studiostockart

That is an replace to our collection of articles began in 2012 assessing marketplace valuation and estimating ahead inventory marketplace returns. The newest earlier replace was once April 2023.

The December 2021 replace concluded that the then prevailing situation of overvaluation advised 0 returns from shares to the top of 2028 and the chance of an forthcoming main downturn for equities. Through finish of March 2023 the S&P 500 was once 15% decrease and because then the index has recovered and is now best 4% down from the December 2021 top.

The projections listed here are in part in accordance with Estimating Ahead 10-Yr Inventory Marketplace Returns the usage of the Shiller CAPE Ratio and its 35-Yr Shifting Reasonable, which is known as the “referenced article” additional down.

What momentary inventory marketplace returns may also be anticipated?

No one is aware of, and the finest one can do is to make use of the historical information (which is from Shiller’s S&P collection) to steer us to make estimates for the long run. From the true worth of the S&P-Composite with dividends re-invested (S&P-real) one unearths that the best-fit line from 1871 onward is a instantly line when plotted to a semi-log scale. There’s no explanation why to imagine that this long-term pattern of S&P-real can be interrupted.

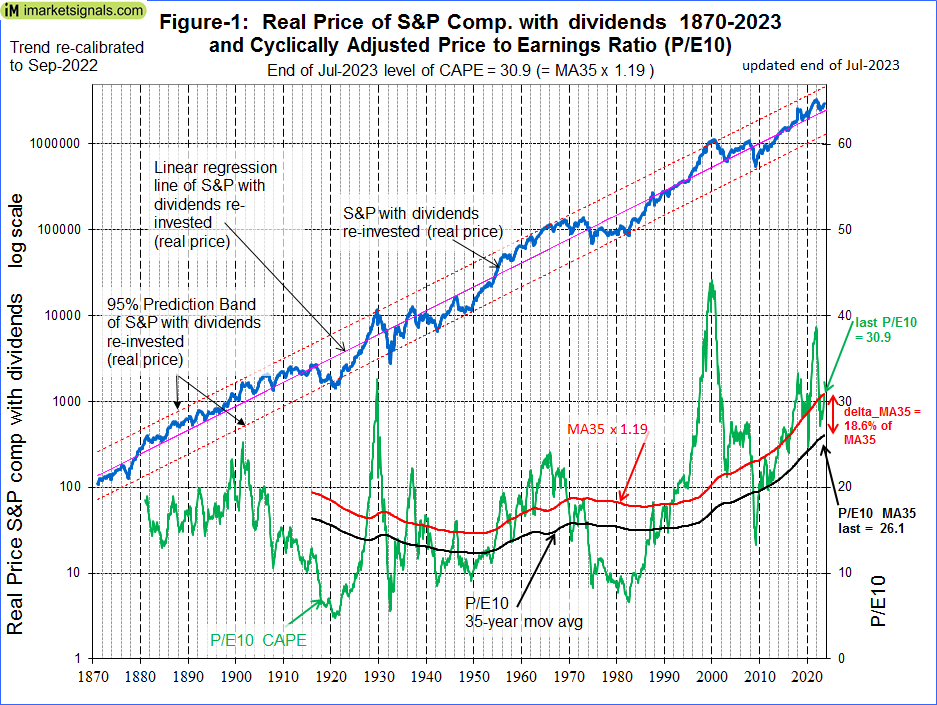

S&P-real and the finest match line in conjunction with its 95% prediction band traces are proven in Determine-1, up to date to finish of July 2023. (See the appendix for the equations.)

