Robert Method

Financial investment thesis

Our existing financial investment thesis is:

- BOSSY remains in the middle of a change job, looking for to accommodate existing patterns under 2 unique brand names. Although we comprehend the goal and think it will be useful in the near term, we are not extremely bullish as it seems like trend-chasing.

- Economically, BOSSY stays unappealing due to margin dilution. This stated, Q1 looks positive that an enhancement can be made in the coming quarters.

- BOSSY’s evaluation does not recommend upside at its existing cost when considering its weak point relative to peers.

Business description

Hugo Manager ( OTCPK: BOSSY) is a German high-end style brand name that focuses on premium menswear, womenswear, and devices. With an abundant history going back to 1924, the business is renowned for its advanced styles, workmanship, and attention to information.

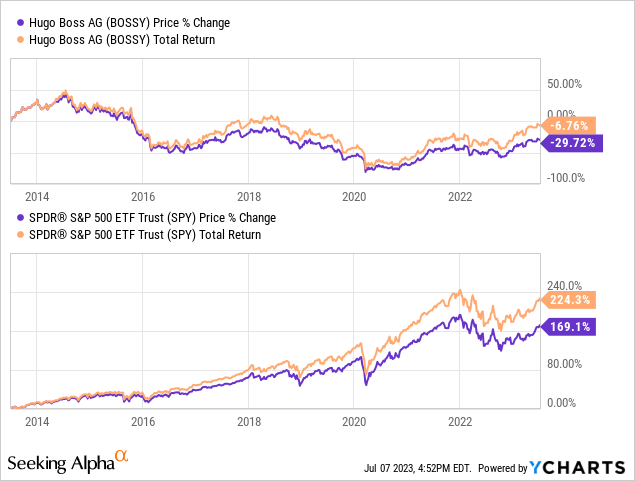

Share cost

BOSSY’s share cost has actually carried out inadequately in the last years, as decreasing monetary weak point has actually added to a duration of lost market share. BOSSY has actually dealt with increased competitors and altering market characteristics and has actually been not able to effectively react so far.

Monetary analysis

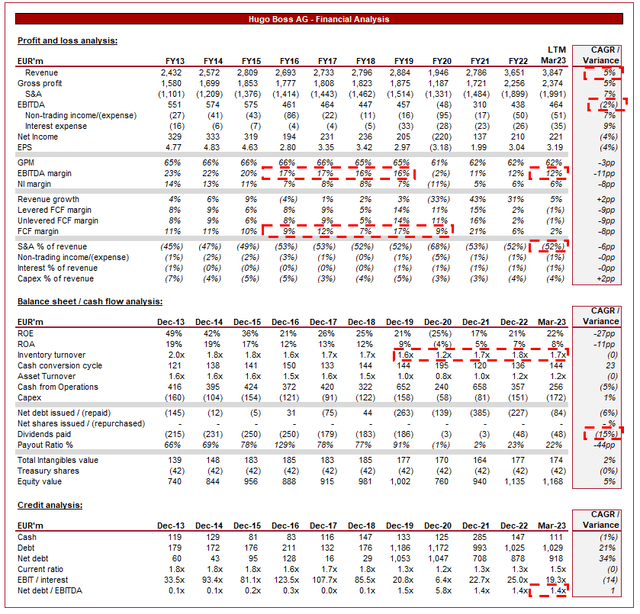

Hugo Manager financials ( Capital IQ)

Provided above is BOSSY’s monetary efficiency for the last years.

Income & & Commercial Elements

BOSSY’s income has actually grown at a moderate 5% over the last ten years, a decent level provided the increased competitors dealt with (which we will talk about later on). Throughout this duration, income development has actually been fairly constant, with just one duration of unfavorable development (excl. the effect of Covid-19).

Company Design

Hugo Manager provides an extensive variety of style items, consisting of customized matches, casualwear, shoes, devices, and scents. The business’s focus is on “entry-level” high-end, targeting critical clients who value quality, design, and exclusivity. This stated, BOSSY likewise runs in the more standard mass-market section with more budget friendly items.

