kynny

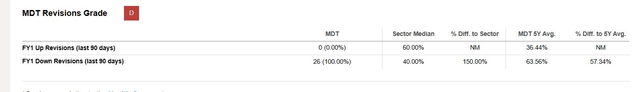

An Exceptional Dividend History, However Is This At Danger Of Turning Sour?

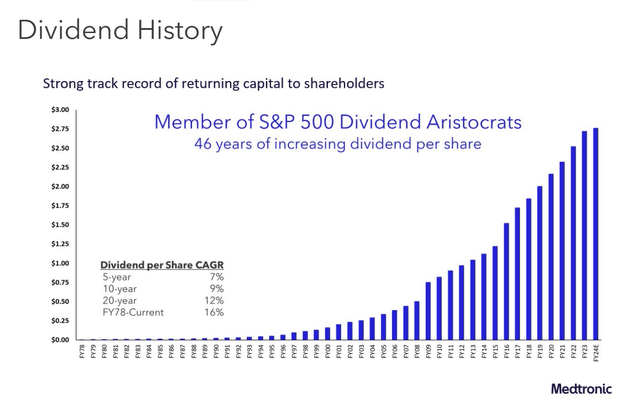

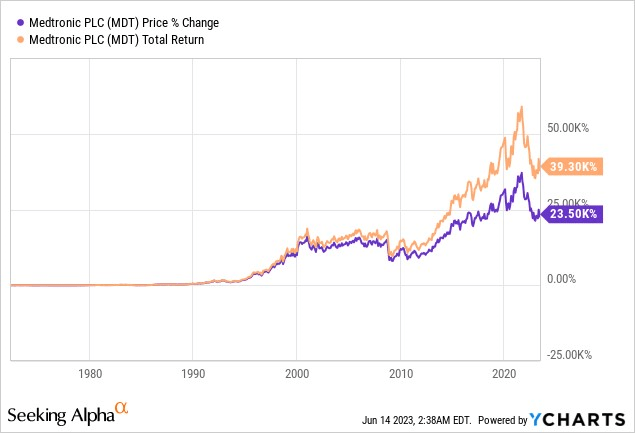

The medical-tech company- Medtronic, possesses some quite outstanding qualifications when it pertains to the dividend element. The company is presently part of the S&P Dividend Aristocrats ETF ( NOBL) which looks for companies that have actually paid and grown their dividends for a minimum of 25 years; Medtronic ( NYSE: MDT) conveniently trounces this requirement, as it has actually been paying and growing its dividends for 46 years, at a remarkable adequate CAGR of 16%!

The image listed below provides you a sense of the distinction these dividends make in bumping up the overall return by 1.67 x relative to the cost returns because its listing date.

YCharts

Towards completion of last month, Medtronic brought out FY outcomes (it follows an April year-ending calendar); whilst the business handled to beat street price quotes on the topline and the bottom line, the marketplace was not best pleased with the assistance supplied where inflation and FX were most likely to leave a negative mark on forward bottom line numbers; in impact, the sell-side friend needed to cut their FY24 non-GAAP EPS price quotes from $5.2, down to levels of $ 5.06 (this is a little greater than the mid-point of management’s assistance of $5-$ 5.1). All in all, if things go to prepare, we would see YoY profits decreases for the 2nd succeeding year (suggested de-growth of -4.5% for FY24).

