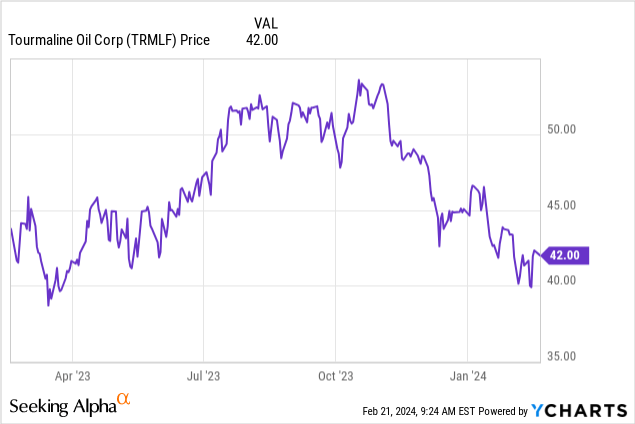

wenbin/Moment through Getty Images YCharts

In my newest upgrade on Tourmaline Oil Corp. ( OTCPK: TRMLF), Canada’s biggest gas manufacturer and a substantial gamer in gas processing and midstream operations, the business continues to show strength in the middle of the depressed gas market. Its existing assessment and rebound potential customers make the stock a STRONG BUY, as I argue listed below.

Tourmaline has actually differentiated itself not just as Canada’s biggest gas manufacturer however likewise as a business with incredibly low capital expenses, especially within the Alberta Deep Basin. This tactical benefit is important, particularly when thinking about that around 80% of Tourmaline’s output is gas.

Tourmaline can sustain its development and upkeep capital investment, together with its dividend payments, at a gas cost limit of US$ 1.50 per thousand cubic feet (mcf). In truth, Tourmaline has actually approximated that it will still produce near C$ 3 billion in capital at a US$ 1.50 gas cost for 2024 (slide 28 of its business discussion).

The gas sector has actually just recently dealt with substantial cost decreases, with Tourmaline’s stock consisted of. Nevertheless, the business’s rock-solid balance sheet, and cost-efficiency put it in a beneficial position to weather these declines.

For financiers, the existing low assessment, together with its strong development potential customers, makes the stock a really interesting bet.

What’s happening with gas?

It’s merely a supply and need story. Constant boosts in production, especially from oil business that produce gas as a by-product of oil, have actually resulted in an oversupply in the market This excess has actually put gas manufacturers at a downside in contrast to oil manufacturers.

The last couple of months have actually been difficult for business in the gas market. Rates have actually dropped more than 50% compared to in 2015, reaching their least expensive in over 3 years.

As an outcome, some gas manufacturers have actually needed to shut down wells, stop jobs, or combine with other business to avoid monetary losses. However there may be a light at the end of the tunnel.

On February 21, there was a tip that things may be beginning to reverse. Gas rates increased to $1.73/ mcf, an almost 10% boost in simply one day. This dive came right after Chesapeake Energy ( CHK), a significant U.S. gas manufacturer, stated it was cutting down on production

Chesapeake strategies to invest 20% less this year on keeping its production steady, which will lower its everyday production to about 2.7 billion cubic feet comparable (bcfe), below 4.05 bcfe in 2015.

This might be an essential minute for the gas market, revealing that rates may be beginning to support and even return up from here. For a business like Tourmaline, with its low expenses and strong balance sheet, this might be a terrific opportunity to purchase for financiers.

Purchasing Tourmaline stock now, while rates are low, might settle if the marketplace enhances, as numerous anticipate it to. For one, the U.S. Energy Administration anticipates a typical cost of $2.94 in 2025.

Tourmaline’s bullish upgrade

Tourmaline Oil reports that it is off to a fantastic start in 2024, keeping its everyday production well above 600,000 barrels of oil equivalent, that includes a strong 150,000 barrels of liquids. The business is running at complete capability, utilizing all 16 of its drilling rigs for the early 2024 expedition and production efforts.

