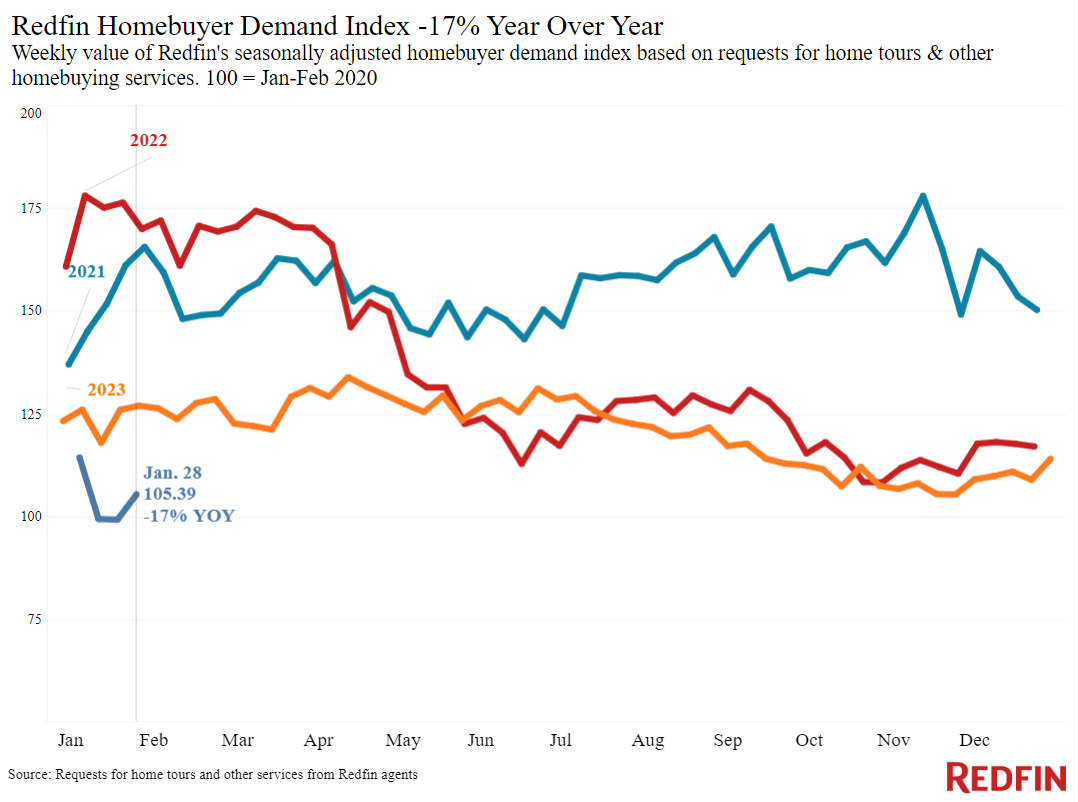

Redfin’s Property buyer Need Index, which determines ask for home trips and other services from Redfin representatives, is ticking up as the spring home-selling season draws nearer. That hasn’t yet transformed to a significant enhancement in pending sales– however Redfin representatives anticipate it will in the next couple of months.

Some home hunters are dipping their toes back into the marketplace after severe winter season weather condition froze them out at the start of January. Redfin’s Property buyer Need Index– a procedure of ask for trips and other purchasing services from Redfin representatives– increased 6% from a week previously throughout the week ending January 28, and a different procedure of provings likewise signals they have actually ticked up over the recently.