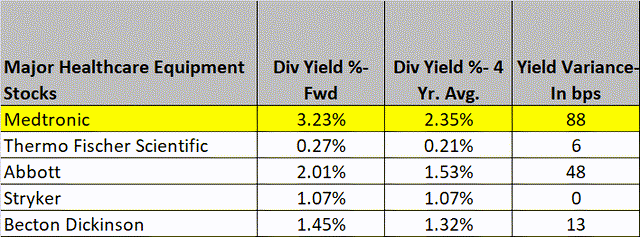

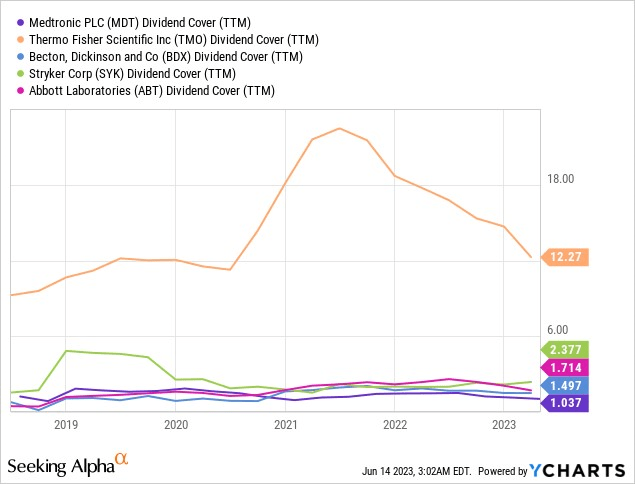

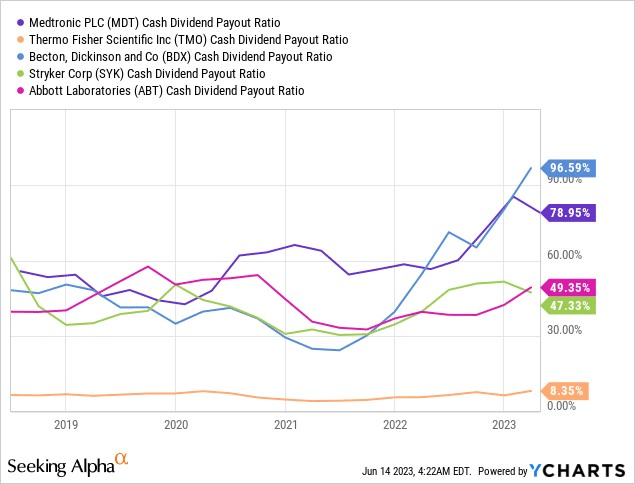

Prima facie, a decrease in the profits trajectory will not show well on MDT’s currently low dividend cover. Keep in mind that relative to a few of the other greatest dividend-paying medical devices stocks, the similarity Thermo Fisher ( TMO), Becton, Dickinson ( BDX), Stryker Corp ( SYK), and Abbott Labs ( ABT), MDT’s dividend cover is currently the weakest, at a little over 1x!

YCharts

Due to these advancements, a reasonable couple of might have some doubts over the sustainability of MDT’s dividend.

The Dividend Is Still In An Excellent Location

If you’re stressed over the dividend sustainability, we’ll look for to relieve those worries due to the fact that we believe the structure of those dividends are still in great shape. Likewise, more than the dividend cover, our company believe financiers must take note of the money dividend payment ratio.; this is so because, the dividend cover tends to be altered by a great deal of non-cash products and will not always provide you a precise photo of the monetary health.

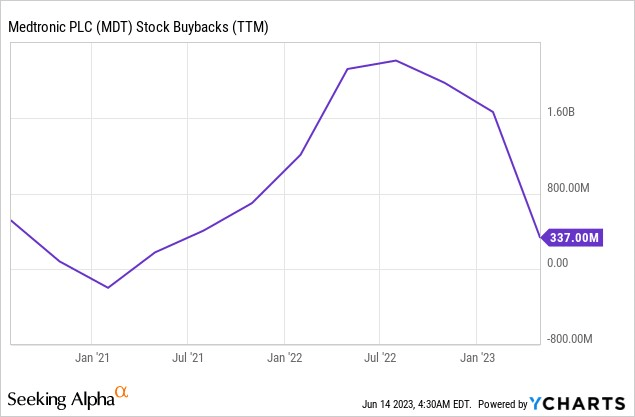

What financiers likewise require to understand is that rather unlike a great deal of other companies that have approximate and uneven dividend policies, MDT’s dividend policy is rather emphatic. In truth management has actually noted this down in their 10-K, highlighting a dedication to return a minimum of 50% of FCF by means of circulations, with precedence offered to dividends over buybacks.

YCharts

In current durations we have actually currently seen MDT management tone down the level of buybacks, and this is something they can constantly reduce if they think FCF generation might be hamstrung. Mentioning FCF generation, it looks anything however hamstrung off late. Keep in mind that in the current quarter, MDT did effectively in cutting its money conversion cycle (the variety of days money is bound in working capital efforts), and this led to the FCF striking its acme in 3 years.

