{“page”:0,” year”:2023,” monthnum”:6,” day”:21,” name”:” sustainability-within-the-modern-commodity-allocation-the-sp-gsci-light-energy-climate-aware-is-launched”,” mistake”:””,” m”:””,” p”:0,” post_parent”:””,” subpost”:””,” subpost_id”:””,” accessory”:””,” attachment_id”:0,” pagename”:””,” page_id”:0,” 2nd”:””,” minute”:””,” hour”:””,” w”:0,” category_name”:””,” tag”:””,” feline”:””,” tag_id”:””,” author”:””,” author_name”:””,” feed”:””,” tb”:””,” paged”:0,” meta_key”:””,” meta_value”:””,” sneak peek”:””,” s”:””,” sentence”:””,” title”:””,” fields”:””,” menu_order”:””,” embed”:””,” classification __ in”: [],” classification __ not_in”: [],” classification __ and”: [],” post __ in”: [],” post __ not_in”: [],” post_name __ in”: [],” tag __ in”: [],” tag __ not_in”: [],” tag __ and”: [],” tag_slug __ in”: [],” tag_slug __ and”: [],” post_parent __ in”: [],” post_parent __ not_in”: [],” author __ in”: [],” author __ not_in”: [],” search_columns”: [],” ignore_sticky_posts”: incorrect,” suppress_filters”: incorrect,” cache_results”: real,” update_post_term_cache”: real,” update_menu_item_cache”: incorrect,” lazy_load_term_meta”: real,” update_post_meta_cache”: real,” post_type”:””,” posts_per_page”:” 5″,” nopaging”: incorrect,” comments_per_page”:” 50″,” no_found_rows”: incorrect,” order”:” DESC”}

