When the international financial projection doubts, fundraising is simply the very first half of the fight for brand-new start-ups. The VCs that continue to buy brand-new business typically require more aggressive terms to decrease their danger. Term sheets from credible VCs most likely will not be straight-out predatory, however throughout an economic crisis, worst-case circumstances are most likely to take place, and creators will be most likely to pay the cost. Mindful cap table modeling and monetary modeling can assist you prevent giving up more equity than you otherwise require to.

As the co-founder of an international VC company that has actually moneyed more than 50 start-ups, I have actually sat throughout the table from creators like you lot of times. I can inform you that VCs desire you to prosper since that’s how they are successful. However a dismal economy makes everybody a little bit more tight-fisted and run the risk of averse, which suggests you can anticipate your financial investment to come with additional conditions you would not always see in boom times.

Assessment gets a great deal of headings, however favored terms– the favored equity that financiers get– are the part of the settlement that can truly tempt you into an even worse offer than you planned to make. Rates these terms can be tough since much of them will just end up being appropriate just under particular situations. Dilution security, for instance, starts solely throughout a down round, so it can look like a fairly low-risk concession in a great economy. In an unpredictable one, nevertheless, it can imply the distinction in between life or death for your business.

The most precise method to cost conditional terms is to run a simulation of prospective results in your monetary design and determine the result of the proposed terms on your cap table, then typical those outcomes over lots of versions. Nevertheless, that can need costly specialized software application and substantial analytical know-how that you might not have.

A far much easier– yet still really reputable– choice is to carry out circumstance analysis with your c ap table and monetary modeling In circumstance analysis, you evaluate unique degrees of monetary results (normally low, medium, and high) instead of running a vibrant simulation that repeats on numerous possible results.

A total summary of how finest to price favored terms is beyond the scope of this post, however I use a roadmap for how to approach a few of the most typical and substantial terms. I likewise reveal you how to value them precisely enough to prevent accidentally handing out excessive of your business.

Position Yourself for Settlement

Prior to you take a seat at the table, do some research: Make certain your start-up’s financial resources remain in order, make certain that you comprehend dilution, make sure that your equity is allocated properly, and have your monetary design in location.

These actions will prepare you to approximate your business’s evaluation and construct your cap table so you can design the terms your financiers are proposing.

Pin Down Your Assessment

If you’re at the seed phase, evaluation is normally a lesser part of the settlement, however you require to make a convincing case for the numbers you present.

This needs some creativity. While there are quantitative tools that speak with the monetary health of a start-up, at this early phase you more than likely will not have enough capital information to come to a robust fair-value price quote. Rather, technique this matter as a triangulation workout, utilizing the following components:

Monetary Design

Even without a great deal of historic information, you require a beginning point, so carry out a standard reduced capital on your monetary design with whatever details you have. Then utilize the basic endeavor target rate of return– 20% to 25%– as the expense of capital to see what contemporary evaluation it indicates. Lastly, work backwards to identify just how much capital development would be needed to strike your target evaluation This will expose the turning points you require to strike in order to establish a clear strategy to accomplish your target evaluation, along with show, preferably, a generous roi to your financiers.

