Among the less-told stories in monetary markets is how the U.K. stock exchange has actually ended up being something of a barren wasteland.

On Citigroup’s numbers since recently, U.K. stocks trade at a price-to-earnings ratio for 2023 of 10.6, compared to 20.7 in the U.S. and 17.2 internationally. And while getting high-flying techs would shave U.S. P-to-E down to 18.4, it would not have any effect on the U.K. numbers at all. Not surprising that SoftBank is choosing to list U.K. microchip designer ARM in the U.S. instead of its native nation.

Numerous ascribe the sluggish descent to an accounting guideline modification in the 1990s, that any pension fund liability would be reported as a business liability. (That modification was triggered by the scandal where Robert Maxwell– now understood much better as the daddy of Ghislaine– robbed his business’s pension fund.) The effect of that modification is that these pension funds approached a liability-driven design of investing that no longer required equities. According to Goldman Sachs, equities weightings of business pension funds in the U.K. have actually fallen from two-thirds to “now a rounding mistake” regardless of properties increasing sixfold over the last 25 years.

That’s a prolonged intro to an analysis of U.S. specified advantage pension fund streams from J.P. Morgan strategist Nikolaos Panigirtzoglou. These funds rebalance when there’s been favorable overall returns for equities and unfavorable overall returns for bonds. Taking A Look At Federal Reserve information, he states that in quarters where the space is more than 10%, there has actually on typical been equity selling of $80 billion, and when the space has actually been in between 5% and 10%, equity selling has actually on typical been around $40 billion. It recommends around $55 billion of equity selling based upon the existing quarter-to-date return space, he discovers.

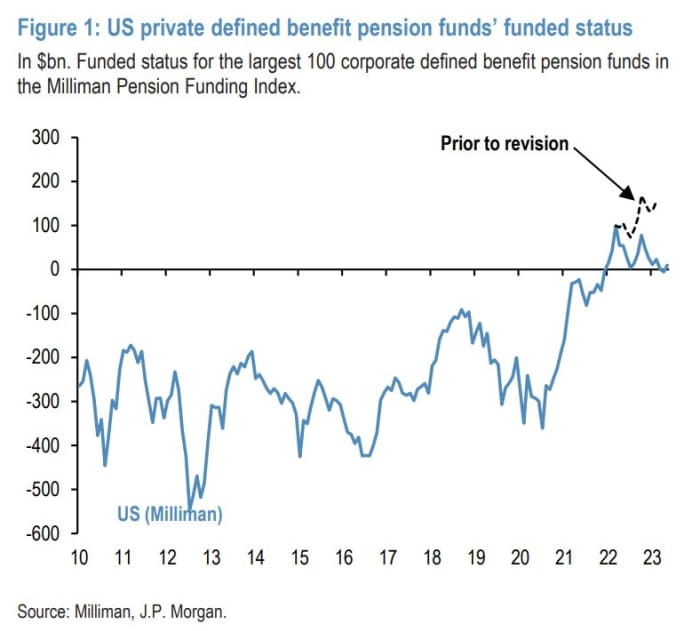

U.S. personal pension funds are well moneyed– apart from a current down modification of a cool $150 billion, perhaps owing to higher than anticipated financial investment losses on personal properties– however that provides a reward to more de-risk, to secure enhancements in their financing ratios. That took place in 2015 when, regardless of the bond market sell-off that saw the U.S. Aggregate index return almost -15% in the very first 3 quarters of 2022, the bond allowance of personal U.S. specified advantage pension funds in fact increased, from 38% to 40%.

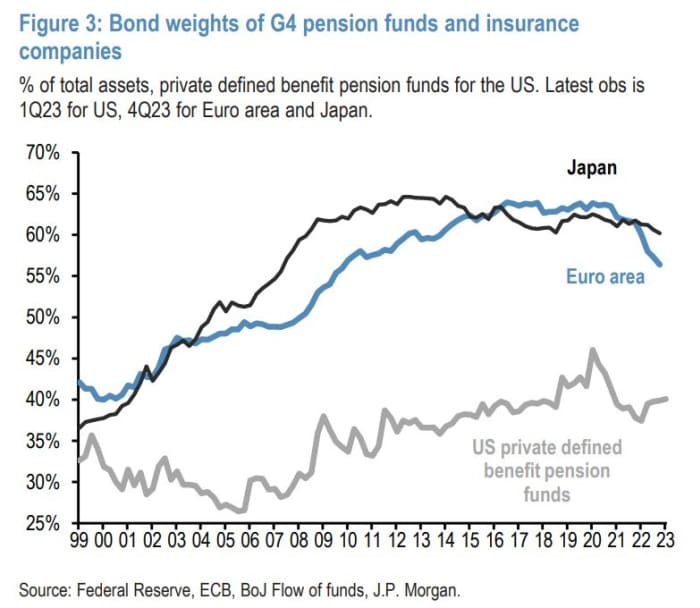

Approved, state and regional pension funds are rather infamously not well moneyed, so they do not have that reward– however they still have high equity allowances and a bond allowance that is close to a record low of simply under 20%, he states. “There is some reward from an asset/liability inequality viewpoint to purchase bonds especially offered [U.S. Aggregate] yields at 4.7% stay at appealing levels relative to the previous 10-15 years,” he states.

