By Pam Martens and Russ Martens: Might 18, 2023 ~

On Wednesday, March 8 of this year, the holding business for the federally-insured Silvergate Bank revealed it was unwinding the bank It had little option however to do so. It was experiencing a bank run and had actually incinerated its track record by concentrating on deposits from crypto business, consisting of those majority-owned by arraigned crypto kingpin, Sam Bankman-Fried.

According to testament from the Chairman of the Federal Deposit Insurance Coverage Corporation (FDIC), Martin Gruenberg, prior to the Senate Banking Committee on March 28, “in the 4th quarter of 2022, Silvergate Bank experienced an outflow of deposits from digital property clients that, integrated with the FTX deposits, led to a 68 percent loss in deposits– from $11.9 billion in deposits to $3.8 billion.”

Silvergate Bank’s main regulator was the San Francisco Fed.

2 days later on, on Friday, March 10, Silicon Valley Bank was taken into receivership at the FDIC following an extraordinary bank run that saw $42 billion in deposits leave the rely on simply the day of March 9, with another $100 billion in deposits marked time to leave the next day– which would have represented the huge bulk of its deposits flying in 2 days. That testament was provided to the Senate Banking Committee on March 28 by the Vice President for Guidance at the Fed, Michael Barr.

Silicon Valley Bank’s main regulator was likewise the San Francisco Fed.

2 more bank failures followed in brief order: Signature Rely on March 12 and First Republic Count On Might 1. Both were experiencing bank runs as an outcome of a loss of self-confidence by their clients. The main regulator of both was the FDIC.

Very First Republic Bank, Silicon Valley Bank, and Signature Bank were the 2nd, 3rd and 4th biggest bank failures in U.S. history, respectively. The biggest failure was Washington Mutual throughout the monetary crisis of 2008. JPMorgan Chase, formally the riskiest U.S. bank, was permitted by its regulators to take control of Washington Mutual in 2008 and First Republic Count On May 1 of this year.

The Other Day, the Senate Banking Subcommittee on Economic Policy, which is chaired by Senator Elizabeth Warren (D-MA), held a hearing on the absence of responsibility at the Fed and propositions to reform its structure. Senator Warren stated this in her opening remarks:

” The fast collapse of 3 banks– Silicon Valley Bank, Signature Bank and First Republic Bank– was a shock. These 3 bank failures together put more possessions at danger than the 25 bank failures in the 2008 crash.

” Silicon Valley Bank’s failure was another sign of what has actually ended up being a foreseeable string of failures in the governance of the Federal Reserve. SVB’s collapse and other bank failures it set off required the FDIC, the Treasury Department, and other regulators to hurry to the rescue to prevent implosion of our banking system. Up until now, the FDIC Insurance coverage Fund has actually suffered billions of dollars of losses, and, as an outcome of the bailouts, America’s most significant too-big-to-fail bank simply got $200 billion larger.” (Senator Warren is describing JPMorgan Chase’s takeover of First Republic Bank.)

Throughout the other day’s hearing, the Fed’s assistance of 2018 legislation that led to the rollback of prudential policy on banks with possessions under $250 billion was analyzed as adding to the current bank collapses. In composed testament, Dr. Peter Conti-Brown, Partner Teacher of Financial Policy, Partner Teacher of Legal Research and Company Ethics at The Wharton School of the University of Pennsylvania, used this analysis:

” In 2018, after numerous months of argument, President Trump signed the Economic Development, Regulatory Relief, and Customer Defense Act. In an age of omnibus costs, frequently hundreds or countless pages long, among the most excellent tasks of the EGRRACPA (or S. 2155, as it is more frequently understood), is its length: the whole expense is simply 75 pages long. The part that pertains to today banking crisis, Title IV of that act, is simply 5 pages long. In those 5 pages, entitled ‘Tailoring Laws for Specific Bank Holding Business,’ Congress altered the $50 billion [asset] limit [for prudential regulation of banks] to $250 billion [in assets] …

” Over the last 2 months, 3 of the twenty banks within that band of $100 billion to $250 billion have actually stopped working. (In the rather ridiculous vernacular of banking, we call these banks ‘local banks.’). We do not understand the number of of the staying seventeen would have stopped working however for the emergency situation statements and concomitant liquidity assistance that the federal government’s remarkable actions assisted in afterwards.

” Therefore, while the focus is frequently on Silicon Valley Bank, the truth is that we have had an excruciating failure of a market section– when 15% of banks stop working within the extremely class that Congress decontrolled in 2018, we have sufficient smoke to ask about the existence of fire.”

Another essential focus of the hearing was on what Senator Warren calls a “culture of corruption at the Fed.” Over the previous 2 years, under Fed Chair Jerome Powell, the Fed has actually experienced a string of scandals, consisting of the extraordinary trading scandal by Fed authorities, where they were selling their own brokerage accounts in stocks and other instruments while resting on personal market moving info at the Fed.