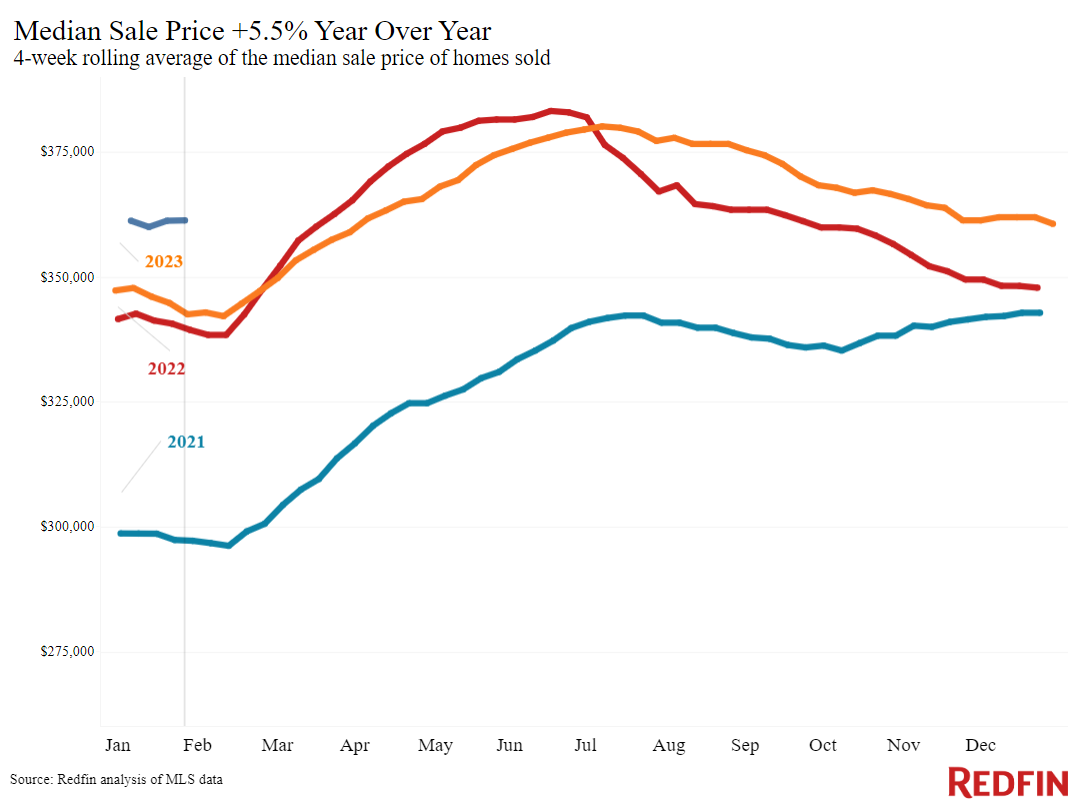

More purchasers are visiting homes due to the fact that home mortgage rates are holding stable listed below 7%, below 8% this previous October, and some purchasers are concerned costs will increase more if they wait longer. List price increased 5.5% year over year throughout the 4 weeks ending January 28, the greatest boost in over a year.

