imaginima

This short article was very first released to members of my service on June 23th 2023. All choice computations are theoretical and are utilized to figure out reasonable worth based upon the normally accepted requirements.

Our continuous look for “alpha” financial investment chances has actually led us to EPR Characteristics PFD C CV 5.75% ( NYSE: EPR.PC), a realty financial investment trust (” REIT”)- released exchange-traded favored stock with value-added due to its conversion provision. With the distress in the banking sector and all the buzz the AI business are delighting in, other market sectors get much less attention than normal. These are ideal conditions that develop concealed gems, and it depends on the financiers to dig a little much deeper to be able to discover them and benefit from them. According to us, EPR.PC is such an underestimated financial investment car, and we will attempt to protect this thesis with this brief short article.

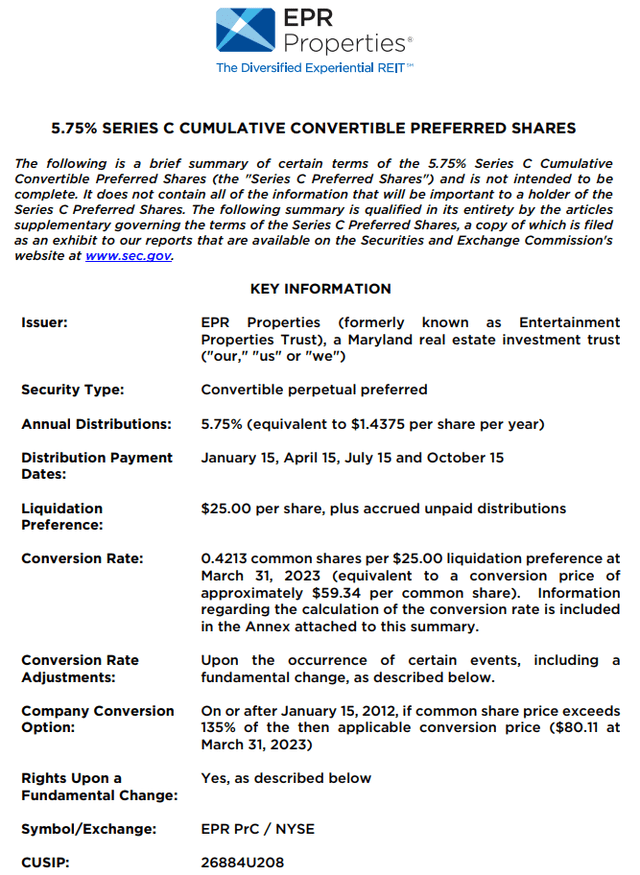

EPR-C chosen stock attributes

EPR-C is a 5.75% fixed-rate cumulative convertible favored stock released by EPR Characteristics ( NYSE: EPR) on 12/20/2006. The shares are presently convertible at any time at the holder’s choice into 0.4213 typical shares of EPR Characteristics per $25.00 liquidation choice. The present conversion rate is comparable to a conversion cost of $59.34 USD per typical share.

EPR-C information ( eprkc.com)

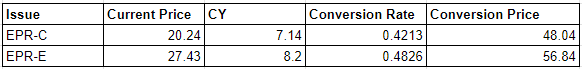

At the minute, EPR-C is trading at $20.24 USD with a CY of 7.11%.

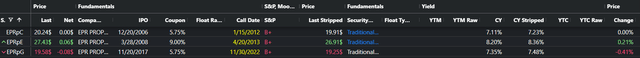

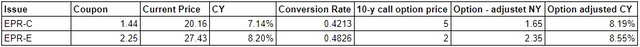

Preferred stocks information ( exclusive software application)

