Derick Hudson

First some caveats: whilst we now have all most definitely learn Charlie Munger’s quote “I by no means permit myself to carry an opinion on anything else that I do not know the opposite facet’s argument higher than they do”, the truth is that this is outstandingly unusual and difficult. In truth, when buyers point out dangers about an organization they prefer, they steadily intentionally make a choice strawman arguments from the opposite facet and advertently or inadvertently forget about steelman arguments. I can attempt to keep away from strawman undergo circumstances (and boy there are lots of), and best define the undergo circumstances that certainly fear me as a shareholder. Since I’m writing concerning the undergo circumstances, they’re identified unknown, however clearly, there will also be unknown unknowns that I won’t even pay attention to however can indubitably impact Meta (NASDAQ:META) ultimately.

Ahead of we get into the ones long-term considerations, let me get started the place I left off in remaining week’s put up: Meta’s Moat. I’ve won fairly a couple of insightful positive comments. One of the most counterarguments was once because the industry of social media had dramatically modified over the past decade, it’s much less helpful to trace the place more recent social firms are nowadays at a an identical scale vs the place Meta was once a decade in the past. Whilst I did point out that “the industry of social media most probably modified endlessly”, I may have achieved a greater activity outlining the place issues stand nowadays between Meta vs. different social firms. For the aim of this piece, I can essentially focal point on Snap (SNAP) to proceed the dialog from the remaining week’s piece.

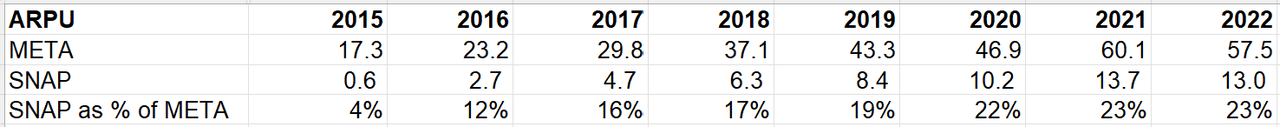

Let’s get started with ARPU.

Again in October 2014, Snap introduced its commercials, so it was once simply ~4% of Meta’s ARPU (see how it’s calculated under) in 2015. However then it briefly ramped as much as 12% of Meta’s ARPU in 2016 and reached 22% in 2020. Then the growth stopped within the remaining couple of years. Zuckerberg and Spiegel to begin with had moderately reverse tones on the subject of ATT; Spiegel virtually welcomed Apple’s (AAPL) ATT however it’s ATT that can have performed a vital position in stalling their ARPU momentum in opposition to Meta.

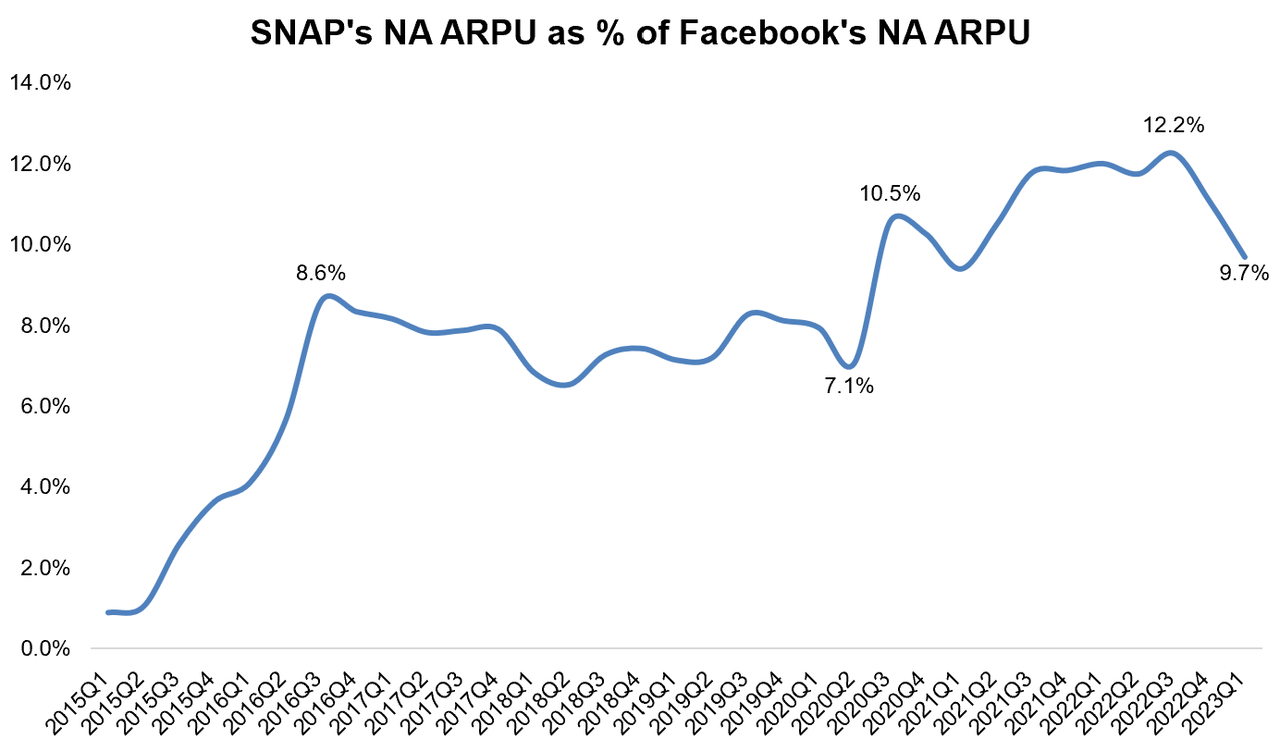

Some might ponder whether person combine differentials between those two firms had contributed to the stalling of growth in ARPU. Now not in reality; if truth be told, whilst Snap’s ARPU briefly ramped to ~8-9% of Meta’s via mid-2016, it hasn’t been ready to achieve a lot ARPU momentum in North The united states (NA) since then, and in contemporary quarters, it began going within the flawed course.

What moderately shocked me is that Snap’s ARPU as % of Meta’s ARPU is if truth be told upper in geographies ex-North The united states. There are attention-grabbing implications right here which can be related to my first undergo fear about Meta (to be mentioned in a while).