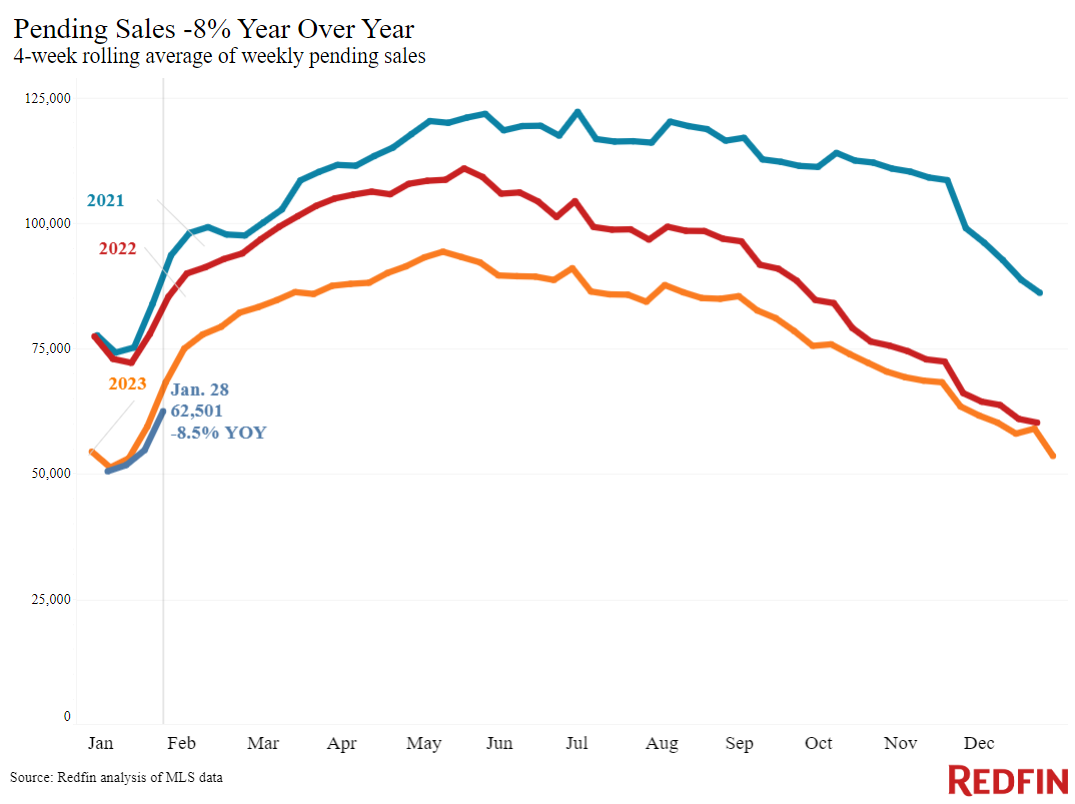

However that earliest-stage need hasn’t yet equated into home sales. Mortgage-purchase applications decreased from a week previously and pending sales published their greatest year-over-year decrease in 4 months, most likely showing warm early-stage need throughout the middle of January. Home trips and other actions purchasers generally take in the past getting a home mortgage was lower than anticipated in mid-January as day-to-day typical home mortgage rates inched up from their December low point and extreme weather condition kept numerous potential purchasers in the house.

Redfin representatives anticipate the boost in trips to transform into an enhancement in pending sales over the next couple of months. That’s partially due to the fact that of common seasonality: Home listings and sales generally get as spring techniques.

” I believed decreasing home mortgage rates and more stock would trigger the marketplace to remove right at the start of the brand-new year. However although need has actually gotten some, I’m not wowed,” stated Hal Bennett, a Redfin Premier representative in the Seattle location. “Now I think this year’s market will introduce in the spring, as soon as 6% rates are a lot more established in purchasers’ minds and more house owners note their homes.”

Today’s financial news recommends that home mortgage rates are not likely to meaningfully fall in the next couple of months. At its interview on January 31, the Fed signified they’re not likely to cut rates of interest in March, which will most likely keep home mortgage rates raised near their present level into the spring, though Redfin economic experts still anticipate them to slowly decrease by the end of the year.

Leading indications

| Indicators of homebuying need and activity | ||||

| Worth (if suitable) | Current modification | Year-over-year modification | Source | |

| Everyday typical 30-year set home mortgage rate | 6.75% (Jan. 31) | Down from 6.95% a week previously | Up from 6.17% | Home Mortgage News Daily |

| Weekly typical 30-year set home mortgage rate | 6.69% (week ending Jan. 25) | Up from 6.6% a week previously, however near most affordable level given that Might | Up from 6.13% | Freddie Mac |

| Mortgage-purchase applications (seasonally changed) | Down 11% from a week previously; up 10% from a month previously (since week ending Jan. 26) | Down 20% | Home Mortgage Bankers Association | |

| Redfin Property Buyer Need Index (seasonally changed) | Down 3% from a month previously (since week ending Jan. 28) | Down 17% | Redfin Property Buyer Need Index, a procedure of ask for trips and other homebuying services from Redfin representatives | |

| Google look for “home for sale” | Up 25% from a month previously (since Jan. 27) | Down 16% | Google Trends | |

| Exploring activity | Up 9% from the start of the year (since Jan. 30) | At this time in 2015, it was up 5% from the start of 2023 | ShowingTime, a home visiting innovation business | |

