jewhyte

Intro

Efficient December 15, 2023, the Index tracked by the SPDR S&P 500 Worth ETF ( NYSEARCA: SPYV) will reconstitute, leading to substantial modifications comparable to in 2015 when Microsoft ( MSFT) and Amazon ( AMZN) signed up with as 2 of the Index’s leading holdings. For that reason, the function of this short article is to go over the modifications slated for next month, how they will dramatically affect SPYV’s evaluation, and recognize other worth ETFs that may be much better core worth holdings. In addition, this short article provides a summary of 1-10Y returns for 50 large-cap worth or dividend ETFs, and after evaluating, I believe you’ll concur that while SPYV is unquestionably strong, it’s not the very best long-lasting option. I anticipate taking you through the numbers in information listed below.

SPYV Summary

Method Conversation

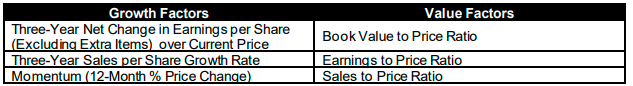

SPYV tracks the S&P 500 Worth Index, which, according to its approach file, determines the efficiency of large-cap U.S. stocks totally or partly classified as worth stocks, as figured out by design ratings. I highlighted the above since the objective of S&P Design Indices is not to categorize a stock as either worth or development completely, however rather to divide the overall market capitalization roughly similarly into worth and development Indexes. The procedure depends on 3 screens for each aspect:

S&P Dow Jones Indices

All aspects are backward-looking, without any factor to consider for experts’ future quotes. More significantly, despite the fact that we’re just thinking about the worth side today, we require to think about the development ratings, too, as they assist separate a stock’s design. For instance, if a stock has outstanding worth aspects however is likewise up significantly over the last twelve months, it still may have more weight in the Development Index. On the other hand, conventional development stocks with bad current efficiency may go into the Worth Index. That’s what occurred with Microsoft and Amazon in 2015, however with their outstanding year-to-date returns, it’s sensible to think a turnaround remains in order.

SPYV Fundamental Functions

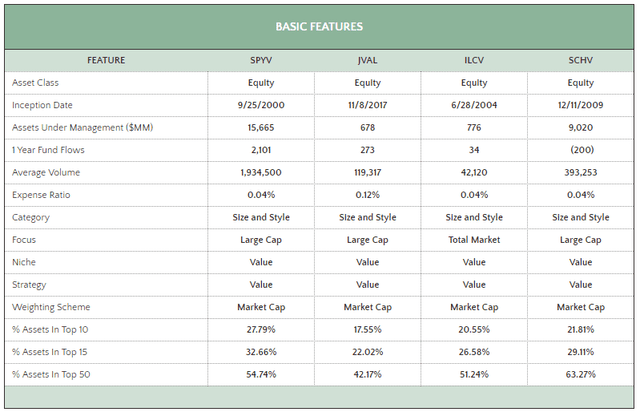

The following table consists of some fundamental info about SPYV and 3 market-cap-weighted options you may discover handy. As revealed, SPYV’s 0.04% expenditure ratio matches the iShares Morningstar Worth ETF ( ILCV) and the Schwab U.S. Big Cap Worth ETF ( SCHV), and it’s without a doubt the biggest, with $15.7 billion in properties under management. The JPMorgan U.S. Worth Aspect ETF ( JVAL) is another, better-diversified option, with 10% less concentration than SPYV in its leading 10 holdings.

