DNY59

Financial Investment Thesis

Visa ( NYSE: V) is my 3rd biggest position, comprising 6.4% of my portfolio. I have not offered a single share given that I initially invested, and my newest purchase was December 2021, when I got shares at $192.83 per share. I intend on broadening my position down the roadway as I mean on holding this position for as long as I can. As such, I’m naturally likewise prejudiced in favor of the business, which relates to understand when reading this short article.

As financiers we are just able to designate any offered capital as soon as, which causes the requirement for choice making in regards to what financial investment chances to focus on. From individual experience, I ‘d state we as financiers frequently wind up thinking twice when it concerns preferring the business with a more pricey cost. Here I describe a steeper assessment, where we feel as if we get more ‘back for the dollar’, if we opt for the alternative stock that brings a more economical assessment. All financiers are various, however this is at least something I have actually observed among those who are less threat averse and concentrate on capital conservation – that includes myself. This can in some cases show to be an error, and recalling, I’m happy I handled to combat off the desire to not purchase Visa as I keep in mind believing it would not have the ability to turn into its high assessment back when I initially chose it up. In the rearview, it can appear extremely apparent how whatever played out, however when you are on the ground in the middle of things, doubt can sneak into your mind, and it’s shown that losses struck us more difficult than gains, which is described as loss hostility.

I went long Visa back in 2016, however I keep in mind having a hard time seriously prior to I lastly handled to convince myself to proceed. I ‘d been checking out the business for a number of years, and it was simply regularly trading at a high assessment that I wasn’t sure it might validate in time. At that time, the business generated $13.8 billion in earnings with an earnings of $6.3 billion, compared to a FY2022 earnings of $29.3 billion with an earnings of $14.9 billion. The information orientated reader will observe how Visa is commanding a more powerful earnings margin today, on the basis of a bigger earnings swimming pool compared to at that time – more on that later on.

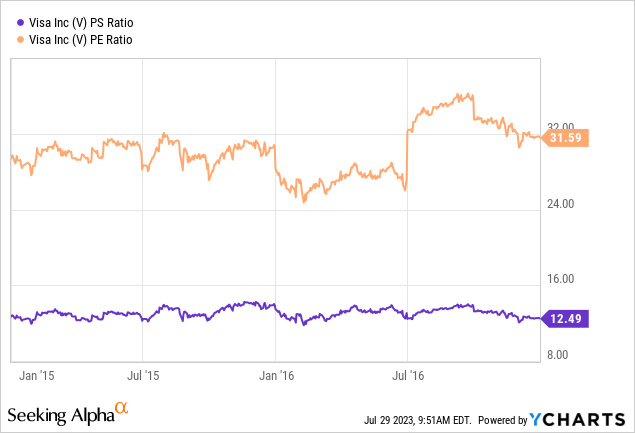

Today, it’s practically a $500 billion dollar market cap, making it among the outright heavy weights internationally. Sure, it was simply around the $200 billion market cap at that time, however as I did my due diligence throughout 2015 and start of 2016, it was still trading at a cost to sales ratio >> 12 and a cost to incomes ratio >> 25. Nevertheless, $200 billion is adept for a market cap, particularly prior to we began speaking about market caps determined in a number of trillion dollars.

You can see the assessment for Visa back in 2015-2016 in the chart below.