On the other hand, the image listed below provides you a sense of MDT’s money dividend payment ratio (determined as dividend payments as a function of FCF) gradually. Post pandemic, MDT’s ratio has actually hovered around the 60% mark and in current durations it has actually inched closer to 80% highlighting strong protection. Among the big med-tech peers, just BDX provides a greater money dividend payment ratio.

YCharts

Looking ahead, it appears that MDT wishes to call down on its natural R&D efforts (R&D to grow above earnings), and there’s the danger of this drawing up a higher portion of running capital, however financiers must keep in mind that the business is likewise doing a fantastic task with excess money cost savings, which might make a more noticable contribution to the R&D goals. Although management has actually not measured the level of expense savings they have actually mentioned that headwinds associated with inflation, FX, interest and tax would usually have actually led to a double-digit decrease in the FY24 eps however due to the fact that of the limit of expense savings, the anticipated decrease will likely just remain in mid-single digits.

We likewise acknowledge that some financiers might not have actually been too pleased with MDT’s current walking in its dividends, which just was available in at a parsimonious rate of ~ 2% This is easy to understand considered that the 5-year and 10-year CAGR in dividend development has actually been a lot greater at 7% and 9% respectively. Nevertheless, I think management might have chosen to be a little conservative with the near-term dividend development, because the NewCo sale is yet to come to fulfillment, and funds will likewise be needed to close the acquisition of EOFlow

However even if you aren’t pleased with the current dividend development, it deserves keeping in mind that MDT still provides the greatest yield among the big med tech peers; besides that, the difference in the yield relative to the 4-year average is likewise the best at 88bps.

Closing Ideas – Appraisal And Technical Stories

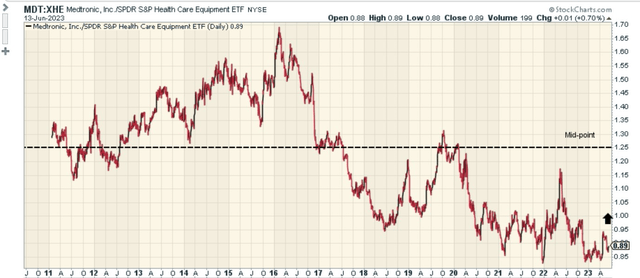

With concerns to a few of the other aspects of MDT, it deserves keeping in mind that MDT presently seems an appealing prospect for a mean-reversion trade; compared to the similarly weighted medical devices ETF; the image listed below highlights how MDT’s relative strength ratio is presently around ~ 30% off the mid-point of its long-lasting variety.

On the other hand on MDT’s own weekly chart, we can see that the enduring sag which began in Sep 2021, is no longer in play. After a series of lower-lows, and lower-highs, MDT appears to have actually developed some assistance at the $75 levels. It’s motivating to keep in mind that the stock did not make a 3rd effort to retest the $75 levels however has actually rather revealed indications of starting a duration of higher-highs and greater lows. In the meantime, the cost action seems relocating the shape of a wedge pattern, and if one were to action in at this point, and trade the 2 lines of the wedge, the risk-reward remains in your favor.

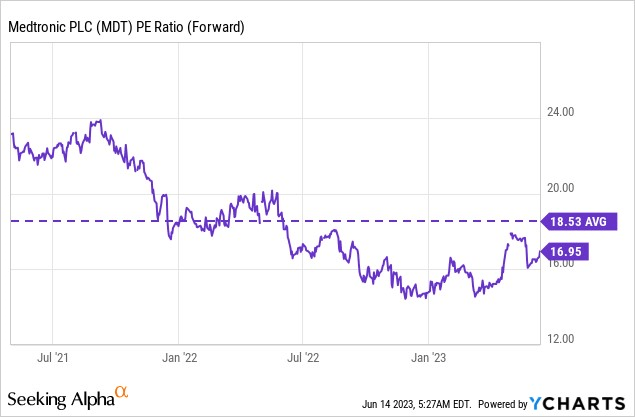

Lastly, the appraisal photo of MDT too looks rather encouraging.

For context, there have actually been 26 down modifications to the FY24 EPS number, and this would usually make the forward appraisal several appear expensive. Nevertheless, at 17x forward P/E (based upon the FY24 EPS of $5.06), the stock still is available in at an 8% discount rate relative to its long-lasting average. MDT stock is a Buy.

YCharts