[{“display”:”Craig Lazzara”,”title”:”Managing Director, Index Investment Strategy”,”image”:”/wp-content/authors/craig_lazzara-353.jpg”,”url”:”https://www.indexologyblog.com/author/craig_lazzara/”},{“display”:”Tim Edwards”,”title”:”Managing Director, Index Investment Strategy”,”image”:”/wp-content/authors/timothy_edwards-368.jpg”,”url”:”https://www.indexologyblog.com/author/timothy_edwards/”},{“display”:”Hamish Preston”,”title”:”Director, U.S. Equity Indices”,”image”:”/wp-content/authors/hamish_preston-512.jpg”,”url”:”https://www.indexologyblog.com/author/hamish_preston/”},{“display”:”Anu Ganti”,”title”:”Senior Director, Index Investment Strategy”,”image”:”/wp-content/authors/anu_ganti-505.jpg”,”url”:”https://www.indexologyblog.com/author/anu_ganti/”},{“display”:”Fiona Boal”,”title”:”Managing Director, Global Head of Equities”,”image”:”/wp-content/authors/fiona_boal-317.jpg”,”url”:”https://www.indexologyblog.com/author/fiona_boal/”},{“display”:”Jim Wiederhold”,”title”:”Director, Commodities and Real Assets”,”image”:”/wp-content/authors/jim.wiederhold-515.jpg”,”url”:”https://www.indexologyblog.com/author/jim-wiederhold/”},{“display”:”Phillip Brzenk”,”title”:”Managing Director, Global Head of Multi-Asset Indices”,”image”:”/wp-content/authors/phillip_brzenk-325.jpg”,”url”:”https://www.indexologyblog.com/author/phillip_brzenk/”},{“display”:”Howard Silverblatt”,”title”:”Senior Index Analyst, Product Management”,”image”:”/wp-content/authors/howard_silverblatt-197.jpg”,”url”:”https://www.indexologyblog.com/author/howard_silverblatt/”},{“display”:”John Welling”,”title”:”Director, Global Equity Indices”,”image”:”/wp-content/authors/john_welling-246.jpg”,”url”:”https://www.indexologyblog.com/author/john_welling/”},{“display”:”Michael Orzano”,”title”:”Senior Director, Global Equity Indices”,”image”:”/wp-content/authors/Mike.Orzano-231.jpg”,”url”:”https://www.indexologyblog.com/author/mike-orzano/”},{“display”:”Wenli Bill Hao”,”title”:”Senior Lead, Strategy Indices”,”image”:”/wp-content/authors/bill_hao-351.jpg”,”url”:”https://www.indexologyblog.com/author/bill_hao/”},{“display”:”Maria Sanchez”,”title”:”Director, Sustainability Index Product Management”,”image”:”/wp-content/authors/maria_sanchez-243.jpg”,”url”:”https://www.indexologyblog.com/author/maria_sanchez/”},{“display”:”Shaun Wurzbach”,”title”:”Managing Director, Head of Commercial Group (North America)”,”image”:”/wp-content/authors/shaun_wurzbach-200.jpg”,”url”:”https://www.indexologyblog.com/author/shaun_wurzbach/”},{“display”:”Silvia Kitchener”,”title”:”Director, Global Equity Indices, Latin America”,”image”:”/wp-content/authors/silvia_kitchener-522.jpg”,”url”:”https://www.indexologyblog.com/author/silvia_kitchener/”},{“display”:”Akash Jain”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/akash_jain-348.jpg”,”url”:”https://www.indexologyblog.com/author/akash_jain/”},{“display”:”Ved Malla”,”title”:”Associate Director, Client Coverage”,”image”:”/wp-content/authors/ved_malla-347.jpg”,”url”:”https://www.indexologyblog.com/author/ved_malla/”},{“display”:”Rupert Watts”,”title”:”Senior Director, Strategy Indices”,”image”:”/wp-content/authors/rupert_watts-366.jpg”,”url”:”https://www.indexologyblog.com/author/rupert_watts/”},{“display”:”Jason Giordano”,”title”:”Director, Fixed Income, Product Management”,”image”:”/wp-content/authors/jason_giordano-378.jpg”,”url”:”https://www.indexologyblog.com/author/jason_giordano/”},{“display”:”Qing Li”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/qing_li-190.jpg”,”url”:”https://www.indexologyblog.com/author/qing_li/”},{“display”:”Sherifa Issifu”,”title”:”Senior Analyst, U.S. Equity Indices”,”image”:”/wp-content/authors/sherifa_issifu-518.jpg”,”url”:”https://www.indexologyblog.com/author/sherifa_issifu/”},{“display”:”Brian Luke”,”title”:”Senior Director, Head of Commodities and Real Assets”,”image”:”/wp-content/authors/brian.luke-509.jpg”,”url”:”https://www.indexologyblog.com/author/brian-luke/”},{“display”:”Glenn Doody”,”title”:”Vice President, Product Management, Technology Innovation and Specialty Products”,”image”:”/wp-content/authors/glenn_doody-517.jpg”,”url”:”https://www.indexologyblog.com/author/glenn_doody/”},{“display”:”Priscilla Luk”,”title”:”Managing Director, Global Research & Design, APAC”,”image”:”/wp-content/authors/priscilla_luk-228.jpg”,”url”:”https://www.indexologyblog.com/author/priscilla_luk/”},{“display”:”Liyu Zeng”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/liyu_zeng-252.png”,”url”:”https://www.indexologyblog.com/author/liyu_zeng/”},{“display”:”Sean Freer”,”title”:”Director, Global Equity Indices”,”image”:”/wp-content/authors/sean_freer-490.jpg”,”url”:”https://www.indexologyblog.com/author/sean_freer/”},{“display”:”Barbara Velado”,”title”:”Senior Analyst, Research & Design, Sustainability Indices”,”image”:”/wp-content/authors/barbara_velado-413.jpg”,”url”:”https://www.indexologyblog.com/author/barbara_velado/”},{“display”:”Benedek Vu00f6ru00f6s”,”title”:”Director, Index Investment Strategy”,”image”:”/wp-content/authors/benedek_voros-440.jpg”,”url”:”https://www.indexologyblog.com/author/benedek_voros/”},{“display”:”Cristopher Anguiano”,”title”:”Senior Analyst, U.S. Equity Indices”,”image”:”/wp-content/authors/cristopher_anguiano-506.jpg”,”url”:”https://www.indexologyblog.com/author/cristopher_anguiano/”},{“display”:”Michael Mell”,”title”:”Senior Director, Custom Indices”,”image”:”/wp-content/authors/michael_mell-362.jpg”,”url”:”https://www.indexologyblog.com/author/michael_mell/”},{“display”:”George Valantasis”,”title”:”Associate Director, Strategy Indices”,”image”:”/wp-content/authors/george-valantasis-453.jpg”,”url”:”https://www.indexologyblog.com/author/george-valantasis/”},{“display”:”Andrew Innes”,”title”:”Head of EMEA, Global Research & Design”,”image”:”/wp-content/authors/andrew_innes-189.jpg”,”url”:”https://www.indexologyblog.com/author/andrew_innes/”},{“display”:”Rachel Du”,”title”:”Senior Analyst, Global Research & Design”,”image”:”/wp-content/authors/rachel_du-365.jpg”,”url”:”https://www.indexologyblog.com/author/rachel_du/”},{“display”:”Izzy Wang”,”title”:”Analyst, Strategy Indices”,”image”:”/wp-content/authors/izzy.wang-326.jpg”,”url”:”https://www.indexologyblog.com/author/izzy-wang/”},{“display”:”Fei Wang”,”title”:”Senior Analyst, U.S. Equity Indices”,”image”:”/wp-content/authors/fei_wang-443.jpg”,”url”:”https://www.indexologyblog.com/author/fei_wang/”},{“display”:”Joseph Nelesen”,”title”:”Senior Director, Index Investment Strategy”,”image”:”/wp-content/authors/joseph_nelesen-452.jpg”,”url”:”https://www.indexologyblog.com/author/joseph_nelesen/”},{“display”:”Jaspreet Duhra”,”title”:”Managing Director, Global Head of Sustainability Indices”,”image”:”/wp-content/authors/jaspreet_duhra-504.jpg”,”url”:”https://www.indexologyblog.com/author/jaspreet_duhra/”},{“display”:”Eduardo Olazabal”,”title”:”Senior Analyst, Global Equity Indices”,”image”:”/wp-content/authors/eduardo_olazabal-451.jpg”,”url”:”https://www.indexologyblog.com/author/eduardo_olazabal/”},{“display”:”Jason Ye”,”title”:”Director, Strategy Indices”,”image”:”/wp-content/authors/Jason%20Ye-448.jpg”,”url”:”https://www.indexologyblog.com/author/jason-ye/”},{“display”:”Ari Rajendra”,”title”:”Senior Director, Head of Thematic Indices”,”image”:”/wp-content/authors/Ari.Rajendra-524.jpg”,”url”:”https://www.indexologyblog.com/author/ari-rajendra/”},{“display”:”Louis Bellucci”,”title”:”Senior Director, Index Governance”,”image”:”/wp-content/authors/louis_bellucci-377.jpg”,”url”:”https://www.indexologyblog.com/author/louis_bellucci/”},{“display”:”Daniel Perrone”,”title”:”Director and Head of Operations, ESG Indices”,”image”:”/wp-content/authors/daniel_perrone-387.jpg”,”url”:”https://www.indexologyblog.com/author/daniel_perrone/”},{“display”:”Raghu Ramachandran”,”title”:”Head of Insurance Asset Channel”,”image”:”/wp-content/authors/raghu_ramachandram-288.jpg”,”url”:”https://www.indexologyblog.com/author/raghu_ramachandram/”},{“display”:”Narottama Bowden”,”title”:”Director, ESG Index Intelligence, Index Governance”,”image”:”/wp-content/authors/narottama_bowden-331.jpg”,”url”:”https://www.indexologyblog.com/author/narottama_bowden/”},{“display”:”Lalit Ponnala”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/lalit.ponnala-388.jpg”,”url”:”https://www.indexologyblog.com/author/lalit-ponnala/”},{“display”:”Srineel Jalagani”,”title”:”Senior Director, Strategy Indices”,”image”:”/wp-content/authors/srineel_jalagani-446.jpg”,”url”:”https://www.indexologyblog.com/author/srineel_jalagani/”}]