Secret housing-market information

| U.S. highlights: 4 weeks ending January 28, 2024

Redfin’s nationwide metrics consist of information from 400+ U.S. city locations, and is based upon homes noted and/or offered throughout the duration. Weekly housing-market information returns through 2015. Topic to modification. |

|||

| 4 weeks ending January 28, 2024 | Year-over-year modification | Notes | |

| Average price | $ 361,245 | 5.5% | Most significant boost given that Oct. 2022 |

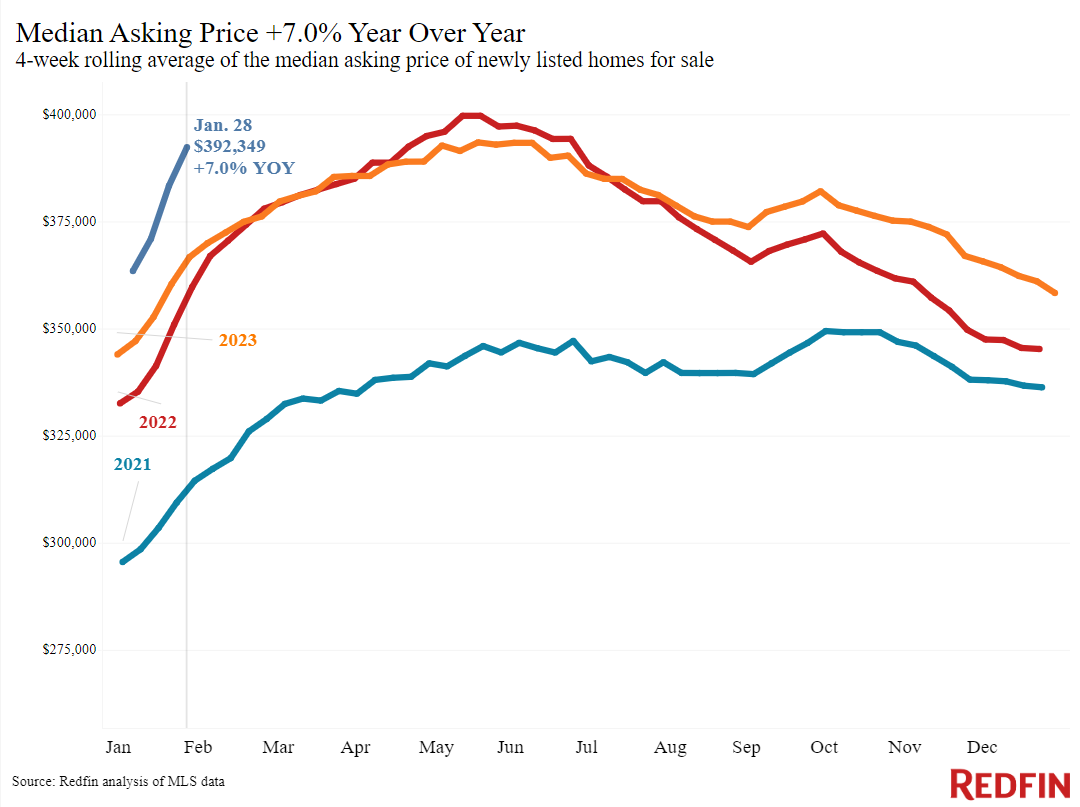

| Average asking cost | $ 392,349 | 7% | Most significant boost given that Sept. 2022 |

| Average month-to-month home mortgage payment | $ 2,595 at a 6.69% home mortgage rate | 12.3% | Down approximately $120 from all-time high set in October 2023, however up approximately $250 from the 4 weeks ending Dec. 31 |

| Pending sales | 62,501 | -8.5% | Most significant decrease given that October 2023 |

