Jacopo M. Raule/Getty Images Home Entertainment

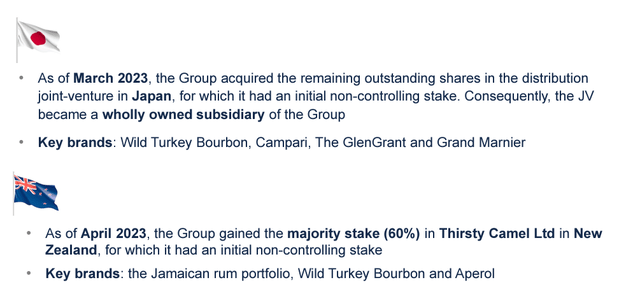

Today, we chose to proceed with Davide Campari-Milano N.V. analysis ( OTCPK: DVDCF). The business is integrated in the Netherlands and is active in the top quality spirits market. Campari owns a varied item portfolio of over 50 brand names and remains in more than 190 nations thanks to 21 commercial centers and a strong circulation network. Connected to the business’s development technique, Campari chose to concentrate on the APAC location by reinforcing the circulation structure. Undoubtedly, the group sped up the acquisition of bulk stakes in regional industrial JV in Japan and New Zealand, working out early call alternatives and increasing its direct logistic network.

Japan and New Zealand newest acquisition (Campari Q1 Outcomes Discussion)

Q1 Outcomes

Really quickly, the Italian drink gamer closed the very first quarter of 2023 with net sales of EUR667.9 million, up by +24.9% on an annual basis (and beating agreement quotes of EUR618.6 million). The business provided a gross margin of EUR389.7 million, up by +25.1%, and taped a strong start to the year. Taking a look at the information, we see that top-line sales favorably gain from rate boosts which were performed in 2015.

Drawback Dangers with Modifications in Quotes

Nevertheless, we wish to report some disadvantage threats and essential notes to consider in your Campari financial investments.

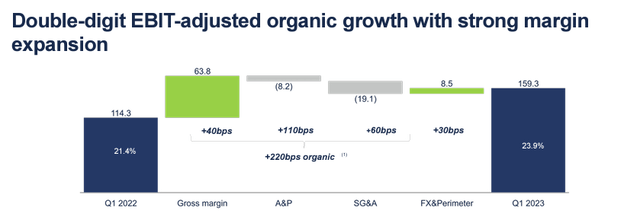

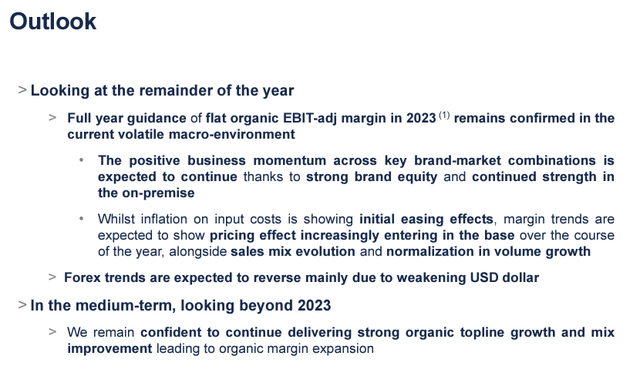

- Regardless of excellent sales momentum, the CEO is not too positive. He verified a steady adjusted EBIT margin as a portion of Campari’s turnover (Fig 1 and 3). If we take a look at the pre-COVID-19 level, in 2018 FY outcomes, the business reported income of EUR1.7 billion with an operating revenue margin of 22%, while in 2022, income reached practically EUR2.7 billion with an operating revenue margin of 18.98%. Campari’s operating take advantage of is not completely working;

- We can state that assistance is likewise a bit deceptive, in our viewpoint (Fig 2); undoubtedly, the CEO likewise anticipates greater market share penetration in all Campari essential markets while market need is stabilizing;

- As a pointer, Campari increased its rate two times in 2015, and for 2023, it has actually currently achieved a cost boost in aperitifs. For this year, we are approximating no extra expense pass-through to Campari clients;

- Q1 sales were preferred by Easter timing in Italy, and this may offer an unfavorable pattern in Q2 outcomes,

- We will keep an eye on SG&An expenditures; nevertheless, we are anticipating a reducing in logistics expenses beginning with H2. This need to favorably affect the business margin. In information, supply chain expenses are coming down on transatlantic paths; nevertheless, we are still seeing a high-single-digit greater rate than the pre-COVID-19 level;