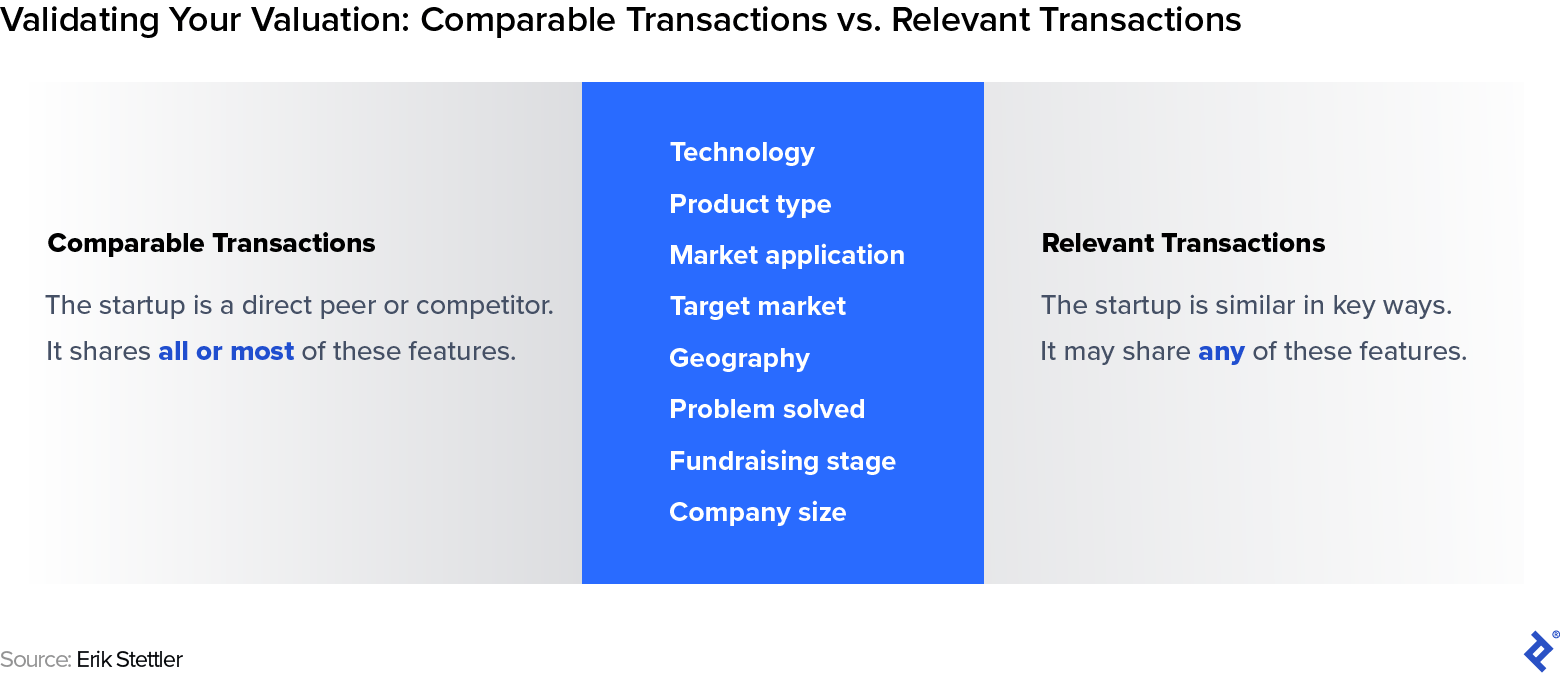

Current Pertinent Deals and/or Exits

The standard knowledge is to take a look at current equivalent deals to confirm your figures, however discovering current comparable offers amongst direct peers or rivals is tough, even under regular market conditions. Every start-up and endeavor offer is various, and the openly offered details on deals leaves out crucial components of the general offer terms or structure.

Nevertheless, by broadening your search to current appropriate deals– those in your basic market or innovation location– you can still offer financiers with convincing context to support the several on your earnings and other appropriate metrics.

Aggregate Market Trends

Pitchbook uses a significant quantity of complimentary information on personal market patterns in evaluation and offer size throughout financing phases. That information can be altered by a little number of “mega rounds” at abnormally high evaluations and can conceal a significant variety of results. Nevertheless, in basic, revealing that the suggested evaluation from your monetary design remains in line with other offers will assist confirm your asking cost.

If a financier strongly promotes a lower evaluation, think about that a warning. The main issue of financiers need to be their return. Framing the cost conversation within the bigger context of the development that you’ll accomplish with this financing round– and the future evaluation it will allow you to reach– can assist take a few of the pressure off your existing evaluation. I as soon as had a start-up customer that had the ability to show so convincingly that it might anticipate continuous 70% regular monthly development that the concern of decreasing its evaluation never ever turned up.

