jetcityimage/iStock Editorial through Getty Images

Financial Investment Thesis

I think about Paycor HCM, Inc. ( NASDAQ: PYCR) to be an appealing financial investment chance in the long term. The business has an extensive platform for payroll, labor force management, skill management and other HCM applications, in addition to strong recommendation company from Paycor’s advantages brokers, and an open-system technique establishes the business for nonreligious share gains from tradition service providers and internal Certified public accountants. Paycor’s crucial differentiator in human capital-management software application for small companies is its vertical competence, focusing on healthcare, food and drink, expert services and production. Paycor has a competitive item that can record market share in a TAM that is still controlled by tradition suppliers. The present assessment appears appealing, with a sensible price-to-sales numerous in line with its SaaS peers.

Strong Q3 Outcomes & & Beneficial Outlook

Paycor provided better-than-expected outcomes, driven by strong rates development and a boost in income per staff member each month by 15%. The business likewise experienced a 6% development in staff member count amongst its customers. Paycor’s outlook is positive, with a steady need environment and labor market and flat customer-employee development anticipated. Secret verticals such as food and drink, production, health care, and expert services reveal no considerable modifications. The skill module within their Labor force sector sticks out, with management noting its trajectory as being as considerable as payroll and personnels.

Paycor continues to buy its go-to-market abilities and direct sales groups to enhance win rates and broaden typical offer size. In the medium term, the business seems focusing on the upmarket chance over broadening down-market, which is anticipated to enhance retention rates and PEPM through much better accessory rates. The business stays on track with its growth into Tier 1 markets, targeting a 20% development in sales headcount to drive sustainable top-line development. Nevertheless, there are concerns about when more significant utilize in business design will be observed beyond the effect of float.

Complete HCM Option Protection for SMB

Paycor’s health-care program is set up to fulfill payroll-based journal (PBJ) requirements and screens nurse engagement, scheduling obstacles and recruitment. The production program supplies combination into ERP, licensed payroll requirements and labor-cost tracking. The food and drink program ties into points of sale and application-tracking systems where there’s high market turnover. Expert services has analytics for retention, gender and variety tracking and settlement capture. Market options are high-touch executions with professional assistance for market vertical legal requirements and other analytics.

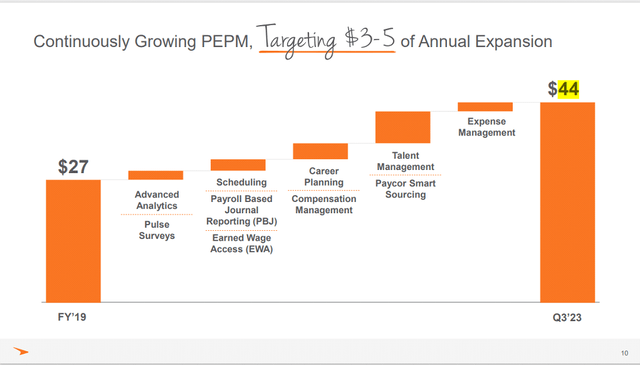

Portfolio reaches $44 per staff member each month (PEPM) on analytics, studies, scheduling, payroll-based journal reporting and clever sourcing. That’s on top of employee-experience apps like onboarding, HR, wallet and settlement expenditures that use raised cross-selling capacity and most likely upward momentum in typical income per client (presently more than $21,000). Paycor’s human capital-management item totally covers HR and payroll software application, skill and labor force management, staff member experience and advantages administration. According to management, the skill management module (recruiting, skill advancement, discovering and profession management) might surpass core HR and payroll chances in numerous years.

