andreswd/E+ through Getty Images

Author’s Note: This post was released on iREIT on Alpha back in late Might of 2023.

Dear customers,

KION AG ( OTCPK: KNNGF) is a business that has actually currently been settling a fair bit as an financial investment for the previous couple of months. My last significant buy was made throughout later durations of 2022 – and my position in September has actually produced a TSR of around 12.38% consisting of the dividend, compared to the 3.82% of the S&P 500 since the time of composing this post.

Still, KION’s healing is most likely to stay rather soft in the near term. The business has a lot of difficulties to conquer – that’s why it’s so low-cost. Nevertheless, I think the business will conquer these and considerably outperform – which is where I take my conviction from.

In this post, I’ll upgrade my thesis, and reveal you why I anticipate a non-trivial advantage of 250% for KION – a minimum of in the end, when things truly stabilize.

KION – Upside in products dealing with and automation

KION is the marketplace leader in numerous essential innovations not just crucial for the present advancement in commercial innovations and products along with logistics, however essential.

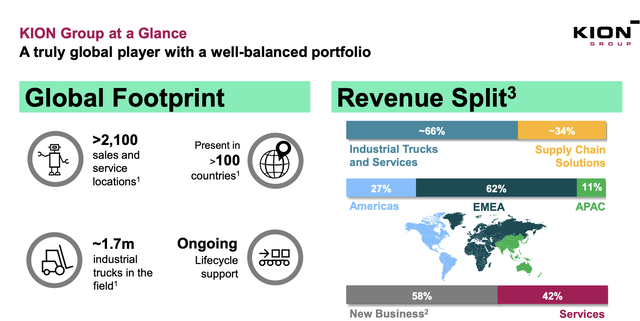

KION is the world leader in commercial truck options in EMEA, and the worldwide #2 in the very same sector. It’s # 1 in worldwide supply chain options and can report a yearly order consumption climbing up towards the EUR13B on a yearly basis. This has actually seen some pressure over the previous year approximately, however the issue with KION and what has actually triggered it to fall is not top-line development or absence thereof. The business in reality has a well-filled orderbook and exceptional need patterns. Still, it’s down to around EUR11.1 B in 2022, with a brand-new consumption of somewhat above that.

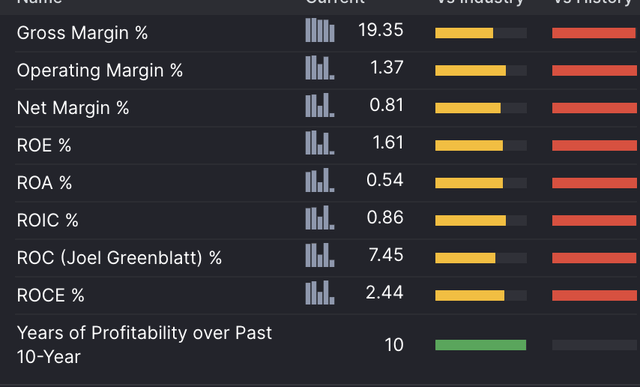

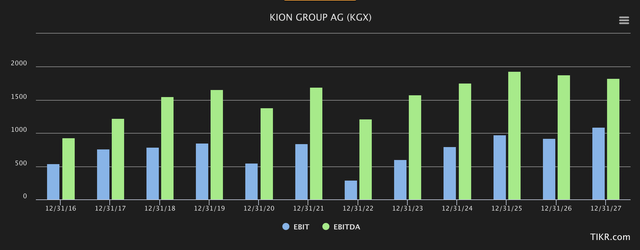

The concern is truly discovered in the business’s margins. On a pre-tax, or EBIT basis, the business made just 2.6% for FY22, which’s truly rather awful for a market leader in supply chain options and 1-2nd location in commercial trucks.

The business’s profits split and footprint stay enticing …

… and it’s the very first business to use the sort of fully-automated massive warehousing and logistics options to automated storage facilities with a complete life process item offering, consisting of services. Toyota might presently be the leader in Industrial Trucks, however KION leads the charge, without a doubt, in Automation and logistics.

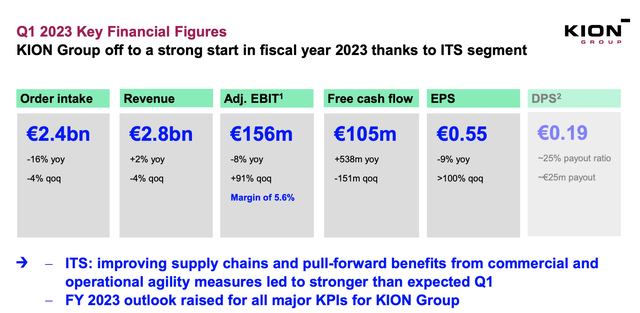

The difficulties that KION faces are broad-based and not distinct to KION as a business. We saw a lot of those concerns come back, or clarify throughout 1Q23. The business had a strong start to the year, with a good-sized order consumption and a 2% profits boost, however margins are anything however fixed. With a -8% YoY changed EBIT, we’re not seeing 2.6% EBIT, however we’re seeing 5.6% compared to the normal double digits. Still, outcomes were up considerably quarterly, so the healing has at the really least started.