Utilize a Dynamic Cap Table

Your monetary design is main to the evaluation conversation. However the real battleground for the settlements is your cap table, which is where you track the equity breakdown of your business. Here are 3 functions you need to consist of in your cap table format to design your financiers’ proposed terms:

- Every Round of Fundraising: Consist of any previous seed or pre-seed financial investments that will transform upon Series A. Include your future rounds also– something I see creators stop working to do all the time. Usually, I presume a minimum of a Series B prior to exit or enough success, however it’s a great concept to presume a Series C too.

- Financier Payment: Include a line that tallies your financier payment throughout rounds. This is very important since if you use a particular favored term to your Series A lead financier, then you can normally anticipate your Series B cause require the very same. If you’re not modeling the effect of your terms through completion of fundraising, those concessions can grow out of control.

- Future Fundraising Requirements: As your service grows, so will your costs– personnel income and choices, physical overhead, production expenses, and more. Simply as you budget plan for those in your monetary design, you’ll require to budget plan for them in your cap table.

Cap table modeling will likewise aid with the typical concern of just how much cash you need to try to raise in a provided round. Fundr aising in smaller sized increments can lessen dilution, because your evaluation will most likely increase with time. Nevertheless, you need to weigh this prospective advantage versus the danger of having less deposit at any given minute, along with the possibility that you’ll have less time to concentrate on fundraising as your service grows.

This concern typically links with settlements, as the appearance of the terms will impact just how much capital you select to accept. Your modeling might likewise assist you choose that it may be much better to leave totally and carry out an extension of your previous seed or pre-seed round rather, to purchase you more time to grow.

Prepare to Design Preferred Terms

Assessment is simply one piece of the puzzle. In times of capital shortage, financiers are most likely to think about more aggressive chosen terms in the hopes of lowering their danger (disadvantage security) or increasing their prospective benefit (advantage optionality).

Here are 3 of the most typical and impactful favored terms that creators should, sometimes, prevent and, at the minimum, design thoroughly prior to accepting.