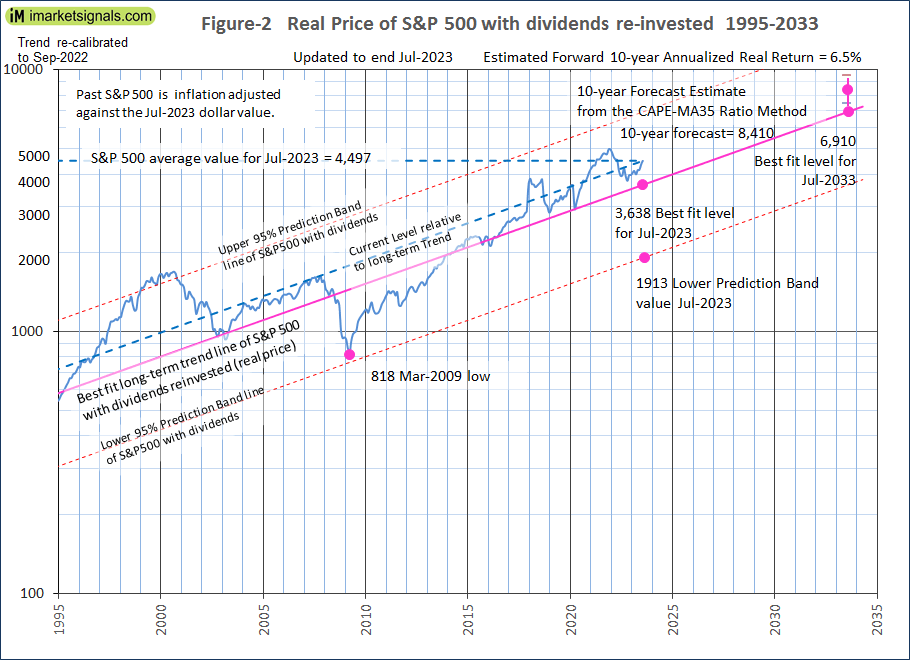

The S&P-real reasonable July stage of four,497 is now 24% above the long-term imply pattern stage of three,638, (Determine-2).

iMarketSignals iMarketSignals

In Determine-2 the present stage of the S&P 500 relative to the long-term pattern is indicated by way of the road parallel to the long-term pattern line. Notice that this relative stage is now about the similar because it was once at mid-2007 previous to the 55% decline of the S&P 500 to the March 2009 low. So it’s conceivable for the S&P 500 to provide a identical decline from the present stage.

Forecasting inventory marketplace returns with the CAPE-MA35 Ratio

Additionally proven in Determine-1 are the CAPE-ratio (which is the S&P-real divided by way of the typical of the true income over the previous 10 years) and its 35-year transferring reasonable (MA35), having finish of July 2023 values of 30.9 and 26.1, respectively. Thus, the CAPE is nineteen% above its MA35.

As proven within the referenced article, a awesome technique to the usual use of the Shiller CAPE-ratio is to expect 10-year genuine returns the usage of the CAPE-MA35 ratio as a valuation measure. It’s merely the price of the Shiller CAPE-ratio divided by way of the corresponding price of its 35-year transferring reasonable (30.9 / 26.1 = 1.19).

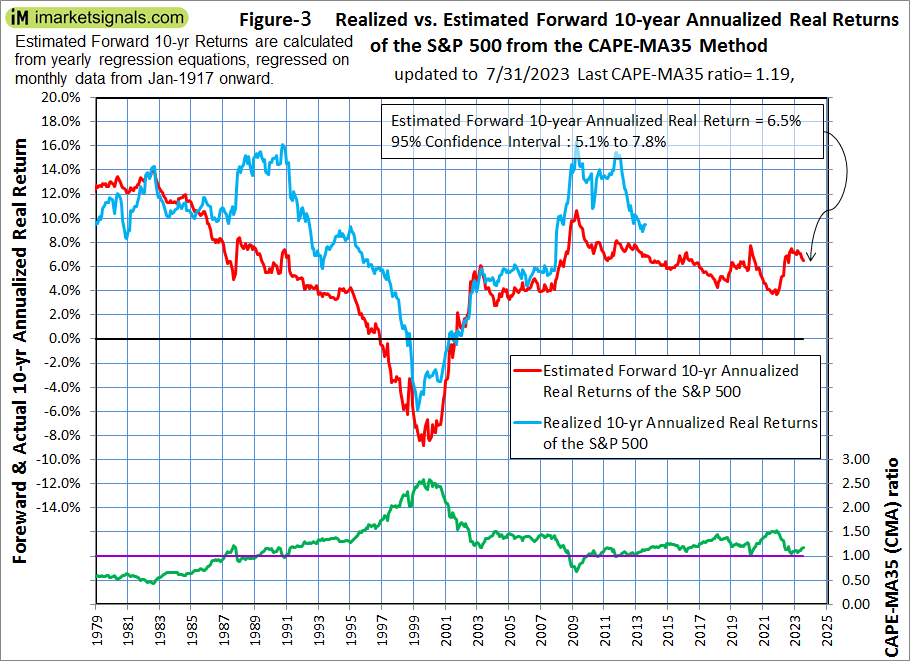

Recently the CAPE-MA35 ratio of one.19 forecasts a possible 10-year annualized genuine go back of about 6.5% to finish of July 2033. In line with the present S&P 500 price this could point out an finish of July 2033 price of 8,410 for S&P-real, with higher and decrease self assurance values of 9,500 and seven,400, respectively (Figures-2 & 3).

