sodafish/iStock by means of Getty Images

Intro

A sneaking inner stress undoubtedly emerges whenever I take a seat and attempt to evaluate and value a business that supplies a product and services that I truly like. Positivity predisposition driven by individual choices can cause uncomfortable financial investment errors, however it is challenging for even the most hard-headed expert to stay totally unbiased and reasonable when they have a warm and fuzzy sensation about a product/service. I’ll attempt my finest to prevent positivity predisposition in this Duolingo, Inc. ( NASDAQ: DUOL) note, regardless of the truth that my kids will grumble bitterly if I land at anything however a strong buy ranking for their preferred gamified language finding out platform.

It would be much easier to stay sensible and dispassionate about Duolingo if I had not listened to a long interview that Tim Ferriss made with the business’s co-founder and CEO Luis von Ahn in 2015. In plain contrast to all a lot of CEO’s, because interview Luis von Ahn struck me as authentic, modest, fascinating and vibrant. For any readers not yet acquainted with the Duolingo story, the Tim Ferriss interview is an amusing and simple method to start, although it deserves bearing in mind that Ferris himself might be handling positivity predisposition towards Duolingo considered that he was an early phase financier in the business back in 2011.

Outstanding Development

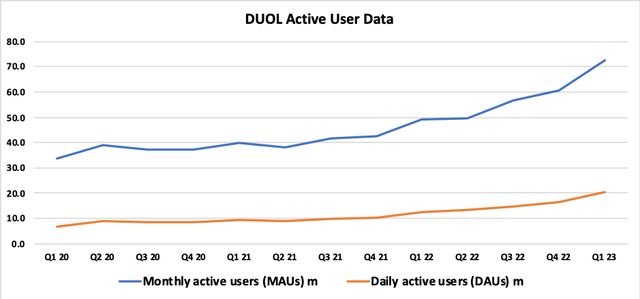

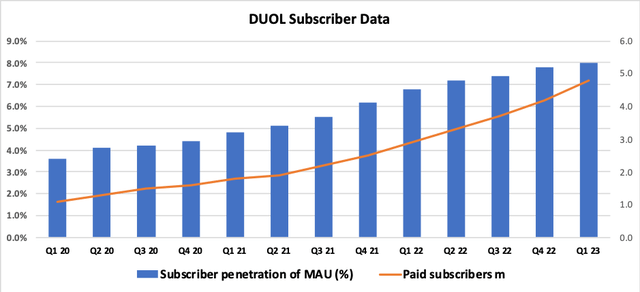

DUOL continues to report strong development in active user volumes (refer Display 1). Customer numbers are likewise growing at a fast rate and customer penetration continues to increase (refer Display 2). Whilst these patterns are really favorable, I keep in mind that the rate of enhancement in customer penetration has actually just recently softened.

Display 1:

Source: Expert computations based upon DUOL quarterly reports.

Display 2:

Source: Expert computations based upon DUOL quarterly reports.

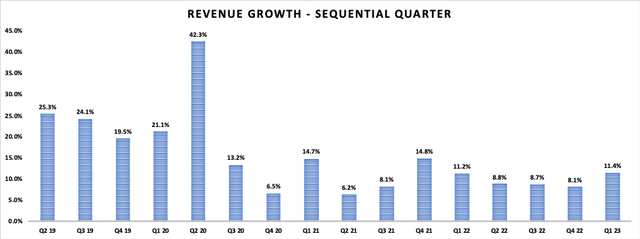

Active user and customer development is feeding perfectly through into profits development. Display 2 tracks the rate of consecutive profits development (note that these %’s are not annualised). 1Q23 revealed a better rate of consecutive profits development relative to the previous 3 quarters. DUOL is assisting to FY23E annualised profits development of 35-38% and this seems possible. The response to the concern regarding for how long DUOL can keep these remarkably high profits development rates is most likely to be among the primary differentials in between bull and bear contacts the stock.

Display 3:

Source: Expert computations based upon DUOL quarterly reports.

More Than Language Knowing

Duolingo has aspirations to extend beyond language education. Duolingo Mathematics is an app that provides primary mathematics for kids and brain-training video games for grownups. Users of Duolingo’s language finding out innovation will discover the basic structure of the mathematics platform comfortingly familiar. I believe that Duolingo Mathematics has excellent possible, especially at the primary education level. I was somewhat shocked that the brand-new mathematics app wasn’t discussed in the 1Q23 management speech, however 2 sell-side experts did ask concerns on the subject, so I presume that I’m not alone in seeing the upside capacity here.