| New listings | 65,722 | 4.9% | |

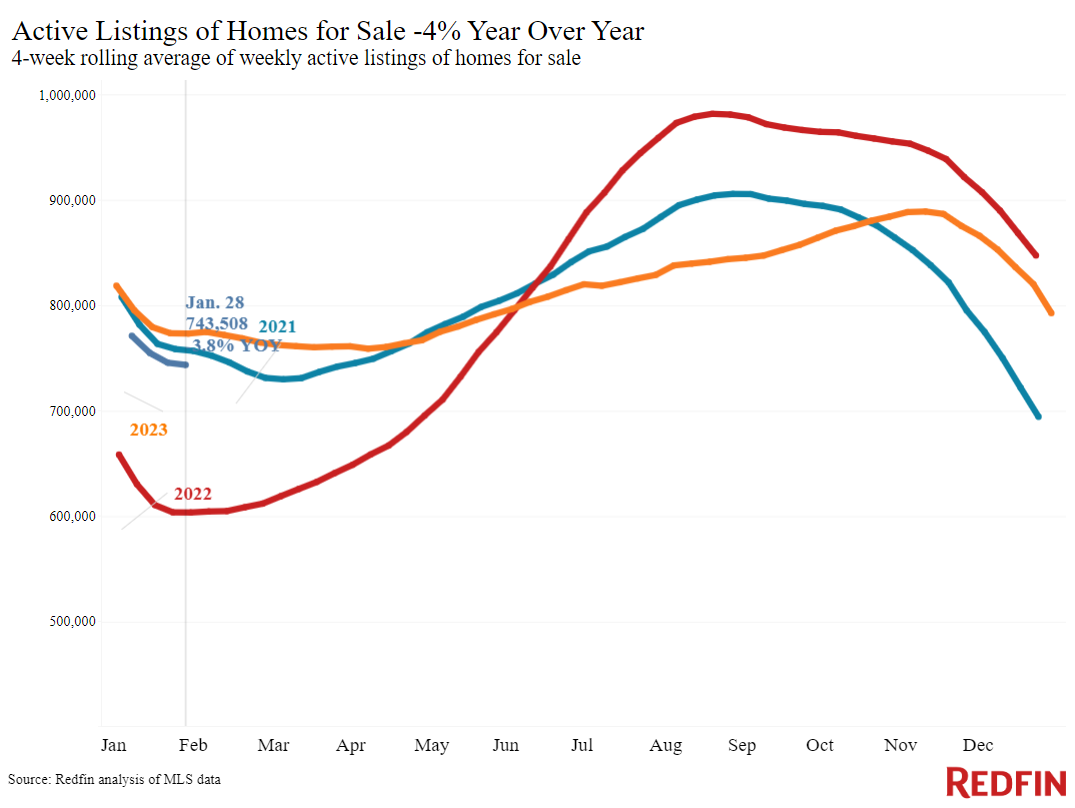

| Active listings | 743,508 | -3.8% | |

| Months of supply | 4.8 months | +0.2 pts. | 4 to 5 months of supply is thought about well balanced, with a lower number suggesting seller’s market conditions. |