Likewise, the business has actually provided substantial advantage for its clients throughout 1Q, consisting of brand-new Li-ion collaborations, its own fuel cell system, and a brand-new multi-brand worldwide method, with substantial concentrate on brand-new export items from China. The business’s ITS sector outcome were much better than anticipated, with supply chain healing driving profits and margin healing.

Posts ponement are truly the primary concern and factor regarding why the business isn’t recuperating much faster. The present financial unpredictability, with individuals anticipating an economic crisis to start and maybe last for a long time, choices on brand-new orders for logistics systems and commercial trucks are being held off, causing buy unpredictability for KION. There is great exposure in the near-term order book, however the majority of the reason that KION saw a great 1Q23 is because of the particular ITS sector.

Put simply, the business’s margin advancement and healing will be helped by healings and patterns in the total macro, which is presently unsure. Among the main motorists of the business presently being down is financiers and clients doubting of when this will be.

Nevertheless, it’s clearly crucial to not error this for it never ever recuperating. Which is a typical error I see financiers making, value-oriented or not. When a business is trading down as KION when did, it is as though financiers do not anticipate the business to ever recuperate. While this might hold true for some companies, which then do wind up declaring bankruptcy, a market leader like KION is exceptionally not likely to go to absolutely no in as brief a time as that.

Because of that, I see the present patterns as really beneficial in regards to evaluation, which we’ll look more detailed at in a little while.

In the meantime, I wish to highlight the following:

- KION remains in a healing sort of mode – the business’s margins are as low as they have actually been for numerous years. The last time it was this bad remained in comparable, recession-type environments. Do not anticipate a fast turn-around.

- At the very same time, the business is revealing early indications of essential healing. In 1Q23, we saw the EBIT margin recuperate to above 5% as particular business sectors returned towards normalization.

- Since the business’s basics stay exceptionally strong, this is the best time for value-conscious long-lasting financiers that can accept a 2-5 year period to recuperate. If you want to do this, you may see those 250%+ returns that I am speaking about here.

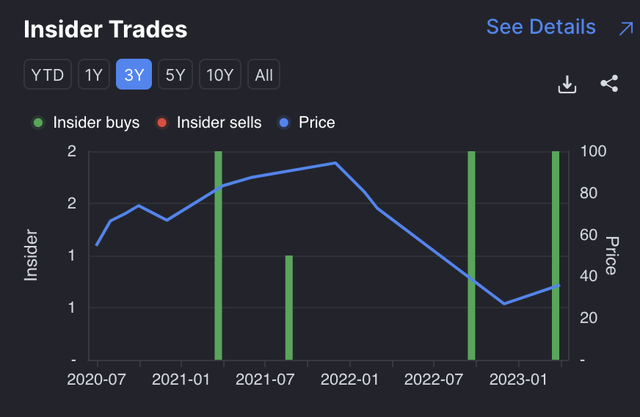

- I see healing as exceptionally most likely gradually. The business has a history of being unstable. Even prior to the pandemic, it increased to practically EUR80/share prior to toppling to EUR38 in the COVID-19 mania. This suggests that the business is now less expensive than throughout COVID-19.

The business’s margins have actually decreased to sector average, or listed below the sector average, depending upon your compensations. Nevertheless, this is because of the enormous decrease in the last 2 years, which is most likely to be non-permanent, as I see it.

And, as you can see, business success is still exceptional over a 10-year amount of time. I likewise wish to explain that regardless of a net margin of less than a percent presently on a 2022 basis, the business still isn’t even near “worst” in its sector.

This is not a reason – however a highlighting of how terribly the pandemic and the most recent year affected business margins sector-wide. KION is not alone, and it is definitely not distinct.

The business’s dividend is cut to the bone. Do not purchase KION for the 2022-2023 dividend – it’s presently less than 0.6%. Nevertheless, the business has less than 35% LT debt/cap, it’s BBB-rated and investment-safe (on a score basis), and regardless of all the negatives, stays lucrative.

I likewise wish to highlight that KION has actually seen a reasonable quantity of current expert purchasing, which is usually a great piece of news in an environment like this or for a stock like this. And those expert purchases have really been increasing, about throughout the very same time that I have actually been purchasing too. In reality, not a single expert has actually been offering stock regardless of the rollercoaster the business has actually been doing.

KION expert purchasing (GuruFocus)

Based Upon this, and whatever I have actually stated above, I’m favorable about the potential customers of KION, and offer you my evaluation presumption for the business at this time.

KION’s evaluation – Stays favorable, and I see an enormous advantage

As normal, I like thinking about the most practical possible results, or a minimum of a series of them, when buying a business. There are lots of possible results for buying KION, however the typical thread I see in each of them boils down to the net outcomes being quite favorable total.