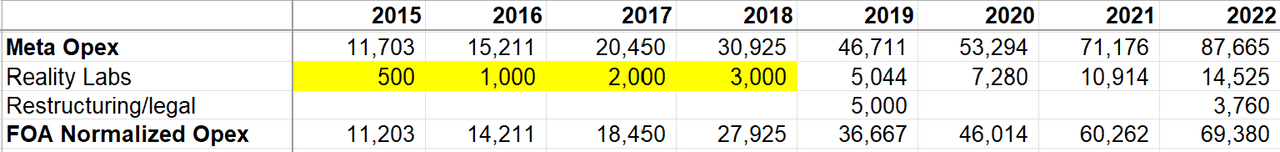

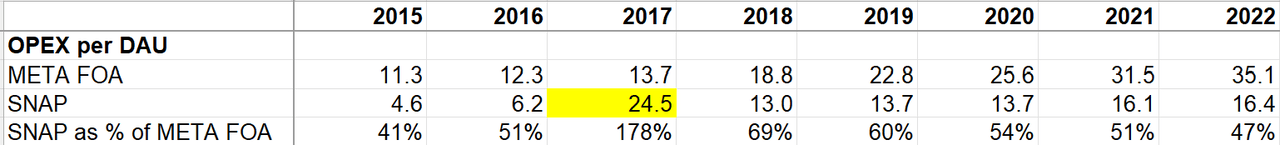

Let us take a look at Opex now. To make it extra apples-to-apples, we wish to make some changes. Since we need to evaluate Snap to Meta’s FOA industry, I’ve excluded Fact Labs (RL)-related opex. Since RL bills have been disclosed in 2019, I’ve made some assumptions for RL Opex in 2015-2018. I additionally excluded restructuring bills for each Meta’s FOA phase and Snap in 2022 in addition to Meta’s massive felony expenses in 2019. To be honest, Snap additionally invests in AR however since they do not fairly reveal it one after the other (and it sort of feels very a lot a part of the core industry), I took Snap’s general Opex base (ex restructuring) for calculating their Opex in line with DAU (Be aware: Snap IPO-ed in 2017 which distorted that 12 months’s quantity, so I’d forget about it).

What we see is on a in line with DAU foundation, Snap spent virtually part of Meta within the remaining 3 years and but best generated approx. one-fifth of Meta’s ARPU. With out ARPU momentum, Snap’s skill to spend money on its personal industry in the course of the Source of revenue Commentary can be restricted.

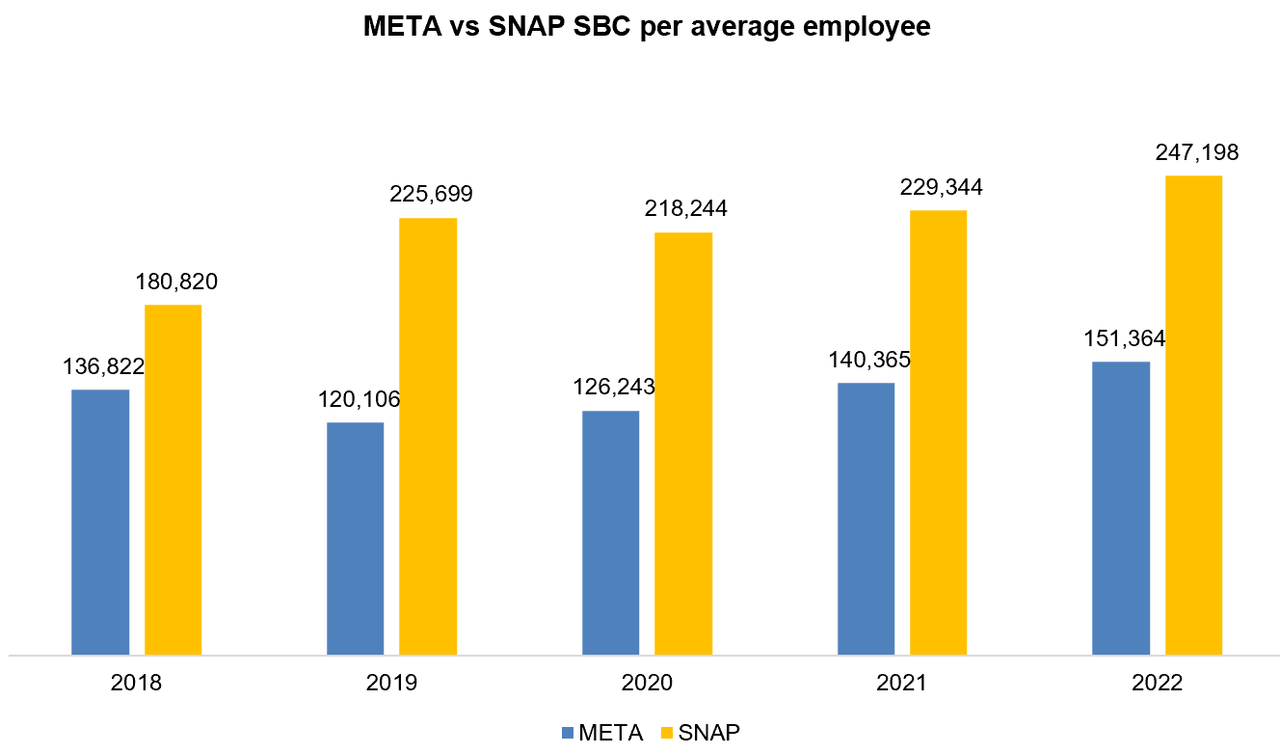

For Meta’s moat, I highlighted two number one moats which can be related nowadays: a) the facility to draw and worth skill, and b) regulatory seize are the main moats of Meta. As ATT and heightened knowledge privateness considerations wreaked havoc in virtual promoting (ex-Google Seek), Snap’s ARPU momentum misplaced its venom which is presenting Meta a good chance to widen the distance from their competition. What in all probability surprised me is Snap’s SBC in line with moderate worker vs Meta’s:

MBI Deep Dives, Corporate Filings, Daloopa

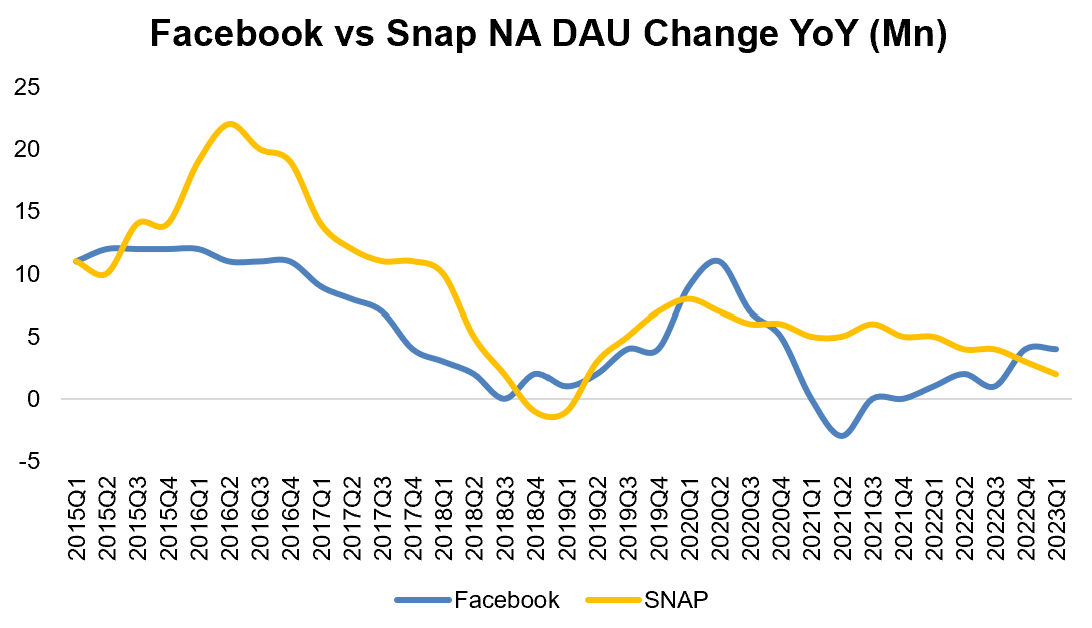

It is a double whammy for an organization reminiscent of Snap. They wish to spend money on the following giant factor (AR, AI, paying creators for content material, ever-increasing moderation requirement, and so on.) whilst coping with ATT, GDPR, and so on. which immediately impact ARPU momentum. The way in which they may have doubtlessly escaped it’s if their customers grew speedy in order that they revel in some price leverage, however in spite of Fb’s DAU being 2x Snap’s DAU, Fb surpassed Snap’s incremental DAU enlargement YoY for the remaining couple of quarters.

Corporate Filings, MBI Deep Dives, Daloopa

Whilst some readers took a topic with whether or not execution moat is if truth be told sustainable over the long term (control can alternate and even the prevailing control can lose course for plenty of causes and so on.), it’s in all probability some distance much less arguable to mention that Snap (or any person else) must execute out in their skins and hope that Meta loses its approach slightly shut the aggressive hole with Meta. Subsequently, you do not essentially wish to imagine whether or not Meta has an execution moat or now not, quite I’d invert it: you wish to have to suppose Meta could be moderately incompetent precisely when Snap (or any person else) would execute extraordinarily neatly. In fact, it won’t should be binary, however given energy regulations in client web, it can be more difficult to generate constant and sturdy benefit for sub-scaled gamers.

However this piece isn’t about Snap vs Meta and in spite of what the inventory costs could make shareholders really feel at the moment, now not the entirety is domestic dogs and kittens for Meta. My steelman undergo circumstances are twofold: a) Meta’s continual dependency on North The united states, and b) the evolution from “social media” to “media social” and social interactions on-line.

Ahead of I elaborate on my undergo circumstances, let me briefly point out the driving force of Meta’s earnings nowadays: a) the selection of DAU or MAU, and b) the time spent on Meta’s platforms. Whilst a lot of the undergo considerations revolve round customers leaving the platform that may be doubtlessly speeded up because of opposite community results, I believe it’s the “time spent” serve as that is much more credible undergo case.

Throughout the time spent serve as, Meta’s earnings is pushed via: a) the quantity or selection of advert impressions, and b) the effectiveness of commercials which impacts the associated fee in line with advert. My first “Achilles heel” for Meta revolves across the effectiveness of commercials whilst the second is concerning the quantity of commercials or the selection of advert impressions.

Meta’s continual dependency on North The united states

In the beginning look, it will sound like a peculiar undergo fear, so permit me to provide an explanation for.

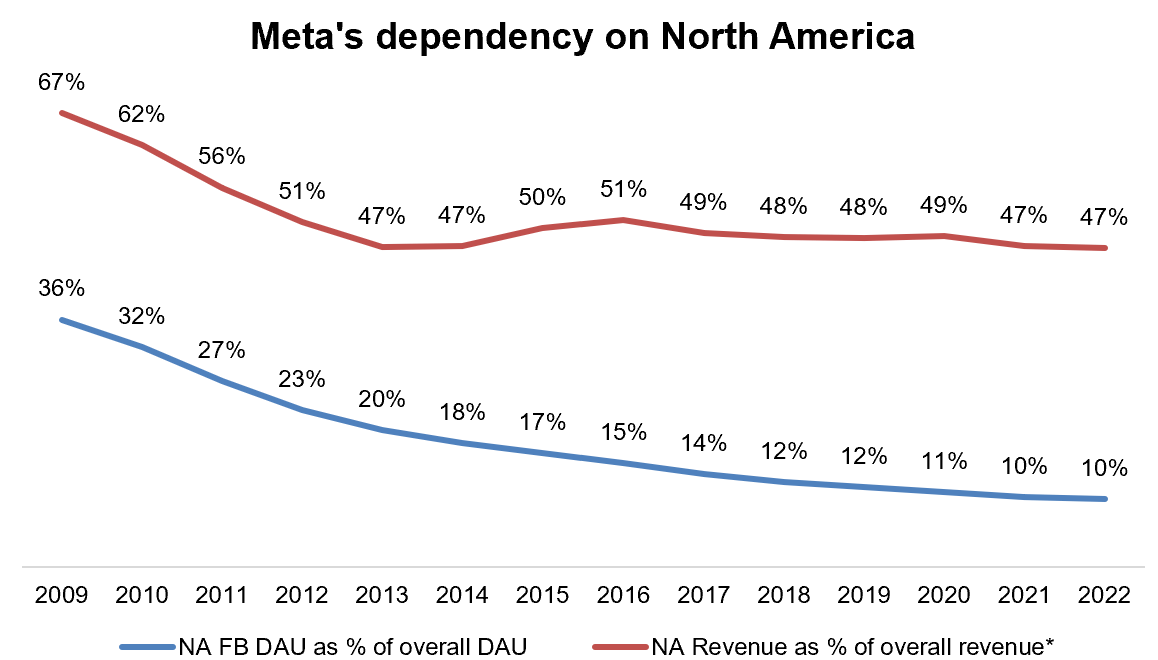

Again in 2009, 36% of Fb DAU was once based totally in North The united states (NA) which contributed two-thirds of the corporate’s general earnings. 4 years later in 2013, NA customers turned into 20% of the DAU and 47% of the earnings. As Meta grew its tentacles all over the place the sector, NA DAU turned into best 10% of general DAU in 2022. Unusually, NA’s earnings contribution stays virtually part of the corporate’s earnings.