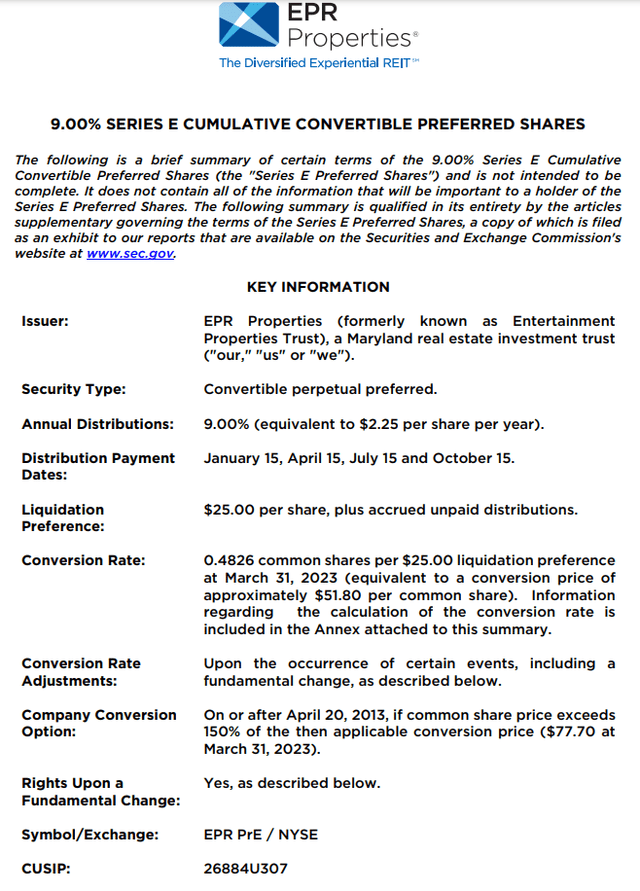

EPR-C has 2 exchange-traded bros – EPR-E ( EPR.PE) and EPR-G ( EPR.PG). EPR-E is likewise convertible favored stock, while EPR-G has no conversion provision. At the minute of composing the short article, EPR-E trades at 27.43 USD with a CY of 8.20% and has a conversion rate of 0.4826. Pure CY contrast in between the 2 convertible prefs offers an edge to EPR-E as a long choice, however the ingrained conversion provision offers EPR-C extra worth, and we will attempt to reveal it.

EPR-E information ( eprkc.com)

EPR-C contrast to EPR-E

Convertible favored stocks such as EPR-C and EPR-E can benefit both from being fixed-income securities and from their conversion provision. Depending upon their conversion rate and the cost of the typical stock, these sort of financial investment cars can trade as a fixed-income security, or with cost connected for the typical stock.

Both favored stocks are convertible – they can not be called by the provider and can be transformed by the holder into a matching quantity of typical stock. De facto, each security has an ingrained no-expiration date call choice with various strike rates. The cost of this call choice, that the holder gets, needs to be consisted of when examining each of the securities.

EPR-C to EPR-E contrast ( exclusive spreadsheet)

At the minute, the typical stock EPR is trading at around 43.60 USD, and this is quite near the conversion cost of EPR-C. At this moment, the cost motion of EPR-C will be rather associated with the upside modifications in the cost of EPR. The convertible security is “connected” to the typical stock on the benefit.

This is not the case with EPR-E. In order for EPR-E to link the very same method as EPR-C with the typical stock, EPR will need to trade within 10% of the conversion cost of EPR-E, or around $51 UDS. If this occurs, nevertheless, EPR-C will need to value a minimum of as much as $23.70 USD, as it is currently connected to the typical stock.

This distinction in the habits of the 2 bros can be discussed by the various strike rates of the ingrained call choices they have. Various strike rates indicate various choice rates.

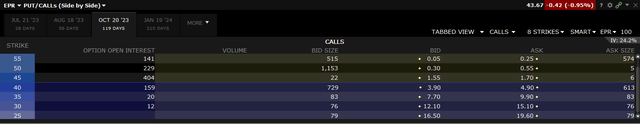

EPR call choices ( Interactive Brokers)

As can be seen from the screenshot above, the EPR call choice with a strike cost of $45 has a quote of $1.55, while the one with a strike cost of $55 has a quote of $0.05. The marketplace is providing worth to the call choice that EPR-C has, however not to the among EPR-E. The BID/ASK spread for the 2 choices is likewise a sign of the high interest in the 45-strike cost one in contrast with the 55-strike cost one.

