Justin Sullivan

Financial Investment Thesis

Darden Restaurants Inc ( NYSE: DRI) is anticipated to sustain its strong development trajectory assisted by market share gains, rate boosts, and ultimate stabilization in traffic. The business’s prices policy, which keeps costs lower than its rivals, combined with Darden’s capability to offer great quality and sufficient part sizes of food, draws in customers and boosts their complete satisfaction. This need to assist the business gain market share throughout this downturn as customers are searching for worth for cash. Over the long term, earnings synergies from the Ruth Chris acquisition and the growth of brand-new dining establishments are anticipated to add to the business’s top-line development. Margin development is likewise anticipated to take advantage of rate boosts. Additionally, moderating inflation, enhanced efficiency, and expense synergies arising from acquisitions need to assist in margin growth. Presently, the business’s stock is trading listed below its historic averages and provides an appealing dividend yield.

While the stock saw some correction post-earnings as the business’s same-restaurant sales Y/Y development assistance of in between 2.5% and 3.5% for FY24 dissatisfied some financiers, this assistance looks conservative provided the strong patterns in Olive Gardens and Long Horn Steakhouse. I think the business’s outcomes over the approaching quarters need to ease a few of the financier issues around assistance. When integrated with the potential customers of earnings and margin development, and appealing evaluation, this makes Darden Restaurants an attractive financial investment choice.

Q4 FY23 Revenues

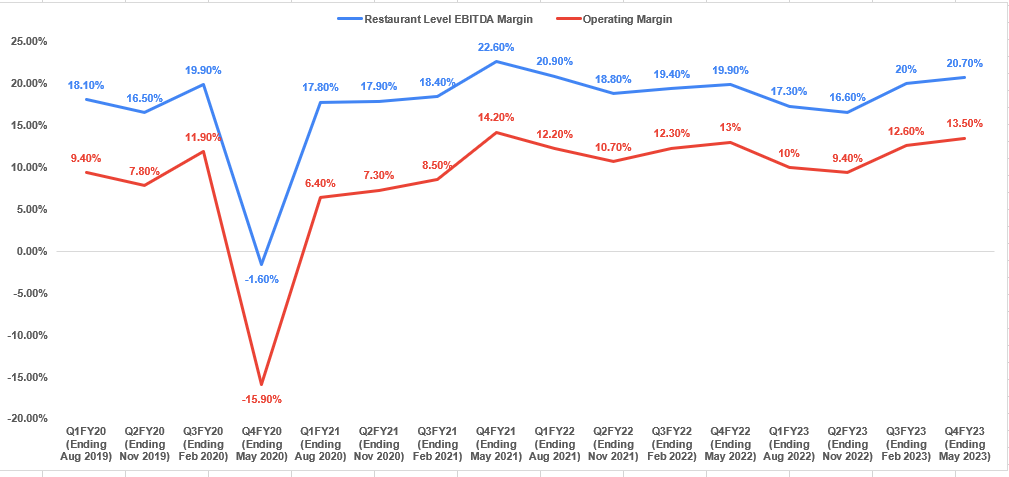

Just recently, Darden launched its fourth-quarter financial 2023 revenues report. The business saw a year-over-year earnings boost of ~ 6.4% to $2.8 billion, beating the agreement price quotes by $30 mn. In addition, the revenues per share grew by ~ 15.2% to $2.58, going beyond the agreement price quote of $2.54. Especially, the restaurant-level EBITDA margin experienced an 80 basis points (bps) boost, reaching 20.7%, while the operating margin increased by 50 bps to 13.5%. The earnings development was mainly credited to a 4% development in same-restaurant sales and the opening of brand-new dining establishments. The development in EPS and margins can be credited to the small amounts of inflationary pressures and enhanced efficiency.

Income Analysis and Outlook

In my previous short article, I provided a bullish thesis on earnings development, stressing the business’s method of prices listed below inflation and the market, which was anticipated to bring in customers. Ever since, Darden Restaurants Inc. has actually reported its fourth-quarter financial 2023 revenues and the outcomes have actually revealed comparable favorable characteristics.