The factor for that is basic. I do not anticipated – and any expert I follow or have actually listened to, nor sign up for does either – the business’s margin-related difficulties to remain around for that long. In reality, we anticipate normalization to strike some level this year.

What I suggest by normalization is this.

KION projections (S&P Global/TIKR. com)

That 2022 was a bad year, no doubt. Nevertheless, that things are going to recuperate appears like an inevitable conclusion at this moment. With 1Q23 in the bag, the concern that stays is not “if” the business will recuperate as the order books begin filling once again and clients move “back on track” with their financial investments, it’s “when”.

And since I invest within a 2-5 year timeframe, and I think it will occur throughout that timeframe, the precise “when” of it does not truly matter. What I think is that when it does happen, this business will advance considerably. We have actually currently seen double-digit market outperformance because September – however that will appear pale in contrast to what a stabilized reasonable worth for the business when it returns to development will be.

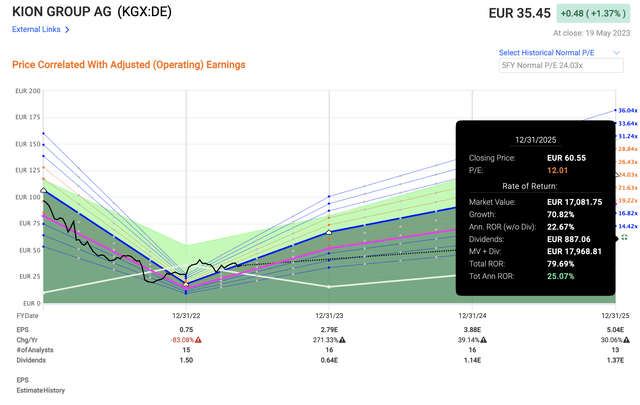

If you wished to, you might anticipate KION at a 12.01 x P/E on a forward basis. That’s conservative – and well listed below where the business normally is. It’s the most affordable I would opt for – and what does that offer you?

F.A.S.T charts KION Benefit (F.A.S.T charts)

Market-beating RoR of 25% annually.

That’s the bearish case, to be completely transparent with you. As you begin changing up, your advantage just grows. A fair-value 15x is more detailed to 35% annually, or 114% till 2025E, and a 20-24x P/E which is a historic 5-year average for this specific business can be found in at 61% every year, or 250.51% TSR till 2025E.

Now, mind you that this is asserted on the business really striking its targets. I do think it will do precisely this however, even if the expert precision is just about 75% on a 2-year basis with a 20% margin of mistake. There may likewise be that the margin healing does not go as rapidly or as “deeply” as experts anticipate. Still, even based upon this I see that enormous 12-24x P/E upside as sufficient to be market-beating in any possibly practical situation at this time.

That makes KION, together with financial investments like Teleperformance ( OTCPK: TLPFY), among the greatest, most safe total-return plays that I presently participate in. Both of these business share lots of resemblances, though KION is the more unstable of the 2 and remains in the commercial, instead of the interactions sector.

Nevertheless, both companies are enormously underappreciated for what they are, and I think this will cause enormous returns and healing for those financiers ready to invest, and for the business to recuperate.

As this is my M.O., I do not have a concern with this.

The present S&P Worldwide targets, as an enjoyable workout, concerned a series of EUR20 on the low side and EUR63 on the high side to approximately EUR44. About a year earlier, this was EUR64 on the low side and EUR140 on the high side, with approximately practically EUR100/share.

Do you think that the business has lost more than 50% of its essential worth in less than a year?

I do not – which is what I purchase here.

Thesis

My thesis on KION is as follows:

- KION Group is an appealing capital products have fun with a focus on intralogistics options, automation, and storage facility innovations – things like forklifts, to put it just.

- The business is underestimated and projections suggest a substantial advantage over the coming 5 years, with a benefit of over 100%.

- KION is a “BUY” with a rate target of EUR78/share, however I am not moving it even more.

Keep In Mind, I’m everything about:

-

Purchasing underestimated – even if that undervaluation is small, and not mind-numbingly enormous – business at a discount rate, enabling them to stabilize gradually and harvesting capital gains and dividends in the meantime.

-

If the business works out beyond normalization and enters into overvaluation, I gather gains and turn my position into other underestimated stocks, duplicating # 1.

-

If the business does not enter into overvaluation, however hovers within a reasonable worth, or returns down to undervaluation, I purchase more as time enables.

-

I reinvest earnings from dividends, cost savings from work, or other money inflows as defined in # 1.

Here are my requirements and how the business satisfies them (Italicized).

-

This business is total qualitative.

-

This business is essentially safe/conservative & & well-run.

-

This business pays a well-covered dividend.

-

This business is presently low-cost.

-

This business has a practical advantage based upon incomes development or several expansion/reversion.

That suggests that the business still satisfies all of my requirements for appealing valuation-oriented investing. I’m still at a “BUY”.

Editor’s Note: This post goes over several securities that do not trade on a significant U.S. exchange. Please know the dangers connected with these stocks.