- The leading supervisor likewise highlighted that “ although inflation on production expenses is decreasing, the pattern in margins will gradually mark down the result of the rate boosts” In addition, our company believe that volume development will support. As recommended in our current Heineken publication, in an inflation duration, “ customers are trying to find less expensive options” And we may anticipate that customers may change from spirits to beer/wine items;

- The business is anticipating an action up in CAPEX over the next 3 years. This requires to be much better priced by Wall Street experts. In our projection, we are approximating CAPEX on sales at 10% each year. This will require to support Whisky brand names, Tequila, and Aperitifs advancement;

- The currency advancement will be an unfavorable headwind to the business’s revenues, provided the current dollar weak points;

- Likewise, Campari has a very low expense of financial obligation, with a typical interest of 2.54% (Fig 3). Just recently, the business revealed a EUR300 million bond with a discount coupon of 4.71%. For that reason, we anticipate a minor boost in financing expenses. Taking a look at the information, the interest expenditures currently increased on an annual contrast by EUR7.9 million. This was because of greater financial obligation (Q1 2023 EUR1.58 billion vs. Q1 2022 at EUR832.7 million);

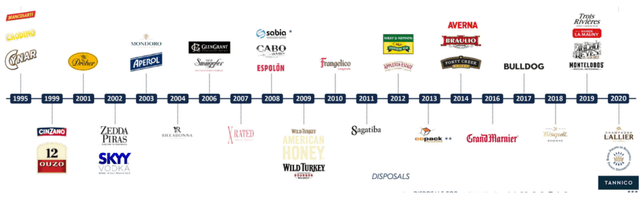

- The business has actually made clear that it is trying to find external acquisitions, consisting of transformational offers. Nevertheless, the business’s net financial obligation to EBITDA is at 2.3 x, and rate of interest are not especially beneficial at the minute (Fig 4). Regardless of a favorable M&A performance history, and a capability to pay lower multiples, our company believe this time is over. Spirits appraisals are costly, and the current offers show these newest offers. In addition, we need to state that size matters in M&A; Diageo and Pernod Ricard have a market cap of EUR88 and EUR50 billion, respectively, while Campari is at EUR13.8 billion. Once again, this can not go undetected.

Campari EBIT margin dev (Campari Q1 Outcomes Discussion)

Fig 1

Campari 2023 assistance (Campari Q1 Outcomes Discussion)

Fig 2

Campari’s present int. rate (Campari Q1 Outcomes Discussion)

Fig 3

Campari Q1 Outcomes Discussion (Campari M&A performance history)

Fig 4

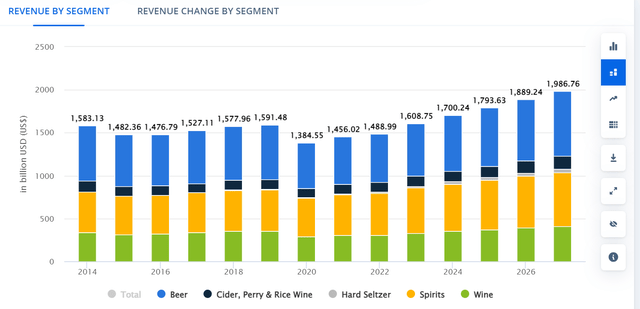

Assessment and Dangers

Here at the Laboratory, much development is priced in Campari assessment. Nevertheless, as currently pointed out in point 7, the beer section will be back to development over the next noticeable duration, exceeding spirits advancement. This appears by Statista Alcoholic Drinks – Worldwide’s newest forecast (Fig listed below). Compared to its peers, such as Diageo, Campari has no beer brand names in its present portfolio. Regardless of that, provided the strong Q1 and the spirits forecast development pattern, we chose to raise our 2023 top-line sales and EBIT by 11% and 13%, respectively. Our EPS is up by 5% at EUR0.41 per share, consisting of the greater expense of interest expenditures and a decremental FX advancement. So, we chose to start protection of Campari with a target rate of EUR12.50 based upon a 30x 2024 EPS price quote. The business is presently trading at a 45% premium compared to large-cap spirit business such as Diageo and Pernod. For this factor, we stay neutral due to a minimal benefit to our target rate (the business is trading at EUR12.28 per share). Aside from the above threats, extra drawbacks are a weaker spirit need (specifically in the EU) and a more escalation in basic material input expenses.

Alcoholic Drinks – Worldwide development (Statista)

Editor’s Note: This short article talks about several securities that do not trade on a significant U.S. exchange. Please know the threats connected with these stocks.