Elena Bionysheva-Abramova

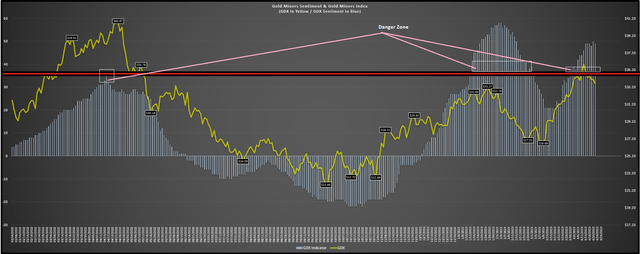

Simply over a month earlier, I composed on Karora Resources ( OTCQX: KRRGF), keeping in mind that while the business had actually simply provided a remarkable Q1 report, it was hard to validate paying up for the stock above US$ 3.40. This is since the general sector was susceptible to a much deeper correction that might bring Karora down with it since of the raised optimism (revealed listed below) we saw for gold miners in early Might, which typically has actually hinted a 15% plus correction in the Gold Miners Index ( GDX). Given that the late Might upgrade, the GDX has actually quit even more ground, which isn’t unexpected, and Karora has underperformed its peer group by 9% with a [-] 10% return. Fortunately is that this has actually enhanced the stock’s assessment, and Karora stays among the much better names sector-wide, with it being among the couple of manufacturers to report significant reserve development per share.

In this upgrade, we’ll look go into its FY2022 Reserve/Resource declaration for Beta Hunt and whether the stock has actually lastly dropped into a low-risk buy zone:

Gold Miners Belief vs. GDX (March 2022 to April 2023) ( Author’s Data & & Chart)

All figures remain in United States Dollars unless otherwise kept in mind.

2022 Reserves & & Resources

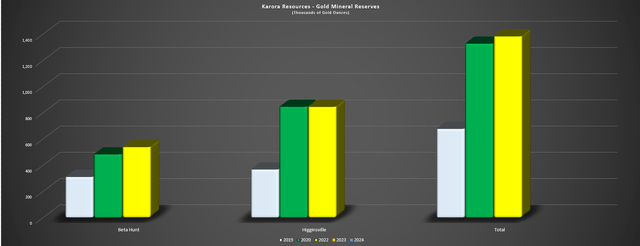

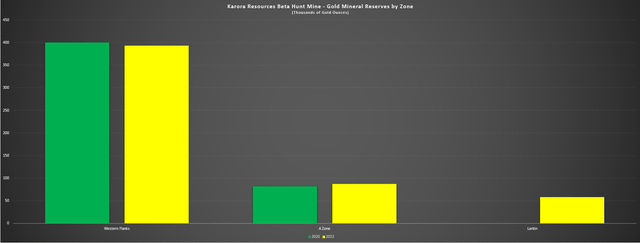

Karora launched its latest reserve upgrade for its flagship Beta Hunt Mine previously this year, reporting a 20% boost in determined & & suggested [M&I] ounces to|1.33 million ounces of gold, a 34% boost in presumed ounces to|1.05 million ounces of gold, and a tested & & likely reserve base of 538,000 ounces. The latter represented a 12% boost from the most current reserve upgrade and a 4% boost in reserves presuming a comparable reserve base at Higginsville vs. its previous Q3 2020 reserve quote. The product boost in Beta Hunt’s reserves from the most current Q3 2020 upgrade (| 538,000 ounces vs.|482,000 ounces) was credited to a small boost in tonnes at its 2 existing zones (Western Flanks and A Zone) partly balanced out by lower grades at Western Flanks (2.5 grams per tonne of gold vs. 2.7 grams per tonne of gold), and first reserves at the freshly marked Larkin Zone, which lies south of the Alpha Island Fault.

Karora – Gold Mineral Reserves by Mine & & Overall ( Business Filings, Author’s Chart)