The business continues to focus on creating complimentary capital, simply as it carried out in 2023. It’s carefully monitoring its costs and the marketplace rates for gas, prepared to change its strategies to remain effective and lucrative.

Tourmaline has actually skillfully secured a cost of C$ 5.28 per thousand cubic feet for 724 million cubic feet of its everyday gas production for the year, safeguarding it versus market swings. At the very same time, it’s placed to take advantage of greater rates in worldwide markets with 959 million cubic feet of its everyday production.

Tourmaline likewise just recently secured substantial long-lasting melted gas offers, consisting of a seven-year contract with Trafigura Pte Limited set to start in January 2027. This relocation, together with another contract connected to Dutch TTF index rates beginning in March 2024, signals Tourmaline’s aspirations to reinforce its worldwide market existence.

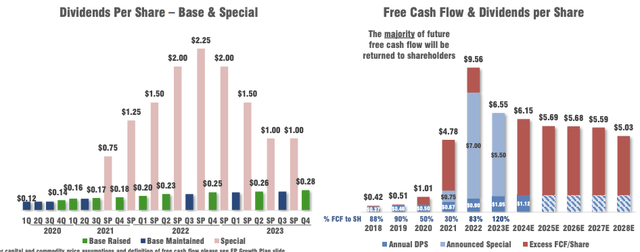

Tourmaline’s investor returns ( Tourmaline Oil )

From a monetary perspective, Tourmaline states that it is set to reward its financiers with 4 quarterly unique dividends in 2024 in addition to its routine dividends. (This follows a year in which it paid $5.50 in unique dividends.)

It stated it prepares to pay 4 quarterly unique dividends this year – in addition to the quarterly base dividend. That suggests its existing yield of 1.84% will likely be much greater, as that just consists of the routine dividend. (Its four-year typical yield is 7.27%, according to Looking for Alpha).

Lastly, the business is likewise aiming to offer the Duvernay possessions it got from Bonavista Energy Corporation. These actions, together with its effort to keep a low net financial obligation to capital ratio, use a really favorable outlook for the business.

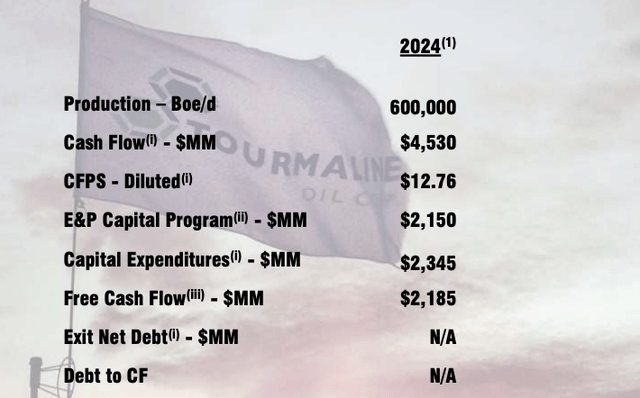

2024 assistance

Tourmaline’s assistance, which was launched in late 2023. ( Tourmaline Oil)

For this year, the business approximates that it will produce 600,000 Boe/d, and, presuming a full-year gas cost of $3.62/ mmbtu, it would produce $4.5 billion in capital, $2.1 billion in complimentary capital, and leave the year with capital per share of $12.76.

The balance sheet: It remains in fantastic shape

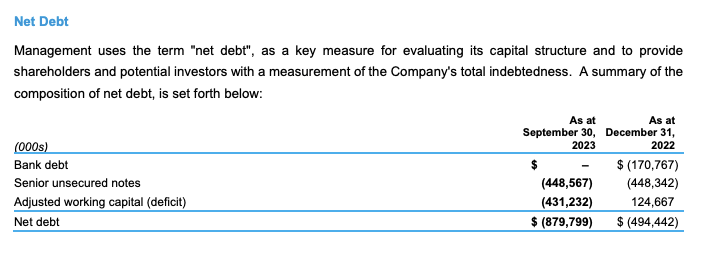

Tourmaline’s balance sheet ( Tourmaline)

Tourmaline Oil sticks out in the oil and gas sector with an incredibly strong balance sheet

At the close of the last quarter, the business reported no impressive quantities on its revolving credit center, with its overall financial obligation making up $448.6 million in senior unsecured notes.