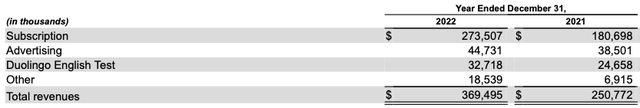

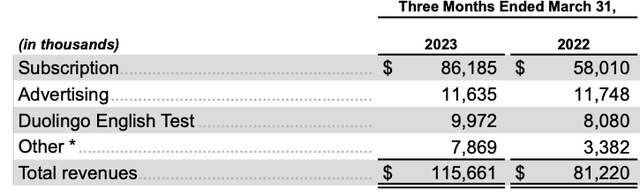

Membership costs and marketing earnings associating with DUOL’s core language finding out service control the group’s profits, however the business has actually currently revealed the capability to include brand-new earnings streams. The Duolingo English Test presently contributes ~ 10% of DUOL’s overall profits (describe Display 4 and Display 5 listed below). English screening earnings will likely increase really materially if Duolingo has the ability to acquire federal government and/or institutional acknowledgment for its test result as evidence of English language proficiency; management claim to currently be making great development on this front in the UK, Canada and Australia. Such screening services might quickly be encompassed other languages in time.

Display 4:

Source: DUOL 4Q22 Type 10K, page 70.

Display 5:

Source: DUOL 1Q23 News release, page 2.

Duolingo explains itself as a mobile knowing platform. The examples above suggest that the group has the desire and capability to extend services and earnings streams well beyond the language finding out app that Duolingo is currently so popular for. A brand name that is related to making finding out enjoyable is well-placed to extend throughout a wide variety of fields.

Look Beyond Adjusted EBITDA

Management’s favored revenues metric is Changed EBITDA, and assistance tends to be set by referral to the Adjusted EBITDA Margin. Making use of non-GAAP financials prevails in management reporting, however is essential for financiers to acquaint themselves with the changes to statutory reporting that management make. In DUOL’s case, I have a number of grumbles about the numbers that management desire financiers to concentrate on.

First Of All, an EBITDA metric, by meaning, omits devaluation and amortisation. Whilst it holds true that D&A is a ‘non-cash’ product, DUOL is likewise capitalising expenses associating with software application. D&A is not a little number for DUOL – FY22 Changed EBITDA was $15.5 m, however some $4.9 m of this associated to the turnaround of D&A. 1Q23 Adjusted EBITDA was $15.1 m, with $1.8 m of this associated to the turnaround of D&A.

My 2nd whine with DUOL’s management reporting connects to another typical change made by business that are still loss-making – being the exemption of expenses associating with stock-based payment. For DUOL, this indicates that management’s favored revenues metric omits a substantial cost product. FY22 Changed EBITDA of $15.5 m left out $75.8 m of expenses associating with stock-based payment. 1Q23 Adjusted EBITDA of $15.1 m left out $21.7 m of expenses associating with stock-based payment. I want to accept the argument that the basic accounting treatment for the computation of stock-based payment expenditures is not ideal, however I discover it rather ridiculous to absolutely omit what is undoubtedly an extremely material expense product. Think about the situation in which DUOL chooses that it will no longer provide stock-based payment to personnel, and ask yourself what is most likely to take place? The apparent response is that personnel will require extra cash-based income or benefits to neutralise or a minimum of partly balance out the worth that they were designating to the stock-based payment got. DUOL is far from alone in executing this kind of change in management reporting, however that does not make the practice sensible. In my view for that reason, financiers relying greatly or (even worse) totally on DUOL’s Adjusted EBITDA metrics when developing a financial investment case for the stock are refraining from doing themselves any favours.

Is The Target 30-35% Changed EBITDA Margin Realistic?

In DUOL’s latest investor letter, CEO Luis von Ahn described the group’s ‘long-lasting target of 30-35% Changed EBITDA margin’. The Adjusted Margin for 1Q23 was available in at 13.1%, and the business is assisting to a FY23E Changed Margin of 11-12%. A great deal of things require to work out for DUOL in order to enhance the Adjusted EBITDA Margin from ~ 12% to north of 30%.