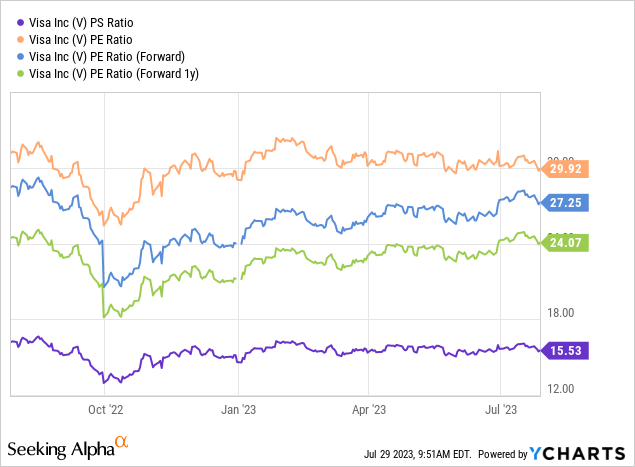

Today, the business is still trading at an evaluation of comparable sorts. The P/S ratio is greater, however the P/E ratio is close to similar offered the variations we see with the stock going up and down as time passes. The business is likewise handling much better system economics, which realistically enables some sort of growth in the assessment.

Where am I attempting to opt for this? I believe that the very same arguments that encouraged me to invest 8 years back, still apply today, and can form the structure regarding why Visa stays a business with an appealing future. For that reason, I’ll focus this short article on my 3 arguments from at that time.

Argument number 1: The market chance – going cashless

Visa, and its peer Mastercard ( MA) exist on the facility that people wish to perform payment deals digitally instead of through the standard money in the kind of costs & & coins. This covers both domestic and cross-border deals, in addition to credit & & debit cards.

Maturity in regards to going cashless varies greatly throughout countries internationally. I can’t keep in mind having actually utilized money in my own nation for the previous 10 years. It’s simply not required anywhere, any longer. At the very same time, my nearby nation, Germany, here money stays the favored kind of payment Likewise, I keep in mind being shocked by the United States preferring money when I initially went there several years back. Having actually existed often times given that, newest last summer season, I constantly guarantee to bring a lot of money with me. There is absolutely nothing incorrect or ideal with either of these revers, however it’s simply to state that Visa runs in a market where we are far from having the ability to call it totally develop or filled on an international scale. Having actually taken a trip to numerous undeveloped areas of the world, I can state there is still development chances out there for Visa.

The above is my individual experience, which does not bring much credibility, however if we observe real empiric information checking out the subject, then it validates that specific observation.

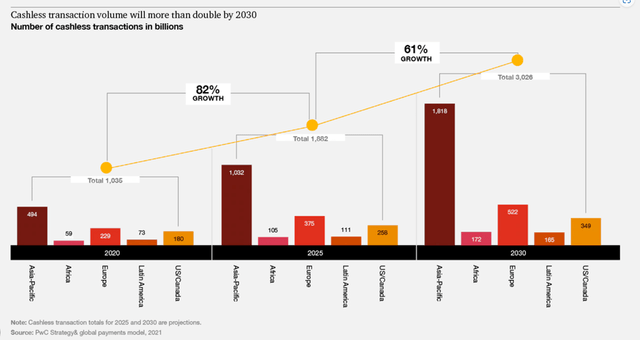

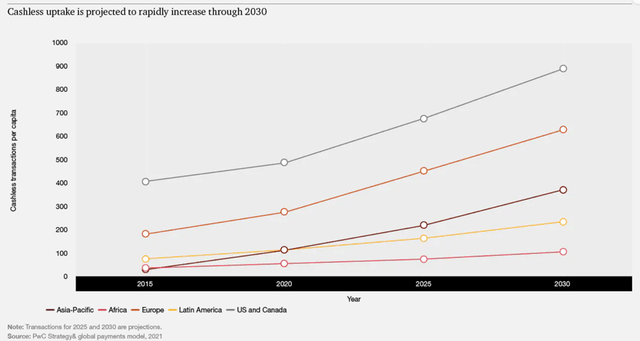

Payments 2025 and beyond (pwc.com)

Cashless deals are anticipated to grow enormously throughout this years and beyond.

Payments 2025 and beyond (pwc.com)

It’s anticipated to do so both in volume and worth, both which are worth chauffeurs for Visa. In addition, we are residing in a world with a growing middle class, who wish to take a trip to see the world and disclose in the items and services of other parts of the world. This increases the variety of cross-border deals, another focus location for a business like Visa.