SPYV Top Holdings and Sector Direct Exposures

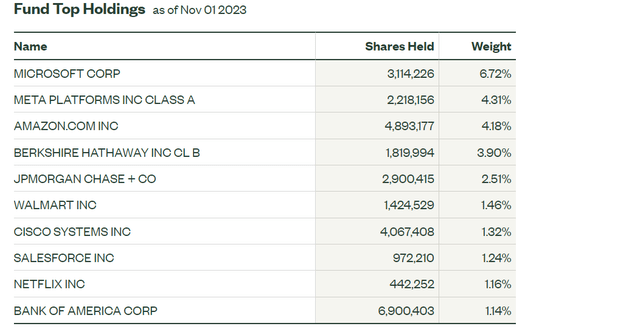

SPYV’s leading 10 holdings are below, amounting to 27.94% of the portfolio. Include Meta Platforms ( META) to the list of previously-categorized development stocks that have actually had a favorable influence on the ETF this year. Microsoft, Meta Platforms, and Amazon are up 45.29%, 159.14%, and 63.10% through November 1, 2023. Offered the rate momentum screen, I question these will be popular holdings come December.

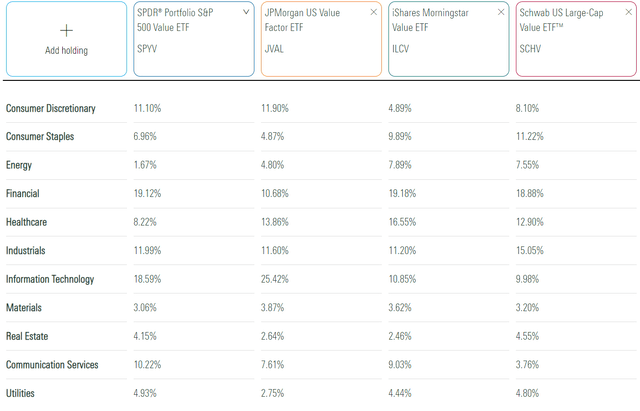

Next, let’s examine SPYV and these options by their sector direct exposures. I discover it intriguing how various these direct exposures are, provided how each efforts to catch the “worth” part of the large-cap section. With the addition of Microsoft last December, SPYV has actually 18.59% assigned to Innovation stocks compared to 10.85% and 9.98% for ILCV and SCHV. On the other hand, JVAL has 25.42% direct exposure.

Nevertheless, SPYV is still healthy. No sector represent more than 20% of its portfolio, and while Energy direct exposure is low at 1.67%, it does take some threat off the table. When it comes to prospective modifications in December, we can sneak peek them by taking a look at year-to-date returns for State Street’s Select Sector ETFs, as follows:

- Interaction Provider ( XLC): 35.79%

- Innovation ( XLK): 32.65%

- Customer Discretionary ( XLY): 18.57%

- Industrials ( XLI): 1.37%

- Energy ( XLE): 0.00%

- Products ( XLB): -0.70%

- Financials ( XLF): -4.06%

- Healthcare ( XLV): -7.21%

- Customer Staples ( XLP): -7.26%

- Property ( XLRE): -8.13%

- Energies ( XLU): -13.32%

Offered these inconsistencies in returns, we might see a boost in Energies, however, with fairly little market capitalizations, the modification may be immaterial. Nevertheless, we can anticipate a reduction in Interaction Providers, Innovation, and Customer Discretionary, as META, MSFT, and AMZN are the crucial holdings in those sectors. This ought to bring SPYV’s direct exposures more in line with ILCV and SCHV for 2024.

