New listings have actually struck their least expensive level of any early June on record, restricting house sales and keeping costs afloat. However numerous purchasers are still visiting houses, suggesting that we’ll see bottled-up need when home loan rates fall and provide enhances.

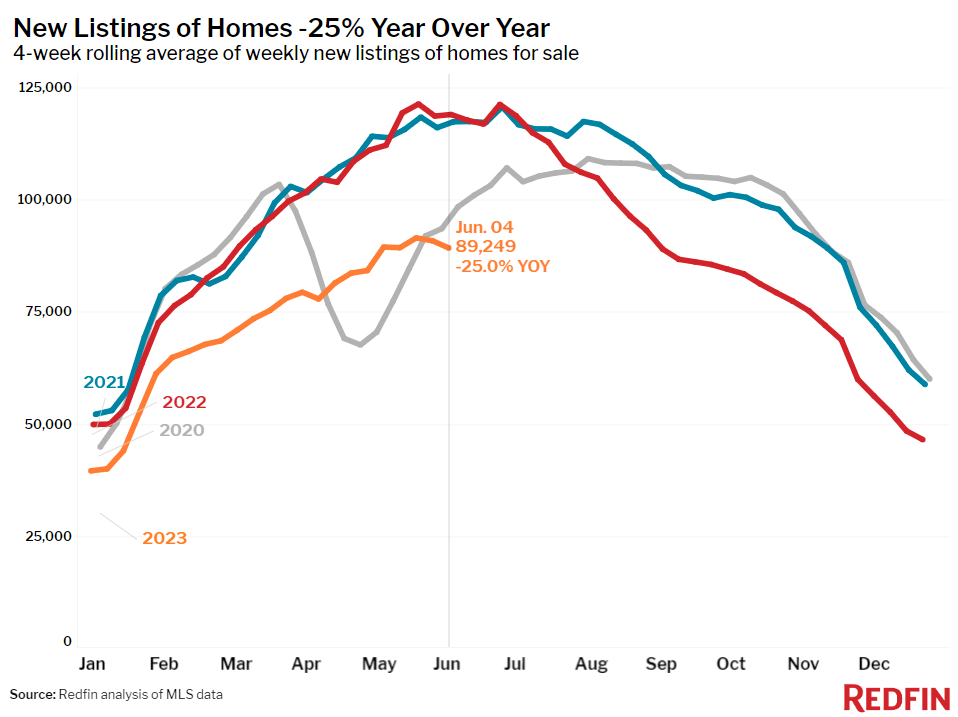

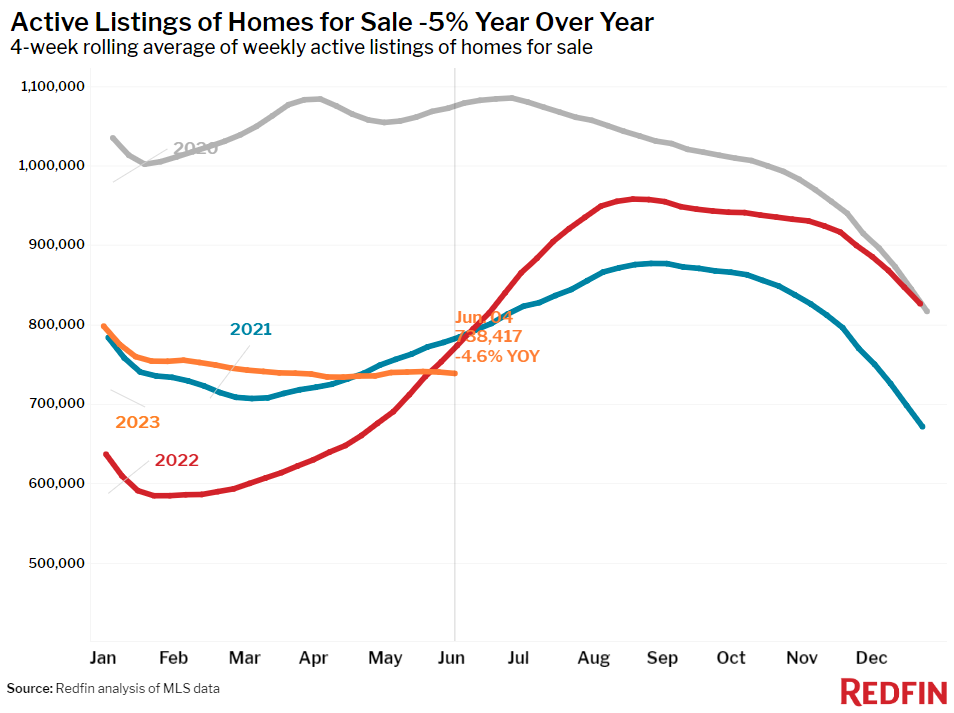

New listings of houses for sale fell 25% from a year previously throughout the 4 weeks ending June 4 to their least expensive level of any early June on record. The ongoing absence of brand-new listings has actually pressed the overall variety of houses on the marketplace down 5% year over year to its least expensive level on record for early June.

Raised home loan rates– the everyday average was 6.94% on June 7, near its greatest level in 20 years– are driving the stock scarcity. The large bulk of property owners have a home mortgage rate listed below 6%, dissuading them from noting their house and quiting their fairly low rate.