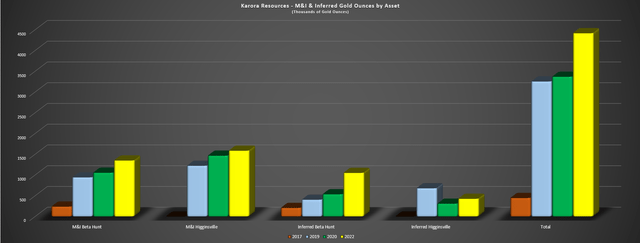

Going into the reserve base a little closer, we can see that the bulk of Karora’s reserves lie at the lower-grade Higginsville property (| 800,000 ounces at|1.5 grams per tonne of gold), however Beta Hunt is growing considerably, with its reserves up over 70% from 2019 levels (| 310,000 ounces– >|538,000 ounces). This product reserve development has actually offered the business far more breathing space with|6.8 million tonne reserve base (| 3.4 year mine life based entirely on reserves at brand-new throughput rate) as it works to increase mining rates to 2.0 million tonnes per year with its 2nd decrease. And while this may appear like a fairly little reserve base, it is necessary to keep in mind that the resource base at Beta Hunt has actually more than quadrupled because 2017, with considerable resources included at Western Flanks. In reality, its M&I and presumed combined gold resources now sits at|2.4 million ounces, up from|445,000 ounces simply 5 years earlier.

Karora – Gold Mineral Resources by Property ( Business Filings, Author’s Chart)

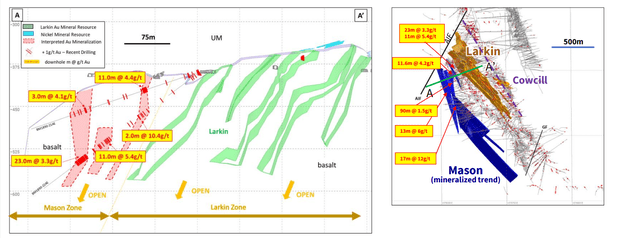

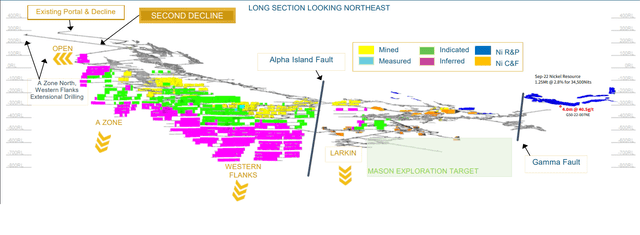

Karora kept in mind previously this year that it will be concentrating on updating presumed mineral resources to M&I along with ongoing growth of its reserve base, and with what’s now|4.4 million ounce combined reserve base (with over half of these ounces at Beta Hunt), the business has definitely warranted its current mill purchase and the addition of a 2nd decrease. And it deserves keeping in mind that these resource ounces do not consist of the Fletcher Shear Zone, where the business struck an outstanding 7.0 meters at 46.5 grams per tonne of gold. In addition, these resources do not consist of Mason and Cowcill, which have actually likewise yielded outstanding outcomes over strong widths, with an emphasize obstruct of 17 meters at 12 grams per tonne of gold. To sum up, Karora continues to have a few of the most expedition success sector-wide, and this has actually reached its nickel resources where it likewise included significant tonnes this year, benefiting the business from a spin-off viewpoint.

Mason and Cowcill + Larkin Resources ( Business Site)

So, existed any unfavorable news?

While the resource and reserve development at Beta Hunt was favorable, we did see a small decrease in resource ounces at the freshly specified Larkin Zone, with the January 2022 resource of|280,000 ounces lowered to|205,000 ounces, and simply|58,000 ounces making it into reserves, well listed below the 100,000+ ounces I anticipated to be contributed to reserves. Karora kept in mind that it saw a 54% decrease in the presumed resource (88,000 ounces) vs. the previous upgrade, with the dip in ounces mainly connected to a geological re-interpretation of the northern end of the resource that resulted in a downgrade in size and grade based upon the extra drilling information. And while this is frustrating, the expedition success at Mason and Cowcill need to quickly offset this, with the capacity for a 150,000 plus ounce reserve base in between the 3 zones (Larkin, Cowcill, Mason), with Cowcill and Mason analyzed to be parallel shear zones to Larkin.

Beta Hunt Mine – Gold Reserves by Zone ( Business Filings, Author’s Chart)

Lastly, while we have not seen a resource upgrade yet from Higginsville, the land bundle definitely look appealing, with an 1,800 square kilometers of tenements south of the popular KCGM Super Pit that’s house to over 12 million ounces of gold reserves. And while Beta Hunt has actually been the focus which definitely makes good sense considered that Karora continues to strike outstanding intercepts at above typical grades anywhere it drills at this underground mine, the business’s development to the 190,000+ ounce production mark need to enable a more aggressive expedition budget plan with substantially more complimentary capital generation each year. Plus, when it pertains to Beta Hunt, the considerable underground advancement and fairly low mining expenses (| $39/tonne) definitely lead to a low obstacle to including reserves to the mine strategy, indicating that while 10+ gram per tonne grades would be a sweetener to head grades, 3.0 gram per tonne product will be enough too.