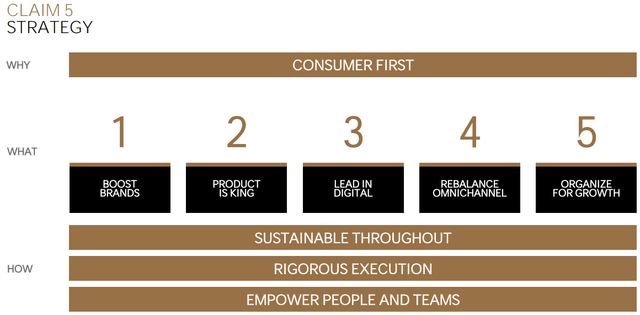

Management has actually been performing a change workout, looking for to much better position BOSSY in the existing market. This includes its “Claim 5” technique, looking for to enhance its brand names, establish much better items, and establish its functional ability. The objective being to set the business on a sustainable upward trajectory.

Technique ( Hugo Manager)

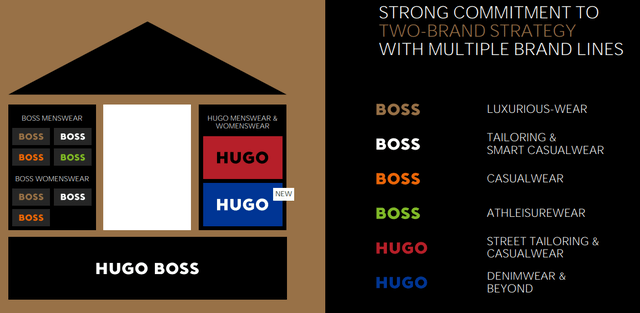

BOSSY has actually established its brand names into 2 unique offerings (having actually performed numerous refreshes and modifications over the years). To start with, there is “MANAGER”, which is the broad section however stays real to the “Hugo Manager” image. The goal here is to broaden its worth proposal throughout lots of growing sectors, looking for to record a bigger market share of the broader fashion business. We are not extremely crazy about this technique, as it feels somewhat “scattergun”. BOSSY is basically trying to record every section, no matter if its brand name fits.

Second Of All, “HUGO”, which is the more easygoing technique, targeting the streetwear, casual, and jeans sectors. All 3 have actually carried out exceptionally well in the last years, with streetwear ending up being the top-dog. This is a much-needed advancement for BOSSY provided much of the standard high-end brand names like Louis Vuitton ( OTCPK: LVMHF) have actually integrated streetwear into their style approach. BOSSY has actually done a much better task with targeting this section, nevertheless, at its existing cost point, the business is dealing with major competitors from the standard high-end brand names.

Brand Names ( Hugo Manager)

Although the instructions feels needed, the execution is extremely complicated. The concept of one brand name called “Hugo” and the other called “Manager” is longstanding going back to 1997 (although somewhat puzzling in itself). Nevertheless, with the color pattern and item growth for each subgroup, it seems like BOSSY is attempting to do whatever while losing concentrate on its core clients. We are having a hard time to see what the style approach is now, as it seems like each section is looking for to duplicate the most popular item on the marketplace. Lastly, there are lots of item styles which are overlapping in both, such as shoes and boots, blurring the distinction.

Intensifying our sensation that BOSSY looking for to follow patterns is its brand-new logo design that is because of be introduced. The print due to launch in 2024 looks rather comparable to Burberry ( OTCPK: BURBY) monogram that was introduced numerous years back. This is not to recommend BOSSY copied the style however we are not seeing anything advanced from business. This seems like another effort at developing an effective monogram, however does not have the layers and intricacy of the Burberry one, looking fundamental in contrast.

On a favorable note, our company believe the standard Hugo Manager style of customized elegance might be rising. In the in 2015 or more, there has actually been a silently establishing modification in the high-end market, with customers significantly turning down logo designs for properly designed, top quality, customized clothes, looking for shapes over brand names. This has actually been described as “Peaceful Style”, promoted by the struck program Succession BOSSY seems placing itself to exploit this, as highlighted by the screenshot listed below of its ambassadors.

Even more, targeting emerging markets and broadening its retail existence in these nations continues to be a development location of the business, as an ever-growing middle class needs Western products. We anticipate a bump from China, as financial conditions in the nation enhance following a constant series of lockdowns in 2022.