Lastly, he keeps in mind, bond allowances must slowly increase as a gradually bigger share of specified advantage pension fund recipients are close to or in retirement. Bond allowances in the U.S. are overshadowed by those in Europe and Japan.

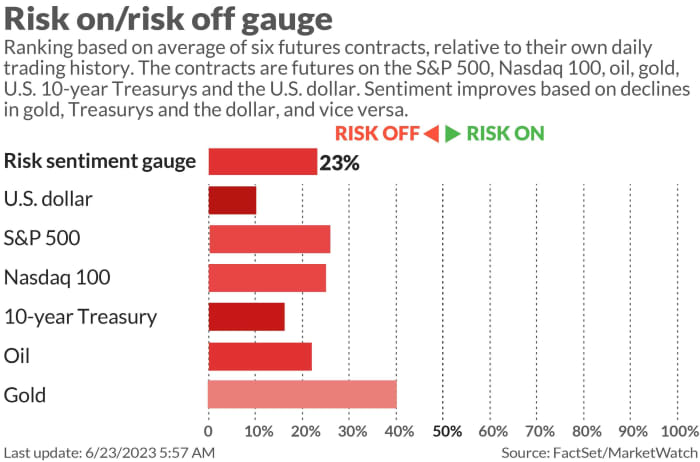

The marketplaces

U.S. stock futures

ES00,.

NQ00,.

were indicating a weaker start, a day after both the U.K. and Norway reserve bank treked rates of interest by a half point. Unrefined futures.

CL.1,.

plunged over $1 per barrel to $68.36, and the yield on the 10-year Treasury.

TMUBMUSD10Y,.

fell 5 basis indicate 3.74%.

Attempt your hand at the Barron’s crossword puzzle and sudoku video games, now running daily together with a weekly digital jigsaw based upon the week’s cover story. To see all puzzles, click on this link

The buzz

Friday sees the release of the flash getting supervisors indexes for June– a comparable step for the eurozone plunged listed below economic expert expectations– and Cleveland Fed President Loretta Mester caps a week of Fedspeak with a speech in the afternoon.

3M shares.

MMM,.

increased 4% in premarket trade as the business stated it would pay $10.3 billion to settle claims it was accountable for so-called “permanently chemicals” in drinking water.

GSK shares.

GSK,.

leapt in London trade as the pharmaceutical stated it reached a monetary settlement ahead of a California trial due to begin next month on the Zantac heartburn medication where it didn’t confess liability.

Virgin Stellar shares.

SPCE,.

fell as the area tourist business stated in a filing it looks for to raise $400 million to enhance its fleet and scale its service

Finest of the web

Via a top-secret system, the U.S. Navy heard what it believed was the Titan imploding, days back.

Some $ 64 billion of industrial realty is now called distressed.

The maniacal conspiracy theory threatening Wall Street.

Leading tickers

Here were the most active stock-market ticker signs since 6 a.m. Eastern.

| Ticker. | Security name. |

|

TSLA,. |

Tesla. |

|

GME,. |

GameStop. |

|

NVDA,. |

Nvidia. |

|

SPCE,. |

Virgin Galactic. |

|

AMZN,. |

Amazon.com. |

|

AMC,. |

AMC Home entertainment. |

|

AAPL,. |

Apple. |

|

MULN,. |

Mullen Automotive. |

|

NIO,. |

Nio. |

|

MANU,. |

Manchester United. |

The chart

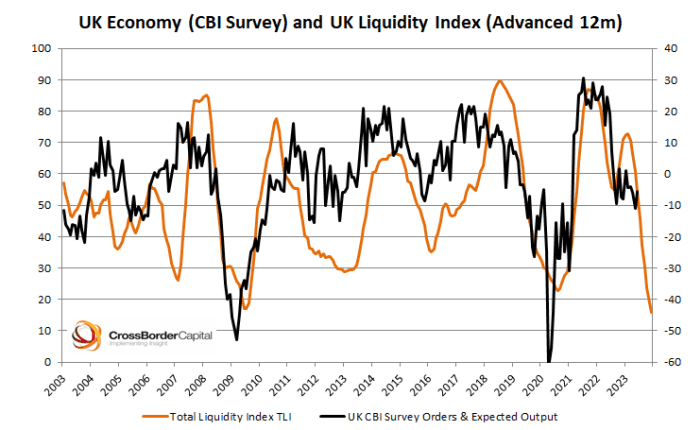

The Bank of England made a surprise half-point rate trek on Thursday, reacting to stronger-than-forecast inflation. The group at CrossBorder Capital state it is among the greatest financial policy errors in current times. They mention this chart, outlining their liquidity index advanced by 12 months– keep in mind, reserve bank rate walkings take a while to be transferred to their wider economy– and the orders and output elements of a leading commercial study. Economic Experts at Goldman Sachs individually state they anticipate another 50 basis point trek from the Bank of England in August.

Random checks out

Elon Musk’s mommy does not desire her kid to combat Mark Zuckerberg

A male invested almost 2 years at a first-class Indian hotel without paying.

Required to Know begins early and is upgraded up until the opening bell, however register here to get it provided as soon as to your e-mail box. The emailed variation will be sent at about 7:30 a.m. Eastern.

Listen to the Finest Originalities in Cash podcast with MarketWatch press reporter Charles Passy and economic expert Stephanie Kelton.

.