Efficiency Analysis

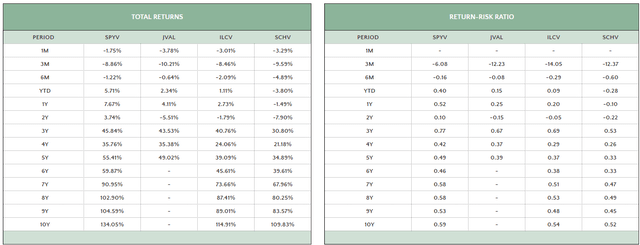

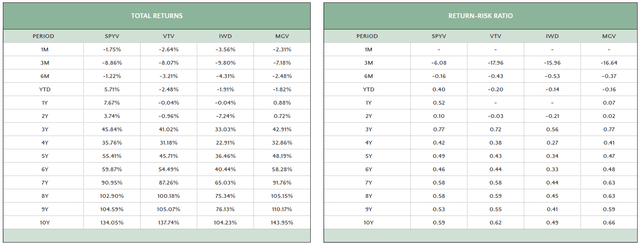

Improving direct exposure to 3 of the Spectacular 7 stocks showed effective in 2023. According to the overall returns and return-to-risk tables listed below, SPYV is up 5.71% YTD through October. JVAL and ILCV tape-recorded little gains of 2.34% and 1.11%, while SCHV decreased by 3.80%. Schwab’s worth ETF is regularly the weakest entertainer.

Still, SPYV’s returns and risk-adjusted returns are regularly much better than the 3 options. Still, when we think about some multi-factor ETFs like the Lead Worth ETF ( VTV), the iShares Russell 1000 Worth ETF ( IWD), and the Lead Mega Cap Worth ETF ( MGV), SPYV looks more typical. Due to its index modifications in 2015, it’s still the very best entertainer year-to-date. Nevertheless, over 10 years, VTV and MGV surpass SPYV by 3.69% and 9.90%. Risk-adjusted returns were likewise much better.

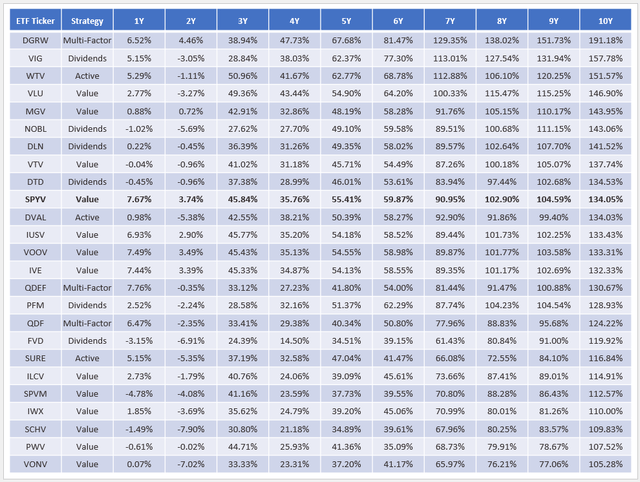

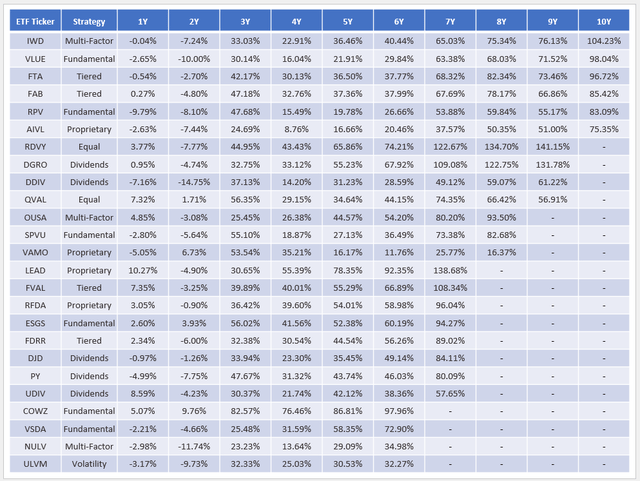

Finally, think about SPYV’s efficiency versus 49 other large-cap worth ETFs, arranged by ten-year overall returns throughout 2 tables. Many have a worth or dividend focus, however I made some exceptions. For instance, I consisted of the Pacer United States Money Cows 100 ETF ( COWZ), despite the fact that its FactSet category suggests it’s a multi-cap mix fund. This list is not extensive, as there are at least 30 others not consisted of. Nevertheless, I wish to highlight the efficiency of completing ETFs you may not have actually thought about and see how SPYV accumulates.

