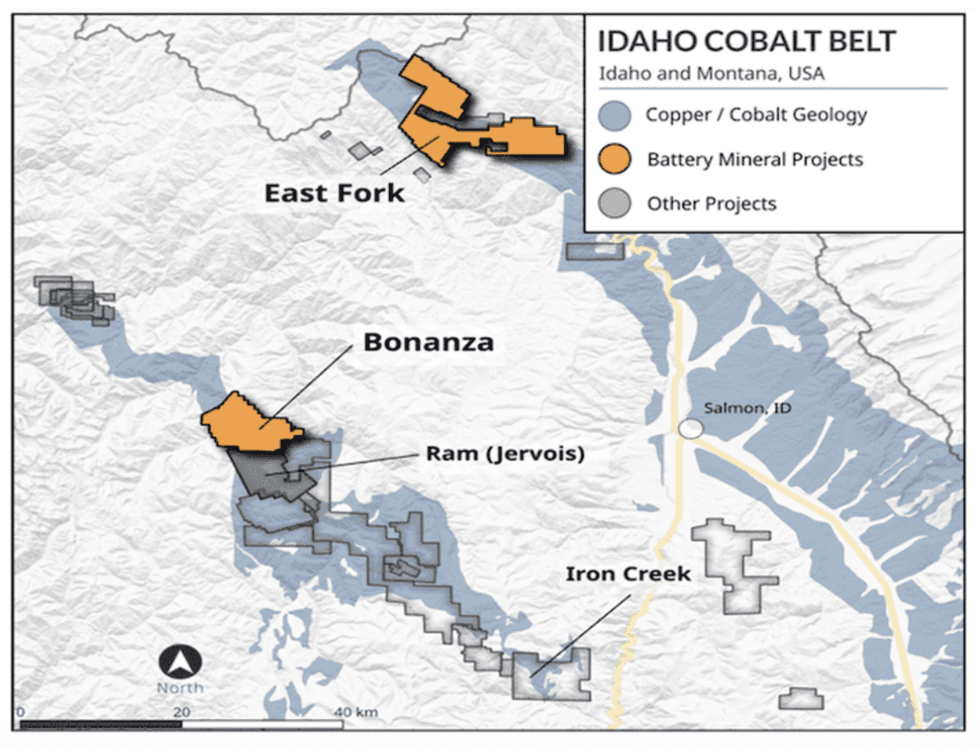

The business’s cobalt reach extends into the respected mining district of Idaho with its 3 100-percent-owned residential or commercial properties covering 14 considerable cobalt potential customers in the state. Gold mine, Desert and East Fork residential or commercial properties are tactically placed near the house of eCobalt Solutions’ Idaho cobalt task, the only advanced-stage, near-term, ecologically allowed, main cobalt deposit in the United States.

Another amazing addition to the BMR portfolio is its extremely potential graphite properties situated in South Korea and lithium properties in respected United States mining districts. The Guemam and Taehwa jobs are 2 past-producing graphite mines, which take advantage of close distance to outstanding lithium-ion commercial facilities and significant yield and state-of-the-art graphite capacity.

BMR closed a sale-leaseback deal on a commercial home situated at 7102 West Sherman Street, Phoenix, Arizona. The home was formerly held by Ozzie’s, Inc. subsidiary of BMR’s 100-percent-owned ESI Energy Providers, Inc., which runs in the devices leasing and sales sector of the pipeline and renewable resource area. Ozzie’s likewise just recently closed an devices refinancing deal worth US$ 2 million by means of a refinancing of 11 tools owned by Ozzie’s and is structured as a lease with a four-year term.

Battery Mineral Resources’ management group includes leaders with substantial functional and advancement experience. Integrated with an excellent and helpful investor portfolio, the business is primed for remarkable financial development and well-funded advancement.

Business Emphasizes.

- Battery Mineral Resources (BMR) is a multi-commodity resource business concentrated on finding, obtaining and establishing battery metals jobs (cobalt, lithium, graphite, nickel & & copper), in North and South America and South Korea. It’s poised to end up being a premier and sustainable provider of battery minerals to the electrification market.

