FangXiaNuo

On April 4, 2023, I released a short article on the Invesco KBW Premium Yield Equity REIT ETF ( NASDAQ: KBWY) – KBWY: Bad Option Throughout Times Of Distress – elaborating on why KBWY offers damaging return potential customers due to unfavorable macroeconomic and sector-specific background.

Looking For Alpha

Ever Since KBWY has actually underperformed the S&P 500 by ~ 6.6%.

Now the concerns is whether KBWY is still a sell or whether the current divergence in the efficiency (versus the marketplace) has actually caused a more beneficial outlook for KBWY’s stock.

Synthesis of KBWY’s direct exposures

Presently, KBWY uses an appealing regular monthly dividend yield of 9% and trades really near to a 52-week low.

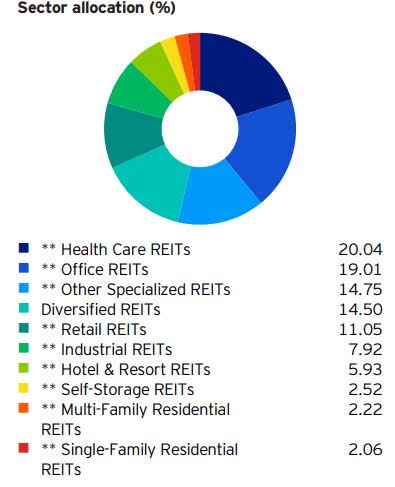

More than 98% of the financial investments are focused in the little cap area and dispersed amongst the following sectors:

Invesco Distributors, Inc.

4 biggest sector direct exposures in the KBWY’s portfolio are healthcare (20%), workplace (19%), specialized REITs (15%), and varied REITs (14%).

In theory, just workplace sector appears to enforce substantial headwinds for KBWY’s efficiency moving forward.

Nevertheless, the mathematics of how KBWY assigns capital amongst the underlying constituents (i.e., REITs) in these sectors present rather dangerous conditions in the portfolio. Put in a different way, KBWY invests based upon a dividend yield weighted index concept in which the capital gets assigned more to greater yielding stocks and less to decrease yielding stocks.

As we understand, a direct exposure towards unusually high yielding properties generally increases the possibility of suffering type a “worth trap” and undergoing raised monetary threat.

Let’s have a look at Leading 3 biggest holdings.

- 7.5% weight for Brandywine Real estate Trust ( BDN) – dividend yield of 17.1%, severe financial obligation ratio of 72%, which is considerably above the workplace REIT sector average.

- 7.4% weight for Hudson Pacific Residence ( HPP) – dividend yield of 10.3% in spite of the current cut of 50% and a lot more aggressive financial obligation ratio of 83%.

- 6.4% weight for Uniti Group ( SYSTEM) – dividend yield of 13.6% and the 2nd greatest financial obligation ratio in the facilities REIT sector (86.8% for system versus 58.6% for sector average)

Bulk of the staying holdings bring comparable attributes to the previously mentioned stocks, i.e.:

- Sky-high dividend yields sending out a clear signal that the marketplace has actually been appointing substantial threat premiums.

- Greatly indebted balance sheets at levels, which suggest a significant threat of distress (e.g., failure to re-finance growing financial obligation, experiencing rising expense of funding due to raised credit threat premiums and so on).

3 factors to keep away from KBWY

In my current post – Buy Workplace If You Missed Out On Shopping Center And Hotel Renaissance – I described a number of table stakes, which need to remain in location for REITs to make it through rough times when loan providers hesitate to provide and the medium-term supply/ need characteristics do not bode well for top-line efficiency.

The most essential component is the concept of having big cap status and fortress balance sheets. Taking a look at REIT survivors from shopping mall, retail and hotel crises that have actually effectively recuperated with no equity dilutions, it is clear how the financial investment graded balance sheets and big capitalizations aspects played an essential function.

This is important to gain access to capital from varied sources as it enables REITs to take pleasure in an access to funding at beneficial terms and at the needed scale to prevent any refinancing threat.

Back in the Covid -19 age and preliminary work-from-home crisis, REITs, which had overleveraged balance sheets and reasonably small capitalization levels, were required to either declare Chapter 11 or enormously water down the existing investor base.

For instance, Washington Prime Group Inc, Pennsylvania Realty Financial Investment Trust ( OTC: PRET) and CBL & & Associates Residence, Inc. ( CBL) declared Chapter 11. Macerich ( MAC) was required to considerably dilute its investor base to make it through. Presently, Ashford Hospitality ( AHT) is likewise one action far from insolvency.

So, the very first factor to prevent KBWY is the reality that it tracks just small-cap REITs, where the lion’s share of them bring considerably leveraged balance sheets.

In addition, whenever stocks uses unusually high dividend yields, there is an increased threat of falling under a worth trap. In reality, taking a look at the Leading 10 biggest holdings, 4 have currently cut their dividend this year.

It is extremely most likely that there will be more dividend cuts happening within KBWY’s portfolio over the foreseeable future. Once again, this is just rational thinking about the mechanics how KBWY chooses and disperses its capital amongst U.S. equity REITs. Throughout times of distress the technique to invest into greatest yielding REITs without a robust analysis on the underlying basics is a dish for catastrophe.