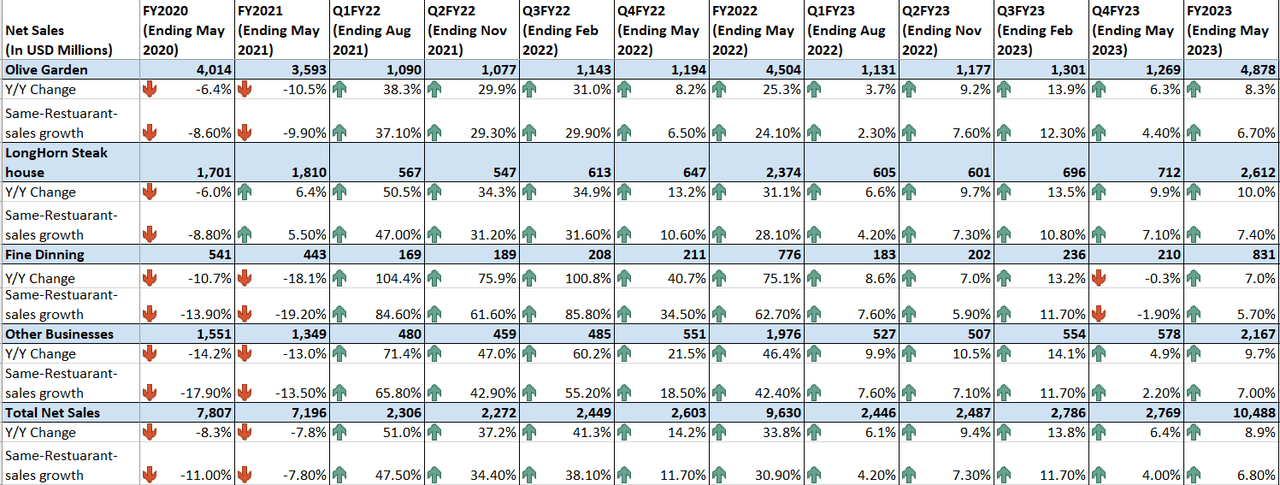

Throughout the 4th quarter of financial 2023, the business’s development momentum stayed strong. The boost in sales was driven by both rate boosts and the opening of brand-new dining establishments. As an outcome, typical weekly sales experienced a year-over-year development of 4.1% (and a 15.6% boost compared to pre-COVID levels, i.e., the 4th quarter of financial 2019.) The overall sales for the quarter reached $2.76 billion, showing a 6.4% year-over-year development. This development was mainly driven by a 4% boost in same-restaurant sales, with the staying contribution originating from the opening of 47 brand-new places. While Olive Garden and LongHorn Steakhouse continued to outshine the wider dining establishment market, the great dining sector dealt with obstacles due to hard year-over-year traffic count contrasts.

DRI’s Historic sales ( Business Data, GS Analytics Research Study)

Looking ahead, I prepare for that the business will continue to attain earnings development, taking advantage of different elements such as rate boosts, worth offerings, the strength of its operating design, and dining establishment growth.

To deal with inflationary pressures, Darden Restaurants Inc. has actually carried out rate boosts over the previous couple of quarters, and they prepare to continue this method in the coming years. While inflation is revealing indications of small amounts, management strategies to continue carrying out incremental rate boosts albeit at a lower rate. The carryover effect of rate boosts from the 2nd half of the previous , in addition to extra rate modifications, is anticipated to support sales development in the coming quarters. Additionally, the lower rate of incremental rate boosts need to ease some pressure on consumers, therefore assisting support visitor traffic development throughout the .