Sustainability within the Modern Product Allowance– The S&P GSCI Light Energy Environment Conscious Is Released

After substantial market outreach, S&P Dow Jones Indices released the S&P GSCI Light Energy Environment Aware to please a requirement for a benchmark connected to sustainability and the energy shift, however with a lighter energy weighting than the brand-new S&P GSCI Environment Conscious As can be seen in Exhibition 1, the S&P GSCI Light Energy Environment Conscious uses the S&P Global Sustainable1 Product Environmental Dataset to the popular S&P GSCI Light Energy in order to offer a products criteria with a 25% lower ecological effect per dollar invested, which supplies market individuals a products overlay within a sustainable method. The index has lower weights to nonrenewable fuel source products while increasing the weights of less ecologically extreme products connected to the energy shift.

Compared to petroleum, the production of products such as copper, nickel, zinc and gold is much less disruptive to the environment, and these products will likewise be essential to the world’s brand-new electrical economy throughout the energy shift. Previously this year, we released a blog site highlighting the value of copper in specific as perhaps the most crucial natural deposit required to assist us move far from our existing carbon extensive energy systems.

Copper is among the least carbon extensive products to produce amongst the commercial metals, however it is likewise among the significant natural deposits making up electrical automobiles and renewable resource applications such as wind turbines. Exhibition 2 reveals the existing ecological footprint of the production of each of the 24 products within the S&P GSCI. Within our international food supply, livestock production is extremely ecologically extensive and was among the products within our brand-new index that saw the most significant portion drops in weight compared to the benchmark index.

Sustainability is a crucial style within the investing neighborhood, however prior to S&P DJI’s launch of our environment mindful product indices, there were just index offerings that represented sustainable factors to consider within an equity or set earnings part of a method. Now with the S&P GSCI Light Energy Environment Aware, market individuals can use those factors to consider to their product techniques, making the most of the inflation hedging and diversity qualities traditionally supplied by this property class.

S&P DJI continues to be the leader when it pertains to bringing ingenious, sustainability-focused index offerings to the marketplace. The S&P GSCI Light Energy Environment Aware is another example of how we seek to drive openness and include sustainability requirements into our benchmark indices.

The posts on this blog site are viewpoints, not suggestions. Please read our Disclaimers

S&P 500 Low Volatility Index Might 2023 Rebalance

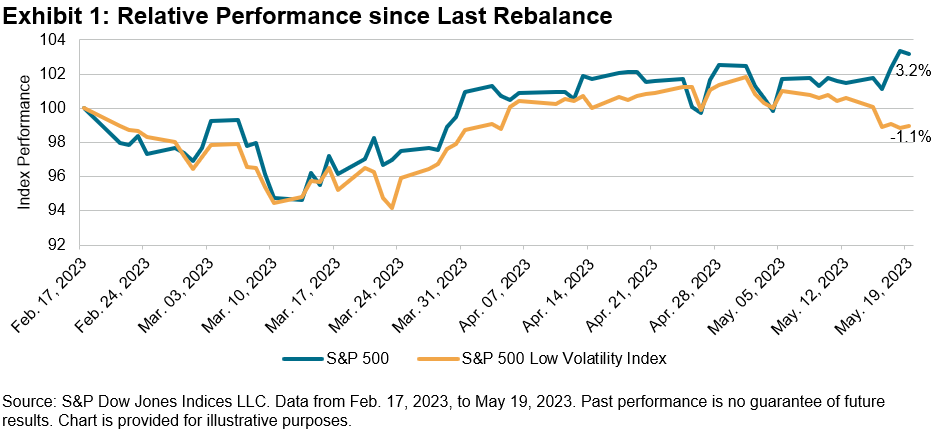

Because the last rebalance for the S&P 500 ®(* )Low Volatility Index on Feb. 17, 2023, the S&P 500 ended up 3.2% in spite of briefly dropping in mid-March throughout the collapse of Silicon Valley Bank. Exhibition 1 reveals that throughout this duration, the S&P 500 Low Volatility Index underperformed the S&P 500 by 4.3%. This divergence is primarily due to the substantial efficiency contributions from the mega-cap tech stocks as an outcome of their strong efficiency and big weights in the S&P 500. Exhibition 2 reveals that the total tracking 1 year volatility reduced somewhat given that completion of January. Determined in outright terms, volatility reduced the most for the Infotech and Customer Discretionary sectors, falling 2.4% and 2.2%, respectively. Out of the 11 GICS

®(* )sectors, 9 had their tracking 1 year volatility minimized throughout the duration, with the exceptions being the Realty and Utilities sectors, which increased simply 0.3% and 0.4%, respectively. Since April 28, 2023, Energy, Customer Discretionary, Interaction Solutions, Infotech and Realty were the leading 5 most unstable sectors in the S&P 500. As an outcome of the total reduction in volatility, the low volatility index’s most current rebalance brought some modifications to the sector weights. The most recent rebalance for the S&P 500 Low Volatility Index moved an extra 4% weight to the Customer Staples sector. Likewise, Interaction Solutions and Realty each made headway and included 1% weight to their sectors. Regardless of small modifications in volatility at the sector level for Energies and Financials, these 2 sectors lost one of the most weight in the index at 3% and 1%, respectively.

Interaction Solutions, Infotech and Realty were the most underweighted sectors in the most recent rebalance of the low volatility index (reliable after the marketplace close on Might 19, 2023).