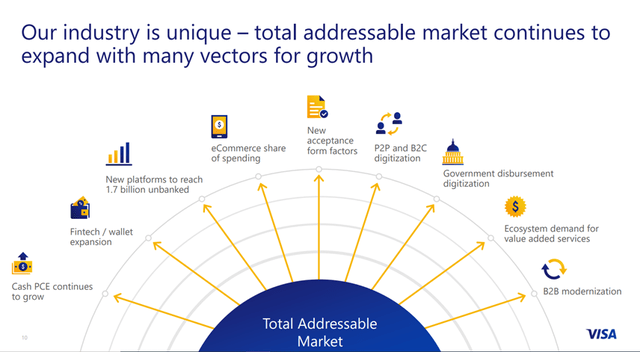

I’m frequently taking a look at the overall addressable market chance for a business prior to I invest. For a business like Coca-Cola ( KO), that is a rather diminished chance as you can’t discover a country on this world where you can’t get a bottle of coke on more less any corner. For a business like Visa, there is a lot of chance staying. Sure, there is likewise growing competitors from Fintech and crypto options, however this is a business with a considerable moat as they are running under network advantages, as likewise seen from the growing margins I mentioned earlier.

This is naturally likewise something Visa fasts to mention themselves, as observed from their financier day discussion product.

Visa Overall Addressable Market (Visa Financier Day 2020)

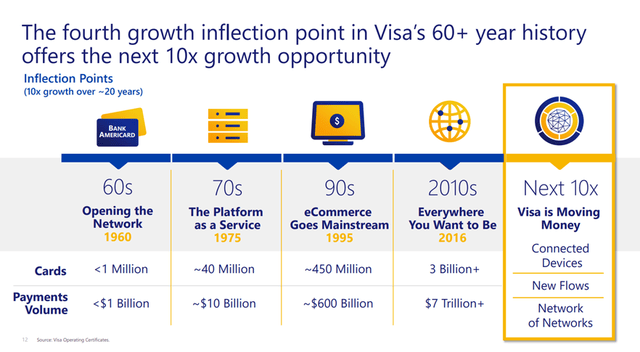

Visa has actually taken its investors on a significant journey, and in numerous methods thanks to the basic and instinctive nature of their item.

If I were to sum up a few of the selling points for why a business like Visa is required in this world, I ‘d appear like the following

- Customers desire a more smooth experience as soon as very first appearing. Acquiring money is a trouble and time can be conserved from merely swiping your card at the shop.

- Services pay considerable expenses associated to dealing with money and saving it securely. They risk of theft, however if there is no money, there isn’t much for a burglar to pursue. In the last years, banks began presenting cashless branches nationally in my nation, and in 2015, the quantity of bank break-ins had actually fallen 84.4%. Consider that for a 2nd.

- Federal governments wish to have the ability to track cash deals both to prevent cash laundering however likewise to guarantee earnings are taxed. It’s popular that big costs, such as the EUR 500 expense, is utilized for unlawful functions.

- The little do it yourself coffee & & ice cream stand in the regional park wish to have the ability to get payment from clients however can’t manage to bring considerable quantities of modification. Here, digital payment as soon as again makes it simpler for both celebrations.

The list goes on, and I make certain you can develop comparable examples to highlight simply why digital kinds of payment develops worth for both sides of the deal.

Visa Development Inflection Point (Visa Financier Day 2020)

There comes a day where development will stall, and as is constantly the case in the stock exchange, it will be a surprise and the stock will take a huge pounding. Nevertheless, I do not personally see that as something that’s looming simply around the corner. However naturally, we never ever understand, however in my viewpoint, business structure for Visa is simply as alive today as it was back in 2015-2016.

Argument number 2: A strong management group

When I attempt to evaluate if a business has a strong management group, I examine a number of things. Naturally, any business the size of Visa will have a management group filled with individuals bring the greatest degree’s possible and great deals of sector associated experience prior to ever signing up with the greater tiers of management. That holds true for any business out there, so it does not truly always state much by itself.