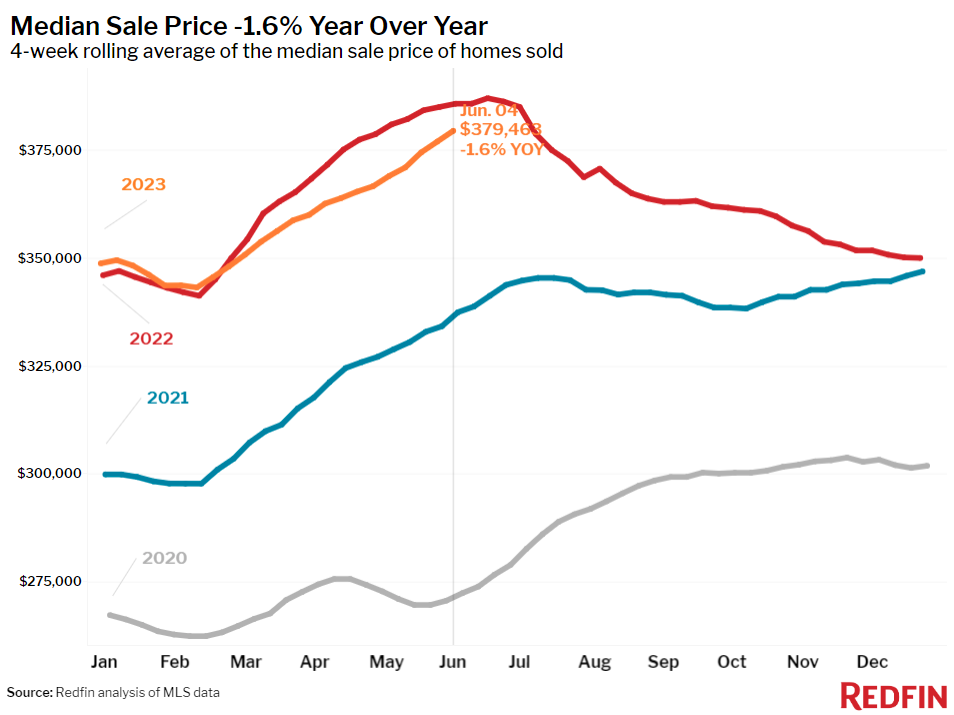

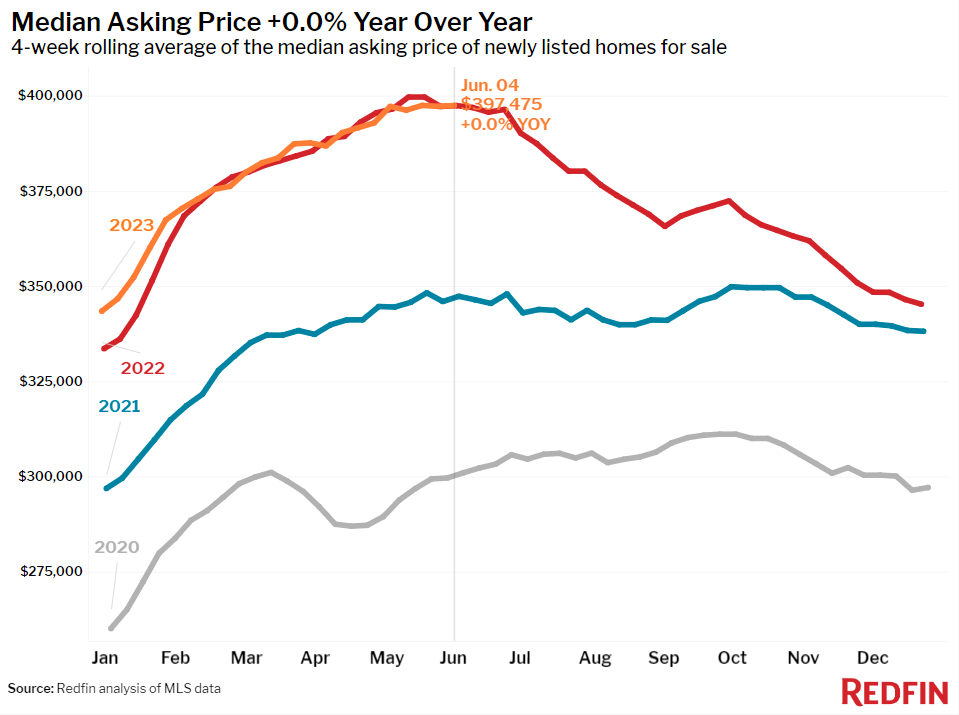

Restricted stock is keeping nationwide home-price decreases fairly modest, with the common U.S. house cost down 1.6% year over year. That’s the tiniest dip in 3 months and half the size of April’s 3.2% drop, which was the greatest in a minimum of a years. House costs are still increasing in some parts of the nation. The typical U.S. asking cost is the same from a year ago after numerous weeks of decreases, suggesting that sellers in a minimum of some city locations are observing that they can command beneficial costs.