EPR-C – EPR * 0.42 ( TradingView)

If we provide on a chart EPR-C – EPR * 0.42, one can plainly see that it is on its low. The conversion worth of EPR-C is as close as ever to EPR, showing that on the benefit the convertible will relocate line with the typical stock. On the disadvantage, nevertheless, it has the defense of being a favored stock indicating it remains greater in the capital structure of the business. This is the reason that we are picking EPR-C as the long leg in our set trade. EPR-E is not linked in the very same method with EPR on the benefit, at this cost of the typical and EPR-G can never ever be, as it is doing not have the conversion provision.

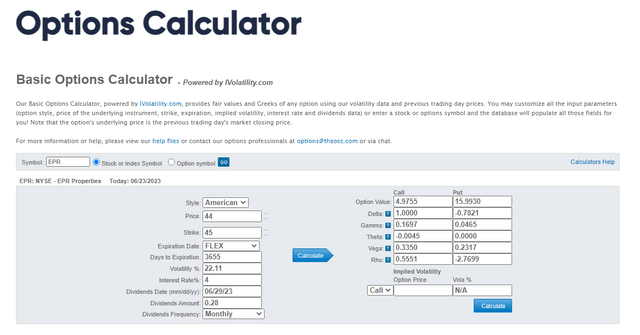

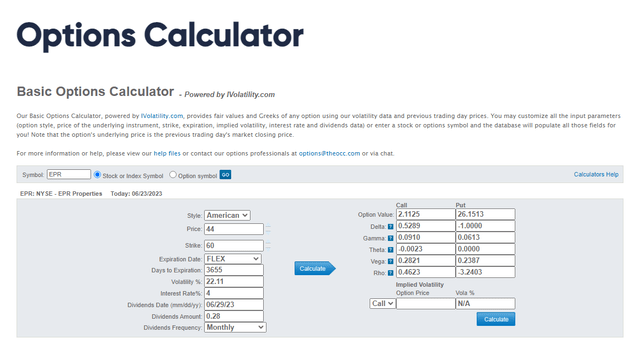

EPR-C and EPR-E have actually embedded call choices, and their worth needs to be consisted of in each of the favored stock’s assessment. For each of these convertible securities, we can offer a call choice in the typical stock EPR with a strike cost as near the matching conversion cost as possible. By doing so, we have value-added by additional improving the yields of each financial investment car. In the choices calculator we are utilizing, we determine the cost for a 10-year call choice in an effort to imitate the no-expiration ingrained call choice in each convertible favored stock.

EPR 10-year call choice with a strike cost of 45 ( optionseducation.org) EPR 10-year call choice with a strike cost of 60 ( optionseducation.org)

These choices worths, increased by the conversion worths, are then divided by 10 and contributed to the matching small yield in an effort to figure out the adjusted present yields.

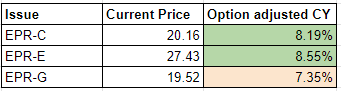

Changed CY contrast ( exclusive spreadsheet)

The call choice changed CY spread for EPR-C and EPR-E is rather narrower than the vanilla CY spread, and this is the predicted outcome. As mentioned above, the ingrained call choice of EPR-C has more worth than the EPR-E one.