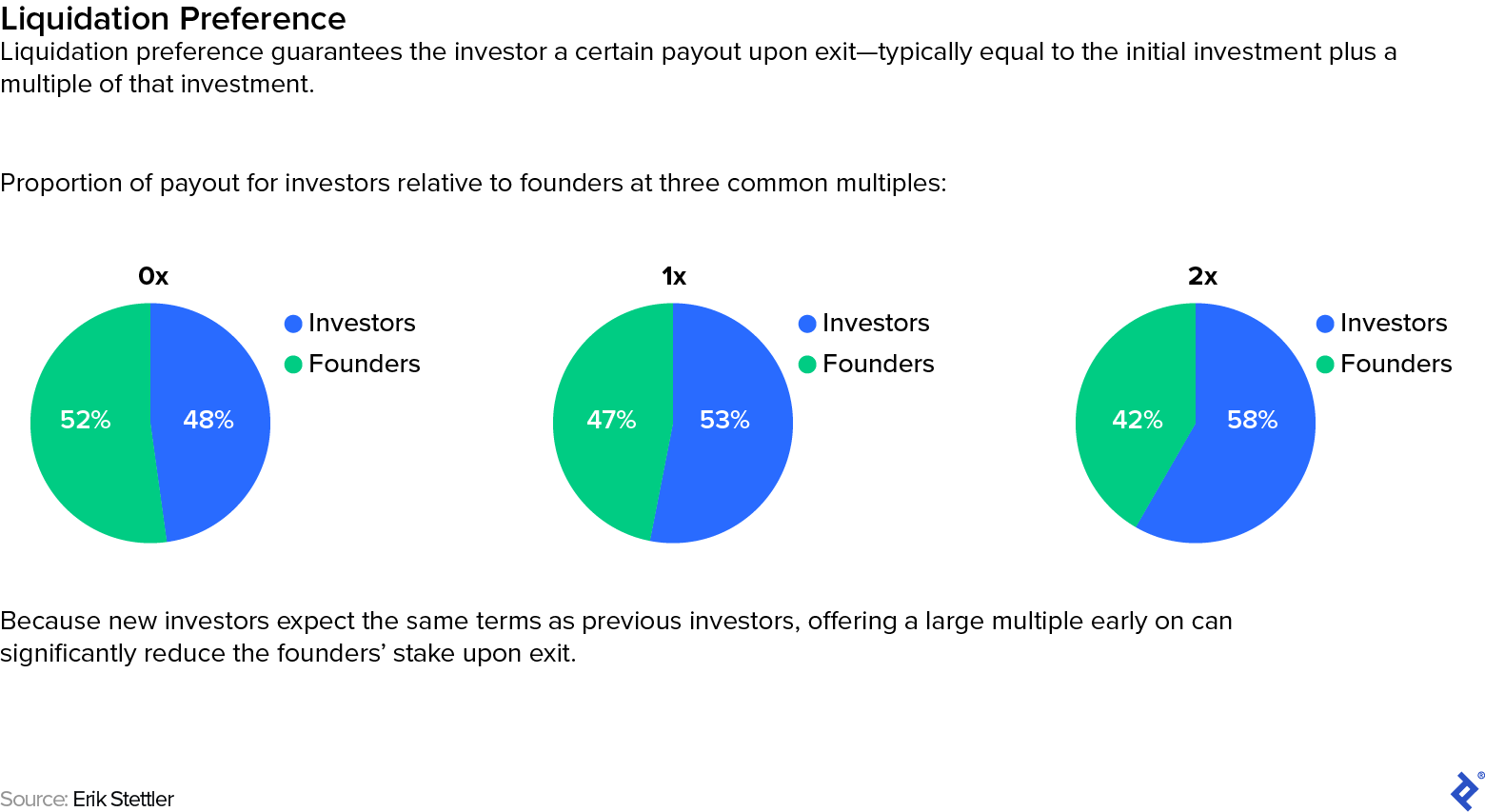

Liquidation Choice

In case of liquidity or dissolution, liquidation choice grants the financier an agreed-upon quantity– normally the return of their capital (1x), plus a prospective ensured several (>> 1x)– prior to you get anything. The remainder of the pie is assigned proportionally based upon percent ownership.

To see the effect of your financiers’ proposed liquidation choice, include a line to the cap table that reveals the quantity that will be due in advance to your financiers (and those from anticipated future rounds) prior to you get your share. The outcomes might show a significant decrease in the payment that you and your staff member can anticipate.

You can utilize this details in the settlement to make the case that if the financiers anticipate to derisk their return in this method, they need to accept a greater evaluation. It refers concept: Danger and benefit go together in investing, and contractually lowering the previous need to then raise the size of the latter.