The posts on this blog site are viewpoints, not suggestions. Please read our

Disclaimers

The S&P GARP Index Series Broadens to Consist Of S&P MidCap 400 and S&P SmallCap 600 Variations Classifications

Equities,

® GARP (Development at a Sensible Cost) Index was released in February 2019 to strike a balance in between pure development and pure appraisal. Due to its appeal amongst market individuals, this index series has actually just recently been broadened to consist of the S&P MidCap 400 ® GARP Index&and the S&P SmallCap 600 GARP ® (&* )Index .(* )The S&P GARP Index Series makes every effort to choose business with constant revenues and sales development, in addition to strong revenues power, strong monetary strength and affordable appraisal

Because the launch of the S&P 500 GARP Index, international economies have actually weathered the COVID-19 pandemic and the continuous Ukraine-Russia dispute. As an outcome, high inflation and increasing rates of interest have actually been trademarks of this period. From the start of 2020 through to the end of Might 2023, it is intriguing to keep in mind that all 3 S&P GARP indices have actually exceeded their matching criteria (See Exhibition 1) by a large margin. For that reason, choosing successful development stocks with more affordable evaluations has actually been a beneficial method throughout this duration. In this blog site, we will analyze the S&P GARP Indices’ building method, historic efficiency, sector structures and aspect direct exposures. Method Introduction The S&P GARP Index method utilizes a two-layer consecutive filtering technique to choose its constituents.

1

In the primary step (filter 1), stocks are ranked by their development z-scores (three-year EPS and SPS development), with a targeted variety of top-ranked stocks staying qualified for constituent addition. 2

In the 2nd action (filter 2), the qualified stocks are ranked by their quality & & worth (QV) composite z-scores and a targeted variety of top-ranked stocks are chosen. The QV Rating is based upon the average of 2 quality aspects (return on equity and monetary utilize ratio) and one worth aspect (earnings-to-price ratio). As shown in Exhibition 2, the resulting constituents represent development stocks with fairly greater quality and worth qualities. The chosen constituents are weighted proportional to their development direct exposure, based on the optimum private weight of 5% and sector weight of 40%. This technique looks for to offer purer development direct exposure and limitation concentration danger. Efficiency Contrast Historically, over the long term, the S&P GARP Indices exceeded their matching criteria in regards to both overall and risk-adjusted return

The outcomes reveal that the technique of choosing successful development stocks with affordable evaluations has actually yielded significant outcomes over longer durations. In addition, both the S&P MidCap 400 GARP Index and the S&P SmallCap 600 GARP Index exceeded their matching criteria for all durations studied (see Exhibition 3).

Sector Structure

Exhibition 4 reveals the historical sector direct exposure distinction in between the S&P GARP Indices versus their criteria. The S&P GARP Indices have actually had a visible obese in Customer Discretionary and an underweight in Financials, Customer Staples, Utilities and Interaction Solutions. Element Direct Exposure Exhibition 5 reveals the aspect qualities as determined through the lens of Axioma Danger Design Element Z-scores. The techniques had greater direct exposure to revenues and sales development, success and revenues yield, while having lower utilize (lower direct exposure to utilize ratio).

Conclusion

As the simulated efficiency programs, using the S&P GARP Index method to the mid-cap and small-cap universes has actually led to outperformance over the long term. For market individuals wanting to get direct exposure throughout the marketplace cap variety, the S&P MidCap 400 GARP Index and the S&P SmallCap 600 GARP Index are a welcome addition to the S&P GARP Index Series.

1 Hao, W. and Soe, A.,

Indexing GARP Techniques: A Specialist’s Guide

, S&P Dow Jones Indices, 2019.

2 The indices use 20% choice buffer according to the following procedure: 1. Rank the leading Development z-score stocks by QV composite z-score. Select immediately the leading 80% greatest ranking stocks for index addition. 2. Select existing constituents ranked within the leading 120% by QV composite z-score for index addition in order of QV composite z-score up until the target QV count is reached. 3. If, at this moment, there are inadequate constituents chosen to fulfill the QV count, choose non-constituents based upon QV composite z-score ranking up until the target count is reached. The posts on this blog site are viewpoints, not suggestions. Please read our Disclaimers

Classifications

Equities, Aspects Tags

Disclaimers

Craig Lazzara Handling Director, Index Financial Investment Method S&P Dow Jones Indices