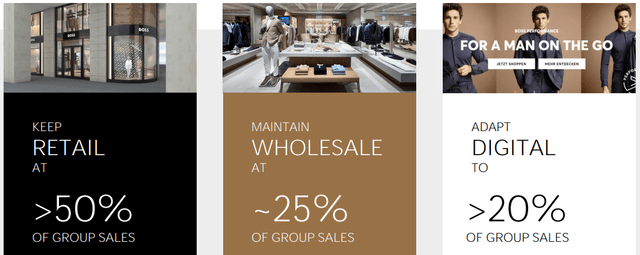

The business runs through numerous channels, consisting of owned retailers, outlet store, e-commerce platforms, and wholesale collaborations. BOSSY has actually concentrated on establishing its e-commerce abilities, as increased competitors has actually required business to look for brand-new methods of recording customers. The worth of offering to clients straight is enhanced margins, so it is crucial from a monetary point of view, likewise. Presently, c. 75% of sales are through its own channels, a healthy level in our view. Business does not wish to shift too far from wholesale, as this section supplies marketing through retail area and likewise certainty over need.

Circulation channel ( Hugo Manager)

The business preserves control over its production procedures and leverages its proficiency in products, style, and making to provide top quality items. This is crucial for BOSSY to preserve its high-end image, as it otherwise deals with dilution through the goal of cutting expenses.

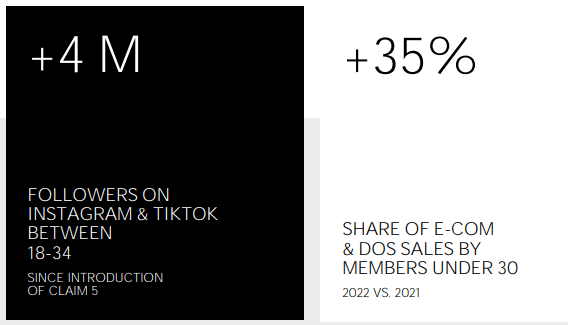

As part of its change, Management has actually looked for to enhance its social networks existence. This is an important goal they should perform, as social networks significantly drives customer tastes and patterns. Given that the initiation of the existing technique, BOSSY has actually registered numerous extremely prominent ambassadors, consisting of the most followed Tik Tok’ er, Khaby Lame.

This has actually produced 4m+ social networks fans and a fast boost in online sales. The e-commerce section is 25% of income which suggests additional advancement is needed, however this is a favorable advancement.

Fans ( Hugo Manager)

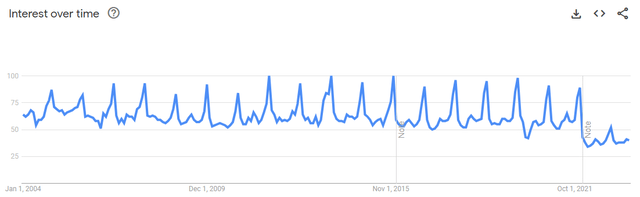

Utilizing our own test of customer interest listed below, which thinks about Google impressions,, there does not appear to be a product boost in interest, indicating the existing efforts so far have actually been to preserve the status quo.

Hugo Manager ( Google Trends)

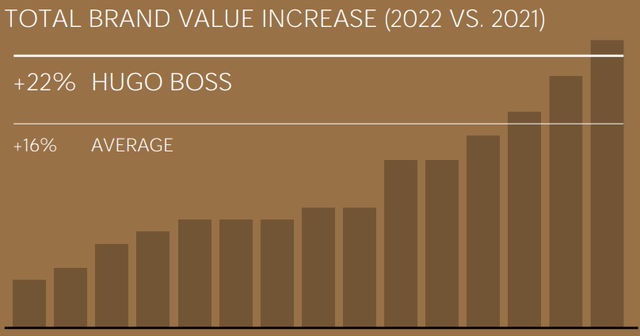

Management quote that the Hugo Manager brand name has actually increased 22% in worth considering that 2021, compared to 16% in the market.

Brand name evaluation ( Hugo Manager)

Economic & & External Factor To Consider

The existing financial conditions provide a prospective danger to BOSSY. The mix of raised rate of interest and high inflation is a dish for customer costs downturn, with discretionary purchases inescapable to secure financial resources. Nevertheless, it is very important to keep in mind that the existing financial weak point varies from previous recessions due to high work and resistant costs.

In the most current quarter, BOSSY experienced 25.4% YoY development however from a low level a year prior. This quarter’s income is partially up on Q3′ 22, indicating an extension of the existing pattern, although at a slower level.