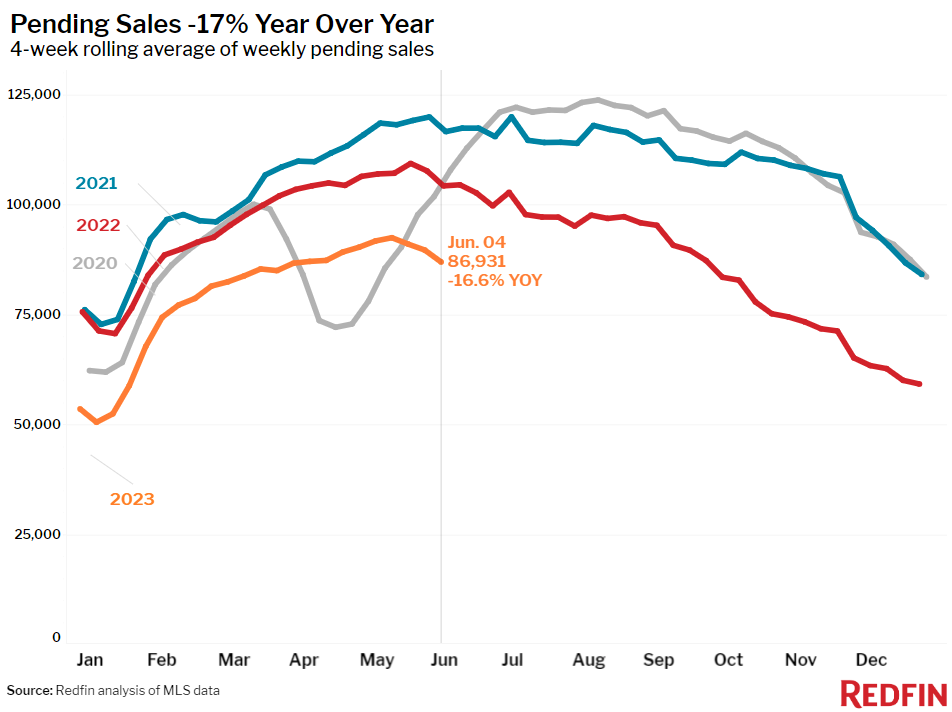

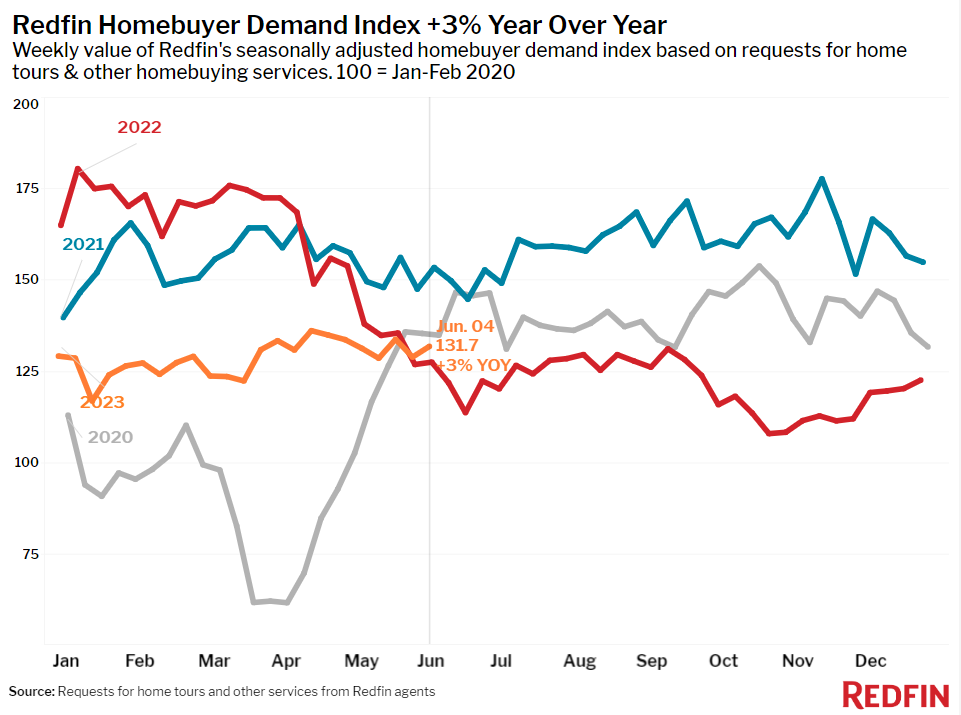

In addition to propping up costs, the shortage of listings is restricting purchases; pending house sales are down 17%, continuing a yearlong streak of double-digit drops. However early-stage homebuying need continues to hold up, with Redfin’s Property buyer Need Index– a step of ask for trips and other services from Redfin representatives– near its greatest level in a year. That shows that prospective purchasers are out there and might make a deal when home loan rates decrease and/or more houses are noted.

” House priced under $500,000 are flying off the marketplace since purchasers because cost variety do not have numerous choices,” stated Sacramento Redfin Premier representative David Orr “I have actually been dealing with one newbie property buyer for about a year, and she’s changed her search as rates have actually increased. Now that home loan rates are close to 7%, she’s taking a look at lower-priced, smaller sized houses. However the issue we’re dealing with now is competitors: Because lower cost variety, it takes numerous misses out on prior to you get a hit. She simply made a deal almost $30,000 above asking cost for a house noted at $429,000, however she lost since it had 4 other deals. I’m encouraging purchasers to get their loan pre-approved and take a look at houses under budget plan so they’re prepared to exceed asking cost.”

Leading signs of homebuying activity:

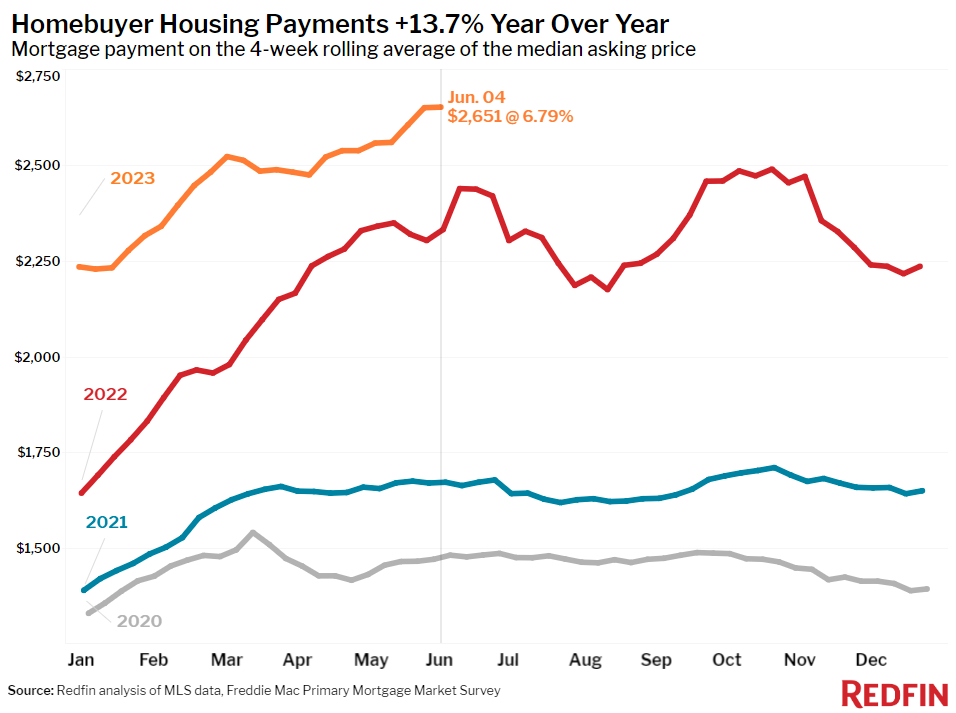

- The everyday average 30-year set home loan rate was 6.94% on June 7, below a seven-month high of 7.14% 2 weeks previously however up from about 6.6% a month previously. For the week ending June 1, the typical 30-year set home loan rate was 6.79%, up from 6.57% the week in the past– that’s the greatest weekly boost because October. It’s likewise the greatest rate because November.

- Mortgage-purchase applications throughout the week ending June 2 reduced 2% from a week previously, seasonally changed. Purchase applications were down 27% from a year previously.

- The seasonally changed Redfin Property buyer Need Index– a step of ask for house trips and other homebuying services from Redfin representatives– was up a little from a week previously throughout the week ending June 4. It was up 3% from a year previously, marking simply the 2nd yearly boost in over a year (the very first was a week previously). Need was dropping at this time in 2022 as home loan rates increased.

- Google look for “ houses for sale” were up 7% from a month previously throughout the week ending June 3, and basically flat from a year previously.

- Exploring activity since June 4 was up 16% from the start of the year, compared to a 2% decrease at the very same time in 2015, according to house trip innovation business ShowingTime Trips decreased throughout this time in 2015 as home loan rates soared.

Secret real estate market takeaways for 400+ U.S. city locations:

Unless otherwise kept in mind, the information in this report covers the four-week duration ending June 4 Redfin’s weekly real estate market information returns through 2015.

Information based upon houses noted and/or offered throughout the duration:

For bullets that consist of metro-level breakdowns, Redfin examined the 50 most populated U.S. cities. Select cities might be omitted from time to time to guarantee information precision.

- The typical house list price was $379,463, down 1.6% from a year previously, the tiniest decrease in 3 months. Cost decreases have actually been diminishing for the last 6 weeks.

- Home-sale costs decreased in 29 cities, with the greatest drops in Austin, TX (-13.4% YoY), Oakland, CA (-11.9%), Las Vegas (-9%), San Francisco (-8.7%) and Phoenix (-7.9%).

- List price increased most in Cincinnati (9.2%), Miami (8%), Milwaukee (8%), Fort Lauderdale, FL (5.8%) and Virginia Beach, VA (4.8%).

- The typical asking cost of freshly noted houses was $397,475, the same from a year previously.

- The month-to-month home loan payment on the median-asking-price house struck a brand-new record high of $2,651 at a 6.79% home loan rate, the average for the week ending June 1. That’s up 14% ($ 320) from a year previously.

- Pending house sales were down 16.6% year over year, on par with decreases over the last month.

- Pending house sales fell in all cities Redfin examined. They decreased most in Seattle (-31.7% YoY), Milwaukee (-29.5%), San Diego (-28.4%), Portland, OR (-27.7%), and Providence, RI (-26.7%).

- New listings of houses for sale fell 25% year over year, among the greatest decreases because May 2020.

- New listings decreased in all cities Redfin examined. They fell most in Las Vegas (-42.3% YoY), Phoenix (-40.9%), Seattle (-40.4%), Oakland (-39.8%) and San Diego (-37.2%).