Tracking Behind Peers However is Progressively Broadening

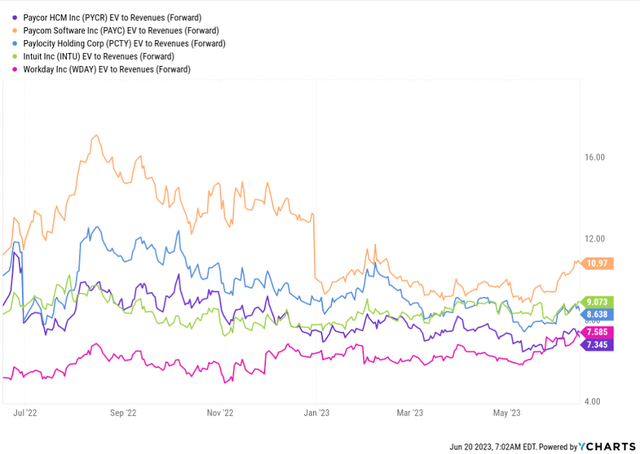

Paycor drags other cloud-native human capital management and payroll business in size, with income less than half that of Paycom Software Application, Inc. ( PAYC) and Paylocity Holding Corporation ( PCTY), yet is poised to capture up by financial 2025. Regardless of its restricted size, smaller sized consumers (approximately 79 staff members at the customer), direct-sales protection ramp-up and portfolio build-out yield totally free capital and running margin listed below competitive levels by 500-1,000 bps. Paycor’s advantage to agreement average income development for 2023 and 2024 is restricted, I think, with gains in client staff member counts flattening, eliminating among the 3 pillars for greater per staff member each month, though bundled rates and cross-selling appear healthy. The human capital management software application sector, and Paycor particularly, isn’t unsusceptible to longer sales cycles and tech-spending examination throughout the application-software market, with client additions most likely topped at mid-single-digit gains. The management continues to perform to 20% income development, changed gross margin (leaving out devaluation and amortization) of 80% and changed operating margin of 20%.

Appraisal & & Financial Outlook

Paycor’s near-term focus is on a United States market. Its HCM suite growth (increasing per staff member each month to $50), plus a bigger prospective client, yields a substantial increase to its market. The worldwide chance in the early phase of cloud payroll approval is a long-lasting chauffeur.

Vertical sectors (production, healthcare, dining establishments and expert services), tight United States labor markets and human capital-management and cross-selling capacity might sustain income growth in the high teenagers. Paycor’s target consumers are small companies with a worker per customer of about 79, listed below Paylocity and Paycom’s typical client size. The management continues to target up-market chances, with a portfolio geared up for a wider variety of client sectors behind substantial third-party combination. The gross margin of 70% and running margin of 12% in the most current quarter are advancing towards management’s long-lasting targets of 80% and 20-25%, however I think have to do with 2 years away. Paycor has a human capital-management portfolio constructed out to $44 per staff member each month, with an objective of $50 by 2024. After this build-out, I think there might be considerable margin enhancement as product-development expenses track off. Paycor is broadening direct-sales group and broker protection in existing and brand-new markets, concentrating on the 15 most inhabited United States city locations.

Paycor’s shares trade at 7.3 x EV-to-2023 sales, a discount rate to peers. I keep an end of year cost target of $29 on the stock based upon a forward EV/Sales multiple of 8x used to the 2024 income price quote

Dangers to Ranking

The marketplace for HCM options for SMBs is extremely competitive and continuously altering. It includes both recognized business deeply incorporated with consumers and more recent cloud-based companies providing innovative functions. Significant rivals in this market consist of Automatic Data Processing, Inc. ( ADP), Paychex, Inc. ( PAYX), Paycom, and Paylocity, to name a few. If competitors heightens or measures up to effectively reproduce Paycor’s performance, it might adversely affect Paycor’s development. Although software application multiples have actually decreased just recently, they are still fairly high compared to historic levels. In addition, the worldwide economy is decreasing, and joblessness rates stay greater than prior to the pandemic. These aspects increase the drawback threat for business like Paycor, as they are delicate to macroeconomic advancements such as high-interest rates.

Conclusion

Paycor focuses on supplying payroll and HCM options to companies. The business aims to supply users with a merged experience through a mobile-focused technique and an user-friendly interface. The business has actually established a contemporary facilities that makes it possible for smooth combination with a large range of other applications utilized by its consumers. This contemporary cloud-based option provides Paycor an edge over tradition payroll service providers in regards to item offerings. I am positive on the business in the long term and presently have an end-of-year cost target of $29 on the stock.