When I initially began checking out Visa, the president at the time was Charles Scharf. I observed how he acted in conference calls and naturally compared that to the business efficiency. This was prior to I ended up being knowledgeable about the possibility of searching for Glassdoor evaluations, however I reached the conclusion that this man was the ideal individual to guide the ship. Quickly after I chose to invest, he resigned his position on his own terms as he concluded he could not commit adequate time which the business required somebody who could. Alfred Kelly Jr. took control of in December of 2016 and held the position till simply recently, and he likewise did an excellent task seen from the beyond an amateur financier. The brand-new CEO, Ryan Mcinerney took control of February this year, so I have not had much possibility to truly observe him yet. In my time as a Visa investor, the board of directors has actually shown efficient in choosing people who the basic staff members might rally around, which’s simply as essential, and I’m positive they have actually done so as soon as again. What I like about having actually offered Ryan the chance is initially of all that he’s from inside the business and second of all that he utilized to run the global operations of Visa. And where does the chance lie once again for Visa moving forward? A huge piece of it will be globally.

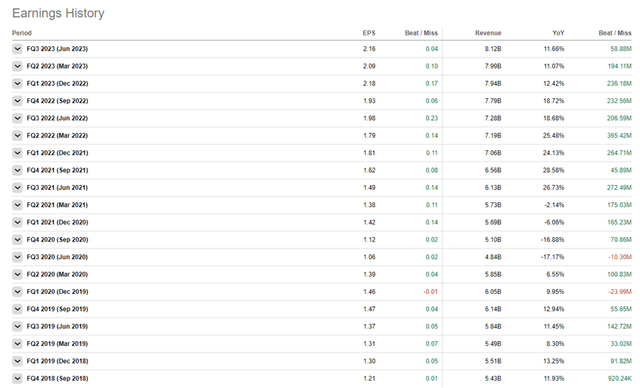

In essence, I think about a management group strong when they under guarantee and regularly overdeliver.

This is finest seen by taking a look at the incomes history. I do not desire management groups who begin empire structure such as performing worth ruining acquisitions or fattening the business to the point where it starts deteriorating margins. No, I wish to see the business grow its operations beneficially.

Visa Revenues History (Looking For Alpha)

In the illustration above, you can see the incomes history for Visa over the previous twenty quarters. Green shows a beat of the agreement expectations while red shows a miss out on. It’s clear to me how this business typically carries out.

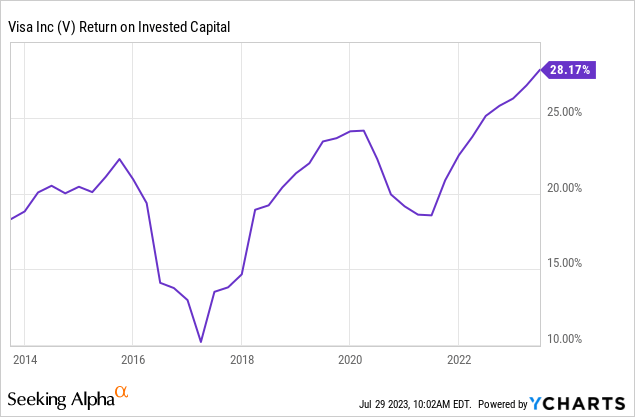

There is likewise one monetary metric I constantly take a look at, which is return on invested capital (‘ ROIC’). Essentially, it uses a point of view on the efficiency of a management group in assigning capital to lucrative endeavors. How effective the business remains in assigning the capital under its control. Likewise, to financiers, a business can just designate its capital as soon as. Then you might have the ability to recover it through possession sales, however even if that is possible, it constantly comes at a cost or loss compared to your initial expenses associated to developing that possession.