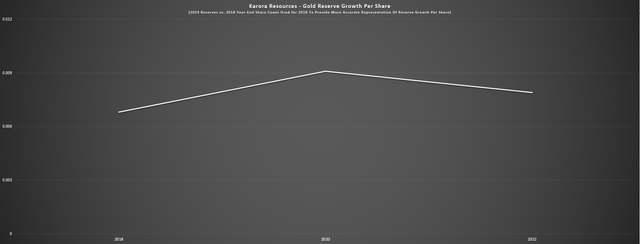

Reserves Per Share

As talked about in previous updates, reserve development is essential, however even more essential is reserve development per share. This is since reserve development that comes at the expenditure of considerable share dilution implies that financiers are getting direct exposure to less ounces of gold per share held and the outcome is one is really seeing their direct exposure to rare-earth elements watered down by owning an offered rare-earth elements manufacturer. The outcome is that a financier is not getting their preferred utilize to the silver and or gold cost if reserves and or production per share are decreasing. Undoubtedly, this isn’t perfect, because it makes little sense to own a more unpredictable and riskier manufacturer of a product (vs. the metal itself) if it is not providing the utilize that a person ought to get for handling this included threat. Some examples of business that have actually regularly stopped working to provide reserve development per share are Coeur Mining ( CDE), Americas Gold and Silver ( USAS), and McEwen Mining ( MUX), and I continue to see these names as un-investable.

Karora Resources – Reserve Development Per Share ( Business Filings, Author’s Chart)

Thankfully, Karora has actually effectively grown reserves per share, with the business including substantial reserves and a mill with its Higginsville acquisition, with just moderate share dilution. Especially, this offer permitted the business to be more self-sufficient, with it no longer needing to pay a toll to truck its product to other mills and rather sending its product to its own plant. Ever since, the business included another 1.0 million tonne per year mill in Lakewood, which is 20 kilometers to Beta Hunt and almost doubles the business’s overall processing capability. So, while the reserve per share pattern revealed above is favorable from 2019 to existing with reserves doubling, which has actually outmatched the boost in the business’s share count, the pattern is much more outstanding offered the development in facilities too. And even if we utilize the year-end 2018 share count vs. year-end 2019 to show the timing of the Higginsville acquisition (a more precise representation of reserve development per share) reserves per share has actually still increased by over 15% (2018-2022).

Beta Hunt Long Area & & Resources ( Business Site)

While Karora has actually done a strong task of growing reserves per share because Paul Huet took control of as CEO in 2019, it is necessary to keep in mind that the above chart does not do the business justice. This is since there are several chances to contribute to the reserve base that didn’t make it into the most current reserve upgrade (538,000 ounces of gold reserves at Beta Hunt). These consist of the Fletcher Shear Zone (1.4 kilometer prospective mineralized strike that is a structural analog to Western Flanks), Mason and Cowcill, Spargos Underground (presently being examined), and other targets that consist of the Sorrenson Shear Zone, A Zone North, and Western Flanks North. Based upon these targets, of which numerous have actually yielded considerable gold outcomes, I would argue that we might see the Karora’s mineral reserve base grow to 800,000+ ounces by year-end 2025, and presuming|180 million shares, this would equate to material development in reserves per share, which is precisely what financiers wish to see, which is per share development in production and reserves, and not merely outright production/reserve development.

Let’s take a look at Karora’s assessment and see whether the stock remains in a low-risk buy zone:

Assessment

Based Upon|181 million completely watered down shares and a share cost of US$ 3.05, Karora trades at a market cap of|$552 million, a really sensible assessment for|150,000-ounce manufacturer that’s working to turn into|190,000-ounce manufacturer. This is specifically real considered that Karora gain from running expenses well listed below the market average ($ 1,150/ oz vs.|$1,300/ oz) and continues to make brand-new discoveries at its flagship Beta Hunt Mine that might eventually move the business’s overall resource base (determined, suggested, and presumed) above the 5.0 million ounce mark (| 4.4 million ounces presently). That stated, I am trying to find a substantial margin of security when it pertains to beginning brand-new positions in small-cap gold manufacturers, with a favored 40% discount rate to reasonable worth at a bare minimum. And while this was definitely the case when I purchased the stock listed below US$ 2.10 in 2015, I do not see that margin of security present presently.