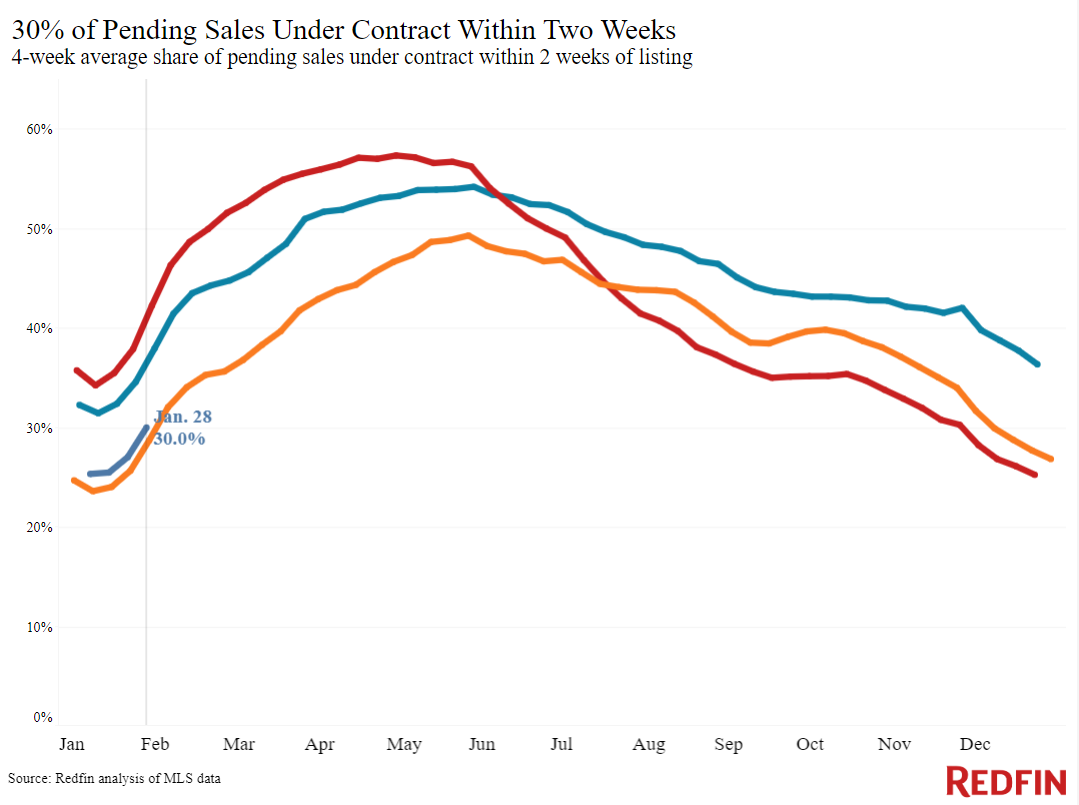

| Share of homes off market in 2 weeks | 30% | Up from 29% | |

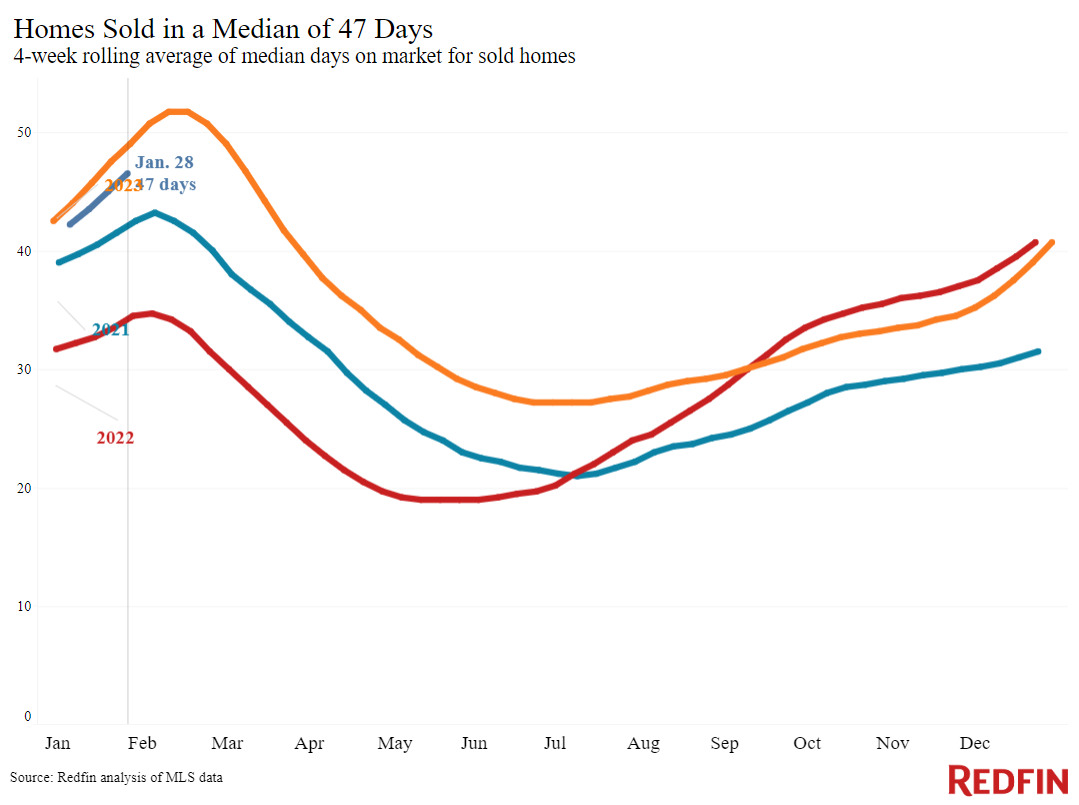

| Average days on market | 47 | -2 days | |

| Share of homes offered above sticker price | 22.8% | Up from 21% | |

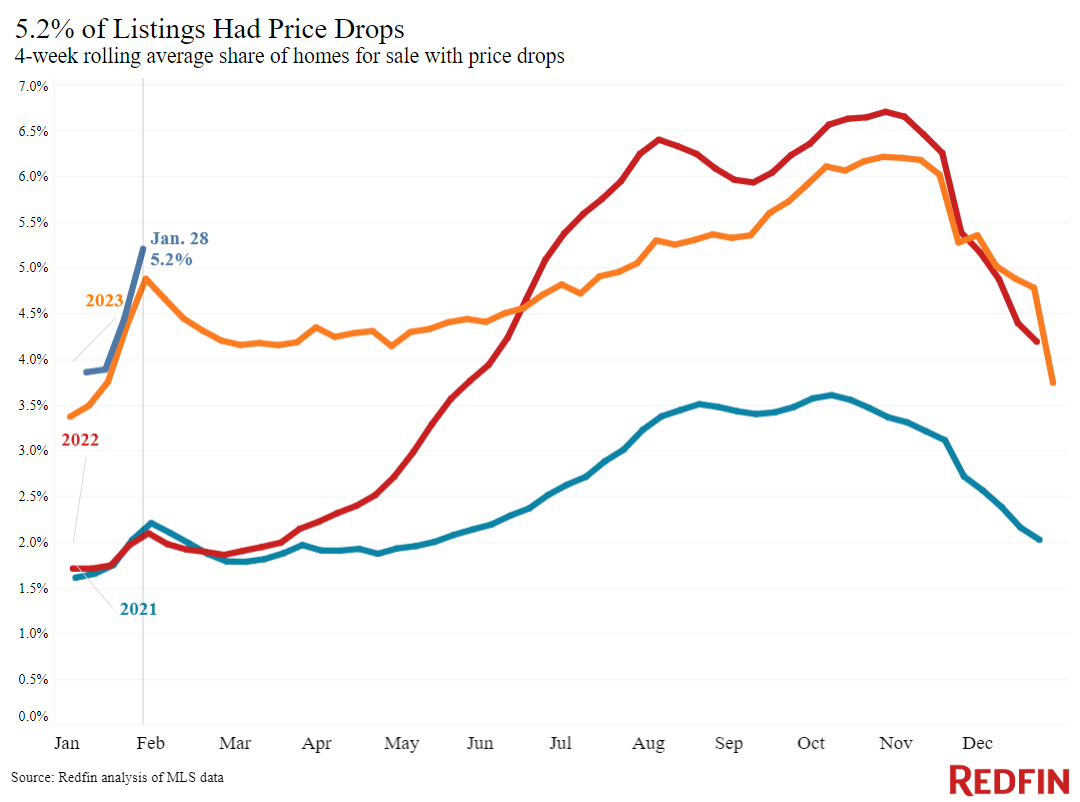

| Share of homes with a rate drop | 5.2% | +0.3 pts. | |

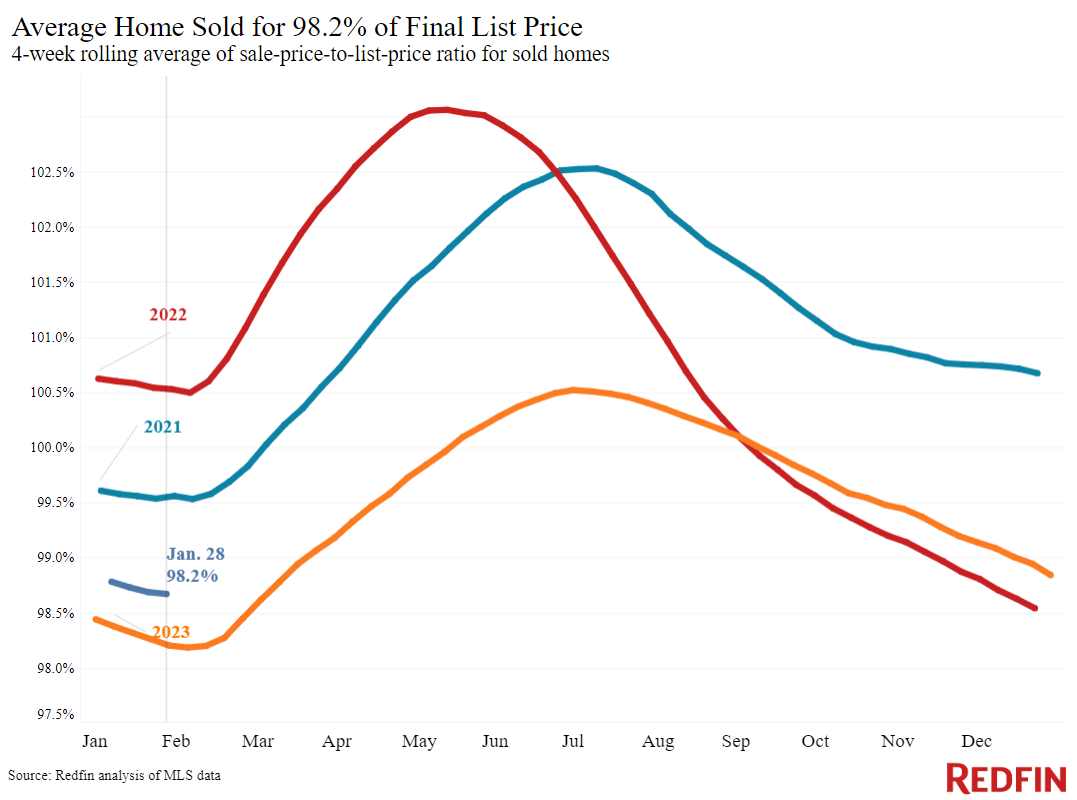

| Typical sale-to-list cost ratio | 98.2% | +0.5 pts. | |

|