For That Reason, this is a crucial criterion for me, informing me a lot about how capable a management group truly is. It can be tough to compare such a monetary metric throughout sectors and even within a provided sector, however the essential thing is that the ROIC exceeds the expenses associated to acquiring capital, be it financial obligation or equity. I choose to observe a ROIC in excess of 15%. Thankfully for me, Visa still provides on this criterion. A little benefit information is, that Mastercard in fact does much better than Visa on this criterion.

Argument number 3: Business operations relocating the ideal instructions

Here we’re taking a look at a variety of things. Ideally, whatever is as I ‘d like, however often I need to accept some unpleasantries at the expenditure of still investing. No business is ideal, and extremely couple of are close to. Summing up, it boils down to a few of the following elements.

- A strong balance sheet suggesting a restricted quantity of financial obligation, goodwill not surpassing equity supplemented by a net money position if possible

- Strong credit score by the acknowledged companies.

- Complimentary capital favorable

- Strong operating margins, more suitable broadening in time as the business grows

Visa brought no long-lasting financial obligation back in 2015, however today brings $20.5 billion TTM. Goodwill comprises $18 billion which is well listed below equity being available in at $37.2 billion. I’m constantly taking a look at goodwill, as it is among the very first things on a balance sheet to frequently show useless in a scenario where a business ends up being destressed. Your financial obligation is sculpted in stone, lenders desire their cash, while goodwill is soft as butter. Lots of possessions bring some sort of worth, however goodwill is simply the approximate worth the business slapped onto something they frequently obtained, and maybe paid too much for. It’s downright harmful if goodwill comprises a considerable quantity of the balance sheet, a minimum of seen from my viewpoint. Finally, Visa presently holds $18.8 billion in money and short-term financial investments, which indicates it practically brings a net money position. For that reason, it’s likewise of little surprise that the score companies offer Visa with a steady and strong credit score in the ‘A’ bracket.

The balance sheet these days, isn’t considerably various from when I initially invested, and I’m happy to be able to make that conclusion.

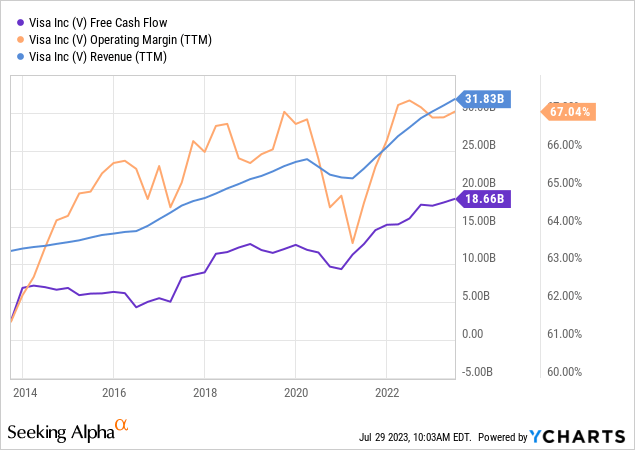

When it concerns organization operations, a great deal of favorable modification has actually occurred given that I initially developed my position. Profits has more than doubled, and the yearly totally free capital has actually increased more than 3 times. The business has actually handled to broaden its margins by a fair bit, as shown by the operation margin in the chart. This is downright excellent, and it speaks into the extremely strong market position of Visa. I would nevertheless beware in anticipating the business to be able to broaden margins even further from their present level.

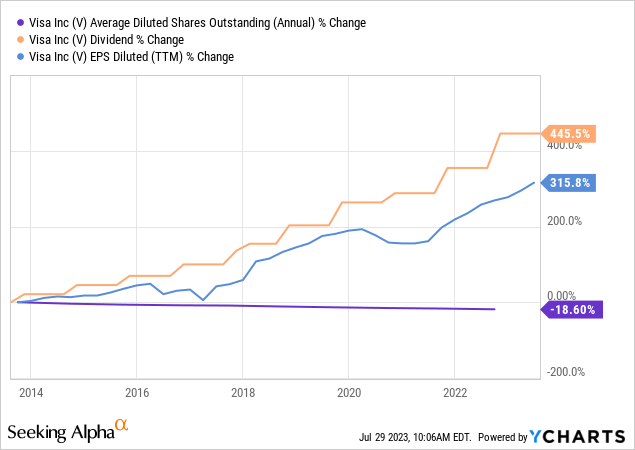

Running a service with strong incomes power and sensible capital allotment enables performing investor friendly activities. Visa has actually handled to redeem a reasonable piece of its own shares in the previous years, grown the dividend enormously and seen its EPS broaden along the method.