The Sunday Financier The Sunday Financier

SPYV ranks # 10/31 on ten-year returns, however a number of dividend funds exceeded, particularly the Lead Dividend Gratitude ETF ( VIG) and the ProShares S&P 500 Dividend Aristocrats ETF ( NOBL). Likewise, the WisdomTree U.S. Quality Dividend Development ETF ( DGRW), a multi-factor fund that consists of dividend screens, was # 1 with a 191.18% overall return. It’s proof that other methods exist to specify “worth” besides the conventional 3 utilized by SPYV. For instance, dividends minimize threat by returning money to investors, and business that regularly pay dividends usually have balance sheets in excellent working order. The Lead Worth ETF ( VTV) is another option with a strong ten-year record, though it hasn’t carried out well in the in 2015.

Over the last 5 years, SPYV’s 55.41% return ranks # 8/50, which is exceptional. A couple of ETFs with beneficial sector allotments exceeded over this duration, consisting of VIG, DGRW, COWZ, and the First Trust Increasing Dividend Achievers ETF ( RDVY). The latter 2 have greater turnover, however they are likewise choices worth financiers may think about.

SPYV Basics

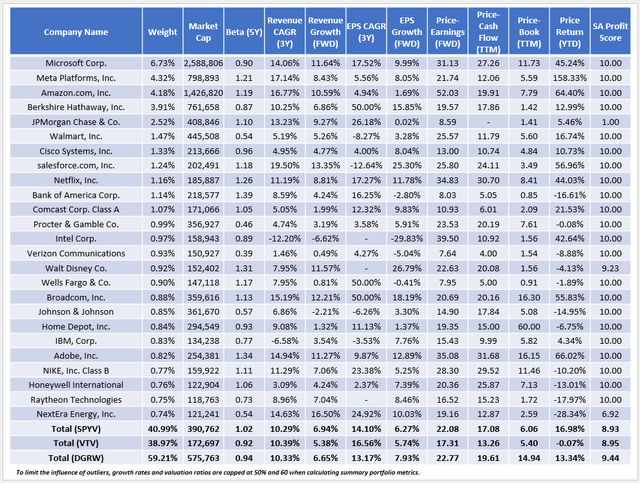

The following table highlights chosen essential metrics for SPYV’s leading 25 holdings, amounting to 41% of the portfolio. As comparators, I consisted of VTV and DGRW to cover the worth and dividend methods.

I have 3 observations:

1. SPYV and VTV’s net revenue ratings of 8.93/ 10 and 8.95/ 10 are somewhat too low. For large-cap ETFs, I go for a minimum rating of 9.10-9.20/ 10, and DGRW’s 9.44/ 10 rating might be why it’s exceeded. With in 2015’s reconstitution, the S&P 500 Worth Index has actually currently shown it can including conventional development stocks like Microsoft, and I believe it’s important large-cap worth financiers stress success most importantly. In the table above, keep in mind how almost all the leading 25 holdings have ideal 10/10 revenue ratings, however it’s the smaller sized stocks that weigh down the fund. For instance, stocks in the Diversified Banks and Electric Utilities sub-industries have actually weighted typical revenue ratings of 4.95/ 10 and 7.65/ 10. They consist of 8.52% of SPYV’s portfolio compared to 3.99% in the SPDR S&P 500 ETF ( SPY).

2. SPYV has a 1.02 five-year beta, which is irregular for a large-cap worth ETF. On the other hand, VTV and DGRW have 0.92 and 0.94 five-year betas and may provide somewhat much better drawback security. DGRW’s remarkable success recommends financiers are likelier to turn to its members in a market slump. For VTV, safe-haven financiers may choose its 17.31 x forward incomes evaluation, which has to do with 5 points less expensive than SPYV.

3. While development isn’t the focus of SPYV, its 6.27% approximated EPS development rate looks average. It’s likewise less than half of the fund’s 14.10% three-year annualized EPS development rate, and because this holds true for all 3 ETFs, it’s proof development rates are slowing throughout the board. It’s excellent news for worth financiers, however bear in mind how not all worth ETFs are produced equivalent. VTV corresponds and prevents the Spectacular 7 stocks, which decreases its development capacity and evaluation ratios. DGRW is more development and quality-oriented, suggesting greater direct exposure to these stocks. Lastly, SPYV is the least constant of the 3. Its screens are backward-looking and might not show the existing environment well.