Powell referred the trading scandal examination to the Inspector General of the Federal Reserve, Mark Bialek, on October 4, 2021. It took Bialek simply 9 months to clear Powell and previous Fed Vice Chair Richard Clarida of breaking “the laws, guidelines, policies, or policies” of the Fed. Bialek has actually stayed mum for the previous 19 months on the most significant suspect in the trading scandal, previous Dallas Fed President Robert Kaplan. (See our reports: Robert Kaplan Was Trading Like a Hedge Fund Kingpin for 5 Years while President of the Dallas Fed; a Lots Legal Safeguards Stopped Working to Stop Him and Dallas Fed President Kaplan Was Making Strong, Market-Moving Declarations to Media Throughout 2020 Crisis; the Exact Same Year He Traded Tens of Millions of Dollars in Stocks and S&P 500 Futures)

Kaplan obviously feels he has absolutely nothing to fear from Bialek. Kaplan appeared on Bloomberg television on Might 3, really offering guidance to the Fed on financial policy.

Under questioning from Senator Warren, Bialek exposed that his wage as Inspector General is $377,800. Warren stated that this is the greatest wage for any worker of the Federal Reserve Board. It is not greater, nevertheless, than what Presidents of the 12 privately-owned Federal Reserve local banks make. For instance, John Williams, the President of the New York City Fed– where the Federal Reserve Board serially outsources its bailouts of Wall Street’s mega banks– was making $506,300 in 2020 according to the Fed’s 2020 Yearly Report Williams got a bump up in wage to $513,400 according to the Fed’s 2021 Yearly Report. (See Table G. 12 at this link) The President of the United States and Leader in Chief, who is chosen by the individuals, makes $400,000.

Senator Warren and Senator Rick Scott (R-FL) recommended that maybe Bialek is getting this high wage as a reward to constantly use a blindfold about misbehavior at the Fed. Scott stated this throughout his questioning of Bialek:

” There’s 23,000 individuals I believe that work at the Federal Reserve. There’s not a report you have actually done because 2011 that you understand of anybody that’s been fired; there’s no one on the Board that’s ever done anything incorrect; we do not have any info– great info– on what took place on these stock trades; and you believe that we ought to more than happy that we do not have an independent, presidentially-appointed Inspector General. This does not make any sense. And it [the Federal Reserve] has a balance sheet of $8.6 trillion … Call another firm that has that huge a balance sheet in the federal government.”

The Fed has a balance sheet of $8.6 trillion, which has actually arised from its serial Quantitative Easing (QE) programs where it purchases up trillions of dollars of government-backed financial obligation securities, developing need that would not otherwise exist, in order to drive down rate of interest to prop up an economy maimed by serial bank crises.

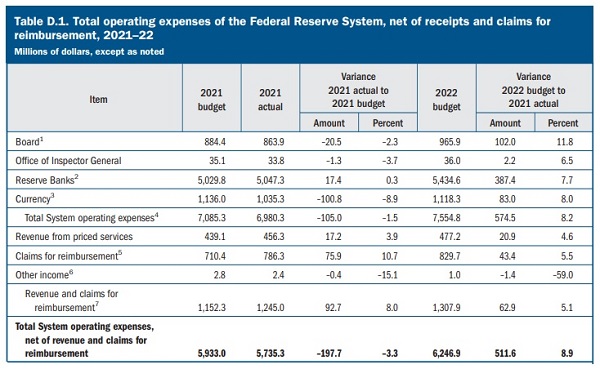

While the Fed has a balance sheet of $8.6 trillion, it really has an expenditure budget plan of $6.2 billion (See Table D. 1 listed below from the Fed’s 2021 Yearly Report. Notes for the chart are readily available in the 2021 Yearly Report)

That $6.2 billion budget plan (integrated for both the 12 local banks and the Fed Board of Governors) consists of the small quantity of $36 million to run the Workplace of Inspector General that is anticipated to police the activities of 23,000 individuals.

Bialek affirmed at the other day’s hearing that he has an overall personnel of 130 individuals to examine misbehavior at the Fed. The Fed’s 2022 budget plan is providing to let him work with 3 more individuals.

There is no much better insight into the culture of corruption at the Fed than the 2018 tome by among its own previous bank inspectors, Carmen Segarra. Her book, Noncompliant: A Lone Whistleblower Exposes the Giants of Wall Street, explains the culture inside the biggest of the Fed’s local banks– the New york city Fed– as follows:

” … absolutely nothing I had actually seen throughout my years of legal work had actually prepared me for what I saw in simply a couple of brief months at the New york city Fed.

” In those months I found a disorienting world loaded with surprise hints, where individuals stated something however implied another. Below the general public face of the Fed laid a web of incompetence, corruption, widespread mismanagement, tricks, and lies. In the ‘phony work’ culture of the Fed, where guidance was a task title, not a task, the most crucial thing was to manage the procedure to serve the supreme master. The New York City Fed was not merely stopping working to stop the banks; it was really allowing their bad habits.”