The numbers: Overall bank financing increased by $22.8 billion to $12.1 trillion in the week ending June 14, the Federal Reserve reported Friday.

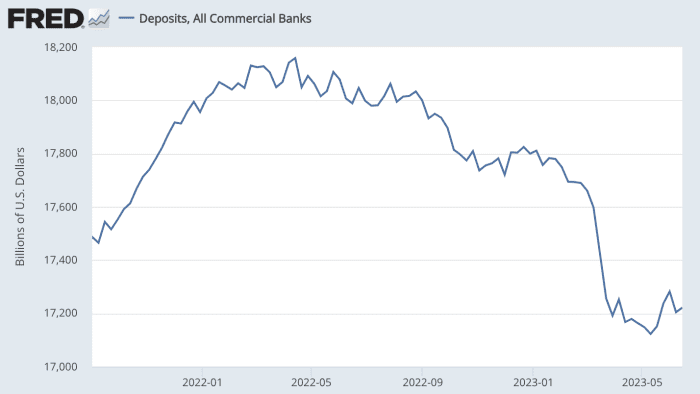

Overall bank deposits, on the other hand, increased by $17.6 billion to $17.2 trillion in the exact same duration. Deposits have actually fallen by $376 billion because early March, nevertheless.

Deposits, all industrial banks, Sept. 1, 2021, to June 14, 2023.

Uncredited.

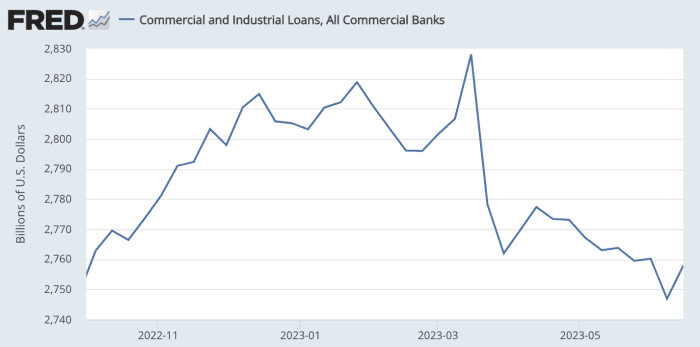

Secret information: Business and commercial loans– an essential financial chauffeur– increased by $11 billion to $2.76 trillion. C&I loans struck a peak of $2.83 trillion in mid-March.

Business and commercial loans, all industrial banks, Oct. 1, 2022, to June 14, 2023.

Uncredited.

All figures are drawn from the Fed’s weekly study and are seasonally changed.

Broad view: The possibility that bank financing might freeze up has actually been an issue because the collapse of Silicon Valley Bank in March and the subsequent contagion that removed 2 other local banks. The unexpected chaos highlighted that banks are susceptible in the wake of the Fed’s speedy tightening up of financial policy over the previous 15 months.

Fed Chair Jerome Powell informed the Senate Banking Committee today that a shock like the collapse of Silicon Valley Bank generally causes reduce financing, however not instantly.

” There might be a bit more tightening up in the pipeline. We do not truly see proof of it yet,” Powell stated.

Issue about possible weak point in bank financing was one factor Powell provided for the Fed’s choice to hold rates of interest consistent recently after 10 succeeding walkings.

Market response: U.S. stocks.

DJIA,.

SPX,.

ended up lower on Friday, topping off the worst week because March. The 10-year Treasury yield.

TMUBMUSD10Y,.

slipped to 3.74%.