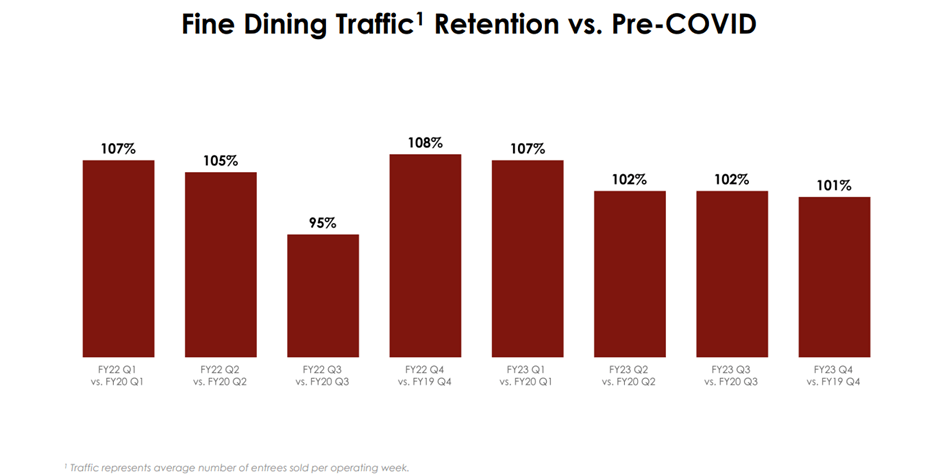

One sector which didn’t succeed last quarter was great dining. Management associated it to hard contrasts in the fine-dining sector. In Q4 FY22, while the renewal of need due to reduced movement limitations led to beneficial visitor traffic retention compared to pre-COVID levels, it likewise caused harder year-over-year contrasts in the 4th quarter of financial 2023, leading to a decrease in traffic for the sector. Comparable characteristics are expected in the very first quarter of 2024, as the very first quarter of the previous likewise experienced great traffic retention (see chart listed below) compared to pre-pandemic levels. Nevertheless, after the very first quarter of 2024, the business anticipates traffic development to support in this sector as contrasts ease, eliminating this headwind also.

DRI Fine Dining Traffic ( Q4 FY23 Revenues’ Discussion )

I likewise prepare for that the strength of Darden’s Olive Garden and LongHorn Steakhouse dining establishments (which contributed ~ 71% of DRI’s sales last quarter) need to more than balanced out any near-term weak point in great dining. The business’s capability to provide worth meals and its resistant operating design is adding to strong efficiency in Olive Garden advertisement Longhorn Steakhouse. Throughout inflationary durations, consumers tend to look for worth when investing in discretionary products. In spite of tight spending plans, consumers designate a part of their earnings for delighting in budget-friendly high-ends that offer worth and complete satisfaction. Eating in restaurants is thought about one such budget-friendly high-end that draws in individuals and we have actually seen an excellent suppressed need for it post-reopening. If customers can discover great worth in it, it ends up being a great deal. Darden Restaurants has actually developed a track record for serving top quality food with generous part sizes at costs listed below the market average. This worth proposal draws in consumers to its brand names, as they get great complete satisfaction for their costs.

Additionally, the business’s operating design is extremely resistant, defined by simpleness in execution, menu products, back-office operations, and consumer engagement procedures. Darden has actually carried out company restructuring in the last few years to get rid of intricacies and simplify its operations. This simpleness causes quick table turnover and quality service, leading to consumer complete satisfaction. This complete satisfaction is anticipated to continue supporting traffic, even in a tough macroeconomic environment. Darden has actually regularly surpassed market standards in current quarters. In the fourth-quarter financial 2023, its same-restaurant sales development exceeded the market by 470 basis points, and same-restaurant visitor counts went beyond the market by 540 basis points. Management expects continued outperformance versus the market criteria in the coming quarters, leveraging the strength of Olive Garden and LongHorn Steakhouse, driven by their streamlined operations and worth offerings. This need to allow the business to sustain sales development regardless of an unpredictable macro environment.