- Active listings (the variety of houses noted for sale at any point throughout the duration) dropped 4.6% from a year previously, marking simply the 2nd decrease in 12 months. The very first was a week previously, when active listings decreased 1.7%. Active listings likewise inched below a month previously; generally, they publish month-over-month boosts at this time of year.

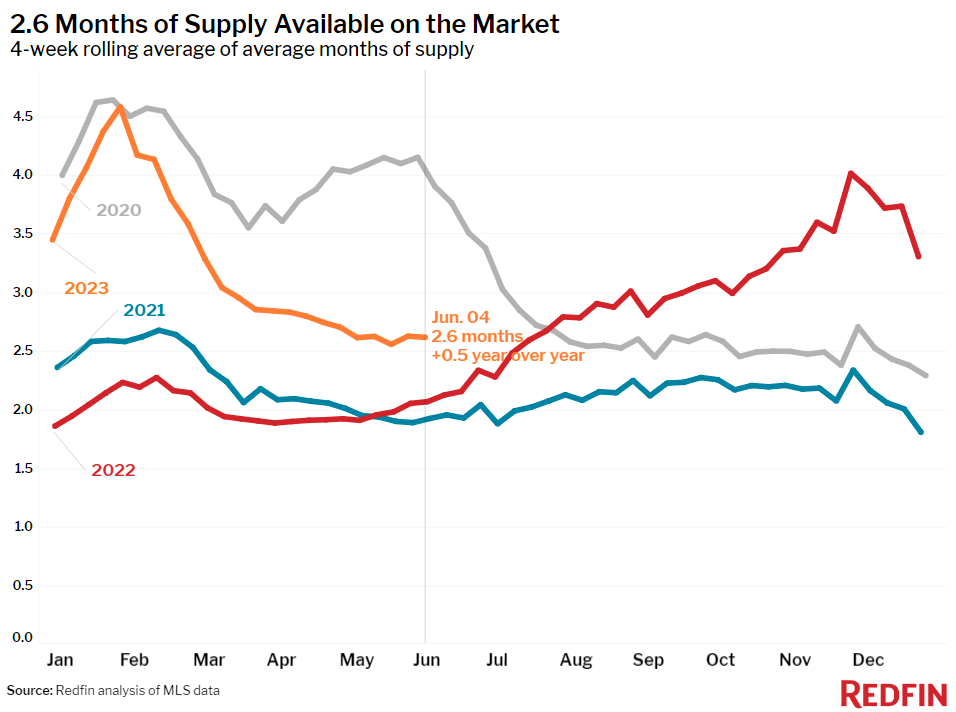

- Months of supply– a step of the balance in between supply and need, computed by the variety of months it would consider the present stock to cost the present sales rate– was 2.6 months, up from 2.1 months a year previously. 4 to 5 months of supply is thought about well balanced, with a lower number suggesting seller’s market conditions.