Classifications

-

Tags

active management, Active vs. Passive, Craig Lazzara, -

aspects,

passive investing, passive management, Determination, predictive precision, S&P 500, S&P 500 Development, S&P 500 Worth, Ability vs. Luck, SPIVA, Design, United States FA In order to produce worth for his customers, an active financial investment supervisor need to differ a passive criteria– by picking sectors, or designs, or private stocks that the supervisor forecasts will exceed. The supervisor’s worth depends on the precision of his forecasts ; the much better he is at determining the very best sectors, or designs, or stocks, the much better his outcomes will be. A passive supervisor, on the other hand, acknowledges his (actual) lack of knowledge about future returns

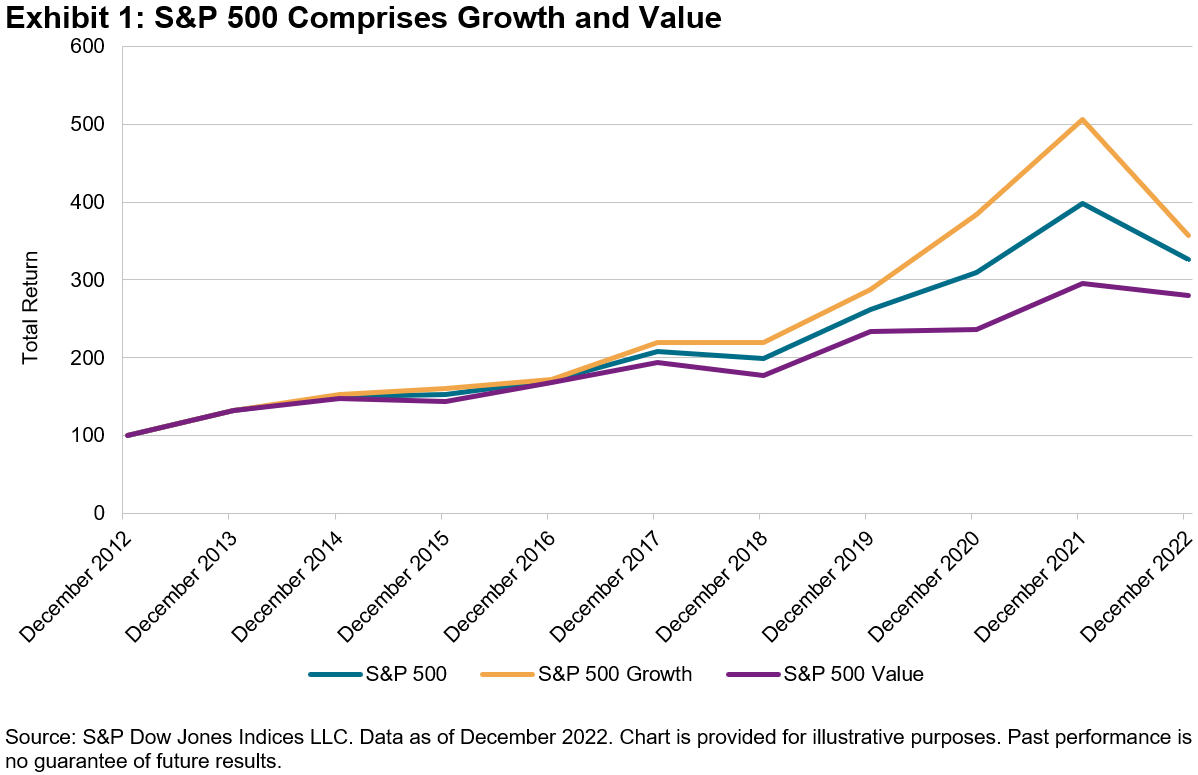

How precise do active forecasts require to be? How precise are they in practice? An easy idea experiment can assist check out these concerns: we’ll believe merely about turning in between development and worth as a way of outshining the S&P 500 ® For the ten years ending in December 2022, the S&P 500’s overall return was 12.6%, while the