Metro-level highlights: 4 weeks ending January 28, 2024 Redfin’s metro-level information consists of the 50 most populated U.S. cities. Select cities might be left out from time to time to make sure information precision. |

|||

|---|---|---|---|

| Metros with greatest year-over-year boosts | Metros with greatest year-over-year reductions | Notes | |

|

Average price |

Anaheim, CA (15.6%)

Miami (14.7%) New Brunswick, NJ (13.3%) West Palm Beach, FL (12.9%) Detroit (11.8%) |

Austin, TX (-5.6%) San Antonio, TX (-2.1%) |

Decreased in 2 cities |

| Pending sales | San Francisco (11.5%)

San Jose, CA (10.9%) Anaheim, CA (1.7%) |

Portland, OR (-31.2%)

San Antonio, TX (-31%) Denver (-30.6%) Nashville, TN (-18.7%) New Brunswick, NJ (-17.6%) |

Increased in 3 cities |

| New listings | Fort Lauderdale, FL (26.5%)

Phoenix (23.1%) San Diego, CA (22.6%) Miami (22.3%) Minneapolis, MN (19.9%) |

Denver (-20.8%)

Chicago (-18.7%) Atlanta (-15.9%) Portland, OR (-10.5%) Nashville, TN (-9.8%) |

Decreased in 16 cities |

Describe our metrics meaning page for descriptions of all the metrics utilized in this report.