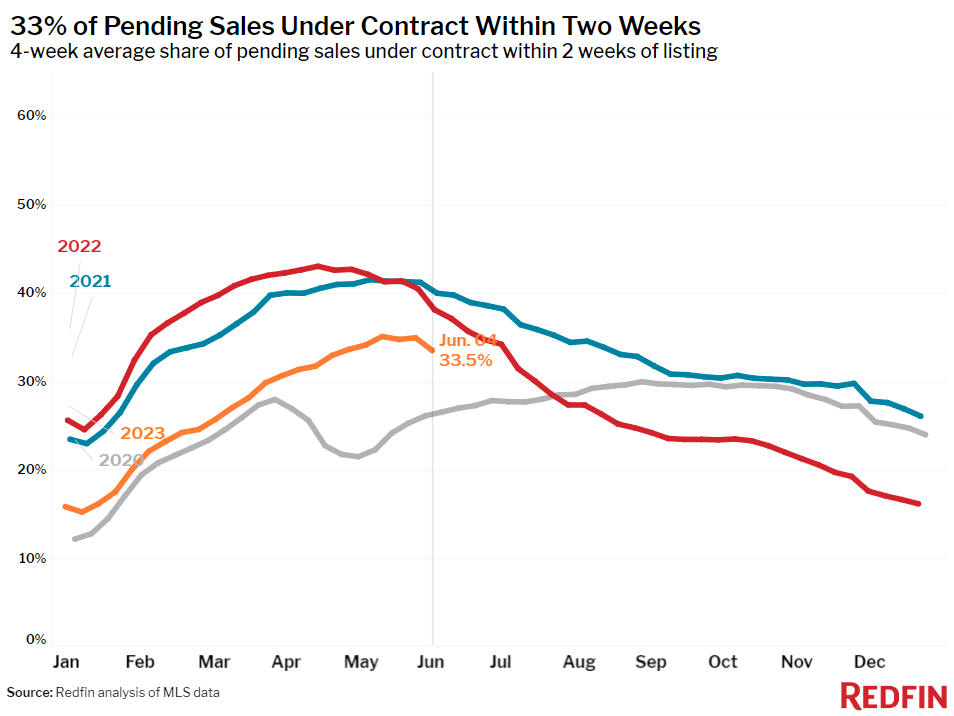

- 33.5% of houses that went under agreement had actually an accepted deal within the very first 2 weeks on the marketplace, below 38% a year previously.

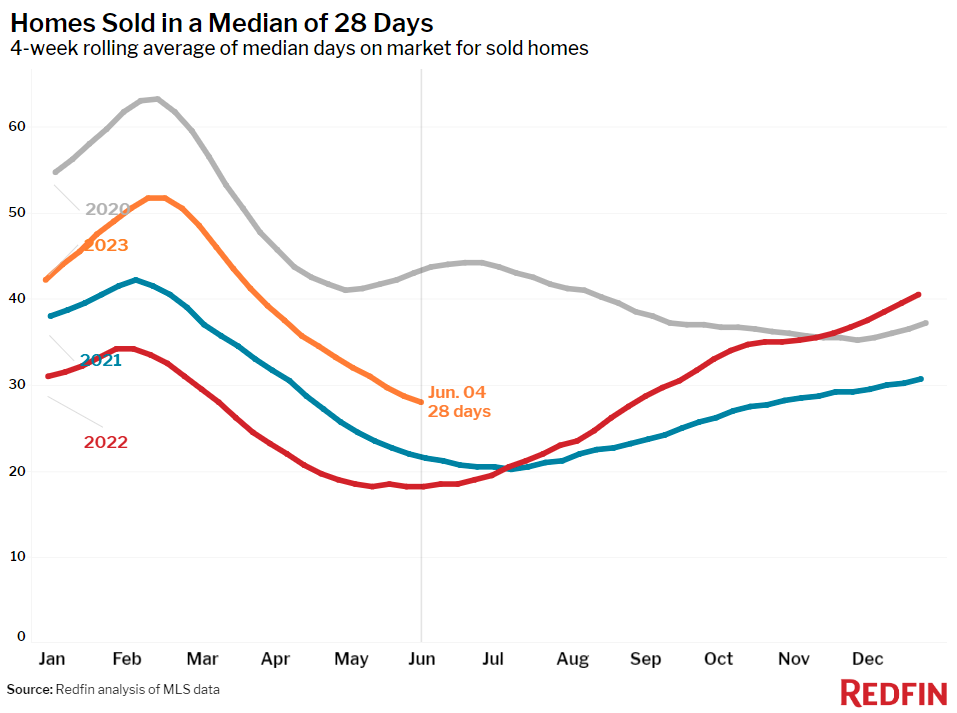

- Residences that offered were on the marketplace for an average of 28 days, the fastest period because September. That’s up from a record low of 18 days a year previously.