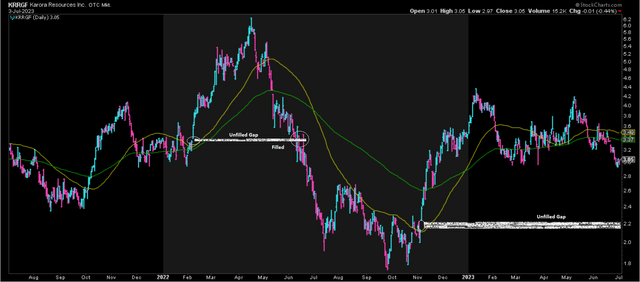

Utilizing what I think to be reasonable multiples of 1.0 x P/NAV and 7.0 x FY2023 operating capital quotes and obtaining Karora’s approximated reasonable worth from a 70/30 weighting to cost to net property worth (70%) and cost to capital (30%), I see a reasonable worth for Karora of US$ 4.31 per share. And while this reasonable worth quote indicate a 41% upside from existing levels, the perfect buy zone to bake in a minimum 40% discount rate to reasonable worth is available in at US$ 2.59 or lower. Undoubtedly, there’s no assurance that the stock drops another 12% to move into this low-risk buy zone, however I choose to pay the ideal cost or pass totally, specifically for unpredictable small-cap names like Karora, and with open spaces listed below in the stock that might be filled at some time (as we saw with the Q1 2022 unfilled space) and a couple of other little cap names trading at far higher discount rates to reasonable worth, with some trading at hardly 4.0 x FY2025 complimentary capital quotes, I see more engaging setups in other places.

KRRGF Unfilled Space – Daily Chart ( StockCharts.com)

Summary

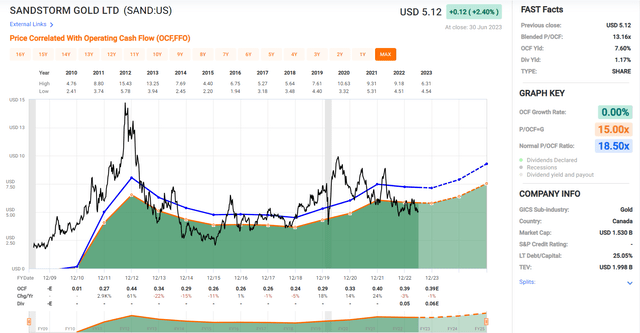

Karora was among the couple of manufacturers that meaningfully increased reserves per share in 2022 and it achieved this while keeping a fairly conservative gold cost presumption of $1,450/ oz, in line with the small-cap and mid-cap average. So, with continued expedition success and the stock over 30% off its year-to-date highs, it’s definitely possible that the stock might bottom out here. Nevertheless, offered the stock’s outperformance over the previous year, there are a number of more appealing choices from an assessment viewpoint sector-wide, among which is Sandstorm Gold Royalties ( SAND) which trades at just a slighter greater P/NAV several (0.90 x vs. 0.70 x) as a royalty/streaming business with almost double the margins ($ 1,500/ oz vs.|$800/oz) and higher diversity (| 40 producing possessions vs. 2 producing possessions).

Sandstorm Gold – Present Assessment vs. Historical Capital Numerous ( FASTGraphs.com)

Undoubtedly, Karora might surpass Sandstorm if the gold cost trades approximately brand-new highs, however I would argue that the bar is set much lower for Sandstorm to beat due to 2 years of underperformance. Plus, with Sandstorm being among the most resented stocks sector-wide and Karora having more neutral belief, I would argue that there’s much less disadvantage for Sandstorm, enabling larger-sized bets. Lastly, I see far higher advantage for Sandstorm, with SAND’s reasonable worth can be found in at US$ 8.95 (72% advantage) even if it simply sells line with its closest peers, indicating a much more appealing reward/risk setup. So, while Karora has a strong year of development ahead and while I would highly think about purchasing the stock were to pullback listed below US$ 2.60, I believe there are a number of more appealing locations to direct one’s capital presently. 2 names that stand apart are Telus International ( TIXT) at|13x EV to FY2024 FCF, and Sandstorm at|12x EV to FY2025 FCF, with both probably being lower-risk bets.

Editor’s Note: This short article goes over several securities that do not trade on a significant U.S. exchange. Please know the threats related to these stocks.