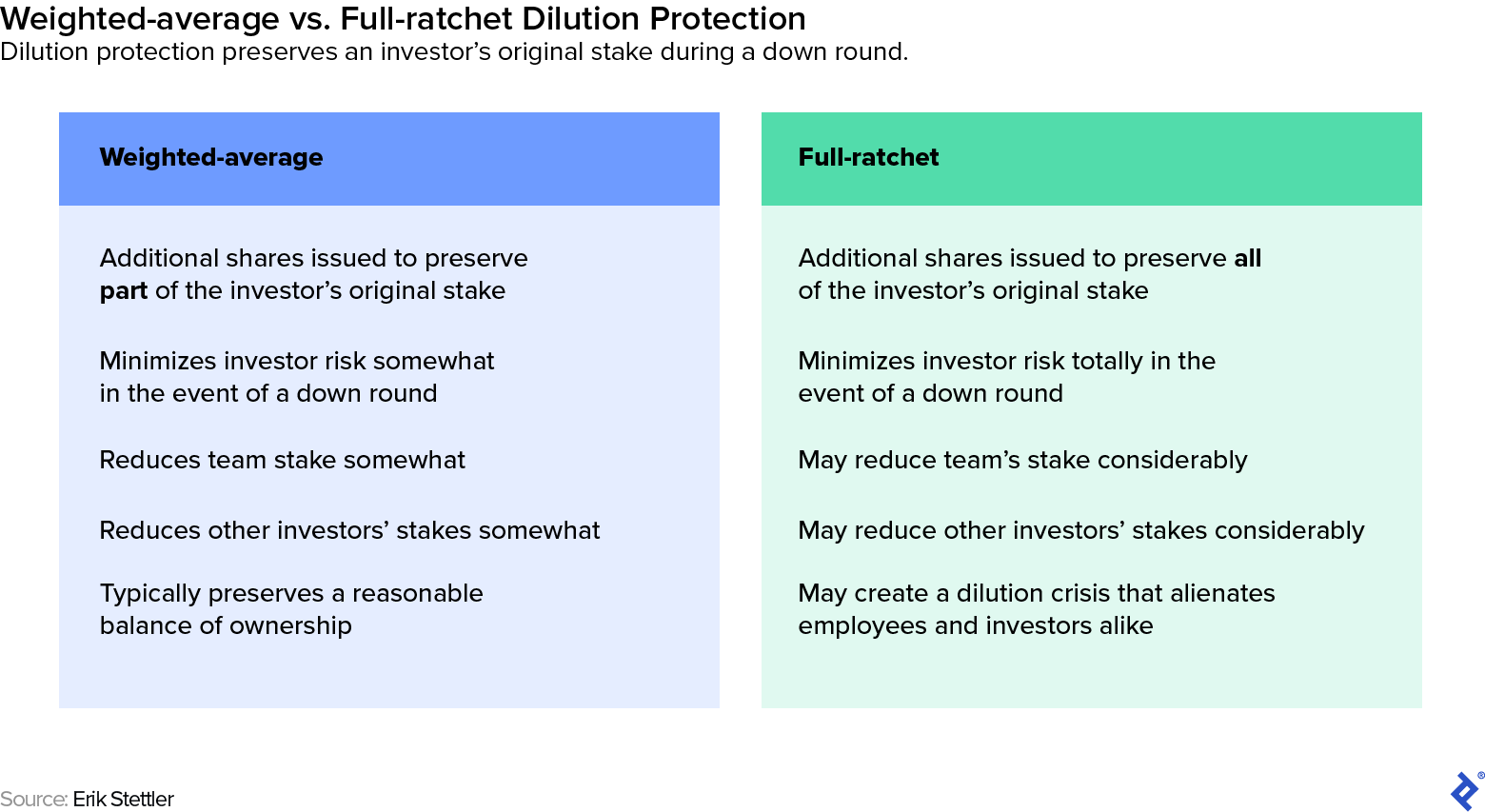

Dilution Defense

In case of a down round, dilution security provisions need a start-up to produce extra shares for the financier in order to preserve the financier’s relative stake. Weighted-average dilution security, which just ensures a particular portion of the initial stake, is a bearable ask. Full-ratchet dilution security, which protects the financier’s whole stake, is an extremely aggressive demand, as it basically requires all the prospective benefit without exposing the financier to the matching danger.

Aggressive dilution security raises your danger also, as it can set off a dilution death spiral that can eventually eliminate your possibilities of enduring a down round. When your business ends up being too watered down, that can consume a lot of of the shares scheduled for your group and future financiers that it ends up being tough to keep and work with the very best skill, along with continue fundraising.

Pressing back versus full-ratchet dilution security needs a fragile touch. I discover the very best method to do it is to take a Socratic technique and ask your financiers enough concerns about the prospective drawbacks of their proposition that they ultimately occur to your position of their own accord.