It is unavoidable that a significant portion of these high yielding REITs will need to reduce their dividends to prevent additional weakening of their balance sheets. Nevertheless, in the context of times like these when loaning conditions are tight and rates of interest are much greater compared to a duration when the existing loanings were presumed, smaller sized dividends are not adequate to move the needle.

All in all, the 2nd factor why financiers ought to think about preventing KBWY is the concept of worth trap and apparently appealing yields (and evaluations), while in truth they are totally warranted offered the weak balance sheets and weakening capital.

Lastly, in the times of unpredictability when the outlook on the economy, rates of interest and supply/ need balance is unfavorable, it is the ideal minute to end up being a selective stock picker.

The 2 biggest sector direct exposures (workplace and healthcare) of KBWY’s portfolio, struggle with significant headwinds – e.g., work from house characteristics, growing financial obligation, which no one wants to re-finance, inflationary aspects, troubles to discover a labor force at sensible incomes and rising rates of interest. While there is a general distress in the workplace and healthcare sectors, there are likewise appealing chances to be discovered.

If you invest blindly into this area with a concentrate on the greatest yielding stocks, which per meaning suggests a concentrate on the most distressed REITs, you instantly sign up for a substantial threat of experiencing long-term losses of capital. This typically happens by means of personal bankruptcies, restructuring or huge equity dilutions, where the opportunities of recuperating preliminary financial investments are really low or exceptionally remote in the future.

So, the 3rd and last factor to not purchase KBWY is the chance expense aspect. Specifically, at the KBWY’s presently used yield level of 9%, there are much better high yielding chances out there that featured a more well balanced threat profile and less take advantage of. For example:

- Global Medical REIT Inc. ( GMRE) yielding 8.9% and having a well-structured balance sheet.

- Simon Home Group, Inc. ( SPG) yielding 6.7%, which is somewhat lower what KBWY uses in yield, however at far higher capital gratitude capacity and very little monetary threat due to financial investment grade balance sheet.

Validation for downgrading KBWY to strong sell

Considering That April 4, 2023, when I released a sell score on KBWY, a number of things have actually altered making the ETF even less appealing and dangerous.

The structure of Leading 10 holdings has actually ended up being more focused and more exposed towards equity REITs with weak and weakening basics.

Back in April, the Leading 10 holdings represented ~ 42% of the overall portfolio, whereas now the biggest 10 allowances of KBWY make up ~ 51% of the overall portfolio worth. This suggests that the concentration threat has actually increased, and, sadly, right into the greatest yielding instruments due to the formerly explained allotment system.

In addition, KBWY naturally brings substantial direct exposure to indirect take advantage of (i.e., by means of underlying financial investments, which in turn are enormously leveraged), which has actually ended up being a greater issue due to the current commentary by the FED. Presently, the marketplace is pricing in a significant possibility of experiencing an extra rate walking of 25 basis points in September. The mix of greater rates and more practical ‘higher-for-longer’ circumstance ought to put a strong down pressure on KBWY’s capability to safeguard its worth moving forward.

Each incremental uptick in expense of funding amplifies the currently aggressive threat aspects originating from KBWY’s indebted allowances, eventually increasing the possibility of experiencing dividend cuts and equity dilutions.

As elaborated above, this is what we currently have actually begun to witness amongst a number of KBWY’ holdings, where extremely leveraged REITs with aggressive FFO payment ratios have actually reviewed their circulation policies. We have actually not yet seen these small-cap equity REITs failing, however considered that the rates have actually increased and most likely will continue to pattern upwards, we ought to see a few of the KBWY’s financial investment declare Chapter 11.

Threats and last conclusion

Clearly, shorting KBWY features its threat also. The crucial threat for any financier, who has actually chosen to open a brief position in KBWY is the FED and its actions on the rates of interest. An unanticipated time out or an abrupt shift in the total policy from hawkish to dovish might supply an enormous increase for KBWY’s stock cost. Under lower rates of interest environment, the extremely leveraged REITs would deal with more beneficial funding conditions, where each refinancing occasion offers a chance to reinforce the money streams due to lowered loaning expenses (opposite to what we have now).

Another threat aspect is the M&An element, where these small-cap, extremely leveraged and depressed REITs are significantly getting more appealing as targets for big cap gamers with financial investment grade balance sheets. For instance, if even 2 names from the Leading 10 holding list were taken control of, the opportunities are exceptionally high that KBWY’s stock would respond in an extremely favorable way, hence causing a damage on the brief position.

With that being stated, I highly question that any of the previously mentioned threat aspects will emerge in the foreseeable future considered that the FED is considering on how to trek and not how to possibly cut.

In a nutshell, KBWY is a below average financial investment for financiers, who look for to record juicy yield with relative stability in the future. The intrinsic monetary threat and chance expense offsets the advantage of the presently used dividend yield by KBWY. Taking brief position in KBWY ought to supply, in my modest viewpoint, strong returns in the next 3 – 12 month duration.