iMarketSignals

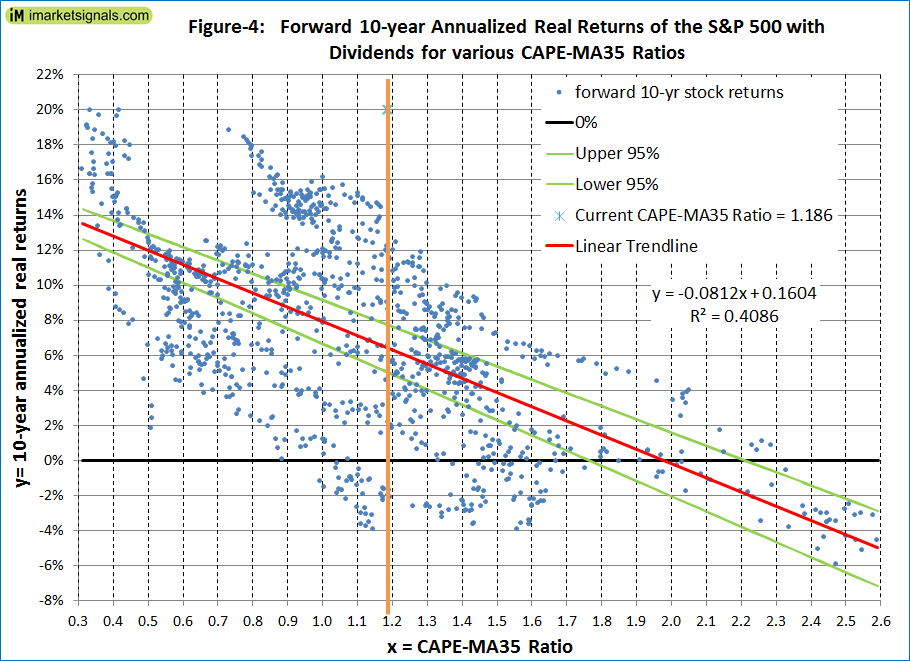

Determine-4 displays the historical ahead 10-year annualized genuine returns for CAPE-MA35 Ratios starting from 0.3 to two.6. For the present CAPE-MA35 Ratio of one.19 the returns ranged from -4% to fourteen%. One observes that when the CAPE-MA35 Ratio turns into lower than 1.0 the historical ahead returns had been all sure.

iMarketSignals

Forecasting returns to 2033 with the long-term pattern

When extending the finest match line and the prediction bands (Determine-2), then the S&P-real finish of July 2033 price could be 6,910.

Thus, the historical pattern forecasts a possible overall acquire of about 54% (or an annualized go back of four.4%) for S&P-real from its finish of July 2023 stage of four,497 to the top of July 2033 ideal match stage of 6,910.

Conclusion

- The present stage of the S&P 500 relative to the present long-term pattern stage signifies that shares are quite overrated; and

- The present CAPE-MA35 ratio of one.19 forecasts a 6.5% genuine 10-year ahead go back for the S&P 500, whilst the long-term pattern signifies a ahead go back of four.4%; and

- The present situation does now not exclude the potential for a big downturn for equities, however the anticipated 10-year ahead returns glance relatively just right.

Appendix

The most efficient match line and prediction band (re-calibrated to Sep-2022)

The most efficient match line and prediction band had been calculated from per 30 days information from Jan-1871 to Sep-2022. This comprises now an extra 10 years of knowledge of the SP-real values for the duration after July-2012, up to now now not incorporated within the regression research.

The equation of the finest match line is y = 10(ax+b)

The place y = is the dependent variable of the finest match line, x = are the collection of months from January 1871 onward, a =0.002321819 and b = 2.133179076

The parameters for the 95% prediction band traces are:

Higher: a = 0.002321819, b = 2.412217299 and Decrease: a = 0.002321819, b = 1.854140854.