Initially, reveal your financiers your cap table modeling and describe the effect that that level of dilution will have on worker spirits and financier appeal. Inquire how they believe it’s possible for you to grow the business under such conditions without the extra capital a greater evaluation would offer. In this method, you can reveal them how the anticipated dollar worth of their last holdings can increase if they offer a little on the portion today.

Full-ratchet dilution security can be so harmful to a start-up that I usually recommend doing whatever possible to prevent it– consisting of leaving the offer– unless your service will not make it through without that financier. Even then, it deserves attempting to press back.

Super Pro-rata Rights

Requirement pro-rata rights enable the financier to take part in subsequent rounds, as much as the point of keeping their preliminary ownership stake. This term can frequently develop throughout the seed round, as lots of seed financiers seek to follow on with more capital as the stars start increasing. I normally suggest that creators preemptively use pro-rata rights to financiers, as the chance to follow on becomes part of what makes early-stage investing practical.

Throughout tight markets, nevertheless, financiers in some cases demand incredibly pro-rata rights, which provide the right to invest enough to boost their percent stake in subsequent rounds.

While pro-rata rights are reasonable, incredibly pro-rata rights are not, as they secure a share of the prospective advantage out of proportion to the size of the financier’s dedication in the existing round. They are basically the opposite side of the coin from full-ratchet dilution security. If you recognize with choices rates, you can design this as a call choice where the strike cost is your anticipated Series An appraisal and the volatility inputs originate from the circumstance analysis you carried out with your monetary design and their particular likelihoods.

I do not suggest approving incredibly pro-rata rights under any situations, as that can impede your capability to cause extra financiers in future rounds. Financiers in later-stage business normally have a minimum portion that they want to accept, and if incredibly pro-rata rights assign excessive to your earlier financiers, you can discover yourself in a circumstance where you have insufficient area left in the round to close your financing space. If a financier desires more direct exposure to your business, they need to increase their existing financial investment quantity rather.

If, nevertheless, you truly can’t pay for to ignore an offer that requires incredibly pro-rata rights, then you require to encourage the financier to offer a bit more on existing evaluation in return for this capability to catch extra advantage.

Check Out the Agreement and Get a Legal Representative

I can not highlight enough how needed it is to work with a legal representative who concentrates on endeavor arrangements when you’re examining an financier agreement This is one location where you do not wish to skimp.

Preferred terms are continuously progressing, and no matter how exactly we try to design or summarize them, the only source of fact is the legal agreement. While you can work out business and monetary essence of the terms, do not sign anything without very first revealing the documents to a legal representative to make sure that it precisely shows what you have actually concurred upon.

Careless and unclear language can be simply as hazardous as an intentional “gotcha” stipulation. For instance, any metrics-based payment strategy unlocks to havoc, even in the uncommon cases when the metrics are completely specified. Uncertainty almost constantly prefers the bigger and better-funded celebration (in this case, the financier), because they can money and hold up against a conflict for longer. Working with an extremely certified endeavor lawyer will assist you prevent this result.

Keep In Mind the Human Element

I have actually concentrated on how your cap table and monetary design can assist you understand particular essential terms in order to comprehend the real worth of what you’re providing and make certain you get enough factor to consider in return. The settlements themselves, nevertheless, are an exceptionally human workout.

Understanding the profile and viewpoint of the financiers will assist you presume just how much relative worth they’ll put on particular terms. Financiers who are more recent to VC, such as household workplaces and financiers with more conventional personal equity backgrounds in emerging environments, will typically focus more on disadvantage security, while Silicon Valley financiers often pay more attention to upside optionality. Business equity capital might be more thinking about tactical terms than financial ones. Comprehending their top priorities will assist you customize your technique.

Lastly, keep in mind that simply as the terms you accept will set a precedent for future rounds, the settlement is just the start of your relationship with a specific financier Your habits throughout settlements will inform the financier what type of partner you will be– and vice versa. The minute you sign the last contract, you’ll all be on the very same group, and quickly enough you’ll be preparing together for the next round.