- BMR is presently establishing the Punitaqui Mining Complex and pursuing the prospective near-term resumption of operations at the prior-producing Punitaqui copper-gold mine.

- BMR is the biggest mineral claim holder in the historical Gowganda Cobalt-Silver Camp in Canada. It manages a robust portfolio of cobalt properties throughout the respected Timmins & & Sudbury and Rouyn & & Val d’Or Quebec locations.

- Its Canadian cobalt portfolio includes McAra and Gowganda with Elk Lake situated about 150 km northeast of Sudbury

- Extra battery mineral direct exposure includes its tactically obtained graphite properties in South Korea and a lithium home in the respected mining district of Nevada.

- BMR’s management group integrates experienced professionals throughout associated markets in financing, resource advancement and battery mineral expedition.

- The business has actually submitted a technical report for its NI 43-101 resource quote at Punitaqui on SEDAR, authored by JDS Mining and Energy Inc.

Secret Tasks.

BMR’s existing focus is the reboot of its Punitaqui copper mine in Chile, along with the expedition and advancement of its cobalt, lithium and graphite properties in The United States and Canada and South Korea. The business likewise continues to recognize and examine brand-new task chances in its operating jurisdictions.

Its existing portfolio consists of:

Chile – Copper

BMR’s 100 percent-owned Punitaqui copper mine, obtained in March 2021, has the prospective to create a yearly EBITDA of as much as $50 million at or above a copper cost of $4.25/ pound. The business’s flagship task, the Punitaqui mine has actually been the topic of various turning points in current months, consisting of:

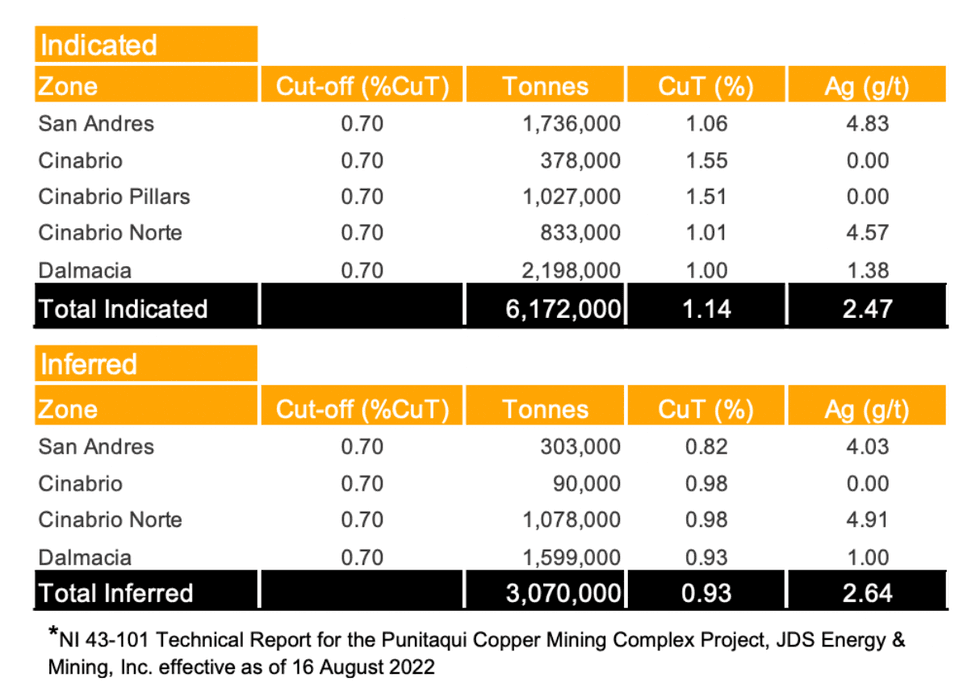

- BMR moneyed and finished an effective 32,526-meter resource drill program in 2022. Metallurgical test work has actually verified the capability to produce outstanding copper focuses from each of the 5 zones checked, consisting of healings varying from 81 percent on the low end at Cinabrio Norte as much as 96.5 percent at the Dalmacia deposit.

