IvelinRadkov

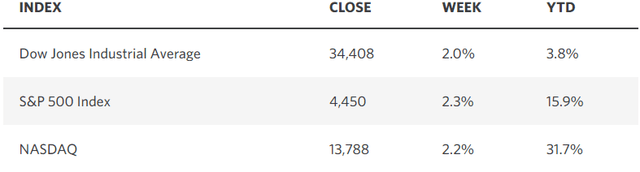

The very first half of this year was an exceptional one for the majority of the significant market averages, however not a lot for the typical stock. I believe that will alter and be a style for the 2nd half that begins today. Defying expectations of an extremely downhearted agreement at the start of this year, inflation has actually fallen at a constant speed, while the economy stays resistant. As an outcome, business profits have actually surpassed, as the Fed nears the conclusion of its rate-hike cycle. A soft landing for the economy need to slowly end up being the agreement view in the months to come.

Edward Jones

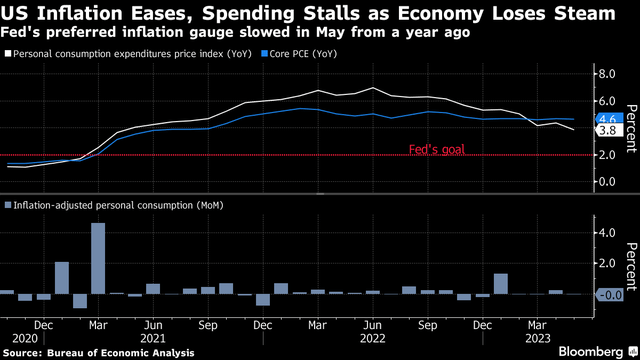

In assistance of that story, we discovered recently that the rate of financial development in the very first quarter of this year was more powerful than anticipated, sustained by an upward modification in customer costs. At the very same time, the Fed’s chosen inflation gauge decreased more than anticipated to its slowest speed in 2 years. Additionally, services inflation omitting real estate and energy services, which is an essential metric kept in mind by Chairman Powell, increased by the tiniest quantity given that last summertime at simply 0.2%. This need to suffice of a factor for the Fed to stop raising rate of interest, however financiers are still expecting another boost in July. The marketplaces do not appear worried, and I still think the Fed will stop briefly once again, which would enhance the chances of a soft landing and the extension of the booming market.

Bloomberg

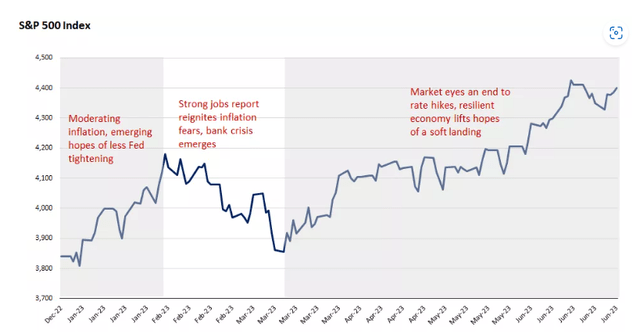

The very first half was definitely not smooth cruising, and I believe we will see a comparable scenario throughout the 2nd half of this year, as bulls and bears fight for instructions of the total market. Stronger-than-expected financial information raises worries of inflation and more limiting financial policy, while weak information stirs issues of the evasive economic downturn that Wall Street has actually been anticipating for more than a year. I alerted on February 7 that we may see a pullback in the S&P 500 to 3,900 after a blistering start to the year, which would be healthy in regards to combining those gains. The index bottomed at 3,855 on March 13 prior to resuming its advance. Days prior to I asserted that would see an ultimate rebound take the S&P 500 to 4,300. We prevailed over that level last month, after which I raised my target to 4,500. Recently I concluded that we would see a brand-new all-time high over the coming 12-month duration.

Edward Jones

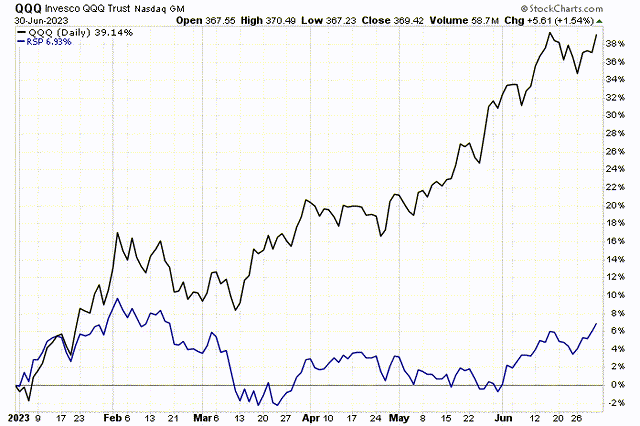

My optimism is grounded in rates of modification that I believe will continue to enhance, however I believe we will see durations of debt consolidation along the method, as we did previously this year. Debt consolidation is most likely to be triggered by financiers turning from technology-related names where extreme evaluations have actually been fed by the expert system trend. The outcome ought to be a reversion to the mean whereby the typical stock, as determined by the equal-weight S&P 500 index, outshines the handful of market leaders, as determined by the Nasdaq 100 index, which have actually driven index gains.

Stockcharts

I was asked just recently how I justify a brand-new all-time high for an index that a lot of think about to currently be misestimated, however I never ever stated it would be logical. Assessment is a pendulum that swings in both instructions to excess. The S&P 500 at 4,450 trades at much better than 18 times next year’s bottoms-up agreement price quote of $246 in profits. That is costly, however so long as rates of modification in the high-frequency financial information, business profits, and belief continue to enhance, evaluations can sustain or increase. The enhancements I see coming need to can recognizing brand-new all-time highs. When rates of modification start to degrade, so will my outlook for the index.

That stated, I believe the more sensible method to buying this market today is to concentrate on the sectors and private constituents of the index that have more affordable evaluations, and which have yet to take part from an efficiency perspective.

Delighted fourth of July!