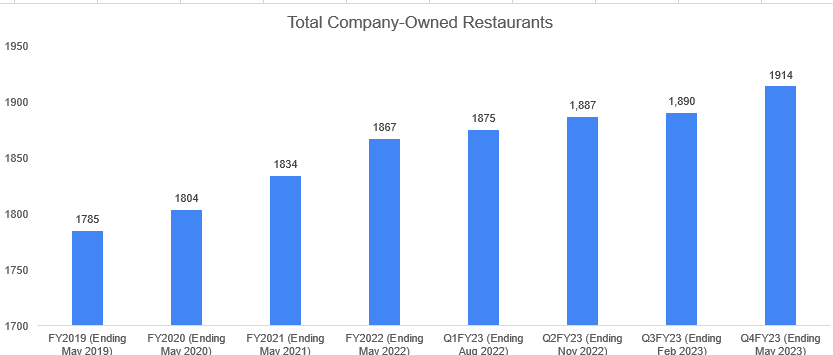

In regards to long-lasting development, Darden has great dining establishment advancement strategies. The business opened 47 brand-new dining establishments in financial 2023, representing a year-over-year development of 2.5%. These brand-new places contributed around 2.1 portion indicate the leading line. Darden intends to open an extra 50 gross brand-new dining establishments in financial 2024 and targets a yearly development rate of 2-3% progressing. This need to continue to support long-lasting earnings development. In addition, Darden just recently obtained Ruth’s Chris Steak Home, which will be reported in the fine-dining sector. While the present macroeconomic environment might not be perfect for the fine-dining sector, provided its greater costs and premium services, restricting its instant influence on the leading line, I think this acquisition will improve the business’s long-lasting development potential customers through earnings synergies. Ruth’s Chris offers Darden with global direct exposure through its dining establishments in Asia and Canada, providing a chance for Darden to broaden its other dining establishment brand names worldwide through Ruth’s Chris’s franchise partners.

DRI’s Historic Company-Owned Dining establishments ( Business Data, GS Analytics Research Study)

For that reason, I think that Darden Restaurants’ company is well-positioned to keep its earnings development even in a tough macroeconomic environment. Management has actually supplied assistance for a 2.5% to 3.5% year-over-year development in same-restaurant sales in FY24, which I think is conservative provided the strong efficiency of Olive Garden and LongHorn Steakhouse and expectations of alleviating compensations benefiting great dining from Q2 FY24 onwards.

Margin Analysis and Outlook

Throughout the 4th quarter of financial 2023, Darden Restaurants, like the remainder of the market, continued to come across inflationary pressure originating from increased product expenses and labor earnings. Nevertheless, the rate of inflation is moderating sequentially, which in addition to rate boosts and efficiency improvements, accomplished through labor effectiveness, added to margin growth in the quarter. As an outcome, the restaurant-level EBITDA margin saw a year-over-year boost of 80 basis points, reaching 20.7%, while the operating margin increased by 50 basis indicate 13.5%.

DRI’s Historic Margins ( Business Data, GS Analytics Research Study)

In the 4th quarter of financial 2023, the general inflation increased by 4.4% year-over-year, revealing a substantial enhancement of 270 basis points compared to the previous quarter. Looking forward, the business expects an overall inflation rate of 3-4% year-over-year in FY24, with most of inflation happening in the very first half of the year. This recommends that inflationary pressures need to slowly alleviate as we advance through the year, therefore minimizing pressure on dining establishment margins. The business is likewise fully equipped to counter these inflationary pressures through rate boosts.

Additionally, I anticipate efficiency to continue enhancing, as evidenced by the constant decrease in 90-day labor turnover. This pattern needs to lead to lower hiring and training expenses while boosting the performance of existing workers as they end up being more acquainted with everyday operations. Furthermore, as part of business restructuring, Darden has actually bought AI tools to drive functional performance. These AI tools help in much better visitor count forecasting, resulting in enhanced expense management in locations such as staffing and basic materials. These functional effectiveness need to even more add to margin development.

In Addition, the Ruth’s Chris acquisition is anticipated to create expense synergies. By the end of financial 2025, management expects accomplishing around $20 million in expense synergies, mainly through the supply chain and basic and administrative cost savings. This combination needs to likewise support margin development in the future. In general, I stay positive about the potential customers for margin growth in the coming quarters.

Evaluation and Conclusion

Darden Dining establishments is presently trading at a price-to-earnings (P/E) ratio of 18.46 x based upon the FY24 agreement EPS price quote of $8.74, and a P/E ratio of 16.73 x based upon the FY25 agreement EPS price quote of $9.64. These appraisals are listed below the business’s historic 5-year typical P/E of 21.84 x.

The business has an excellent capacity to acquire market share and grow its earnings regardless of the hard macroeconomic environment. Additionally, the business has a favorable outlook for margin growth due to the moderating inflationary environment. In addition, Darden provides a strong forward dividend yield of 3.35%, and its management has actually done an excellent task in regards to returning money to the investors through buybacks. Based upon these elements, I suggest a buy score for the stock.