So, why is that this a priority? Two causes.

First, I think whilst there’s a huge distinction amongst areas with regards to ARPU, the price to serve the customers won’t have a lot distinction. Meta’s ARPU in NA is ~3x Europe, ~11x Asia Pacific, and ~15x the Remainder of the International. How concerning the prices? Again in 2012 10-Okay (first 10-Okay after IPO), Meta had a fascinating paragraph that they did not repeat anytime of their annual filings since 2012:

Person geography additionally has some have an effect on on our prices, regardless that typically new customers in Asia and Remainder of International don’t require subject material incremental infrastructure investments as a result of we’re ready to make use of present infrastructure reminiscent of our knowledge facilities in the USA to make our merchandise to be had to those customers. As well as, person enlargement via geography does now not essentially impact our general headcount necessities or headcount-related bills since we’re usually ready to fortify customers in all geographies from our present amenities.

I believe they stopped publishing this paragraph as a result of it can be now not true anymore. A 2018 weblog put up via the corporate indicated that Fb’s “security and safety” workforce employs 30k other folks (maximum of them are contract hard work and therefore now not a part of the corporate’s headcount). Such moderation requirement indubitably did not exist in 2012, and because moderating content material calls for you to know native context and nuances, I believe a lot of this staff is area particular. Additionally, if the political will to keep an eye on voters’ knowledge inside their borders positive factors essential momentum, knowledge infrastructure prices too can grow to be extra area particular. With US-leading ARPU momentum that the opposite areas are discovering arduous to stay alongside of, there most probably is a large margin differential throughout areas. Any weak point within the North American industry might make lifestyles difficult for Meta, and there appears to be one corporate that has a vested pastime in making Meta’s lifestyles tricky in North The united states: Apple (Smartly, their feud is international in nature, however the middle of the feud and the possible implications for Meta is maximum acutely felt in North The united states since this area is a lot more mature than others and therefore enlargement essentially relies on efficient monetization of MAU.)

Mark Zuckerberg is preventing in opposition to Apple to stay his corporate’s economics:

A man who rises to the highest of a giant company and owns none of it’s a lot more involved in keep an eye on than he’s in economics. It is only the character of humanity. A man who owns his industry is already used to keep an eye on. He by no means has to combat for keep an eye on. What he has to combat for is economics”- John Malone

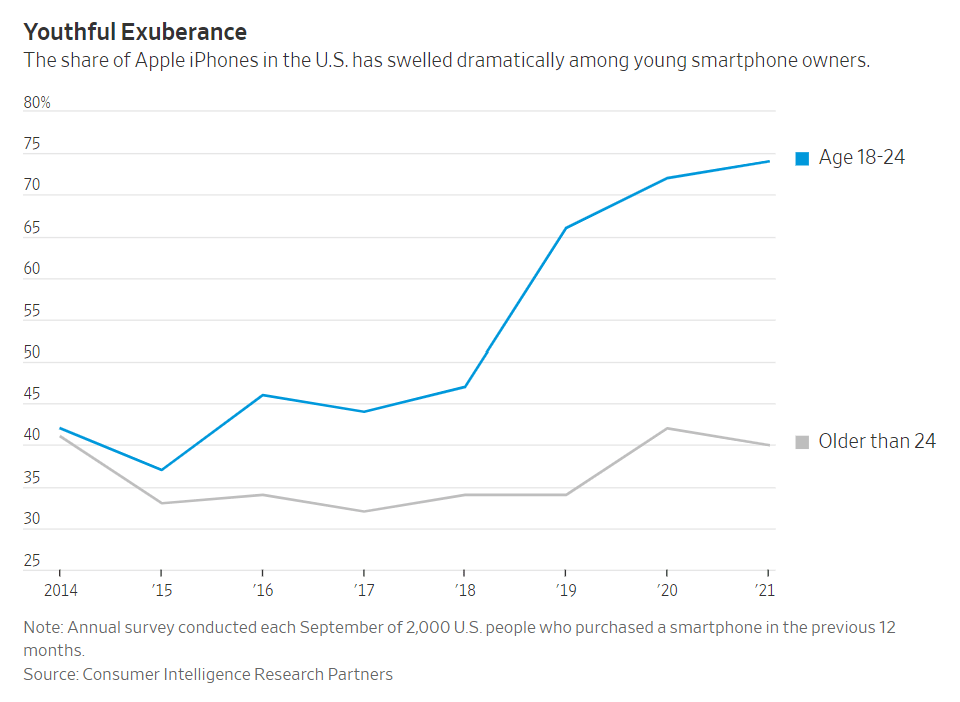

iPhone is dominant in North The united states and if iPhone’s marketplace proportion amongst teenagers is any indication, Apple’s dominance in america is predicted to simply building up over the years. Apple’s endured and chronic dominance in america will also be unhealthy information for Meta. From 2017-2022, Meta’s MAU within the NA greater via ~2% CAGR while ARPU grew via ~20% CAGR all over the similar time. It’s protected to suppose Meta’s MAU enlargement in NA is not going to exceed ~2% within the subsequent 5-10 years; subsequently, the crux of the query round NA’s enlargement sustainability hinges upon the ARPU query.

The 3 greatest beneficiaries of present cellular computing are Apple, Google (GOOG) (GOOGL), and Meta (in that order). Apple reportedly receives ~$20 Bn in line with 12 months from Google which kind of is going immediately to Apple’s base line. That makes their courting slightly extra symbiotic; in spite of the entire hypothesis about Apple getting into the quest marketplace, it could now not wonder me if the connection stays within the present equilibrium for the following 3-5 years (however arduous to grasp past that).

However it’s Meta’s upward push that will have to be so rattling disturbing to Tim Cook dinner (and possibly could be to Steve Jobs too if he have been alive) since Apple receives peanuts from Meta. Given Apple does not take a minimize of promoting from builders, there is no direct fee flowing from Meta to Apple, however some might argue the upward push of social media is what made smartphones a lot more intriguing to possess, and therefore, Apple and Meta too have a symbiotic courting. I’m fairly assured that Apple feels they catalyzed the smartphone revolution, hosts the wealthiest billion on their platform, and therefore merits some proportion of Meta’s economics. Evan Spiegel validates such belief:

We in reality really feel like Snapchat would not exist with out the iPhone and with out the superb platform that Apple has created.