December Reconstitution: What To Anticipate

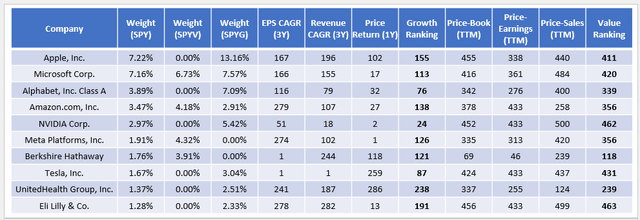

Remember how S&P Design Indices are produced to divide the marketplace capitalization of the S&P 500 Index into development and worth. To support my forecasts, I have actually assembled rankings for the 6 utilized by S&P Indices for all S&P 500 stocks. Below are the leading 10, ranked on a scale from 1-500, with a # 1 ranking being most beneficial.

1. Apple is not likely to relocate to the Worth Index. Its 155/500 development ranking suggests it’s around the leading 30%, while high P/B and P/S ratios put it in the bottom 20%.

2. Microsoft will go back to the Development Index, as it ratings extremely on all 3 development aspects. In specific, its rate return over the in 2015 is 17th best, and its worth ranking is listed below Apple. For that reason, Microsoft might be removed from the Worth Index totally, as it was before the 2021 reconstitution.

3. Alphabet is another stock that ratings extremely on development at 76/100. Its 339/500 worth ranking is likewise bad, and when taken together, I do not expect any significant modifications.

4. Amazon decreased by 49.62% in 2022 however is up 64.37% in 2023. Trading at 71.54 x tracking incomes, SPYV is most likely to drop this stock next month.

5. Meta Platforms has a comparable typical development and worth ranking as Amazon, so I anticipate it will likewise be eliminated from SPYV. It’s likewise the top-performing S&P 500 stock over the in 2015, so keeping it in a Worth Index makes little sense.

Microsoft, Amazon, and Meta Platforms integrate for 15.23% of SPYV, and their allotments ought to be significantly lowered, potentially to no, next month. 5 other stocks that have excellent development rankings and bad worth rankings are Salesforce ( CRM), Netflix ( NFLX), Broadcom ( AVGO), Adobe ( ADBE), and NIKE ( NKE), amounting to 4.09% of SPYV. On the other hand, brand-new entrants might consist of Chevron ( CVX) and Bristol-Myers Squibb ( BMY), 2 stocks down 16.66% and 33.98% over the in 2015 however with tracking P/E’s of simply 11.06 and 12.97 x.

Financial Investment Suggestion

SPYV is an above-average carrying out large-cap worth ETF with a low 0.04% expenditure ratio. Its long-lasting returns are more powerful than other market-cap-weighted worth funds however not as excellent as some dividend-oriented ETFs. SPYV’s quality is somewhat suspect, too. Its 8.93/ 10 revenue rating is somewhat listed below my minimum, and ETFs like DGRW have actually served long-lasting financiers much better.

I anticipate Microsoft, Amazon, and Meta Platforms, 3 stocks accountable for SPYV’s outperformance this year, will leave the S&P 500 Worth Index in one month. If precise, I recommend changing to VTV now, as its principles and structure will be comparable, and its long-lasting performance history is similarly strong. You’ll take advantage of owning a real “core” large-cap worth ETF that regularly produces a portfolio of low-beta stocks trading at appealing appraisals and can constantly utilize more active complementary ETFs to move equipments when needed. That’s the simpler method, so I have actually designated just a “hold” score to SPYV. I anticipate continuing the conversation in the remarks area listed below and intend on reviewing it later on this year when the real modifications been available in.