This brought the net financial obligation to $879.8 million since September 30, 2023, a figure that takes into consideration numerous monetary instruments and responsibilities. It stays remarkably low, particularly due to the business’s significant assessment of around C$ 20 billion and its robust capital, which struck $882 million in 2023.

Furthermore, Tourmaline has a substantial financial investment in Topaz Energy ( TPZ), which was valued at $616 million by the end of Q3 2023.

This strong monetary position is substantial, as it not just permits Tourmaline to browse through durations of low gas rates, however likewise to continue gratifying investors through dividends and share buybacks.

It likewise supplies the business with adequate capability to reinvest in its operations and pursue development chances. A prime example of its tactical development efforts is the acquisition of Bonavista Energy in October for C$ 1.45 billion (around US$ 1.06 billion). This wise relocation becomes part of its debt consolidation technique in the Deep Basin in Western Canada. When gas rates ultimately rebound, Tourmaline will likely be a capital maker.

Exceptional development most likely coming

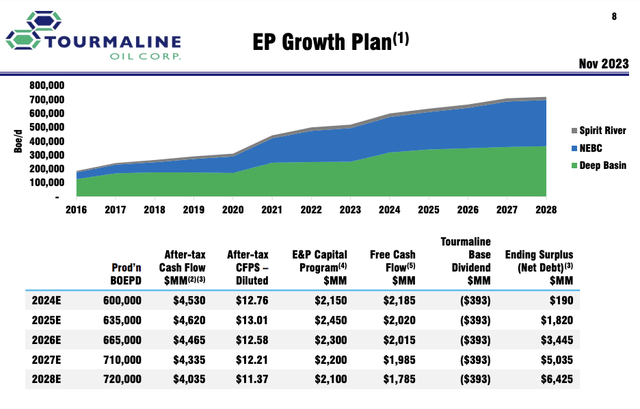

Tourmaline’s 5 year strategy. ( Tourmaline)

Tourmaline Oil is setting its sights on significant development over the next 5 years, with strategies to increase production by a cumulative 20% from 2024 to 2028.

This development trajectory begins with a base of 600,000 barrels of oil comparable daily (boe/day) in 2024– a figure that currently consider the contributions from the just recently gotten Bonavista Energy– and intends to reach 720,000 boe/day by 2028.

With gas rates approximated at $4, Tourmaline jobs creating more than $ 4 billion in post-tax capital yearly over this duration. By the close of 2028, the business is poised to build up a money surplus of $ 6.425 billion, presuming its enthusiastic production targets are fulfilled, and market conditions agree with.

Obviously, provided Tourmaline’s robust monetary health and tactical concentrate on development, it would not be unexpected to see the business utilize its strong position to grab extra oil and gas possessions at appealing rates. Such tactical acquisitions might even more improve Tourmaline’s inexpensive development design and additional increase its capital.

Tourmaline: It’s a Buy

Tourmaline Oil provides an engaging financial investment chance, trading at appealing assessment metrics consisting of a price-to-earnings (P/E) ratio of around 12, a forward P/E of 7.55, and a 2024 business worth to incomes before interest, taxes, devaluation, and amortization (EV/EBITDA) ratio of 4.89, according to information from Looking for Alpha and Yahoo Financing.

The business has fantastic development potential customers, reinforced by its robust monetary position, ownership of cost-effective possessions, and a dedication to gratifying investors with a substantial routine and unique dividend. Lastly, the current decline in gas rates might be nearing an end, signified by production cuts from significant gamers in the market.

Offered these beneficial conditions– strong development potential customers, strong monetary standing, and market assessment– Tourmaline Oil is now ranked as a STRONG BUY.

Editor’s Note: This short article talks about several securities that do not trade on a significant U.S. exchange. Please understand the dangers connected with these stocks.