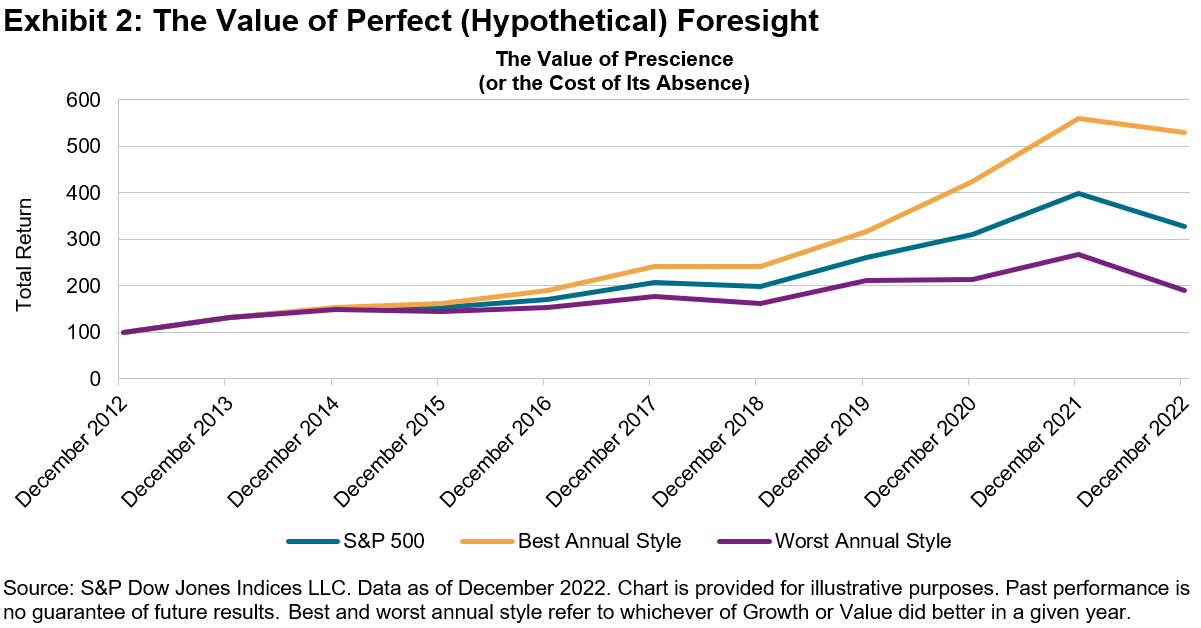

S&P 500 Development and S&P 500 Worth indices returned 13.6% and 10.9%, respectively. Because Development and Worth combined make up the S&P 500, Exhibition 1 is unsurprising. Expect, arguendo, that a financier moves yearly to the design he forecasts will exceed. The limitations on such a financier’s efficiency are displayed in Exhibition 2. A financier who was right every year would hypothetically make a substance return of 18.2% for the duration; if he was incorrect every year the CAGR would be up to 6.6%.

