Sundry Photography

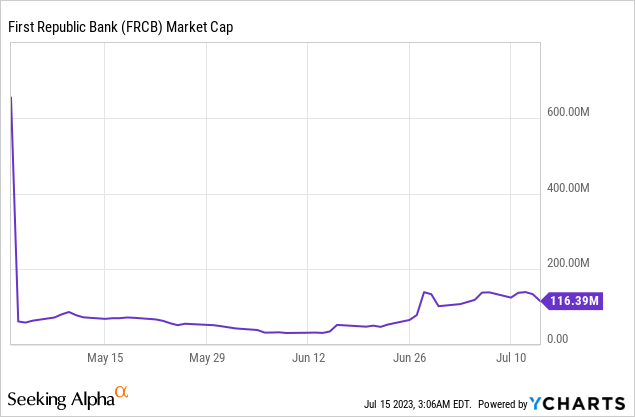

Is it entirely unreasonable that First Republic Bank ( OTCPK: FRCB) typical stock equity deserves $117 million? The bank itself was taken by the FDIC, which then offered it to JPMorgan Chase ( JPM) in early May. There are a variety of intricate concerns included, and this post will attempt to discuss why the equity is not trading at $0.00. Given that the FDIC receivership might last for several years, FRCB may continue to trade for many years, which indicates those anticipating the stock to go to $0.00 in the future may be dissatisfied.

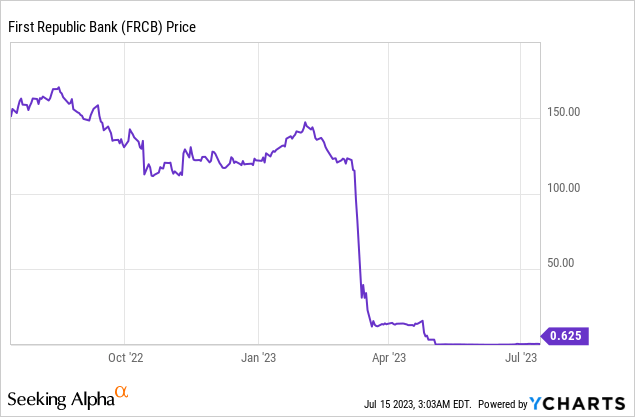

The stock now trades OTC with the ticker FRCB rather of FRC. The rate has actually plunged from over $150 in 2015 to $0.62 presently. The rate increased rather because early Might.

Typical Equity Capitalization Given That FDIC Seizure

Very First Republic Bank Is Not In Ch.11 Insolvency

Very First Republic Bank is not in Ch.11 personal bankruptcy due to the fact that it is a bank and banks can’t declare Ch.11 personal bankruptcy. This is entirely various than Silicon Valley Bank, whose moms and dad business SVB Financial Group ( OTCPK: SIVBQ) remains in Ch.11 personal bankruptcy. Silicon Valley Bank is not itself consisted of in the personal bankruptcy filing. (Note: there is a crucial status conference concerning SVB’s lawsuits versus the FDIC concerning their $2 billion money deposit that was at Silicon Valley Bank set for August 15, and I prepare to cover this in a short article.)

The truth that FRCB is not governed by the Ch.11 personal bankruptcy procedure may really be useful for FRCB investors. I am going to utilize Sears Holdings’ personal bankruptcy as an example. As a routine corporation, Sears Holdings Corp. had the ability to declare Ch.11 personal bankruptcy. Part of their personal bankruptcy procedure included lawsuits versus CEO Eddie Lampert and others. After years of lawsuits, Lampert and others consented to pay about $175 million. That money did NOT go to Sears investors. It entered into the personal bankruptcy estate to be dispersed under a verified personal bankruptcy strategy. Given that investors were the most affordable class for any healing under the strategy, they got absolutely nothing, and SHLDQ shares were ultimately cancelled. Investors were not even noted as recipients of the liquidating trust. A few of the possessions of the estate were utilized for many years to pay the big legal charges associated with this lawsuits.

There currently are FRBC financier class action claims submitted versus different people and entities. Presuming simply for the sake of conversation that they achieve success and win judgements, that money, after charges, would go straight to financiers and not into a personal bankruptcy estate that would be governed by the validated prepare for circulations.

A variety of claims have actually been submitted looking for class action status, such as Kusen v. Herbert, II, et al., No. 23-cv-02940 (N.D. Cal.). There presently is a hearing set for October 12 in Northern District Court of California to combine all the cases into simply one class action. Kusen case would consist of those who purchased First Republic securities from January 14, 2021 to April 27, 2023. Based upon existing filings, financiers who purchased after April 27 would not be consisted of. At this moment, it is unclear if the combined class action would consist of holders of the notes and favored stock. Even if all the financier types are consisted of, the last judgement/settlements typically do not follow the common concern payment treatment that personal bankruptcy prepares follow.

FDIC Receivership

Rather of some personal bankruptcy court having jurisdiction over First Republic Bank, the FDIC is the receiver and manages the procedure. The First Republic Bank fund is # 10543, and ultimately, quarterly press reporters will be published on this FDIC site First Republic Bank was closed, and the FDIC was designated the receiver. After a bidding procedure, the FDIC and JPMorgan Chase settled on May 1 to a purchase and presumption of the majority of First Republic Bank’s possessions and deposits. (This is a copy of the 102-page contract that consists of some redactions.). There are a couple of products in this contract that I believe are intriguing.