In a positive viewpoint, Visa isn’t anticipated to slow its development. Both earnings and EPS is anticipated to grow in excess of 10% every year for the coming 3 This is naturally far more intriguing than the historic efficiency for those who would think about ending up being Visa investors today.

The Assessment

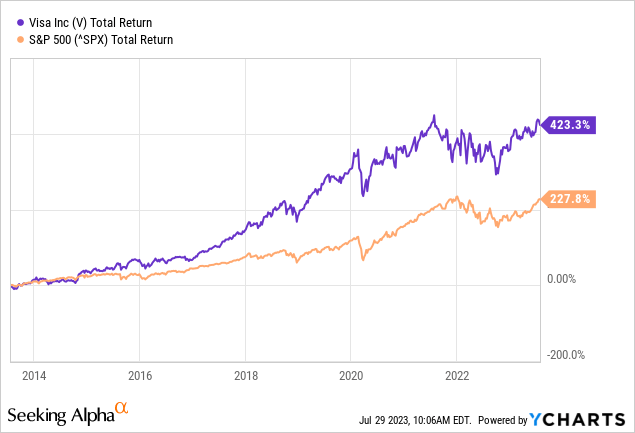

Visa was never ever low-cost, and it isn’t low-cost today either. That’s a dilemma associated to purchasing this business. It’s acquired a strong duopoly like market position, strong incomes power and a terrific outlook. Wall Street understands it and the stock is priced appropriately. Visa has actually beaten the more comprehensive index over the previous years even in spite of having actually protected little gratitude given that 2021.

From my viewpoint, Visa holds the capacity for it to stay a market beating stock due to the abovementioned factors I have actually gone through.

If I discover myself in a scenario where a stock is pricey, as I think Visa is. I dollar expense typical my method into the business. Either I’m fortunate enough that the stock values, and I have actually handled to develop a position that’s increasing in worth, which I can then contribute to. Otherwise, I’m lucky enough that I didn’t toss whatever into the mix simply to experience the stock decrease 25% over a brief preliminary duration, which would permit me to decrease my typical expense. The assessment isn’t a yelling buy, and it never ever has actually been with Visa. That becomes part of what we as financiers should accept if we wish to go long the business. There is a premium to be accepted for a business with such excellent efficiency

If the positive agreement expectations are satisfied, the business will continue becoming its assessment, as it has actually done over the previous 10 years, however the future stays unpredictable, like it did 10 years back.

Takeaway

The arguments that obliged me to purchase Visa back in 2016 are simply as appropriate today. The business has actually provided excellent outcomes for the previous several years thanks to a strong market position, strong and sensible management in addition to a market that continues to provide an appealing outlook.

For financiers who are on the threat averse part of the spectrum nevertheless, Visa can be a complicated deal, as it continues to trade at a high assessment. Nevertheless, it’s likewise a market beating stock, that has actually continued to surpass the more comprehensive index, while becoming its assessment.

If the scenarios surrounding Visa hasn’t altered significantly, with the future outlook still looking like appealing, then it might be worth thinking about challenging oneself in regards to whether this stock could not play a value-adding part in one’s portfolio, in spite of the present assessment. It has actually done so in mine for several years, however it just did so as I handled to challenge my own threat averse nature and invest with regard to guaranteeing I had a varied portfolio in the circumstance that I was incorrect. I chose a dollar cost typical method, and I think that’s a reasonable method to acquire direct exposure moving forward.