A up to date put up on Meta’s close to acquisition of Waze (Google in the end bought Waze) made me understand if Apple have been run via Mark Zuckerberg, he would most definitely be indignant too that Apple does not obtain a lot in go back from Meta even if Meta’s majority of earnings (and most probably supermajority of earnings) is generated on their telephones:

Fb was once the herbal have compatibility from the product viewpoint – they feared dependency at the cellular platforms and sought after to possess their location stack, each for his or her upcoming telephone and their apps. We spent a large number of time in combination mapping out attainable integration, however Fb saved operating up in opposition to the issue of “What if we let you, you grow to be an enormous platform, after which Google comes alongside and acquires you? We’d now not be capable to compete with them financially.” This was once at the heels of the Spotify US release the place Fb believed that they had “constructed Spotify’s industry” however didn’t extract any worth from it.– Noam Bardin (former CEO of Waze)

Bet what, Spotify (SPOT) wasn’t any place with regards to making any cash when Zuckerberg felt that they had “constructed Spotify’s industry” and lamented that they did not get a lot in go back from Spotify. Consider how Zuckerberg would have felt if an organization that runs its merchandise on his platform and generated virtually part of Meta’s working benefit however he could not extract a lot worth from that corporate. Zuckerberg would most definitely do just what Cook dinner had achieved if Zuckerberg’s position have been reversed.

Tim Cook dinner and Mark Zuckerberg are, therefore, at odds at the query of economics. Zuckerberg needs to handle the established order, and Cook dinner is continuously in search of tweaking the established order to get his palms on Meta’s economics. Apple prompt Meta pay 30% to Apple for “Fb boosts”, however Meta declined. In the end, Apple resorted to a privateness narrative and wreaked havoc in all of the virtual promoting ecosystem via introducing ATT. Whilst this will likely sound like previous information to readers, the underlying feud could be very a lot alive and might not be completely solved anytime quickly.

If ATT seems to be a boon for Meta and entrenches its moat in opposition to sub-scaled gamers, I will not believe Apple pondering the activity right here is finished for them. Given how incentives are stacked, I believe Tim Cook dinner would if truth be told want Google to stay and develop their proportion within the virtual advert marketplace on the expense of Meta since Apple assists in keeping a wholesome economic system from Google. Our base case most probably must be that this can be a protracted cat-and-mouse sport between Meta and Apple.

Eric Seufert’s paintings signifies (additionally see this tweet) Apple might proceed to make lifestyles tricky for virtual advertisers till they understand it could also be more uncomplicated to come back to a maintain Apple than continuously dwelling lifestyles at the edge. Zuckerberg most definitely feels via giving into Apple’s calls for, he makes his industry fragile over the long term (suppose a long time, now not years) and would quite bear the ache however handle his corporate’s economics. However make no mistake; if Meta is ever pressured to make a maintain Apple as a result of Apple nukes the sign to stay destroying virtual advert infrastructure, Meta gets an attractive unhealthy deal from Apple.

It isn’t simply advert infra that may be influenced via Apple’s whims, Apple has each and every incentive to lend a hand Meta’s competition. That is why 2022 was once so horrifying for Meta and its shareholders; when Apple was once coming after their skill to monetize customers’ time spent successfully, TikTok was once encroaching and dangerous Meta’s skill to stay customers working on their platforms. Whilst the TikTok risk turns out neatly addressed at this level via Meta (knowledge issues about Reels recognition, in addition to the political onslaught on TikTok for its ties with CCP, makes this risk slightly tame albeit now not absolutely neutralized), Apple’s shadow nonetheless looms massive over Meta’s long run. The reality that also they are the primary competition in AR/VR makes it even much more likely that each firms have incentives to peer the opposite come across protective the cash-gushing machines they each recently have. Meta’s skill to harm Apple, on the other hand, is fairly restricted nowadays; Apple’s may not be.

What can Meta do to cut back its dependency on North The united states? US GDP as % of world GDP (ex-China) is ~30%. Subsequently, Meta’s perfect wager is most definitely for North The united states’s earnings contribution to say no to ~30-35% of general earnings over the years. There are two techniques Meta can scale back dependency:

a) the unhealthy approach: Apple can do it for them via often making it difficult to construct efficient advert infra. and b) the great way: Meta unearths different alternatives to monetize its person base via immediately integrating the entire gross sales funnel inside their houses. One of the most causes I believe world enlargement hasn’t fairly saved tempo is Meta’s loss of important monetization of WhatsApp.

Again in 2014, Meta bought WhatsApp for $4 Bn coins, 184 mn stocks of Fb (now Meta), and 46 mn RSUs which might suggest ~$70 Bn acquisition price for WhatsApp in nowadays’s worth i.e. ~10% of Meta’s Endeavor Price (EV) nowadays. Meta disclosed within the 3Q’22 name that the click-to-messaging earnings run charge was once $1.5 Bn on WhatsApp (rising ~80% YoY) which makes WhatsApp’s contribution to be a measly ~1% of Meta’s general earnings nowadays. Whilst bulls imagine all types of techniques Meta can monetize WhatsApp going ahead and believe Meta can flip WhatsApp right into a “tremendous app” in lots of essential international locations, particularly India and Brazil, Meta has quite been uncharacteristically gradual in ratcheting up monetization. That, on the other hand, appears to be converting in recent times; WhatsApp industry MAU greater from 50 mn in 2020 to 200 mn in 2023. Meta could also be at the verge of a large monetization spigot in WhatsApp which is able to in large part propel its earnings enlargement outdoor NA going ahead.

Examining WhatsApp itself will require a separate piece. My opinion on WhatsApp is in large part going to be hinged upon their enlargement momentum; the issue is Meta won’t constantly reveal it which is able to make it tricky to judge monetization growth.

From “Social Media” to “Media Social”

I do not consider who coined this time period on Twitter, however it certainly left an impact on my thoughts that Meta’s industry had steadily developed from “Social Media” to “Media Social”. Within the “Social Media” industry, you essentially devour content material/media out of your social connections while, within the present “Media Social” level, it’s the “Media” that is the middle and Meta’s perspective against the supply of the “Media” is increasingly more changing into agnostic i.e. all Meta cares about is to entertain you which of them might or won’t come out of your social connections.