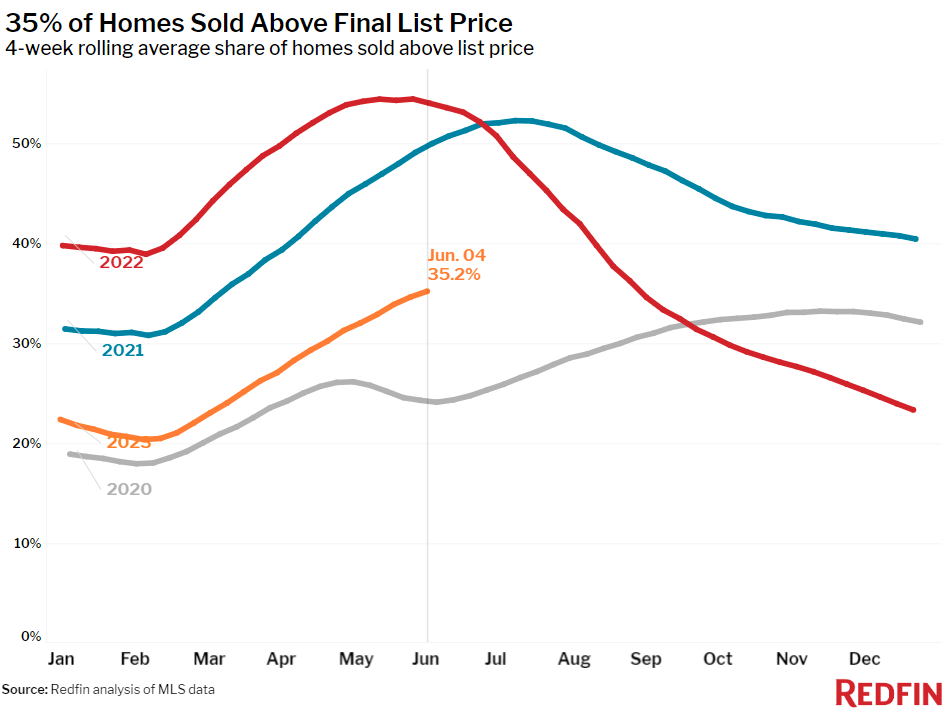

- 35.2% of houses offered above their last sticker price. That’s the greatest share because September however is below 54% a year previously.

- Typically, 5.2% of houses for sale weekly had a cost drop, up from 3.9% a year previously.

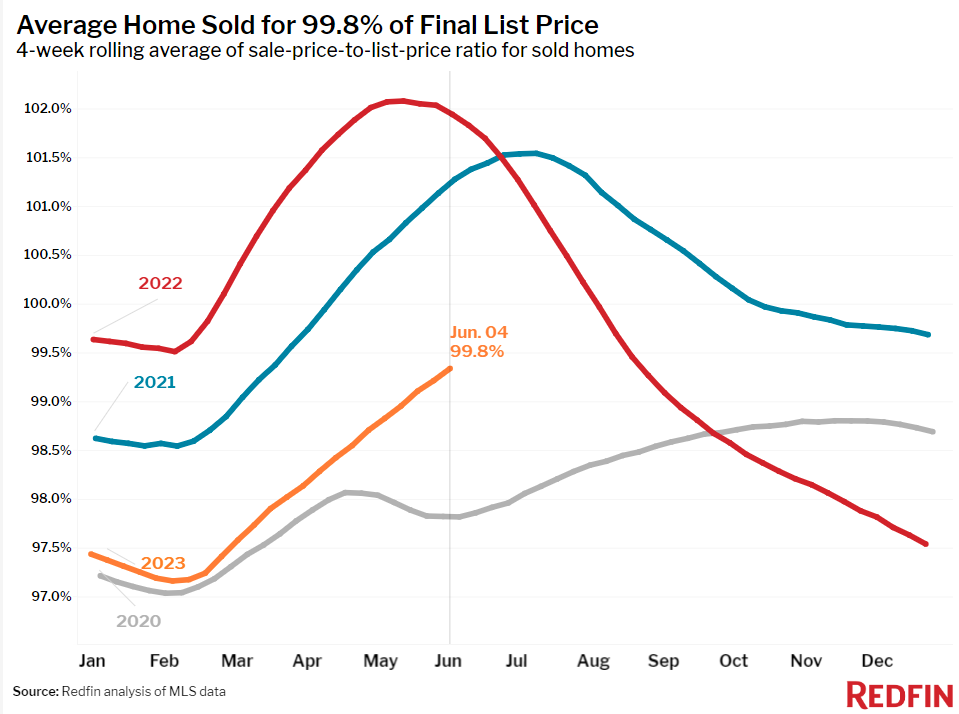

- The typical sale-to-list cost ratio, which determines how close houses are offering to their last asking costs, was 99.8%. That’s the greatest level because August however is below 102.4% a year previously.

Describe our metrics meaning page for descriptions of all the metrics utilized in this report.