- The business in August 2022 reported the outcomes of its first-ever NI 43-101-compliant resource quote for the underground deposits at its Punitaqui copper mining complex of 6.2 million tonnes grading 1.14 percent copper in suggested classification, together with 3.1 million tonnes grading 0.93 percent copper in the presumed classification. This resource quote considerably went beyond management objectives.

- In September 2022, BMR revealed the approval by the Chilean Environment Evaluation Service for the Environmental Effect Statement (DIA) relating to mining at the business’s Cinabrio mine and San Andres deposit. The approval of the DIA enables BMR to progress with beginning mining operations in 2023 and rebooting the mill at its Punitaqui copper mining complex not long after.

- BMR is concentrated on protecting the last financing for the reboot of mining and resumption of copper concentrate production at Punitaqui. As soon as this financing is gotten, BMR intends to finish mine rehab and advancement in 4 to 6 months, with the increase from very first production to the complete production rate of 20 to 25 million pounds of copper in concentrate per year to need a more 4 to 6 months.

” From expedition, engineering, neighborhood and allowing successes to recognizing numerous non-dilutive ways of moneying to permit BMR to advance the task, our group anticipates benefiting from the restored favorable market belief for near-term copper rates and positioning ourselves in a strong position to take part in a robust copper sector in 2023,” CEO Martin Kostuik specified in a press release

Canada– Cobalt/Silver

In Between 2016 and April 2018, BMR obtained through claim staking, choice, joint endeavor and direct purchase the biggest local land holding in the historical house of state-of-the-art cobalt-silver veins in Canada, understood in your area as the Cobalt Embayment.

Since February 2023, BMR managed a land bundle amounting to 9 residential or commercial properties with 4,086 tenements that incorporate a location of 84, 003.39 hectares. The crucial jobs within the land bundle consist of McAra, Gowganda, Elk Lake, Fabre and Wilder In between 2017 and 2022, an overall of 412 holes/ 51,452.34 meters were drilled on 8 jobs/ 20 targets. In addition, an overall of 26,709 line-km of air-borne geophysical studies and 1,324.84 sq km of LiDAR topography was flown. Follow-up ground geophysical studies led to an overall of 37 studies (514.64 Line-Km) being finished.

Preliminary NI 43-101 certified resource specified at McAra (M&I Resource of 1,124,000 pounds Co) was detailed in “Technical Report on Cobalt Expedition Properties in Canada,” dated February 5, 2021 with a reliable date of October 31, 2020, prepared by SRK Consulting– G Cole PGeo (APGO # 1416).

Idaho– Cobalt

BMR holds the Gold mine and East Fork residential or commercial properties situated in the historical cobalt-copper-gold Blackbird mining district (Blackbird Mine from 1902 to 1963 produced 17 Mt grading 0.7 percent cobalt, 1.4 percent copper, and 1 g/t gold) situated about 30 kilometers west of Salmon, Idaho. The Gold mine task is instantly surrounding to Jervois Global’s Idaho Cobalt Operations, the United States’ only operating main cobalt mine. At Gold mine, 7 mineralized websites within a location over 3 kilometers broad extend along a gabbro dyke striking constantly for over 6 kilometers northward from Noranda’s historical Blackbird Cobalt/Copper mine. The provings on the task are: Gold mine Copper Tunnels, Tinker’s Pride, Gold mine Copper # 25, Indian Creek, Gray Copper, Blackrock # 4 and Papoose #’s 1-4.

In Between 2018 and 2021, BMR’s Gold mine expedition consisted of: 550 line-kilometer of air-borne magnetics and radiometrics followed up by surface area expedition that consisted of rock tasting, soil tasting, channel tasting of historical operations, and 3.6 kilometer of time domain-induced polarization geophysics.

The 2 residential or commercial properties cover 12 considerable cobalt-copper potential customers within the recognized mineralized zone. Both of the BMR Idaho cobalt belt residential or commercial properties host outstanding state-of-the-art discovery capacity.