Bulls on the stock might argue that with such high profits development rates (talked about above), DUOL is set to benefit considerably from margin growth due to scale advantages. It needs to be kept in mind that various expenses affecting the Adjusted EBITDA Margin will have differing level of sensitivities to scale utilize. DUOL needs to continue to increase its cost base in order to grow users/subscribers, to establish and carry out brand-new items, to effectively market brand-new and current items, and to broaden and enhance its innovation facilities. DUOL increased personnel headcount from 140 at the end of December 2018 to over 650 by 31 March 2023, and even more material boosts in personnel numbers need to be prepared for.

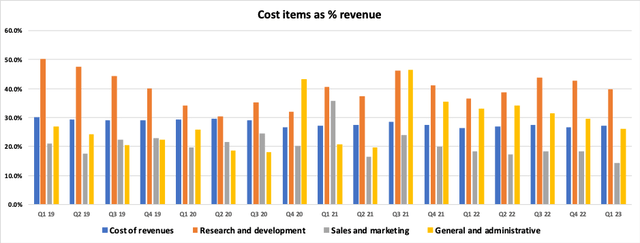

Display 5 tracks DUOL’s expense containers as a portion of profits. Keep in mind that this chart utilizes the statutory reporting numbers and does not make the changes that management consist of in DUOL’s Adjusted EBITDA. Taking a look at this information, regardless of DUOL’s quick profits development, it is not right away apparent that extra scale is benefiting functional effectiveness. Financial investment in research study and advancement has actually been and will continue to be crucial in order for DUOL to bring in and maintain customers and I am not encouraged that this expense product will reveal much utilize to scale. The 2 expense containers that have the best capacity to provide scale advantages in regards to margin growth are sales/marketing and G&A. I believe there is currently some proof of scale utilize in the sales and marketing information displayed in Display 5. G&An expenditures tend to be rather unstable however as a portion of profits these products have actually wandered lower in current quarters.

Display 5:

Source: Expert computations based upon DUOL quarterly reports.

My existing view is that management’s target of a Changed EBITDA Margin of 30-35% is a tough however possible objective. That stated, it is essential for financiers to bear in mind that it will likely take a number of years for DUOL to strike even the bottom end of the target variety.

Evaluation

For a stock such as DUOL, I discover evaluation work rather angst-inducing. Readers of my previous Looking for Alpha work will understand that I’m a value-oriented financier who usually relies greatly upon the idea of sustainable revenues to evaluate a business’s essential worth. Valuing loss-making innovation organizations on ‘market requirement’ or ‘benchmark’ sales multiples makes nearly absolutely no sense to me. When a metric ends up being the standard, such as 10x sales, the credibility of stated metric is seldom questioned. A lot more bewildering is that benchmark sales multiples are typically used throughout business that have really various expense profiles and market structures.

An in-depth DCF design with a 10-15 year revenues projection duration and a reduced terminal worth is one method of bypassing the market standard/benchmark evaluation technique. However this course includes developing an entire lot of presumptions and inputs that I would have really little self-confidence in. As things presently stand, from an essential analysis viewpoint, any evaluation for DUOL is based upon a great deal of uncertainty. Gradually, as the business develops and a clearer photo relating to DUOL’s sustainable revenues emerges, the evaluation procedure will end up being far more trustworthy and less unsure.

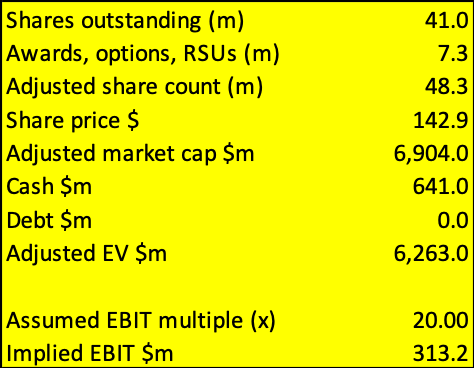

As an option to a standard evaluation, one method to take a look at DUOL is to consider what the business’s existing market capitalisation is informing us about expectations for its future revenues capacity and to integrate this into a ‘sense check’ analysis. In Display 6, I advanced some numbers that can be utilized in such a workout. Initially, I presume that DUOL has actually currently reached maturity which an EV/EBIT multiple of 20x is sensible.

Display 6:

Expert’s computations.