EPR-G

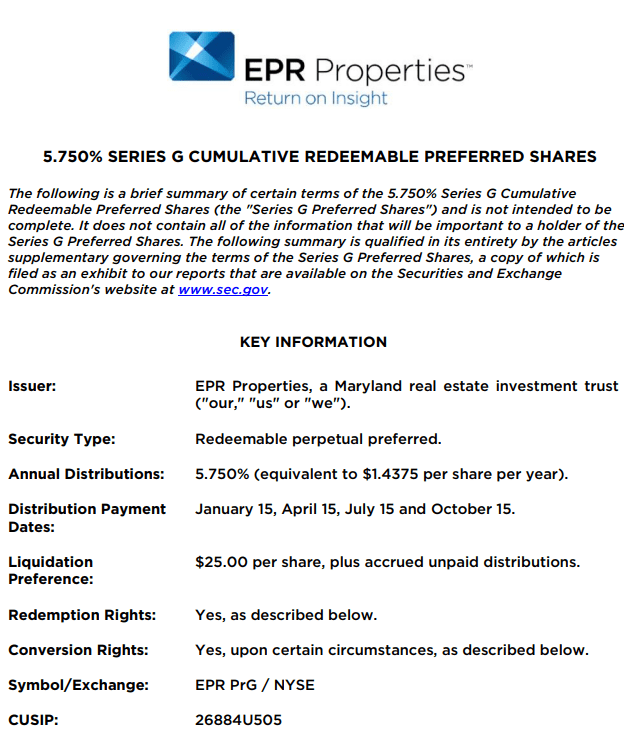

EPR-G is a 5.75% fixed-rate cumulative redeemable favored stock released by EPR Characteristics on 11/20/2017. It has no conversion provision, unlike its 2 exchange-traded bros. At the minute of composing this short article, it trades at $19.58 USD with a CY of 7.35%.

EPR-G information ( eprkc.com)

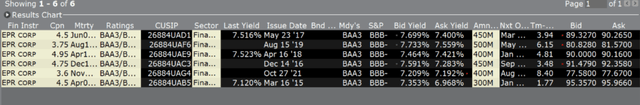

The bonds

EPR bonds ( Interactive Brokers)

In the screenshot above, we are revealing the financial obligation problems of EPR that trade on the bond market. All the financial obligation problems are ranked Baa3 by Moody’s and BBB- by S&P. By contrast, the exchange-traded favored stocks are ranked Ba1 by Moody’s and B+ by S&P. The various financial obligation problems have yields in the series of 7.2% to 7.7%. These yields are the primary factor for us to think that the EPR-G chosen stock is extremely misestimated. The favored stock remains lower in the capital structure of the business compared to the bond problems and we discover no sound monetary factor for it to be priced at an equivalent yield with them. A distinction of 4 notches in the credit score is not a joke.

The trade

In our viewpoint, there are a number of choices for the advanced financier to take a position in the EPR items, must he/she chooses it deserves it:

1. If the financier resembles the concept of taking a long position in the typical stock, our analysis recommends that a matching size in EPR-C is a much better option. The conversion worth of EPR-C is as close as ever to the cost of EPR, and on the benefit, they will move “connected” together. On the disadvantage, EPR-C has much better defense from EPR for being a favored stock.

2. Take EPR-C or EPR-E as the long leg and EPR-G as the brief leg in a set trade in between the exchange-traded items of one provider. All at once with that offer the matching quantity of call choices in the typical stock EPR, so that the convertible favored stock is matched to the non-convertible one. As an example – for every single 2 call choices of EPR with a strike cost of 45 we offer, we require to have a 9000 United States dollar worth in the typical stock. EPR-C is trading with a conversion rate of 0.42, so for every single EPR-C share we transform needs to EPR reaches 45, we get an 18.9 USD worth in the typical stock. That implies we require 476 shares of EPR-C in order to acquire the 9000 USD worth in the typical stock and to cover 2 call choices of EPR with a strike cost of 45. That method we can make use of the distinction in between the convertible and non-convertible favored stock of a single provider to our benefit while not taking an unneeded credit danger. The ingrained call choices in EPR-C and EPR-E are improving the long leg’s yield and making this set trade a rather good chance.

Something extra the financier can do, to get rid of credit danger, is to utilize part of the benefit from offering call choices and to purchase deep out of the cash put choices of EPR. This is just something to chew on, and the computations will not be consisted of in this short article. DOOM put choices are not extremely liquid and pricing them properly can be a difficult job.

Option-adjusted CY contrast ( exclusive spreadsheet)

3. Take a position in the bonds of the business. With yields in the series of 7.2% to 7.7% for investment-grade financial obligation problems, they use a good financial investment chance, as they remain greater than the favored stocks in the capital structure of EPR.

Summary

The conversion provisions of EPR-E and EPR-C make them definitely mispriced and are the smart method to be bullish on EPR Characteristics as long as you concur with the design utilized to identify their relative worth.