South Korea– Graphite

BMR has one hundred percent ownership of the Guemam and Taehwa graphite expedition jobs including high-purity flake graphite deposits. Both properties are past-producing mines with existing regional facilities and near-term production capacity.

Nevada– Lithium

The business’s Amargosa lithium task remains in the southern Basin & & Variety province and main Mojave Desert of Nevada. It is an early-stage expedition chance in a beneficial area that hosts various lithium events, consisting of the Clayton Valley lithium deposit owned by Cypress Advancement Corp., along with a significant close-by lithium salt water mine presently in production called the Silver Peak mine held by Albermarle Corp., among the world’s biggest lithium manufacturers.

Market Chance

Near-term projections for the copper sector are very bullish, with stalwart Wall Street companies such as Goldman Sachs and Bank of America predicting record-highs in the coming months. A mix of short-term supply deficits and long-lasting energy shift need is anticipated to buck the down pressures that have actually affected copper rates in the last few years.

Goldman in December 2022 anticipated a 178,000 metric heap deficit in the copper market in 2023, triggering the company to raise its 12-month target to $11,000/ heap and its typical cost for calendar 2023 to $9,750/ heap.

With China most likely to continue speeding up efforts to restock diminished stocks in the wake of its COVID-19 resuming and a continual push towards electrification around the world positioning a stress on supply, BMR is distinctively placed to capitalize through the awaited reboot of operations at its Punitaqui copper mine.

Management Group.

Martin Kostuik – CEO and Director

Martin Kostuik is CEO and a director of BMR. He gives the business almost 3 years of varied experience in the mining market as a mining engineer and senior executive. Prior to signing up with BMR, Kostuik worked as president and director of Arizona Gold Corporation and as CEO and director of Rupert Resources Limited. He developed a broad base of experience in operations, engineering, expedition and capital jobs with numerous business consisting of Luna Gold (Equinox), Barrick Gold Corporation, Taseko Mines Limited and DMC Mining Providers. Kostuik made his BS in Mining Engineering from Queen’s University and his MBA from the University of Tennessee.

Max Satel – CFO

Max Satel is the business’s CFO. He has more than 18 years of experience as an effective natural resources-focused executive, most just recently functioning as EVP business advancement and financier relations for Arrow Expedition Corp., a TSX Endeavor- and AIM-listed oil & & gas business with operations in Colombia and Canada. Prior to signing up with Arrow, Satel was primary and co-founder of Bordeaux Capital Inc., a Toronto-based advisory company concentrated on the capital requirements of business throughout the natural deposits sector, where he led and carried out task funding advisory requireds including worldwide banks and personal equity funds. He made a Bachelor of Commerce in Financing and Economics from the University of Toronto.

Jacob Willoughby – VP Corporate Advancement and Method

Jacob Willoughby is VP business advancement and method for BMR. He gives the business almost 17 years of varied experience in mining capital markets, consisting of over 8 years as a mining expert covering expedition and advancement business worldwide in both valuable and base metals. Willoughby was most just recently vice-president of research study and expert at Red Cloud Securities in Toronto. He invested 2 years as president and director of Aldridge Minerals, a previous Canadian-based public expedition and advancement business with properties in Turkey and Papua New Guinea. Willoughby made both a BS in Geology and a Masters in Organization Administration from the University of Windsor.

Financial Investment Factors To Consider

- Battery Mineral Resources is concentrated on the discovery, acquisition and advancement of battery metal jobs in The United States and Canada, South America and South Korea.

- The business’s flagship Punitaqui mine has the prospective to create a yearly EBITDA of as much as $50 million at or above a copper cost of $4.25/ pound. with production targeted for H2 of this year.

- BMR is working to protect last financing for the reboot of mining and resumption of copper concentrate production from its Punitaqui complex; it remains in innovative conversations with numerous celebrations and has the objective of closing a financing contract in the coming months.

- In the 2nd half of 2022, BMI made considerable development towards increasing and enhancing its human and funds, along with allowing, metallurgy and ESG efforts.

- The business is tactically placing itself to make the most of restored favorable market belief for near-term copper rates.