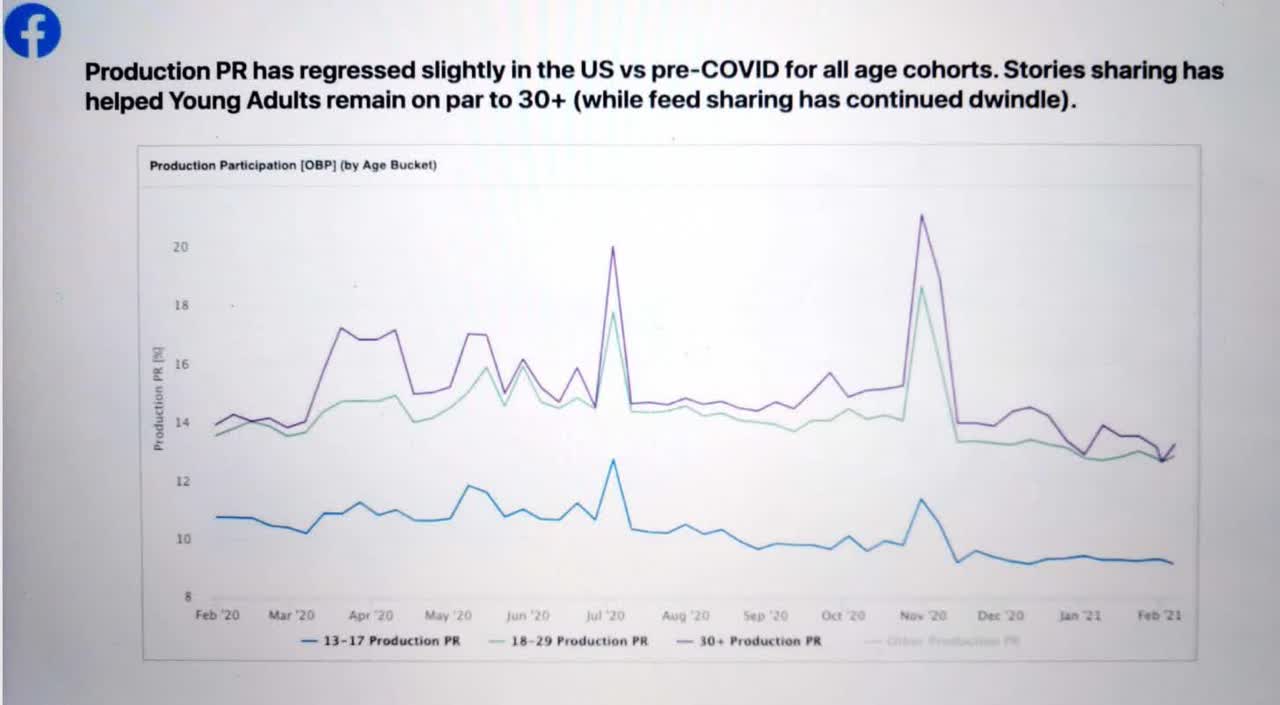

When WSJ printed “The Fb Recordsdata” a few years in the past, this actual slide stuck my consideration. In some ways, Meta has been “fortunate” in going through festival from Snapchat and TikTok. Let me provide an explanation for.

Meta introduced “Information Feed” in 2006. Regardless of vociferous grievance from the customers on the time, Feed (because it was once later renamed) has been essentially the most scaled winning “actual property” within the social networking business.

Meta does not reveal this, however it’s extremely most probably that content material posted for Feed in line with person per 30 days has been on a mundane decline. As other folks grow to be extra self-aware in their virtual presence, the social broadcast is not going to revel in a renaissance anytime quickly, if ever.

With diminishing content material manufacturing over the years, customers wouldn’t have a compelling rationale to come back again to Meta’s houses. Consider if there have been no “Tales”, Younger Adults (18-29 12 months olds) would most definitely produce some distance much less content material.

If there have been no TikTok, there would possibly now not had been any “Reels” (possibly sooner or later regardless that). Meta must litter your feed in any other techniques which may well be some distance much less compelling than Reels.

Meta, sarcastically, wanted reasonable festival to refresh their social networking apps to lend a hand them transition from social broadcast to extra social leisure apps, by which in 5 years other folks might most commonly devour algorithmic content material on Feed and talk about/proportion them on DM.

Meta’s competition recently face the double whammy of monetizing their customers and emerging CAC in a post-ATT non-ZIRP global. Whilst Meta is somewhat higher situated in the ones dimensions, there are credible dangers within the transition from social broadcast to leisure.

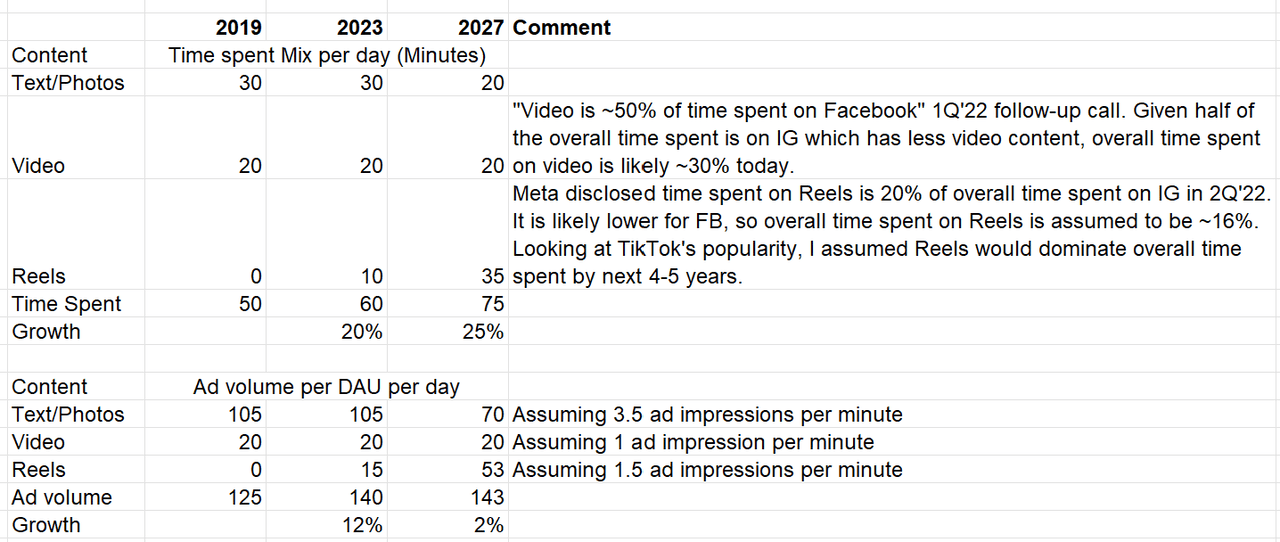

Feed recently has ~25% advert load and given what number of commercials you’ll watch whilst scrolling all over a normal ~60-minute consultation in line with day, Meta could have to extend time spent materially to stay advert impressions rising. When “Tales” got here to the scene and took time clear of Feed, it wasn’t as regarding since Tales took little or no time to navigate and permits Meta to throw you numerous commercials as you flick thru your pals’ Tales. For Reels, this time is other.