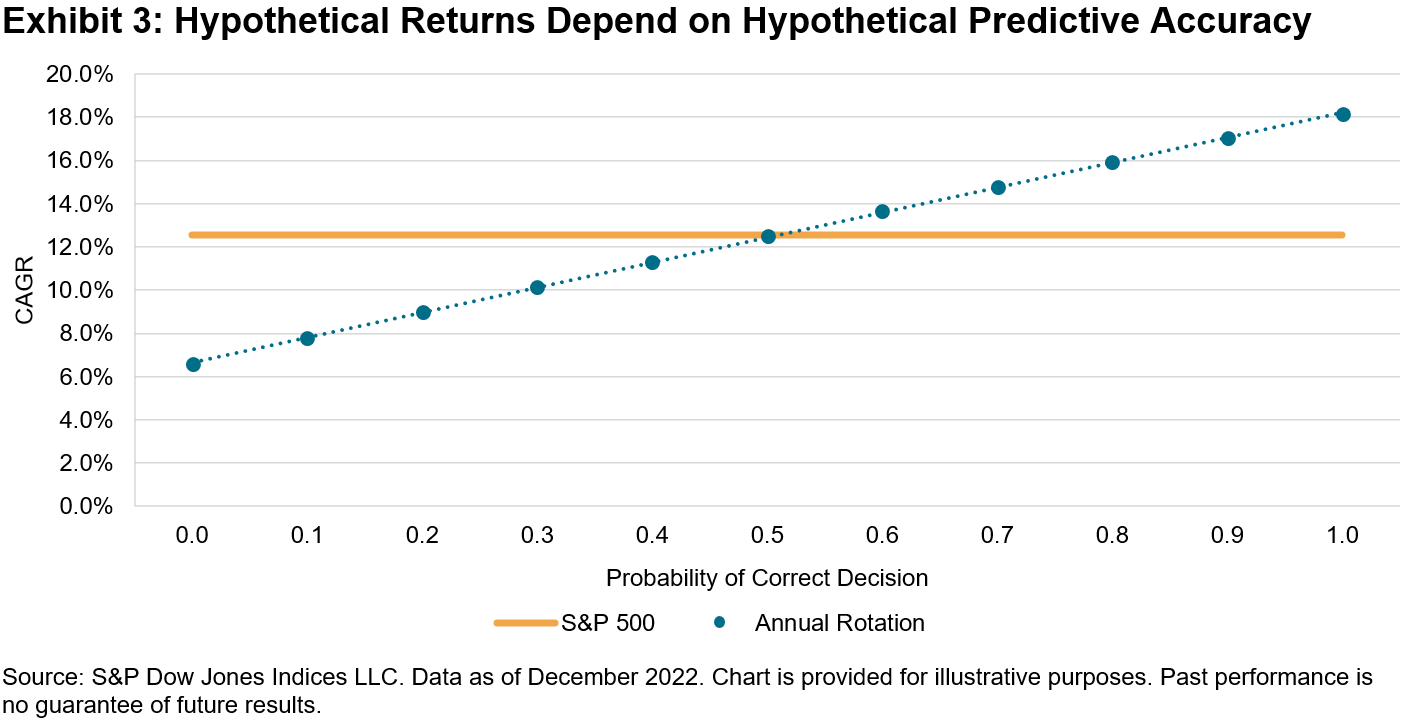

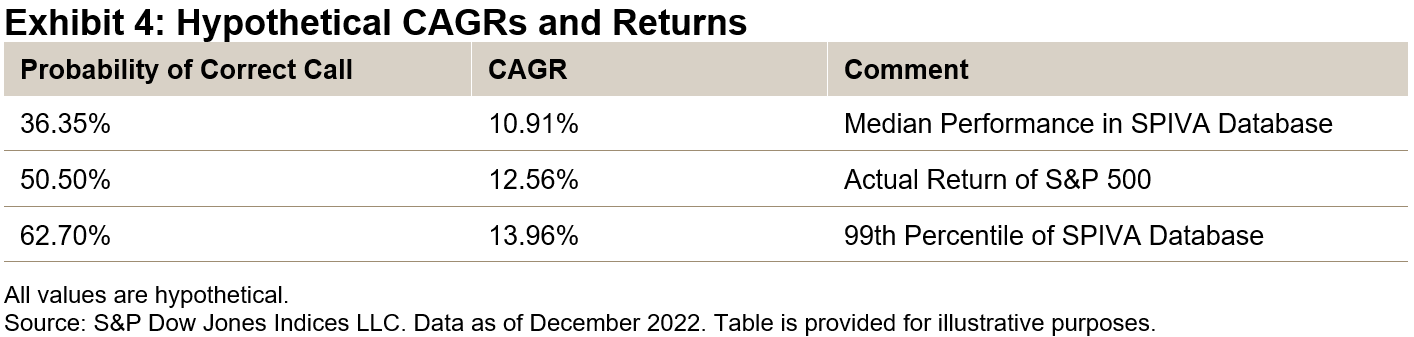

Obviously, it’s not likely that anybody attempting this method in reality would be right– or inaccurate– every year. Exhibition 3 demonstrates how the go back to a tactical rotational method would differ depending upon the likelihood of making the right call. With a likelihood of 0.1, e.g., at the start of every year, the financier would have a 10% probability of picking the much better entertainer and a 90% probability of picking the even worse entertainer. If every choice were best (likelihood = 1.0), the financier’s CAGR would be 18.2%; if every choice were incorrect (likelihood = 0.0), it would be 6.6%. What’s intriguing is to observe what occurs in between those limitations, as summed up in Exhibition 4. From these observations we can make some reasonings about the potential customers for effective design rotation:

The efficiency of the

average large-cap U.S. equity supervisor in our SPIVA

®

database

- follows a 36.35% likelihood of making the best design call— i.e., even worse than a coin turn. Turning a coin would have produced around the return of the S&P 500, which would have implied a top-quartile ranking for a large-cap U.S. equity supervisor. However if turning a coin is the very best you can do, it’s much better not to trouble and simply track the S&P 500. Predictive precision levels above 63% would have produced returns that no supervisor really produced, which indicates that no active supervisor had that level of predictive precision. Passive financiers can be comfy in their agnosticism. The posts on this blog site are viewpoints, not suggestions. Please read our

- Disclaimers

Tags

active management, Active vs. Passive, Craig Lazzara,