courtneyk

Because the last time I composed about the high-end cruise business Carnival Corporation ( NYSE: CUK) ( NYSE: CCL) in March this year, its cost is up by an eye-popping 120%! At the time, I had actually offered it a Hold ranking considering that there was still some unpredictability around the travel sector and the stock.

Much has actually altered considering that, obviously. Which shows up in the wonderful cost returns it has actually offered over the time duration, following updates for both the very first and 2nd quarters of 2023 (Q1 and Q2 2023). It is now at the greatest level it has actually seen in a year. This requires the next huge concern: Can Carnival Corporation continue to race ahead? Or have we, as financiers, missed this ship?

To address this concern, I simplify into 3 parts to get a much better understanding of where the stock is headed:

- Have its numbers enhanced enough to require the quick cost increase?

- What does its outlook show?

- How do its market assessments compare to peers now?

Revenues turn a corner

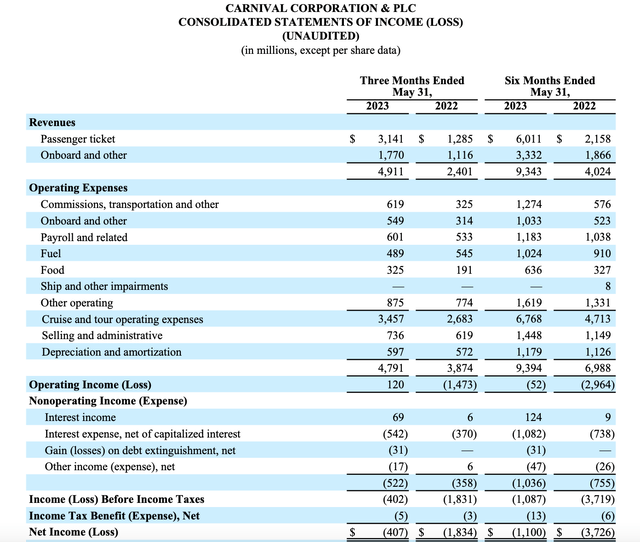

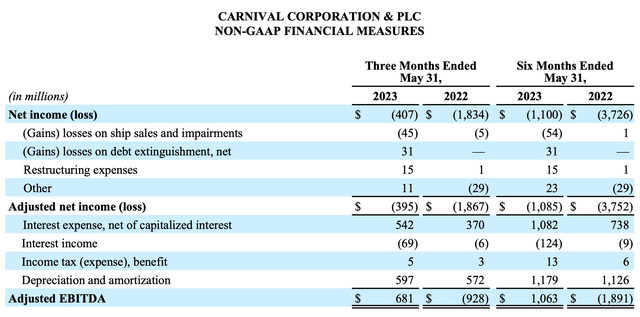

As it takes place, there are substantial positives to the business’s Q2 revenues reports. Initially, it clocked USD 120 million in operating earnings, making it the very first time it has actually done so considering that the pandemic. Its bottom line likewise diminished to 22% of what it remained in Q2 2022. Even more, earnings continued to reveal robust development, more than doubling year-on-year (YoY). Both its money from operations and changed complimentary capital turned favorable, too.

Underpinning these enhancements is increasing need, as travel need in the United States, its most significant market, is returning to pre-pandemic levels Overall reservations reached a brand-new all-time high in the most recent quarter. Besides the boost in need for cruises as such, the business likewise indicates its own method that has actually enhanced earnings. This consists of increasing ticket costs, rather of taking in greater expenses.

Gross margin increases

This is a sign of its rates power, which is likewise shown in a dive in its gross margin to 47.4% from 42.1% in Q1 2023 and 20.5% in Q2 2022. That it has actually had the ability to kip down running earnings is an additional verification of the exact same pattern.

This is a specific favorable, considering that it points out inflation 3 times, in the context of expenses, in its most current release. The issue over inflation stuck out considering that numerous other business I have actually taken a look at just recently are well past the phase of still worrying over it.

The macroeconomic scenario is a bit precarious however, with the timeline for the anticipated United States economic downturn having actually moved to late 2023 and early 2024 This might affect need, and its capability to raise costs far more. At the exact same time, the healing is anticipated to begin with next year itself too, so at this time it appears not likely that Carnival Corporation would be dented much.

Financial obligation in check

Financial obligation levels skyrocketed for the business throughout the pandemic, however it has favorable advancements on that front too. It has actually paid for USD 1 billion of near-term financial obligation. Even more, it states that 80% of its financial obligation is now at a set rate, which will not be affected adversely by any additional rate of interest boosts. In any case, at under 0.7 x, its financial obligation ratio for Q2 2023 does not look horrible to me.

The outlook

Following strong development in the year up until now, Carnival Corporation’s outlook is likewise favorable. It anticipates tenancy rates of 100% or greater. While it anticipates bottom lines this year, this is likely due to the drag from the first-half figures. In Q3 2023 it really anticipates an adjusted net earnings of USD 950 to USD 1,050 million.

If the space in between the changed and net figures remains the exact same in the present quarter as it performed in the very first half of 2023 (see table listed below), we can anticipate the business to end up being successful even on a reported basis from the next quarter itself. It goes without stating, that continued extraordinary earnings development is prepared for, too. Experts pencil in a 75% boost

The marketplace assessments

With a robust sales increase anticipated, its forward price-to-sales (P/S) of 1.14 x does not look bad at all. Even compared it among its closest peers, Royal Caribbean Cruises ( RCL), which is trading at a forward ratio of 2x it looks competitive. However Norwegian Cruise Line Holdings ( NCLH) has a forward P/S of 1.10 x suggesting that it may simply be relatively priced.

Its routing twelve months [TTM] P/S shows a comparable. CUK is at 1.4 x, which is simply a bit lower than that for NCLH at 1.5 x and a fair bit lower than that for RCL at 2.5 x.

Because Carnival Corporation has actually now turned EBIT favorable, I likewise wished to think about the relative forward EV/EBIT ratios. CUK is trading at 29.7 x currently, which is greater than both NCLH and RCL at 21.8 x and 19.5 x respectively.

I am inclined to think, based upon its market assessments, that CUK might be due for some cost correction in the short-term passing its forward multiples. Although the TTM P/S does recommend a little advantage, today, its cost is increasing in anticipation of ongoing development and the possibility of turning a net earnings. For that reason, the forward multiples are more significant today as I see it.

What next?

For the medium term, nevertheless, there is still most likely to be an advantage for the stock. There’s no rejecting that its cost has actually increased enormously this year, however it is still no place near the levels it was at pre-pandemic. And the healing in its financials is still continuous.

It is anticipated to clock strong earnings this year and it has actually likewise begun making an operating earnings as soon as again. It has actually likewise begun settling its financial obligations, which increased throughout the pandemic. With robust patterns predicted for tenancy rates and the pandemic well behind us now, stable enhancement in its financials is most likely.

There can be speed bumps along the method, as its essential market, the United States, might see an economic crisis quickly enough. However the economic downturn itself is anticipated to be a shallow one itself, so the business might simply come out of it reasonably untouched or recuperate promptly from it. Keeping the medium-term point of view in mind, I am updating the ranking to Purchase. Or in the context of the preliminary concern, this ship is yet to cruise for financiers with some persistence.

Editor’s Note: This post goes over several securities that do not trade on a significant U.S. exchange. Please understand the dangers related to these stocks.