Meta indicated the structural demanding situations associated with Reels within the 1Q’23 name:

There are structural provide constraints with the Reels structure as other folks view a Reel for an extended time than a work of Feed or Tales content material, which leads to fewer alternatives to serve commercials in between posts. That can make it most probably tougher to near the monetization potency hole than it was once with Tales.â¦we are operating down the headwind to earnings from the expansion of Reels cannibalizing a while this is spent on our extra mature advert surfaces, Feed and Tales. And principally, we now have been balancing the two elements right here, which is the level to which Reels is using incremental engagement at the platform as opposed to the decrease monetization potency of Reels relative to the Feed and Tales engagement that it cannibalizes. And in the end, the whole economics of Reels is in reality going to be made up our minds via the combo of the ones 2 issues.so whilst we are on target to Reels changing into impartial to earnings via finish of 12 months or early subsequent 12 months, I do suppose you need to name out that Reels is structurally other from Feed and Tales. And so we do not have line of sight of having Reels to monetization parity in line with time with Feed or Tales anytime quickly as a result of the ones structural variations.

It is vitally a lot conceivable such structural adjustments might imply the most efficient days of profitability of “Feed” is in the back of us. To confirm this level, let’s believe a DAU spent ~50 mins on Meta’s Circle of relatives of Apps (FOA) houses in 2019. The next desk outlines why even with the idea of greater time spent over the years, the structural demanding situations could also be a robust headwind for advert impact enlargement for Meta. With out rising advert rather a lot, impressions, and restricted room for DAU/MAU enlargement, earnings enlargement can be in large part depending on worth in line with advert which is determined by focused on and the standard of advert attribution. If you happen to consider the undergo case mentioned above, Apple might make issues tricky for Meta in its adventure to toughen advert focused on and attribution infrastructure.

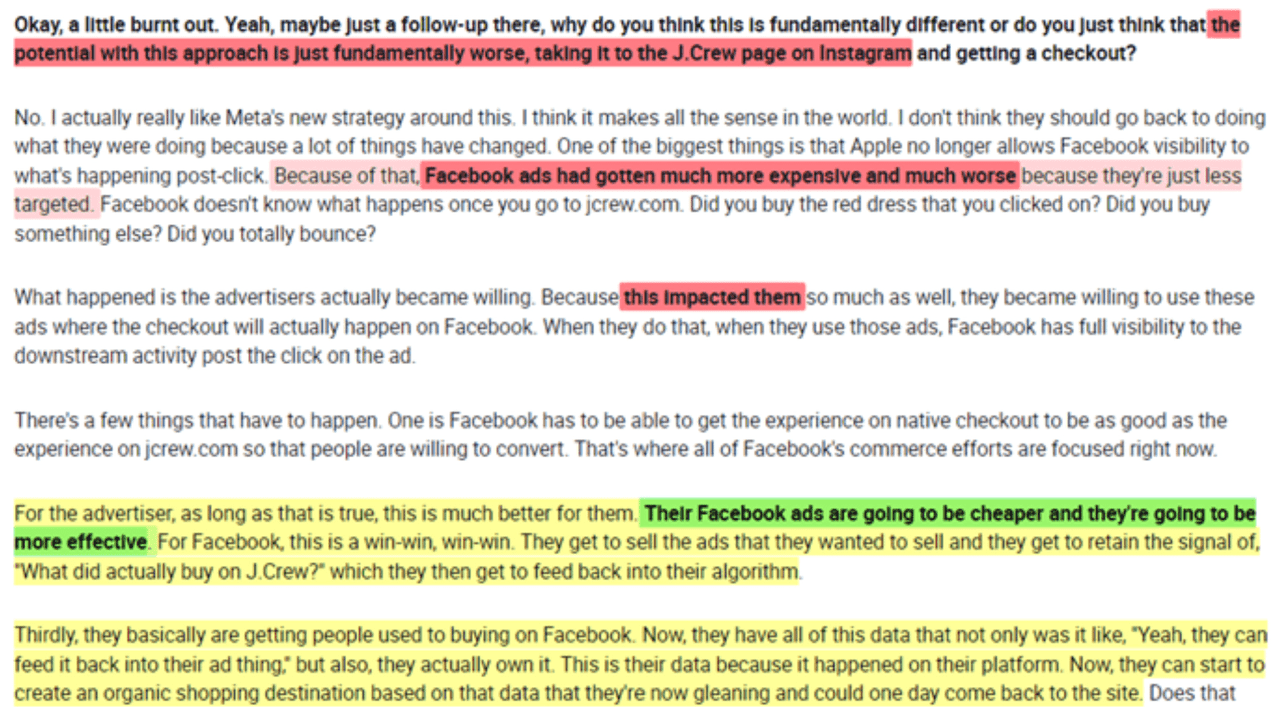

Meta does not appear to be oblivious to such obvious dangers; monetizing messaging and in all probability buying groceries will wish to pull the lever for Meta this decade either one of which were within the investor dialog for the remaining 4-5 years however by no means fairly materialized to the level buyers was hoping. Rihard Jarc shared an insightful skilled community interview that defined why Meta’s buying groceries efforts failed to this point and why that would possibly nonetheless alternate. Whilst I beg you to learn the total thread, the next bit stood out to me:

As a shareholder, after I glance ahead, I do suppose Meta must make buying groceries and messaging paintings in a significant approach for it to be moderately immune from “Apple” possibility (i.e. they might not be absolutely immune from Apple possibility; simply that they’re going to be harm much less). When you assess the extent of ache Apple can inflict upon Meta, it most definitely begins making slightly extra sense why Meta is so extremely desperate to keep an eye on the following computing platform.