This undoubtedly simplistic analysis indicate DUOL needing a sustainable EBIT of ~$ 313m pa to support the stock’s existing share cost of ~$ 143. My next action in this ‘sense check’ technique is to transform the suggested EBIT into an indicated profits number. Taking the midpoint of management’s 30-35% Changed EBITDA Margin and permitting the effect of D&A and stock-based payment (which DUOL omits in its Adjusted EBITDA Margin), I get to an EBIT margin of 12.5%. Working back from a presumed EBIT of $313m and presuming an EBIT margin of 12.5%, we get to an indicated profits result of ~$ 2.5 bn.

DUOL’s existing profits run rate is ~$ 500m pa. Based upon the analysis above, in order to validate the stock’s existing share cost, we require to consider DUOL being ~ 5x larger than it is today (and overlooking the time worth of cash). DUOL’s existing regular monthly active user (MAU) count is 72.6 m. If we increase the MAU procedure by 5x, we get to an indicated MAU of 363.8 m. DUOL management state that there are presently ‘a number of billion individuals out there actively finding out a language’ (source: 1Q23 DUOL Looking For Alpha Records, page 21). If we (really simplistically) presume that 2 billion individuals is a reasonable evaluation of DUOL’s possible addressable market, then my sense check analysis indicate DUOL requiring to get to a worldwide market share of ~ 18% (being 2 billion individuals, divided by MAU of 363.8 m).

Considered that language knowing is an extremely competitive market, which not all language students will prefer to utilize an online gamified service such as DUOL, I’m having a hard time to think of a situation in which DUOL attains a worldwide language finding out market share of ~ 18%. Nevertheless, my undoubtedly over-simplistic sense check analysis makes no allowance for the capability of DUOL to expand its item offering and to move into brand-new, big and profitable market sections (such as that being checked out with Duolingo Mathematics).

Dangers

The online language finding out market is incredibly competitive, with numerous suppliers and items for students to pick from, consisting of a selection of complimentary services (of differing quality). Offered this fragmented and free market structure, the capability of DUOL to totally monetise what is unquestionably an outstanding item is extremely doubtful.

AI is both a chance and a risk for DUOL. Contending platforms likewise have access to AI, so the chance advantage might in fact be rather restricted. The risk from AI in regards to the arrangement of language tools that absolutely negate the requirement for somebody to comprehend a foreign language is apparent – from a simply useful viewpoint, why trouble costs numerous hours finding out a brand-new language when your phone can resolve all your issues utilizing an AI-backed language app? I’m not totally convinced by such an argument, as I believe that lots of people get a bang out of the sense of accomplishment and proficiency that is related to language knowing; it’s likewise real that human interactions are likewise far more satisfying without the requirement to have innovation as a go-between.

Redundancy threat is a more concern for DUOL. When users have actually reached a preferred level of language capability, the inspiration for them to continue utilizing DUOL will quickly lessen. User and customer numbers need to for that reason be thought about in the context of an anticipated natural decrease due to proficiency achievement, and are for that reason not similar to specific other subscriber-based tech designs in regards to worth generation/support.

With high inflation rates putting the capture on discretionary customer costs, DUOL’s near-term capability to grow membership and marketing cost earnings looks most likely to be challenged by macro-economic conditions. My sense is that DUOL’s share cost is extremely conscious near-term development rates for customer numbers; a slowing in this metric activated by modifications in customer costs patterns represents a product near-term drawback threat.

Conclusion

DUOL’s language finding out innovation is industry-leading and extremely efficient. The business has actually shown constant development in user numbers and customers and I do not question ongoing favorable patterns in these metrics. The aspiration for DUOL to extend beyond language knowing and to end up being a wider academic platform supplies fascinating medium-term advantage capacity. AI is both a risk and a chance, however on balance I see AI as an unfavorable threat element for the business.

Obtaining an essential evaluation for DUOL needs a series of presumptions relating to extremely unsure results, and I would argue that any such evaluation needs to be dealt with carefully and taken with a big pinch of salt. Based upon an easy and high level sense check analysis, my view is that DUOL’s existing share cost of ~$ 143 is expensive relative to the level of revenues that the business can reasonably be anticipated to create within an affordable timeframe. Acknowledging that I reach this view originating from the viewpoint of a worth financier, and sensation rather worried about the response of my Duolingo-obsessed kids, I land at an Offer ranking for DUOL.