This suggests financial conditions are most likely weighing on business however not to the degree that a decrease is an issue. BOSSY is because of launch its revenues in the coming days and we are anticipating a great proving (MSD-HSD), and with much of its peers having a hard time for development, this would indicate market share development. The brand-new instructions of business and marketing push is undoubtedly developing some buzz around business, which is well timed to buffer the financial conditions. Experts are directing 12% for FY23 with the existing LTM up 5%, lining up with our view.

Margins

BOSSY has actually dealt with margin disintegration following the Covid-19 duration, with GPM decreasing to 62% and EBITDA-M down to 12%.

The business has actually dealt with a variety of adversely intensifying aspects, consisting of inflationary pressure, increased discounting, and increased S&A financial investment to support its transformational efforts. In Q1-23, EBITDA-M enhanced to 15%, indicating business is presently experiencing a degree of enhancement currently, although we are yet to see the sustainability of this.

Balance sheet & & Money Flows

BOSSY’s balance sheet is relatively uneventful. The business is conservatively funded, minimizing any drawback danger. Even more, stock turnover has actually gone back to pre-Covid levels, indicating strong stock management at a time when development is unstable. Lastly, circulations have actually let to go back to pre-Covid level, as money is purchased operations.

Market analysis

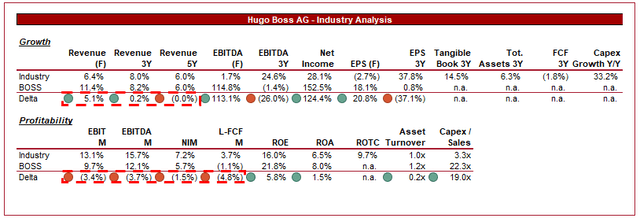

Fashion business ( Looking For Alpha)

Provided above is a contrast of BOSSY’s development and success to the average of its market, as specified by Looking for Alpha (33 business).

BOSSY’s development is equivalent to its peers, with practically similar historic income development, although the projection duration is anticipated to be exceptional. Its success gains have actually been bigger, however this is a reflection of its substantial weak point formerly.

Success, nevertheless, is far even worse. Even if the business was to go back to its FY19 level, this would just leave business at parity.

Based Upon this, our company believe BOSSY ought to trade at a discount rate to its historic average and peers, showing the existing underperformance and execution danger related to enhancement back to its FY19 levels (not to mention surpassing this, which Management is targeting).

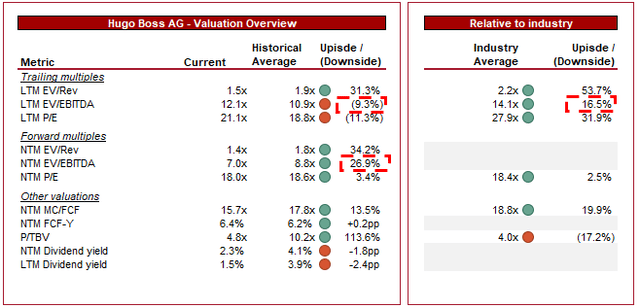

Assessment

Assessment ( Capital IQ)

BOSSY is presently trading at 12x LTM EBITDA and 7x NTM EBITDA. This is a contrasting evaluation of its existing position relative to historicals.

The NTM EBITDA evaluation looks positive, with EBITDA-M anticipated to enhance to c. 19% according to Wall St analysis ( Source: Capital IQ). Offered the Q1 ’23 EBITDA-M is 15%, this suggests a fast enhancement in the coming quarters. Management has actually updated its assistance and is favorable on the advancement of business however we are not extremely positive to this level.

From an LTM point of view, BOSSY is trading at a 17% discount rate to its peers. Our company believe this is extreme, specifically when thinking about the margin enhancement in Q1. This stated, the benefit is most likely not significant (<< 10%). Offered the development staying, we do not think this to be adequate.

Last ideas

BOSSY has probably over-engineered its existing technique in our view. The numerous brand name lines listed below the 2 crucial brand names feel dilutive to its brand name image. Even more, the item advancement is not extremely outstanding. This stated, BOSSY is doing the best thing to take advantage of buzz, be it through its ambassadors or technique to developing items. This wants to have actually produced near-term enhancement.

Economically, the enhancements have yet to be completely seen, although there is some proof to be positive. At its existing evaluation, we do not think there suffices benefit to take part in the extension of its change.

Editor’s Note: This short article talks about several securities that do not trade on a significant U.S. exchange. Please know the dangers related to these stocks.