Of the massive tech firms, Meta is likely one of the more uncomplicated firms to hypothesize undergo circumstances nowadays. 10 years in the past, it was once if truth be told Apple that was once more uncomplicated to hypothesize undergo circumstances e.g. it is a {hardware} corporate and {hardware} firms do not make the type of margins Apple does; Apple will lose marketplace proportion to Samsung (OTCPK:SSNLF), Google, Microsoft, and so on. I you need to be a diligent pupil of giant tech firms and the extra I studied historical past, the extra it jogged my memory to have in mind of ways arduous it’s to are expecting the evolution of moats.

As you’ll most definitely inform, I’ve a good quantity of sympathy for undergo circumstances about Meta. However Meta’s control’s general historic monitor document in addition to some attainable wild playing cards nonetheless assists in keeping me a shareholder nowadays.

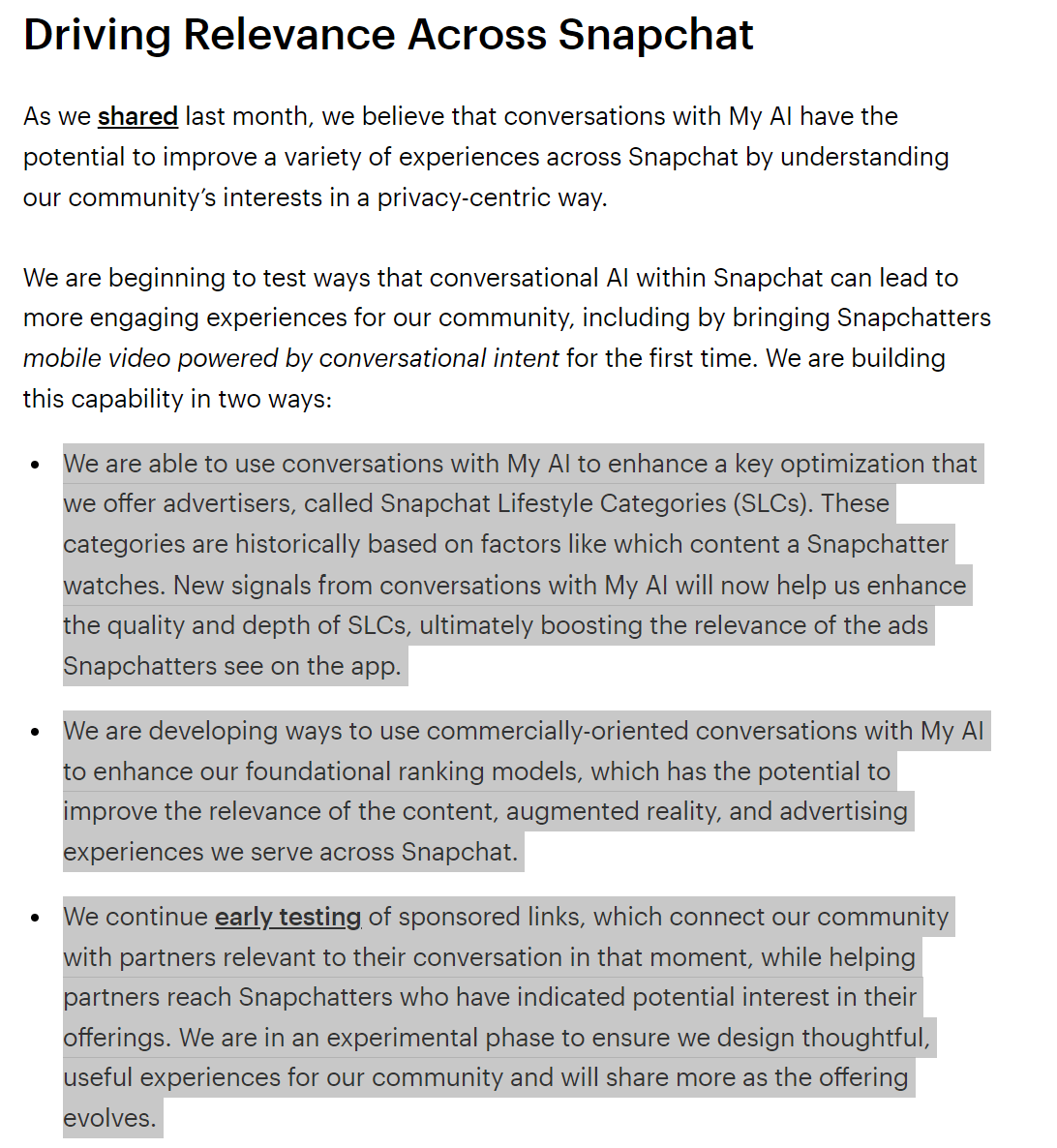

Fact Labs which continues to be most probably assigned a steep adverse worth nowadays via buyers is one such wild card, however the different wild card that I’m beginning to contemplate slightly extra on is AI chatbots. Snap lately shared their early insights on their chatbot known as “My AI”. The entire file could be very, very attention-grabbing and may have doubtlessly uncomfortable implications for Google Seek (disclosure: lengthy). Meta has 3 separate messaging houses (Messenger, WhatsApp, and IG DM) consisting of ~4 Bn MAUs; all 3 can be swarmed with AI chatbots via the top of this 12 months. Whilst we’re approach too early right here (Meta hasn’t even introduced anything else), the panorama can shift briefly in virtual promoting. If chatbots can in reality take off on messaging houses, Meta, which generates lower than part of Google Provider’s revenues, might finally end up gaining subject material marketplace proportion from Google.

Snap

Even though the undergo circumstances for Meta play out, it’s not going to be a terminally unwell industry and therefore, the query of valuation is fairly related. Meta recently trades at ~17x NTM EV/EBIT, however should you assign RL a valuation of 0 (controversial; will also be adverse), it trades at ~12-13x NTM EV/EBIT, a vital cut price from each S&P 500 Index (~18x) and Nasdaq 100 (~23x) maximum of whose constituents upload again SBC (so the real cut price is most probably even upper).

As I’ve discussed prior to, I at all times believe valuation with regards to questions. The reaction to these questions isn’t binary however a probability-weighted solution. The general public believe likelihood to be an inherently quantitative idea with function and exact solutions, however for elementary energetic buyers (particularly with concentrated portfolios) coping with likelihood is essentially qualitative in nature. As a result of it’s the likelihood, I do and can robotically assess and replace it as basics and valuations alternate.

Thanks for studying.

For extra detailed valuation paintings on Meta, learn this put up.

Disclosure: I personal stocks and January 2025 $50 Name Choices of Meta

Editor’s Be aware: The abstract bullets for this newsletter have been selected via In quest of Alpha editors.