Initially, JPM acquired securities at their fair/market worth on the purchase date – not their book worth. It appears that subsequent to the purchase, JPM offered a number of these securities at a loss of $900 million, according to their July 14 2Q release The loss was based upon the purchase rate, which was the marketplace worth in early Might, and because rates of interest trended up throughout the tail end of 2Q, JPM lost a substantial quantity of cash due to the fact that the majority of these were really long-lasting securities.

2nd, there is a shared loss in between the FDIC and JPM on different kinds of loans. JPM is secured for 80% versus losses on property home loans for approximately 7 years and 80% versus losses on industrial loans for approximately 5 years. Given that FRCB had really top quality loans, it appears not likely they will require much security versus defaults. For instance, the medium FICO rating for their property home loan debtors was 780. The intriguing part is really the 7 years. This appears to show that the receivership will be kept open for a minimum of 7 years, which might indicate that FRCB shares might trade for a minimum of 7 more years.

The FDIC approximated a $13 billion loss to the FDIC insurance coverage fund. Prior to FRCB financiers get anything from the receivership fund, this $13 billion price quote will need to be paid initially. I have major concerns, nevertheless, about this $13 billion figure. Given that JPM is paying FDIC $10.6 billion, the FDIC price quote indicates some $23.6 billion in liabilities. There are some loss defenses, such as those discussed above for loans, however I simply can’t identify after checking out the contract how they got that price quote. I question if it is a really conservative number that presumes the worst.

The payment order is governed by area 1821( d)( 11 )( a):

amounts recognized from the liquidation or other resolution of any insured depository organization by any receiver designated for such organization will be dispersed to pay claims (aside from protected claims to the level of any such security) in the following order of concern: (i) Administrative costs of the receiver. (ii) Any deposit liability of the organization. (iii) Any other basic or senior liability of the organization (which is not a liability explained in provision (iv) or (v)). (iv) Any responsibility subordinated to depositors or basic lenders (which is not a commitment explained in provision (v)). (v) Any responsibility to investors or members emerging as an outcome of their status as investors …

FRCB investors are last for healing. Roughly $1.28 billion in notes, an unidentified quantity of lenders who submitted claims, and $3.6 billion in favored stock, in theory, would need to be paid completely prior to FRCB investors get anything. The bar date to sue is September 5, 2023. The FDIC is needed to alert the claim filer within 90 days if the claim is rejected/accepted, which does not indicate they will really be paid after that period. It might take years.

Why Did First Republic Bank Fail?

Very first Republic Bank entered major monetary problem due to the fact that rates of interest skyrocketed from early 2022 to mid-2023. Their issue was they held nearly solely long-dated possessions, consisting of home loans and securities with maturities over ten years that are more conscious modifications in rates of interest. As I published in a March 12 post on bank latent securities losses, FRCB had a $5.242 billion overall latent loss in their securities accounts, which was roughly $28.15 per FRBC share. I included this “yellow flag” declaration in the post:

( Unique note: $27,403 countless the HTM securities grow after ten years. Longer the maturity, the more delicate is the bond rate to modifications in rates of interest. In addition, $16,808 countless that number are tax-exempt local bonds that grow after ten years. Munis are likewise frequently much less liquid than UST securities.)

In addition to their latent losses in both their available-for-sale – AFS and hold-to-maturity – HTM portfolios, their loans, which are roughly 73% single-family and multi-family property home loans, had “reasonable worths” substantially listed below bring worths on their books. The reasonable worth for their realty home loans was $117,520 million for year-end 2022 compared to a bring worth of $136,793 million. That is a distinction of $19,273 million, or about $103.50 per share. The distinction for their other loans is roughly $2,886 million, or $15.50 per share. This indicates an overall of $119 per share, and if you include that to the securities’ latent loss per share of $28.15, you get an incredible $147.15 “paper loss” per share. Some depositors might have been shaken by these numbers and withdrew their deposits, which led to the bank being taken by the federal government.

The boosts in rates of interest were not hedged. First Republic Bank specified in their 10-K, “nor do we come from or sell derivatives for our own account” and even more specified we do “not have actually any derivatives designated as hedging instruments”.

Conclusion

Very first Republic Bank offers a finding out lesson. They had top-notch possessions unlike some other stopped working banks in the past that had scrap possessions, however they were entirely ruined by considerably increasing interest. As the rates of interest increased, the marketplace worth of nearly all their possessions dropped dramatically. Plus, their possessions were not diversified enough.

Purchasing FRCB stock at existing rate levels is very dangerous. The issue is that there is very little particular info on liabilities that might still be sustained by the FDIC that would then affect payments, if any, to financiers. The $13 billion price quote appears doubtful. FRCB investors likewise need to keep in mind that there still might be billions of dollars that need to be paid by the FDIC 10543 fund to cover different liabilities connected with the contract with JPM, such as covering losses connected with loans, prior to investors get anything. Trading in FRCB might go on for a long time and after the very first quarterly report is submitted by the FDIC financiers may improve info on the existing status. For these factors, I think about FRCB stock a neutral/hold.

Editor’s Note: This post goes over several securities that do not trade on a significant U.S. exchange. Please know the threats connected with these stocks.